Adoption of Digital Assets Among Institutional Investors Increases

by Fintechnews Switzerland November 14, 2022Despite turbulent conditions in the crypto markets, adoption of digital assets among institutional investors is increasing worldwide, driven by improved perception of the emerging asset class and investors’ attraction to the prospect of high returns, according to the Fidelity Digital Assets 2022 Institutional Investor Digital Assets Study.

This year’s survey, which polled more than 1,000 institutional investors in Europe, the US and Asia during the first half of 2022, found that adoption of digital assets is increasing globally this year with nearly six-in-10 (58%) institutional investors surveyed indicating investing in digital assets during H1 2022. The figure represents a six-point increase from 2021’s 52%.

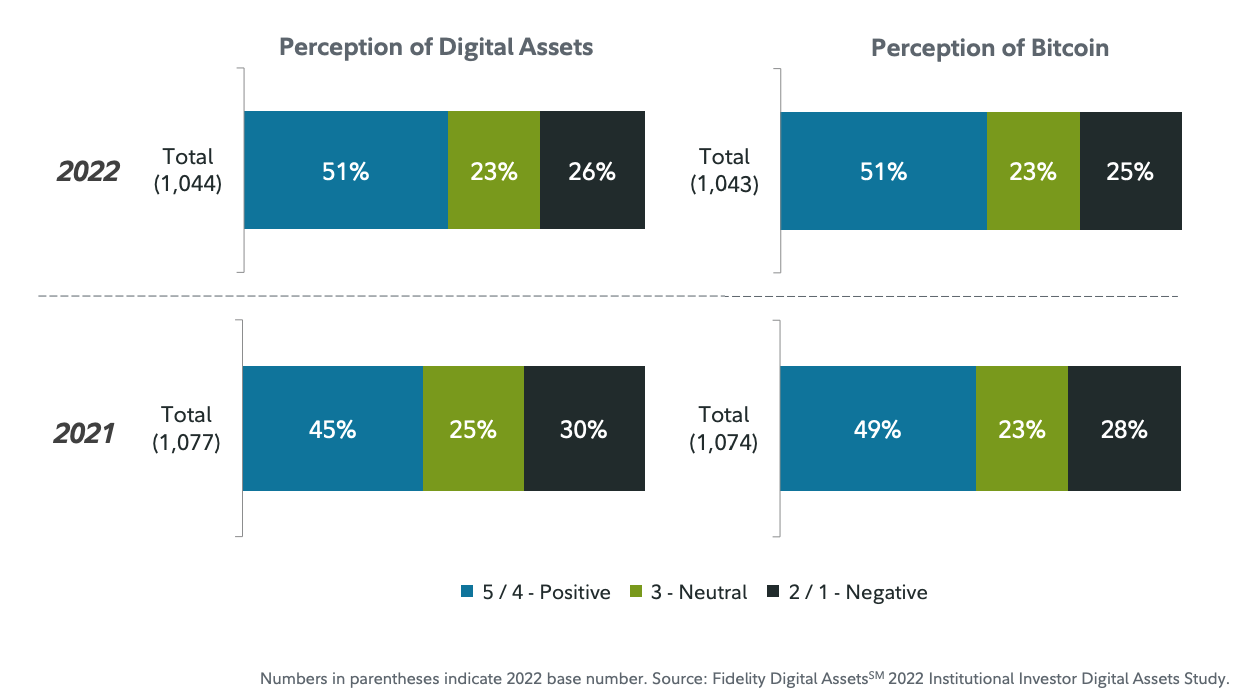

Perception is also rising worldwide with positive perception on digital assets increasing six points from 2021 to 2022, and positive views of Bitcoin growing two points.

Perception of Digital Assets and Bitcoin, Source: Fidelity Digital Assets 2022 Institutional Investor Digital Assets Study, Oct 2022

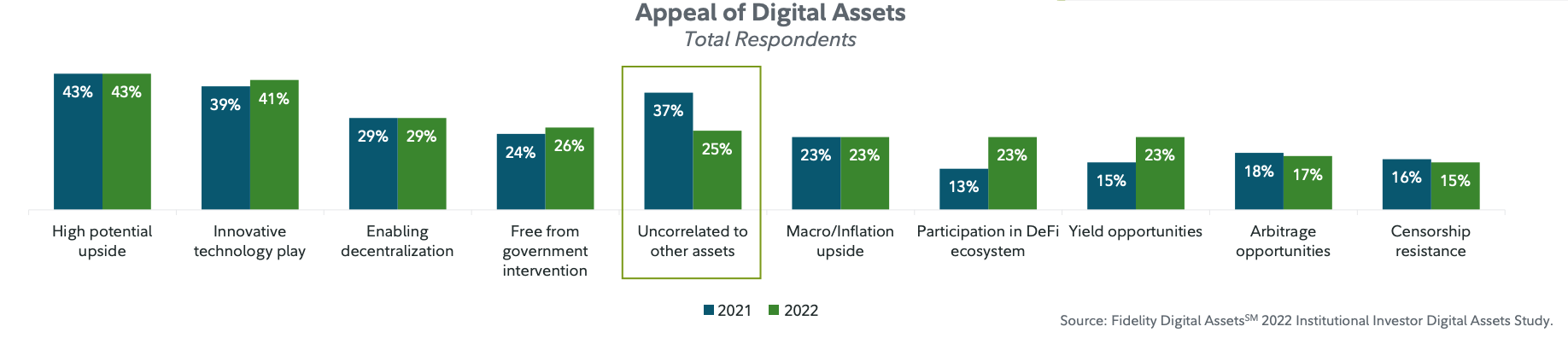

Globally, a vast majority of respondents (88%) indicated finding characteristics of digital assets appealing, a figure that rose five points in the US, and two points in Europe in 2022. Like in 2021, respondents cited the high potential upside (43%), innovative tech play (41%), and the enablement of decentralization (29%) as the most appealing features of digital assets.

But perhaps most notably this year, investors showed greater interest in decentralized finance (DeFi) and yield opportunities, two features related to digital assets that are gaining appeal among institutional investors. 23% of respondents cited participation in the DeFi ecosystem as a compelling feature, up 10 points from 2021, while 17% named yield opportunities, an eight-point increase from last year.

Appeal of digital assets, Source: Fidelity Digital Assets 2022 Institutional Investor Digital Assets Study, Oct 2022

Increased interest in digital assets is also evidenced by rising intent to participate in the sector. In total, 74% of surveyed institutional investors said they planned to buy or invest in digital assets in the future, up three points from 71% in 2021.

Asia is Leading in Digital Asset Ownership

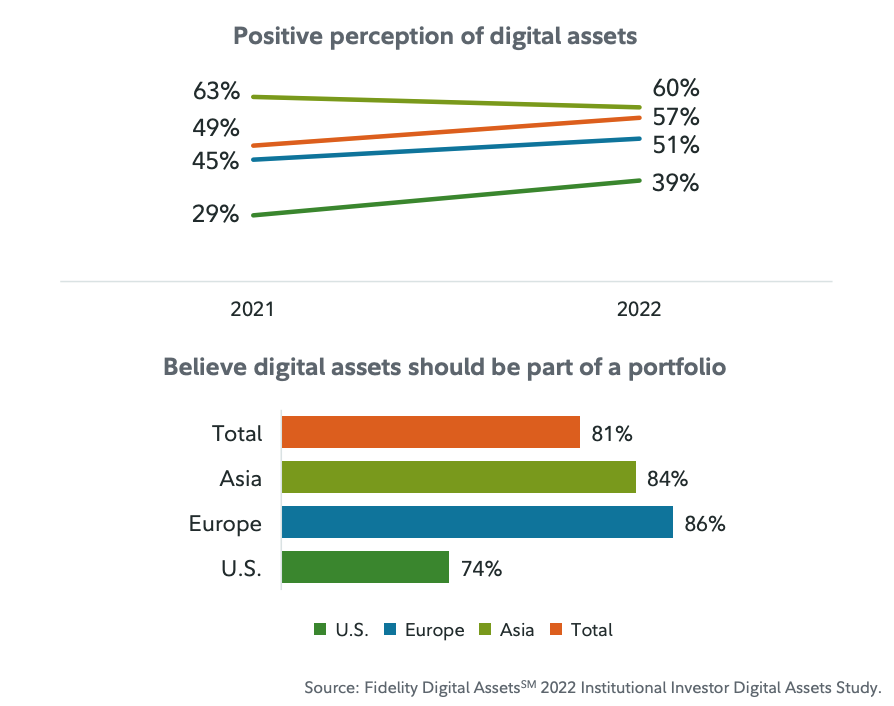

Looking at geographic trends, findings reveal that Asia maintained the leading position in digital asset ownership (69%) in 2022 and had the most affinity for digital assets (60%). Asian investors have historically had a more positive view of digital assets and have been early adopters of new digital payment methods.

The region, however, saw a slight decline in adoption and perception, down two and three points from last year, respectively.

Europe and the US, on the other hand, reported increased familiarly, improved perception, and more digital asset investments. Between the two regions, it is Europe that saw the biggest rise, recording a 11-point increase in ownership, against nine points for the US. Overall, the 2022 results put Europe on par with Asia in terms of overall adoption and positive perception.

Positive perception of digital assets, Source: Fidelity Digital Assets 2022 Institutional Investor Digital Assets Study, Oct 2022

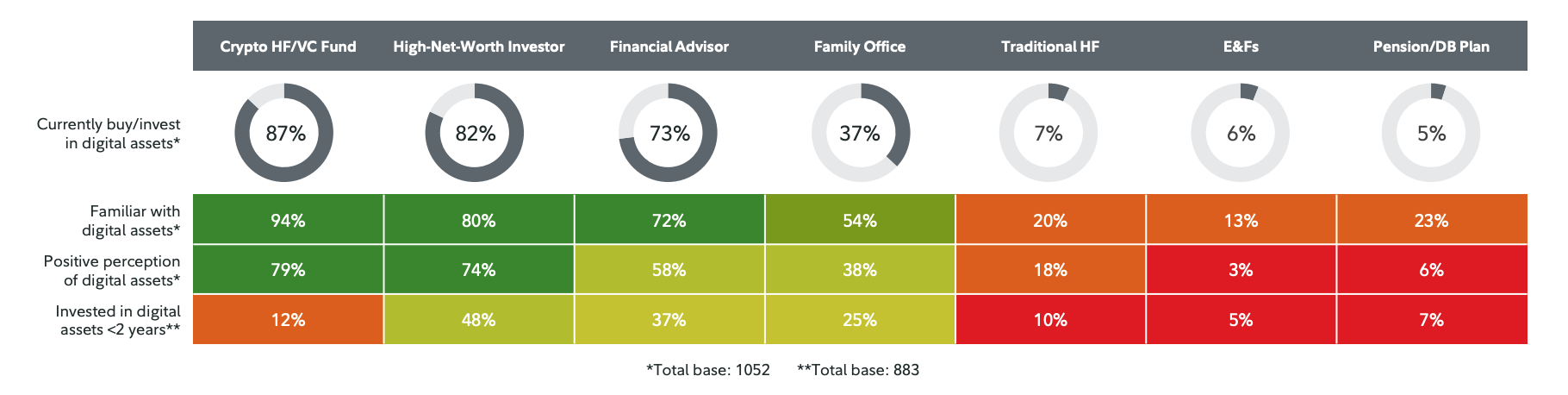

Globally, adoption and consideration of digital assets among institutional investors are the highest among high-net-worth investors (82%), alongside crypto hedge funds and venture capital (VC) funds (87%) and financial advisors (73%).

Adoption is lower among family offices (37%), pensions/defined benefit (DB) plans (5%), traditional hedge funds (7%), and endowments and foundations (E&Fs) (6%).

Global adoption and consideration of digital assets by segment, Source: Fidelity Digital Assets 2022 Institutional Investor Digital Assets Study, Oct 2022

Despite an overall increase in adoption of digital assets among institutional investors, market players also identified several challenges which they believe are hampering adoption.

Consistent with 2021’s results, price volatility (50%) was identified as the biggest barrier to investing in digital assets. The lack of fundamentals to gauge appropriate value (37%), security concerns (35%) and concerns around market manipulation (35%) are other major obstacles.

Cryptocurrencies have a long history of extreme volatility but this year’s price swings have been particularly wild. Just this week, the price of bitcoin fell to a two-year low as the market further dipped following the fall of FTX, a crypto exchange once hailed as the industry’s next success story.

Earlier this week, users and investors of FTX lost confidence in the exchange after Changpeng Zhao, CEO of Binance, liquidated about US$500 million worth of FTX’s in-house crypto token FTT and expressed skepticism about the company’s financial stability. The Twitter posts sparked a three-day bank run of an estimated US$6 billion which sent FTX into crisis.

Binance agreed to bail out FTX but the deal was eventually called off after discoveries made during “corporate due diligence” made the deal too risky.

Bitcoin and ether are down more than 20% over the last week.

Featured image credit: Freepik