EU “Tokenise Europe 2025” Initiative Aims to Boosts Asset Tokenization

by Fintechnews Switzerland February 7, 2023A new initiative called Tokenise Europe 2025 is being spearheaded by the European Commission (EC) and the German Banking Association to tap into the potential of asset tokenization and distributed ledger technology (DLT) to strengthen the bloc’s competitiveness and build long-term economic resilience.

The initiative, which is being supported by more than 20 member organizations from different countries and industries including banking trade groups and paytech firms, aims to establish a solid foundation for the development of tokenization in Europe with hopes that the technology will drive change and efficiency in industries including finance, supply chains, trade finance, logistics and public services.

Tokenization refers to the process by which an issuer creates digital tokens on a DLT or blockchain, which represent any type of assets. Tokenization can be applied to regulated financial instruments such as equities and bonds, tangible assets such as real estate, precious metals, as well as works of authorship and art. The technology’s benefits are multiple and include increased liquidity, faster settlement, lower costs and bolstered risk management.

The best-known type of tokens are cryptocurrencies. These have risen in popularity over the past years and prompted central banks from all around the world to create a new form of money called a central bank digital currency (CBDC).

A 2021 survey carried out by the Bank for International Settlements (BIS) found that nine out of ten central banks were exploring CBDCs. More than half were developing them or running concrete experiments.

The Tokenise Europe 2025 initiative was unveiled in a new report produced by global consultancy Roland Berger, which consolidates individual views of European industry representatives taking part in the effort.

The report outlines the potential of a tokenized economy for Europe in global competition, stressing that tokenization is “crucial to safeguard the region’s future position in the global technological arena and to remain competitive”. Since there is still no clear global front-runner in tokenization, the region has a chance to secure the leading position in the race, the paper says.

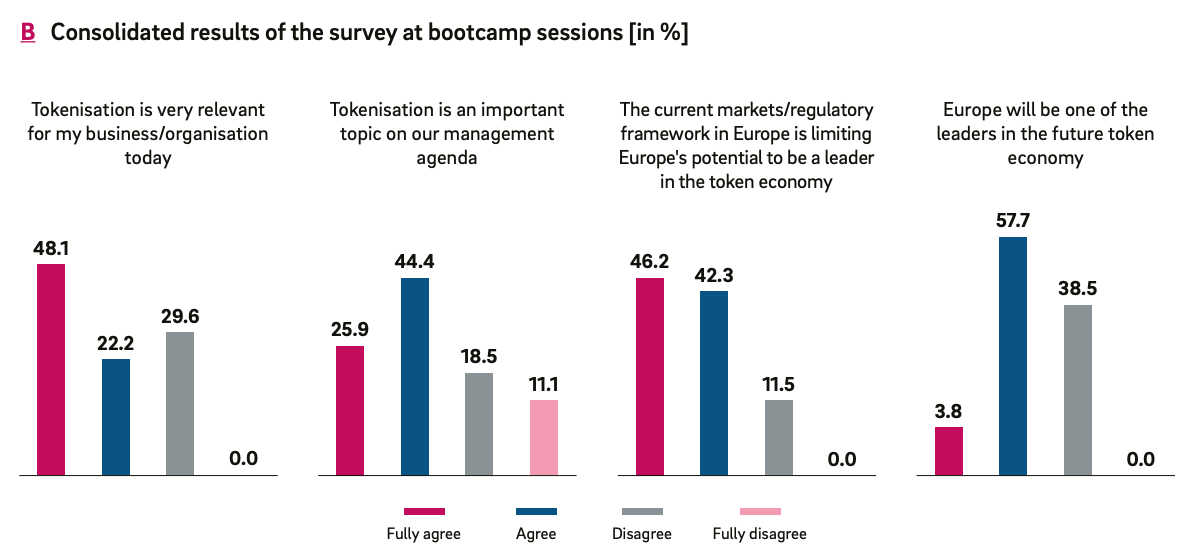

A non-representative survey conducted as part of the report polled decision makers, senior managers of Europe’s leading industry and financial services players, and senior public officials, and found that nearly two-thirds of respondents do see tokenization as relevant to their organization and to the management agenda. About half of the participants believe Europe will become a leader in the future token economy.

Consolidated results of the survey at bootcamp sessions (in %), Source: Tokenise Europe 2025, Roland Berger

Overcoming challenges

Though widespread adoption of tokenization has the potential to create new services, introduce new business models and improve efficiency across many industries, several issues are currently holding back a stronger focus on further development, the report warns.

For one, there is a perceived lack of relevance of tokenization in daily business. Hence, tokenization is not often put on the top management agenda of leading companies, perceived instead as a topic to be developed continuously in the long term.

Another factor limiting development can be found in the European culture itself. Compared with other regions, European institutions, companies and citizens are generally more conservative and risk-averse, the report says. While there is no lack of new ideas and use cases for tokenization, these advances are often viewed skeptically by the public, media and business decisionmakers alike, it notes.

The third factor is the general lack of awareness and understanding of DLT and blockchain, which ultimately nurtures a certain level of skepticism.

Against this backdrop, European regulators have a critical role to play in establishing a uniform legal and regulatory framework that legitimizes tokenization, the report says. This framework should support technological development and incentivize companies to actively innovate. It should also set out a fair competitive environment that enables and actively promotes collaboration across borders.

Central banks also have a role to play and should promote the benefits of tokenization within the financial system, including exploring the potential introduction of a CBDC.

All in all, developing Europe’s token ecosystem will require all stakeholders to make a concerted effort, the report says.

In the private sector, large corporates and small and medium-sized enterprises (SMEs) should analyze their current business models to identify opportunities for tokenization. They should also consider future opportunities that the token economy might create for their business and be actively involved by developing commercially viable and scalable use cases.

Finally, because private citizens will ultimately be the main users of tokenization, they need to educate and familiarize themselves with the technology.

Stakeholder-specific needs and calls to action, Source: Tokenise Europe 2025, Roland Berger

The EU has set out plans for the bloc to become “a leader in blockchain technology”, formally launching the so-called Blockchain Strategy to support the widespread adoption of DLT on the policy, legal and regulatory and funding fronts.

Several initiatives have already been introduced as part of the plan, including the development of a pan-European public services blockchain intended to support use cases including notarization, educational credentials, digital identity and trusted data sharing.

The EC is also developing a “pro-innovation” legal framework in the areas of digital assets and tokenization, and smart contracts, which will seek to protects consumers and provides legal certainty for businesses.