CFA Institute: Finance Professionals Show Divide on Central Bank Digital Money

by Fintechnews Switzerland August 17, 2023Globally, finance professionals have limited understanding of central bank digital currencies (CBDCs) and are showing division on whether central banks should launch such instruments, a new study conducted by industry association CFA Institute revealed.

The survey, which polled more than 90,000 CFA Institute members from countries like the US, Switzerland and China, revealed that, at the global level, the question of whether to launch a CBDC failed to gain majority support. 42% of respondents said they were in favor of central banks launching CBDCs, while 34% were opposed. A sizeable portion, 24%, voiced no opinion.

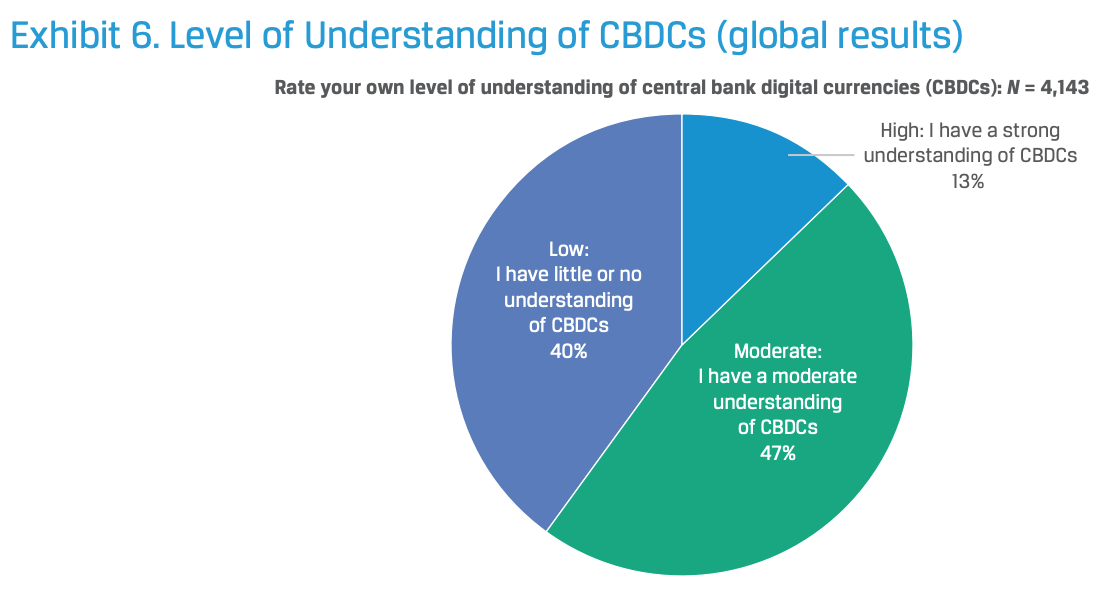

Findings also revealed that finance professionals’ self-reported understanding of CBDCs was quite limited, with only 12% of the respondents stating they had a strong understanding of CBDCs.

These results suggest that central banks and governments will need to engage in a significant educational and outreach effort to explain why they would launch CBDCs, for what purpose, and under what circumstances.

Level of understanding of CBDCs (global results), Source: CFA Institute Global Survey on Central Bank Digital Currencies, CFA Institute, July 2023

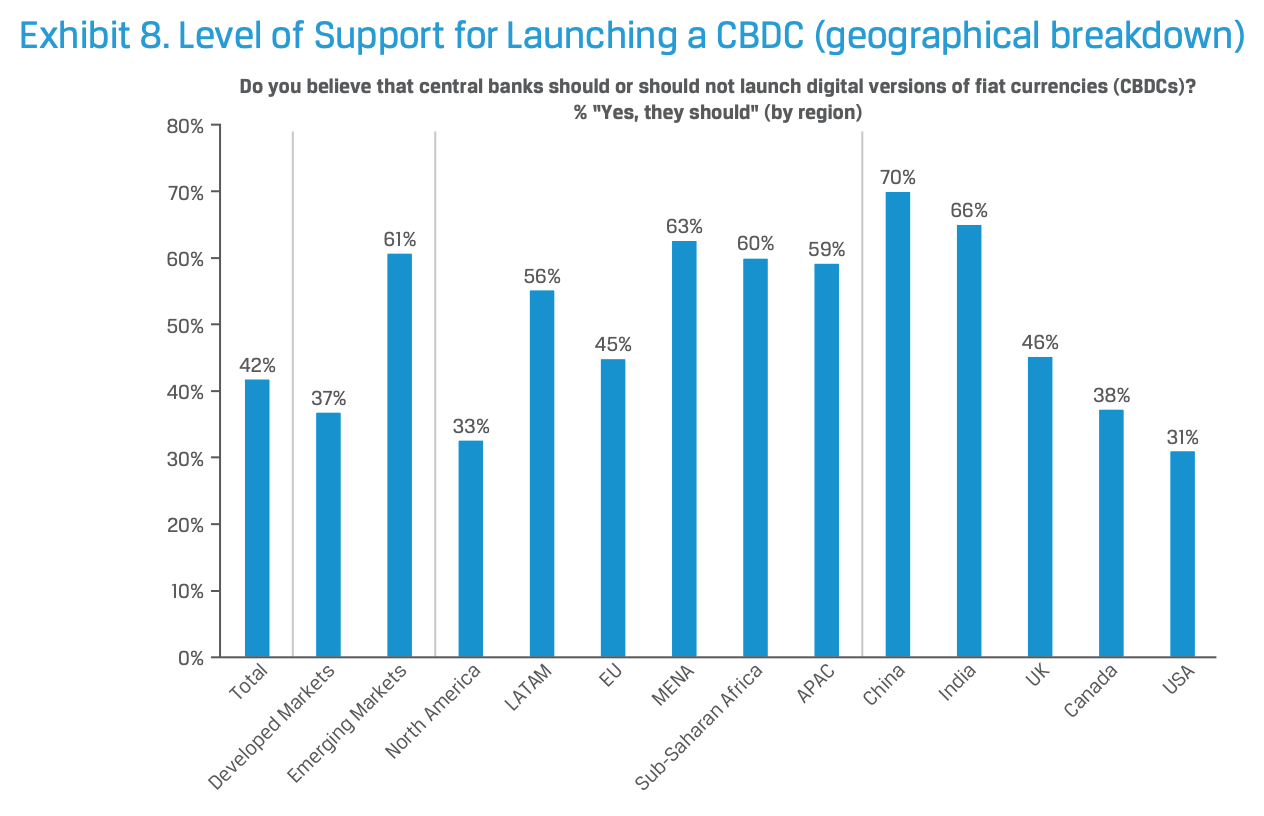

Taking a deeper look at the regional level, the study found that respondents in developed markets were much less enthusiastic for CBDCs (37% of respondents in favor) than did those in emerging markets (61% in favor).

North America, in particular, was found to be the region with the least favorable view (33%) of launching CBDCs, while Asia Pacific (APAC) showcased the most favorable view (59%) with notably high levels of support in China (70%) and India (66%).

This divergence can be partly explained by the different levels of economic development and capital market sophistication in developed markets versus developing markets. Most developed markets already provide a large spectrum of banking and asset choices, but these may be lacking in developing markets, the report notes. Moreover, the availability of cryptocurrency and digital asset products in these markets may already be offering potential users valuable innovation in investment options, making CBDCs somewhat redundant.

Level of support for launching a CBDC (geographical breakdown), Source: CFA Institute Global Survey on Central Bank Digital Currencies, CFA Institute, July 2023

Respondents were also asked about the reasons why they opposed the launch of a CBDC, to which they highlighted two reasons in particular: data privacy concerns (50%) and the lack of use cases for a CBDC (40%).

At a regional level, data privacy concerns were the highest in developed markets, especially in the US and Switzerland, and lowest in India and Latin America, the study found. Developed markets also showed a higher level of doubt as to the purposefulness of CBDCs (42%) when compared to emerging markets (32%).

Reasons for opposing the launch of a CBDC (global), Source: CFA Institute Global Survey on Central Bank Digital Currencies, CFA Institute, July 2023

Improved payment efficiency and financial inclusion

Despite the risks and challenges, financial professionals also believe CBDCs could bring many benefits to the financial services industry. In particular, respondents cited the primary reason for supporting a CBDC as being the potential of enhanced payments and money transfers as well as reduced counterparty and settlement risk in the system (58%).

Another reason cited for launching a CBDC cited by respondents was the belief that central authorities should play a central role in the development of cryptocurrencies. That reason elicited a staggering 100% response rate in China, while scoring 30% globally.

In emerging markets, meanwhile, two of the top motivations to explore CBDCs are to provide a cash-like means of payment and to promote financial inclusion. 55% of respondents in emerging markets said they believed that CBDCs could enhance financial inclusion. with China (66%) and India (64%) recording the highest rates.

Reasons for supporting the launch of a CBDC (global), Source: CFA Institute Global Survey on Central Bank Digital Currencies, CFA Institute, July 2023

These findings align with results of studies conducted by other organizations. A 2022 survey of 86 central banks run by the Bank for International Settlements (BIS) revealed that the motives for considering the issuance of retail CBDCs revolved mainly around improving financial inclusion and payment efficiency.

Motivations for issuing a retail and wholesale CBDC, advanced economies versus emerging economies, Source: BIS central bank surveys on CBDCs and crypto, 2018–2022, Bank for International Settlements, July 2023

CBDCs, tokenization and distributed ledger technology (DLT) more broadly have been praised for their potential to streamline the settlement process in financial markets.

A 2023 report by the Global Financial Markets Association (GFMA) together with Boston Consulting Group (BCG), Clifford Chance and Cravath, Swaine and Moore, estimates that DLT could help save an estimated ~US$15-20 billion in annual global infrastructure operational expenditures by streamlining and automating various processes in the chain as well as reducing the need for intermediaries and human intervention.

Additionally, since CBDCs would be accessible through smartphones or other digital devices, the technology could potentially bringing financial services to those who are unbanked or underbanked. This can be especially beneficial in regions where traditional banking infrastructure is lacking but mobile phone penetration is high.

Central banks accelerate CBDC efforts

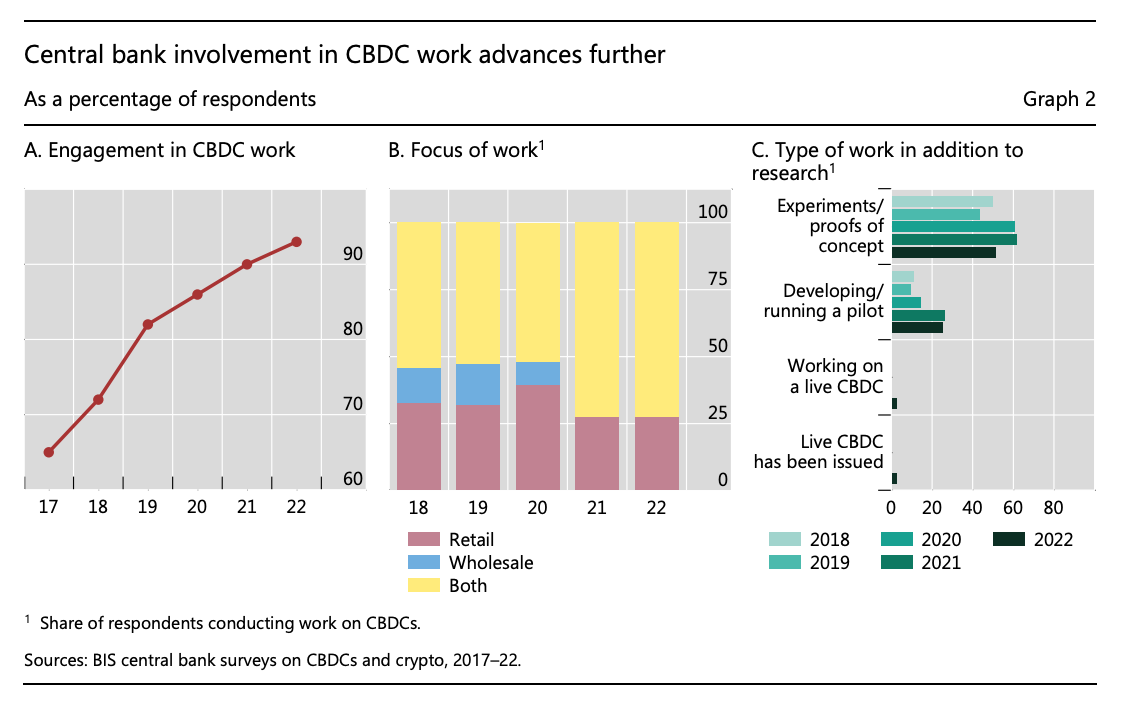

Central banks around the world have ramped up their CBDC efforts over the past years, encouraged by the emergence of stablecoins and cryptocurrencies. Over the course of 2022, the share of central banks engaged in some form of CBDC work rose further, climbing from 86% in 2020 to 93% in late-2022, studies conducted by the BIS show.

Central bank involvement in CBDC work, Source: BIS central bank surveys on CBDCs and crypto, 2017–2022, Bank for International Settlements, July 2023

In Switzerland, the central bank shared earlier this year how it intended to “future-proof” the domestic payment ecosystem, outlining its ambition to leverage technologies and processes including tokenization and DLT.

Swiss National Bank governing board member Andréa Maechler said during an event in March that the authority was conducting a study on how central bank money could be made available in a regulated token environment.

The project focuses on examining different models for token settlement, and is being undertaken in collaboration with regulated financial market infrastructures and other market participants.

Featured image credit: edited from freepik