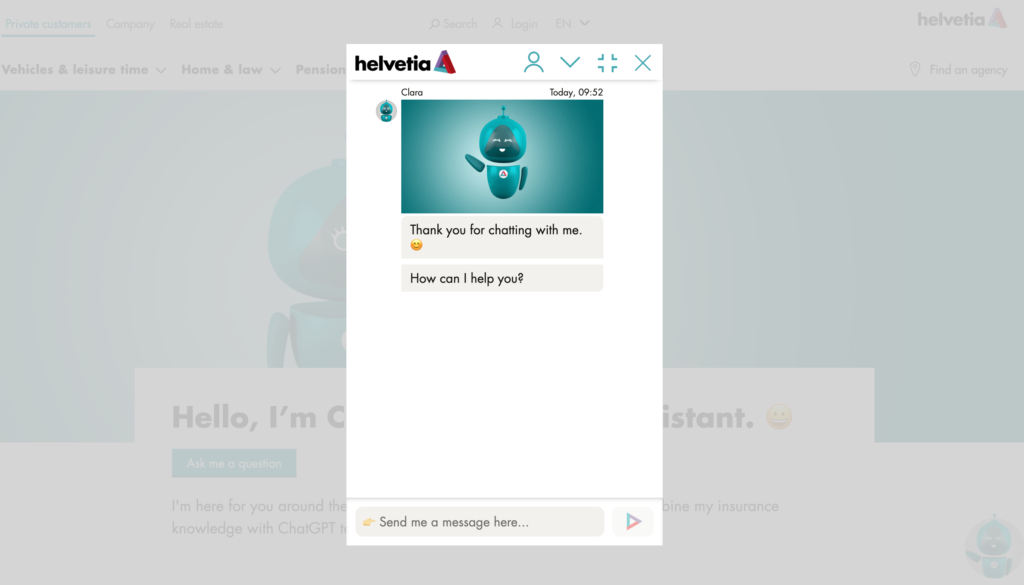

Helvetia insurance enhances its digital assistant Clara. The pilot project was launched in spring 2023 and provides an easy way for customers to ask questions and describe issues via the Helvetia website.

Now that the trial period is over, Clara is going live with immediate effect as a standard service powered by the latest generative AI technology.

Jan Kundert

Jan Kundert, Head Customer and Market Management and Member of the Executive Management of Helvetia Switzerland:

“We’re delighted that our ChatGPT project has been well received by our customers. Our focus moving forward will be on tailoring what is now Helvetia’s key self-service channel even better to user requirements.”

International pioneering role

Following the successful completion of the test phase, Clara is now going live as a standard service incorporating the latest generative AI technology, further optimizing response quality compared to the previous version. Helvetia thus offers its customers in Switzerland a service that is unique in the insurance sector, providing simple and uncomplicated answers to questions about insurance and pensions around the clock, thereby also playing a pioneering role internationally. It remains exploratory in nature, with users contributing to the learning process. Thanks to user feedback, Clara is constantly being developed further. Customer service can be accessed in German, French, Italian, English and various other languages.

Customers can easily ask a question or describe an issue via the digital assistant Clara. The service is designed to be low-threshold and can be accessed without registration. User numbers since the launch of the trial in spring 2023 show it has been well received. Helvetia predicts it will have handled over 150,000 chats by the end of this year – almost double the figure for last year. In just a short period of time, Clara has thus become Helvetia’s key self-service channel. The chatbot is the perfect addition to the existing customer service offering.

Trust is essential

Trust plays a key role in the relationship between insurers and their customers. This is true whether customer services are offered via conventional or digital channels. Although there are currently still no binding regulations for the industry, Helvetia has decided to go live with its chatbot powered by the latest GPT technology.

Helvetia is aware of the resulting responsibility and only uses artificial intelligence within a controlled framework. The data is managed and processed in accordance with the highest security standards and the new Swiss Data Protection Act (DSG), which came into force on 1 September 2023. For example, users are informed that Clara may also provide incorrect answers because these are generated by artificial intelligence. As Clara only uses verified sources when answering customer questions, the risk of incorrect information is low, but Helvetia recommends contacting the customer advisory service or using alternative contact options if anything is unclear. Users can also rate Clara’s answers and thus help improve the service.

Helvetia has been using artificial intelligence for several years already in areas such as claims processing, identification of fraud, underwriting and marketing. The company actively involves its employees in AI-adoption; for example in the development of self-learning models. Helvetia believes that using artificial intelligence expertly and transparently is crucial in the development of current and future insurance models.

Featured image credit: Helvetia