Blockchain has been one of the most talked about technologies and trends of the past years, promising to transform business processes by improving efficiency and saving cost.

As the technology moves towards greater maturity, CB Insights’ recent report, titled What’s Next In Blockchain 2019, delves into 18 of the biggest blockchain trends of 2019, tackling everything from Bitcoin mining and cryptocurrency exchanges, to security tokens and smart contract platforms.

18 blockchain trends to watch out for this year

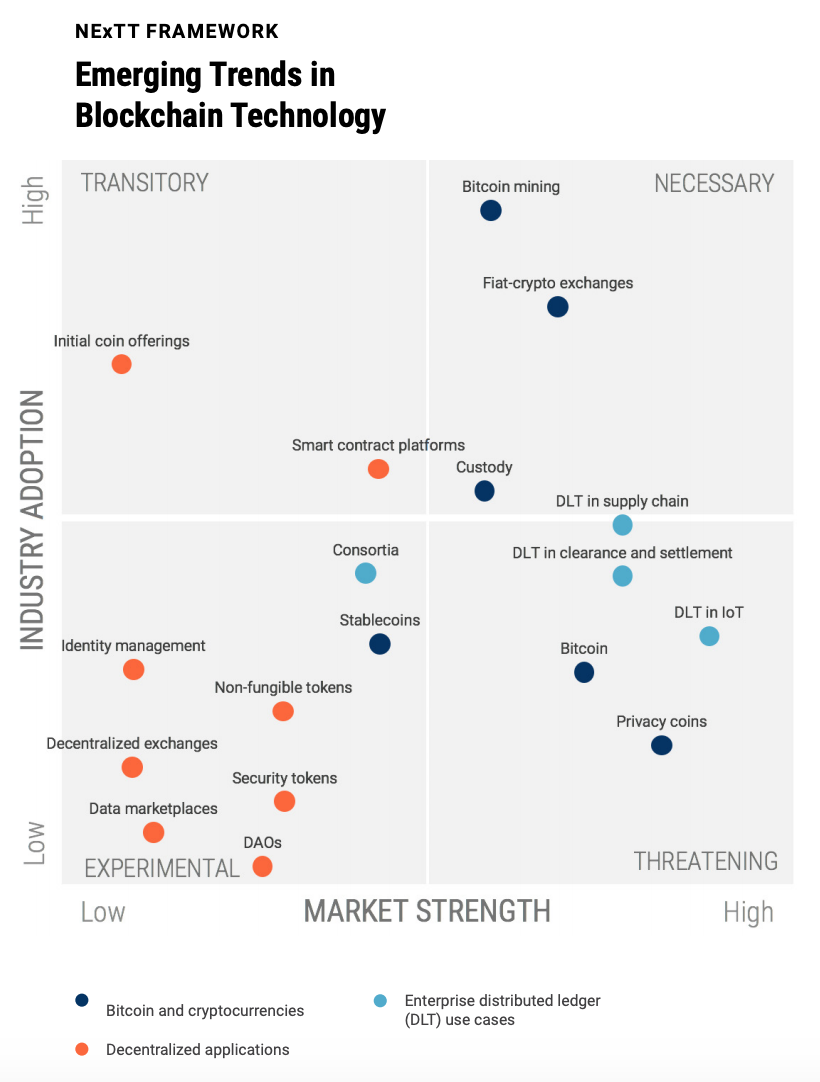

Using the NExTT framework, a method that uses data-driven signals to evaluate technology, product and business model trends from conception to maturity to broad adoption, CB Insights looks at the industry adoption and market strength of key blockchain trends we’re seeing this year, categorizing them as “necessary,” “experimental,” “threatening” or” transitory” (NExTT).

Emerging trends in blockchain technology, What’s Next In Blockchain 2019, CB Insights, July 2019

The report dives into three major “necessary” blockchain trends, which refer to trends that are seeing widespread industry and customer implementation/adoption. There are fiat-crypto exchanges, Bitcoin mining, and custody.

According to CB Insights, the entry of financial services incumbents into the crypto exchange business is pushing crypto players like Coinbase to look for other cryptocurrency use cases to drive additional revenue streams. This includes, for example, launching new trading products, listing additional cryptocurrencies, and investing out of newly-formed venture arms.

As an increasing number of financial institutions are entering the cryptocurrency space, these must figure out how to hold and secure cryptoassets, and will need access to custodial infrastructure, the report says.

On Bitcoin mining, CB Insights notes two main challenges faced by mining companies today: increased competition and decreased demand. These are now expanding into other sectors to stay relevant. The report cites the case of Bitcoin mining giant Bitfury, which raised US$80 million in late-2018 to expand into “adjacent markets” like artificial intelligence (AI).

In terms of “experimental” trends, which are trends that are still conceptual or early-stage with few functional products, the report cites decentralized exchanges, a major trend that refers to platforms that use blockchain to enable exchange without a centralized middleman.

Decentralized exchanges hold the promise of greater security, but the space still need to be weighed against securities laws and KYC/AML, and “it’s only a matter of time before a successful decentralized exchange emerges somewhere,” the report says.

Blockchain consortia too, are still at early stage, despite having made headlines over the past few years. In theory, consortia bring competitors together to collaborate, but significant hurdles remain before these collaborations birth actual solutions that can be deployed and fully implemented, and see broader adoption.

Other experimental trends this year include stablecoins, or cryptocurrencies optimized for stability; security tokens, which intend to bring real-world assets onto the blockchain; non-fungible tokens, or unique, blockchain-based tokens that distinguishable from one another; data marketplaces that leverage blockchain to give individuals the ability to control and sell their data; decentralized autonomous organizations (DAOs), or “ownerless” companies that operate autonomously; and blockchain-enabled identity management, which promises to allow users (not Internet giants) to control their own digital identities.

As of the “threatening” trends, which have been embraced by early adopters and may be close to gaining widespread industry or customer adoption, the report cites the use of blockchain or distributed ledger technology (DLT) in clearance and settlement, an application of the technology that’s been widely explored by numerous financial institutions over the past years; DLT in supply chain where several advances and developments have been made by the likes of Nestle; and DLT for the Internet-of-Things (IoT), where the technology promises improved security and efficiency.

Other “threatening” trends include Bitcoin, which has witnessed significant traction as a speculative asset but where real-world use cases are still limited; and privacy coins, which are still seeking acceptance beyond the black market.

Finally, CB Insights names two “transitory” trends, which have witnessed adoption but where there is still uncertainty about market opportunity.

Initial coin offerings (ICOs) were all the rage in 2017 but have recently witnessed a slowdown due to unfavorable regulations, and smart contract platforms like Ethereum, which remain an exciting area of blockchain technology development, but where consumer adoption today is still low.