Crypto Could Become A Reality Over The Next Decade, Says Deutsche Bank Report

by Fintechnews Switzerland December 30, 2019Until now, cryptocurrencies have been additions rather than substitutes to the global inventory of money, but over the next decade, this situation may change, according to Deutsche Bank’s Imagine 2030 report, which looks at the bank’s predictions for the 2020s.

“As we look to the decade ahead, it may not be surprising if a new and mainstream cryptocurrency were to unexpectedly emerge,” the report says. “Some countries with historically-strong banking industries are trialing cryptocurrencies. Separately, cryptocurrencies may constitute the best tool for a digital war.”

According to the bank, one of the main indicators that cryptocurrencies might become mainstream over the next decade is that on the supply side, governments and banks are rapidly moving towards a cashless society. Currently, the world’s two most populous countries, China and India, are changing their stance towards cryptocurrencies.

Until now, China and India banned the purchase and the sale of cryptocurrencies. But at the same time, the People’s Bank of China (PBOC) is looking to have cash replaced by a central bank-issued digital currency. Meanwhile, in India, a government economic panel recently pitched for the introduction of an official digital currency after triggering a demonetization push in 2016.

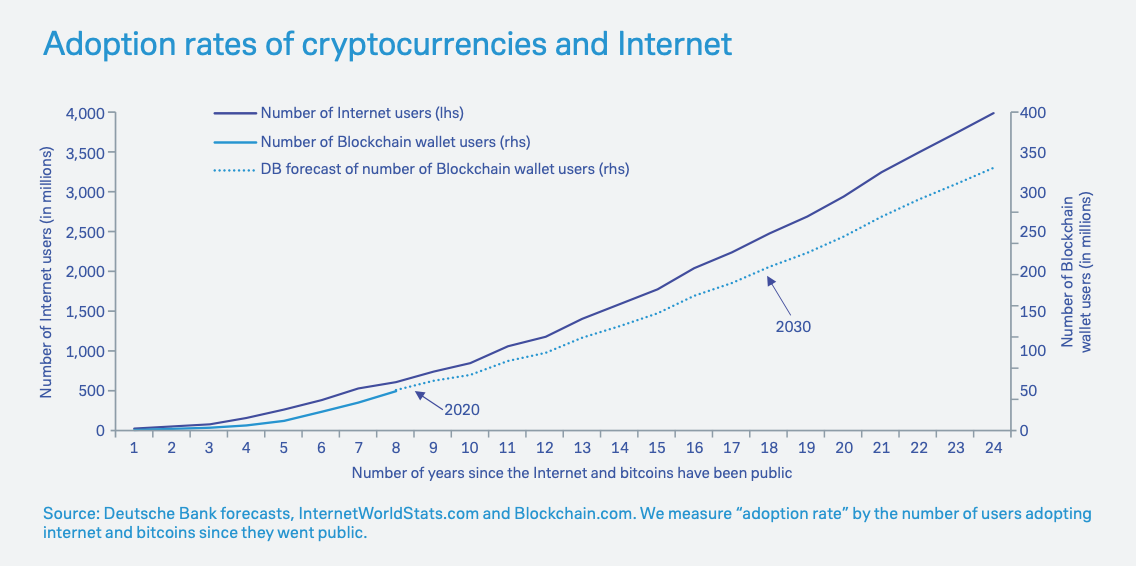

If governments were to back cryptocurrencies and consumers were to request them, adoption rates would drive the timeline for mainstream use. If current trends in adoption continue, there could be 200 million blockchain wallet users in 2030, the report says.

Adoption rates of cryptocurrencies and Internet, Imagine 2030, Deutsche Bank, 2019

Whether or not cryptocurrencies become mainstream in the future will depend heavily on adoption by major tech firms such as the GAFA (Google, Amazon, Facebook and Apple) or their Chinese counterparts, BATX (Baidu, Alibaba, Tencent and Xiaomi), and their ability to overcome regulatory hurdles, the main obstacle at present, the report says.

Cryptocurrencies must become legitimate in the eyes of the governments and regulators, have stable prices, bring advantages to both merchants and consumers, and must also allow for global reach in the payment market. For this, alliances with key stakeholders such as mobile payments apps, card providers, and retailers, must be forged, it says.

But cryptocurrencies becoming mainstream would also bring several challenges including cybercrime concerns, as well as the fact that the financial system would be entirely based on electricity consumption.

With 2019 coming to an end, experts and industry participants have shared their predictions for the year to come. Some expect the price of bitcoin to rise on the back of further expansion of global alternative payment options, while others believe that more governments and businesses will announce their own cryptocurrencies.

2020s should also be a decade marked by significant blockchain innovation and adoption. The technology is expected to get more and more integrated into business models with key areas including supply chain management and identity management, among others.

Other tech trends to watch out for

Besides cryptocurrencies possibly becoming mainstream by 2030, Deutsche Bank also predicts the end of cash plastic cards as smartphones and other electronic devices make physical cards obsolete.

Meanwhile, cash, which is well-ingrained in many advanced countries, will likely still be around despite progressively losing momentum.

The bank also expects the emergence of the “on-demand culture” fueled by the rise of super apps. These will evolve from being platforms for offerings goods and services to being vertically integrated groups.

“By 2030, super apps will use artificial intelligence (AI) to arrange our on-demand lives,” the report says. “This will work particularly well with routine-based household needs and integrate with the growing trend of smart, connected homes, as well as virtual assistants, such as Amazon’s Alexa.”

Other tech trends to watch out for include the rise of drones, electric vehicles becoming widespread, and the increasing use of AI in sports statistics and performance analysis.

Featured image credit: Unsplash