BBVA Switzerland Rolls Out Crypto Asset Trading for Its Private Banking Clients

by Fintechnews Switzerland June 21, 2021BBVA Switzerland makes its first crypto asset trading and custody service available to all its private banking clients after six months of testing with a selected group of users.

The new service is available only in Switzerland and has started operating for its private banking clients interested in digital asset investments.

For the time being, BBVA Switzerland‘s offer includes bitcoin trading and custody services, with the aim of extending it to other cryptocurrencies. The entity will not offer advice on these types of investments.

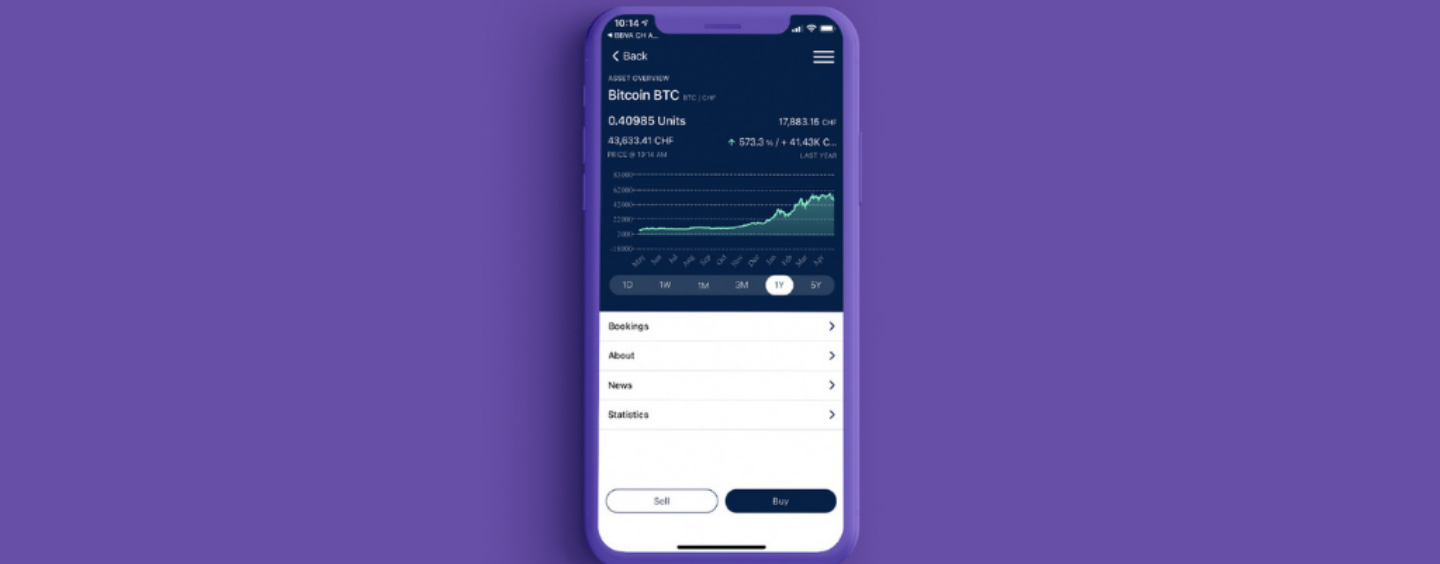

The bitcoin management system is fully integrated in its app, where its performance can be viewed alongside that of the rest of the customers’ assets, funds or investments.

Through the customer’s personalised digital wallet, bitcoins can be converted into euros or any other current currency, and vice versa, automatically, without delays and without the illiquidity that affects other digital wallets or independent brokers.

For the time being, BBVA is limiting this new cryptocurrency service to Switzerland because it has an ecosystem where there is clear regulation and widespread adoption of these digital assets.

Its extension to new countries or other types of customers will depend on whether the markets meet the appropriate conditions in terms of maturity, demand and regulation.

Alfonso Gómez

“This gradual roll-out has allowed BBVA Switzerland to test the service’s operations, strengthen security and, above all, detect that there is a significant desire among investors for crypto-assets or digital assets as a way of diversifying their portfolios, despite their volatility and high risk.

With this innovative offer, BBVA positions itself as a benchmark institution in the adoption of blockchain technology. Over the coming months, we will continue to enhance and expand the digital asset offering,”

said Alfonso Gómez, CEO of BBVA Switzerland.

Featured image: BBVA