Challenges and Opportunities of CBDC for Banks and Corporations

by Fintechnews Switzerland January 26, 2021Central banking digital currencies (CBDCs) are poised to have significant implications for banks and non-bank firms, forcing them to adopt new approaches to processing payments and bringing about new possibilities, says consultancy firm Accenture.

As part of a blog post series on the role of blockchain-powered CBDCs in the future of money, Accenture’s senior advisor of global blockchain technology, Ousmene Jacques Mandeng, wrote in an article that CBDCs will open up a new range of banking service opportunities and shake up national and international banking and payment relations.

Opportunities and challenges for banks

According to Mandeng, there are six main goals and challenges for banks in the adoption of CBDC.

One challenge relates to the infrastructure of the new system, for which, he says, the central bank and the banks must share the operation, maintenance, and integrity of the network.

Ultimately, this means that banks will have to maintain an IT infrastructure capable of processing CBDC transactions on the network at scale. They will also need to have the tech capabilities to connect to existing large-value payment systems to exchange reserves for CBDC as well as maintain electronic vault to store CBDC.

Banks will have to develop user endpoints, including electronic wallets for clients to make payments and transactions. These endpoints must come with features and capabilities that help prevent illicit transactions, including money laundering and terrorism financing.

Another imperative will be to integrate CBDC-related functions into existing core banking and payment applications for seamless operations and users experiences across both legacy and token platforms. Ultimately, end-users will have to be able to make transactions in both environments and even cross these environments without any trouble.

Once the infrastructure and endpoints fully up and running, banks should take advantage of CBDC to build new services. For example, banks can utilize CBDC to perform commercial transactions, reducing thus settlement risks and lowering transaction costs, while easing the related risk management provisions.

CBDC can also be used to settle large-value international transactions and can facilitate security settlements with non-resident institutions.

Finally, end-users may prefer CBDC as a medium to store value, which could lead to them substituting bank deposits for CBDC. Hence, banks must ensure their offerings remain attractive to mitigate any possible migration from bank deposits to CBDC.

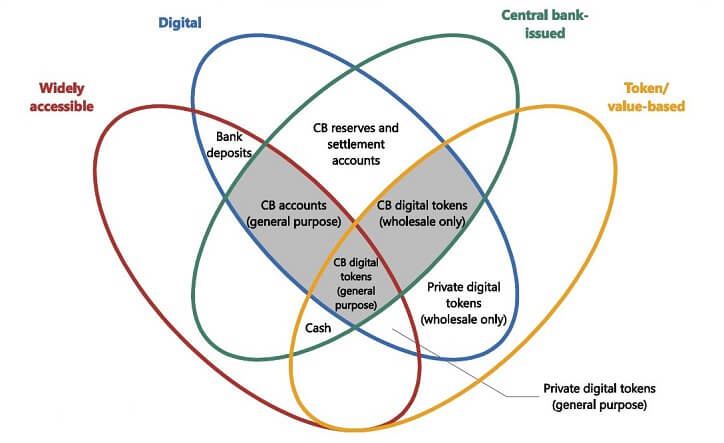

Image: Adapted from M Bech and R Garratt, “Central bank cryptocurrencies”, BIS Quarterly Review

Implications of CBDC for non-banking firms

For non-banking firms, CBDC will open up many new opportunities, Mandeng says. For one, CBDC offers the possibility to establish more direct payments relations and enable peer-to-peer payments in central bank money, reducing risks and costs in both domestic and international transactions. Corporations can also tap into this revamp of central bank money to provide end-users with appealing interfaces and tools to transact with CBDC.

Many advances have been made in the digitalization of transactions in supply chain and other commercial and product settings, but CBDC could push this even further by enabling for complete end-to-end digitalization of real and financial flows.

Furthermore, since CBDCs are programmable, they can come with additional provisions to detect and prevent illicit transactions more efficiently.

Finally, international investors might become interested in the prospect of CBDC to settle token-based debt and equity instruments both domestically and internationally. This trend will ultimately lead to further integration of the financial world, and a broadening of the investor universe.

The post is the second release part of the series which includes articles on what CBDCs are, the role of blockchain in CBDC, and the impact of CBDC on retail, wholesale and international payments.

CBDC has been a hot topic for the past two years or so. A 2020 study by the Bank of International Settlements found that 80% of central banks around the world were engaged in investigating CBDC and half had progressed past conceptual research to experimenting and running pilots.

Most recently, France’s central bank successfully conducted a CBDC pilot using a blockchain platform for interbank settlement.

Featured image credit: Background vector created by starline – www.freepik.com