Application of DLT in Capital Markets Could Help Save Billions of Dollars in Operational Costs

by Fintechnews Switzerland June 5, 2023Distributed ledger technology (DLT) has the potential to deliver transformative benefits for capital markets, helping deliver billions of dollars in cost savings through improved operational efficiency, broader market access and opportunities for value creation, a new report by the Global Financial Markets Association (GFMA) together with Boston Consulting Group (BCG), Clifford Chance and Cravath, Swaine and Moore, says.

The paper, titled The Impact of Distributed Ledger Technology in Global Capital Markets, looks at the opportunities and risks of DLT and DLT-based securities, sharing estimates on the potential cost savings and value creation opportunities brought about the technology in the sector.

Findings from the research show that DLT has the potential to significantly reduce costs, helping save an estimated ~US$15-20 billion in annual global infrastructure operational expenditures. This cost reduction comes from the technology’s ability to streamline and automate various processes and reduce the need for intermediaries and human intervention.

Smart contracts, or programs stored in a blockchain, can automatically execute predefined actions when specific conditions are met, eliminating the need for manual verification and reducing settlement time.

Enhance Market Liquidity

DLT can also enhance overall market liquidity and market access for people and organizations that have traditionally faced barriers to entry. By leveraging DLT, the tokenization of assets becomes possible, allowing fractional ownership and enabling investors to participate in previously illiquid markets, such as real estate, unlisted equities and commodities.

According to the research, the market growth prospects for DLT-based securities are considerable. The stock of DLT-based securities stood at about US$310 billion as of 2022, comprising a combination of listed and unlisted equity, bonds and other financial assets. This value is projected to soar to US$16 trillion by 2030, representing a 63% compound annual growth rate (CAGR).

Growth will be mainly driven by rising demand for DLT-based securities and growing interest in digital assets. A survey of global institutional investors conducted in 2022 by BNY Mellon and Celent found that 53% of respondents had already invested in tokenized securities or were exploring this emerging form of assets. 41% said they owned cryptocurrencies.

An overwhelming majority (91%) of respondents expressed interest in tokenized products, confident that tokenization will “revolutionize asset management” (97%). Respondents cited the removal of friction from transfer of value (84%) and increased access for mass affluent and retail investors (86%) among the top benefits of tokenization.

Respondents also shared plans to increase their investment in the space, indicating that they would increase portfolio allocations to all major types of digital assets within the next two to five years.

Interest from institutional investors in digital assets and allocation, Source: 2022 Survey of Global Institutional Clients, BNY Mellon and Celent, 2022

Market participants have been exploring DLT for several years. As of December 2022, about 85% of members the GFMA trade group had a DLT use case either at pilot stage or in production, the report says, while others had already deployed their DLT-based solutions and platforms to the market.

HQLAx, for example, is a fintech company based in Luxembourg that specializes in liquidity management and collateral management solutions for institutional clients.

Leverage DLT

The company’s platform leverages R3’s DLT to facilitate large scale and cost efficient collateral transfers across the global financial ecosystem by providing improved collateral fluidity with an operating model that allows for transferring of title and which does not require securities to be moved across central securities depositories (CSDs).

JP Morgan provides an application called Digital Financing that makes use of the bank’s Onyx Digital Assets DLT platform and tokenization to enable true delivery-vs-payment (DvP) settlement for repurchase agreements. The platform enables the real-time simultaneous transfer of tokenized cash and collateral, reducing settlement risk and timeline.

Despite clear interest in DLT for use cases in capital markets, the report notes that adoption has been relatively slow in the industry with DLT-based issuances remaining so far largely experimental.

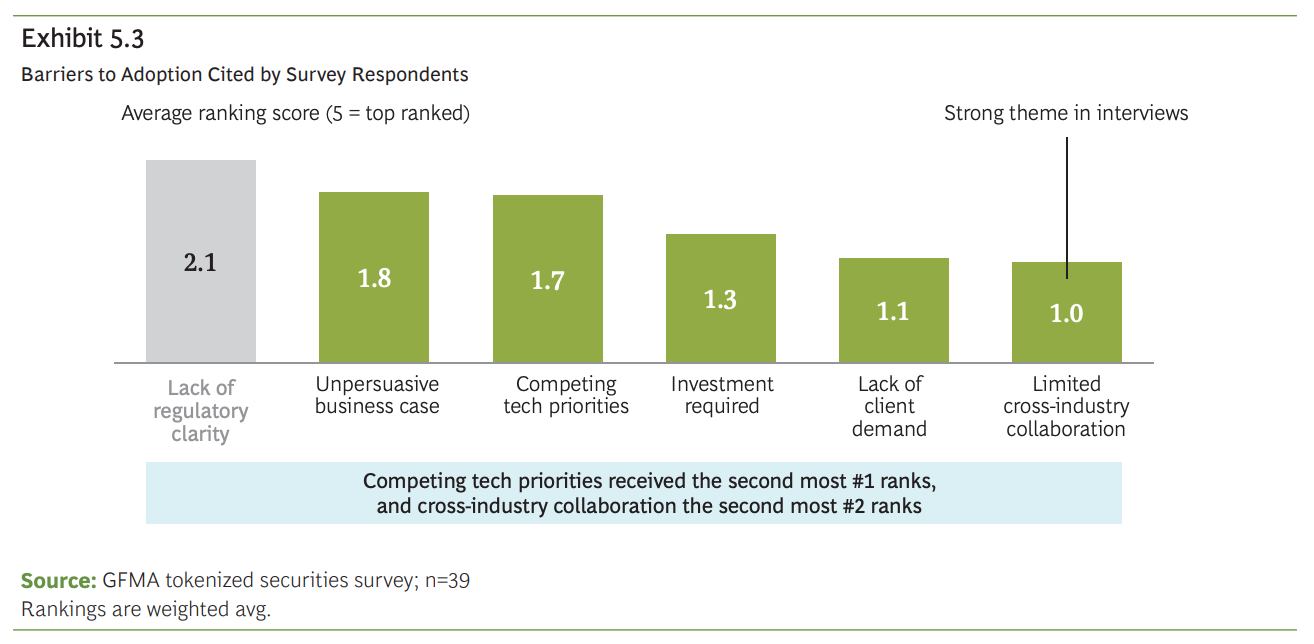

This slow uptake is due to several challenges relating notably to regulatory ambiguity, technological challenges and competing tech priorities, findings from a survey of GFMA members found. Respondents also raised concerns about limited investment and a lack of overall demand.

Barriers to adoption cited by survey respondents, Source: The Impact of Distributed Ledger Technology in Global Capital Markets, Global Financial Markets Association (GFMA), 2023

The report expects the market to end its experimentation phase within the next three years and move into commercialization. In this next phase, demand from issuers and investors will scale, regulatory ambiguity will be solved and DLT-based platforms will become increasingly interoperable, the report says.

The last phase of development, which is expected to take place from 2028 onwards, will be marked by the predominance of DLT-based primary and secondary markets for specific asset classes and transaction types, harmonized legal and regulatory frameworks across jurisdictions, and interoperability across platforms, the report says.

Possible future developments of a DLT ecosystem, Source: The Impact of Distributed Ledger Technology in Global Capital Markets, BCG, Global Financial Markets Association (GFMA), 2023

Featured image credit: Edited from freepik