In the financial services industry, generative artificial intelligence (AI), a class of AI systems designed to generate new, original content autonomously, is being deployed to automate time-consuming, tedious jobs in areas including customer service, fraud prevention, coding and information analysis.

However, its use in more sensitive tasks closer to the core of financial service business models remains limited, hindered by regulatory hurdles and weaknesses in the technology itself, a new report produced by the MIT Technology Review Insights and developed in partnership with UBS Group says.

The report, which is based on six in-depth interviews with senior executives and experts conducted in June to September 2023, looks at the early impact of generative AI within the financial sector and the barriers that need to be overcome in the long run for its successful deployment.

According to the report, banks have started deploying generative AI nimbly, focusing on use cases revolving around cutting costs and freeing employees from low-value, repetitive work. But despite the potential benefits of enhanced productivity and improved efficiencies, financial services companies are facing challenges in adopting these new technologies due to entrenched legacy systems, regulatory risks and challenges relating to bias and accountability.

Customer service

According to the report, financial services firms have so far focused their generative AI deployment efforts on customer service, fraud prevention, coding and software development, and information analysis.

In customer service, the report notes that the most common innovation is the creation of chatbots for either direct use by customers or company service agents. These generative AI-powered chatbots and virtual assistants are used to provide round-the-clock customer support, create instant and accurate responses, and offer highly personalized customer interactions.

At Betterment, an American financial advisory company, a chatbot based on predictive AI has already “reduced the workload on our customer service team drastically,” John Mileham, CTO of Betterment, told the MIT Technology Review Insights in his interview.

Lito Villanueva, chief innovations officer and executive vice president of Rizal Commercial Banking Corporation (RCBC), said during his interview that a generative AI–based chatbot is one of the bank’s leading digital priorities, noting that these tools allow for “real-time quality customer service interactions and contributes to a seamless customer experience” by facilitating the filing of complaints, accommodation of client requests, and collection of relevant customer data.

Fraud prevention

Another popular generative AI use case outlined in the report is fraud prevention. For some years, financial services companies have been using advanced technologies, including predictive AI, to improve risk management and fraud prevention, but generative AI allows the sector to go further, notably through greater integration of unstructured data into these efforts, the report says. By using such information, companies can identify new patterns and anomalies with associated risks at both a micro level, such as the potential for an individual to default, but also at a broader one, like market trends.

Use of generative AI is particularly accelerating in the payment industry where players such as Visa and PayPal have already deployed the technology to prevent fraudulent transactions by blocking suspicious ones. Fintech companies, including such as Datavisor, Feedzai, and Forter, have also integrated generative AI into their off-the-shelf solutions to reduce payment fraud.

Coding and software

In the banking sector, generative AI is also being used for coding and software development. If properly trained, these tools can produce requested computer code as easily as others can answer questions or generate pictures, addressing technical challenges, accelerating development processes and driving innovation, the report says.

Goldman Sachs, for example, has started using generative AI tools to help its code developers. In Australia, Westpac ran a trial with generative AI to assist its coders and found a 46% productivity gain against a control group, with no reduction in code quality.

Meanwhile, Betterment’s Mileham said that his company is using generative AI software to help with debugging. The company has also procured GitHub Copilot, a cloud-based AI tool, to help with code generation and auto-completion.

Information analysis and summarization

Generative AI is also being used for information analysis and summarization, offering valuable applications in the financial services sector that enhance employee performance. This includes tasks such as querying the latest public regulations globally, generating research reports, pitch decks, customer sentiment analyses, and instruction manuals, acting as a knowledgeable “virtual expert”.

Morgan Stanley, for example, has reportedly built an AI assistant, using GPT-4, that helps its tens of thousands of wealth managers quickly find and synthesize answers from a massive internal knowledge base. The tool also summarizes the content of client meetings and generates follow-up emails.

Another leading bank reported it’s close to cutting the time to produce an investment brief by more than 90%, from nine hours to 30 minutes, by using generative AI, according to McKinsey.

And at Man Group, a large hedge fund, managers have found that generative AI can speed up initial research by reviewing academic papers and spotting patterns.

Challenges in adoption generative AI

Despite the many opportunities and benefits brought about generative AI, financial services companies are facing challenges in adopting the new technology. One of the main hurdles shared by the interviewees is the sector’s entrenched legacy systems, including their outdated software and obsolete siloed data storage arrangements.

For example, in the banking sector, the prevalence of COBOL, a six-decade-old programming language, is hindering adaptability to modern technological advancements. As of 2017, 43% of banking systems relied on COBOL, which was also behind 80% of credit card transactions and 85% of ATM activity.

The adoption of generative AI is also challenged by a shortage of talent and expertise. Since the technology is considered new, this makes it difficult to find experienced professionals in the field. But as the technology evolves over time, the report says that the availability of skilled talent will increase, especially with new entrants into the workforce.

Also, generative AI applications, while impressive, are considered general-purpose tools that may not fully address the specific needs of the financial services industry. This requires the necessary customization to meet the particular requirements of the sector.

Additionally, significant challenges lie in ensuring the reliability of the generated output, as well as addressing bias and ensuring accountability.

Finally, UBS research points to potential regulation as the main barrier to adoption of generative AI in the fintech space. The anticipation of regulatory frameworks and guidelines may impact how businesses approach the integration of generative AI, especially in fintech applications.

The potential of AI

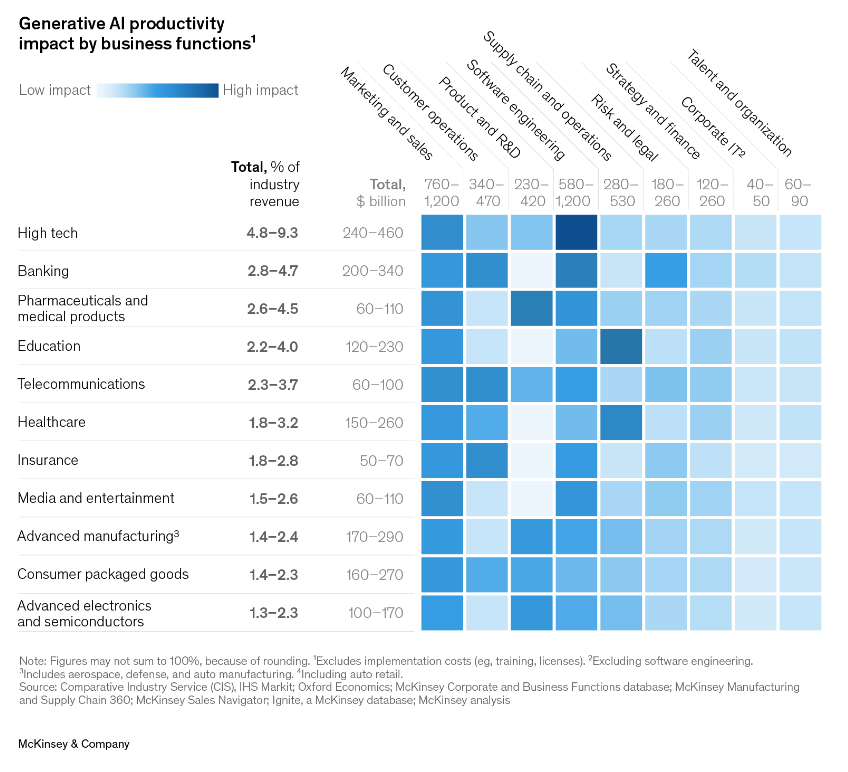

AI is expected to impact all major industries, promising to profoundly transform the way firms conduct business. Across key industries, banking is set to have one of the largest opportunities, with AI potentially adding an estimated US$1.2 trillion in global value annually, new data released by McKinsey show.

The estimates, shared in a new report titled “Capturing the full value of generative AI in banking”, reveal that the economic impact of AI will likely benefit all banking segments and functions, with the greatest absolute gains in risk and legal (US$385 billion annually), corporate banking (US$321 billion), and retail banking (US$306 billion).

Value created by AI at stake by segment and fucntion, US$ billion, Source: Capturing the full value of generative AI in banking, McKinsey, Dec 2023

Generative AI is one branch of AI that’s highlighted in the report for its potential to automate routine tasks, improve efficiencies, and enhance recommendation engines and customer experiences. McKinsey estimates that generative AI could deliver an annual potential of US$200 billion to US$340 billion (equivalent to 9 to 15% of operating profits) in the banking sector.

Generative AI productivity impact by business functions, Source: McKinsey and Company, June 2023

Featured image credit: edited from Freepik