An Introduction to Bitcoin and Blockchain for Financial Services

by Fintechnews Switzerland November 26, 2015Each week, a tremendous amount of news stories related to bitcoin and blockchain technology are being published. At Fintechnews alone, not one week passes by without at least two or three new articles on the matter.

Surely, Bitcoin is hot topic and all major news organizations, blogs and firms are talking about its disruptive potential in all sorts of industries, either it is in the financial services sector or for other use cases such as personal identification and document certification.

For those you arrived late to the party and kind of missed the boat, Diana Biggs, Founder of Global Fintech Consultancy DCCB, put together a presentation on the subject.

Entitled ‘Introduction to bitcoin & blockchain for financial services,’ the presentation was put together for a presentation at BNY Mellon EMEA Treasury Conference 2015, and gives a fine summary on what is Bitcoin, the current state of the industry, as well as its possible use cases in the financial services industry.

What is Bitcoin?

Bitcoin is a global, peer-to-peer value transfer and transaction protocol. Transactions are verified by networked nodes and published on a public ledger called the blockchain.

A bitcoin refers to a unit of account on this ledger, a digital currency created and held electronically that is produced by people and businesses running computers all around the world. This process is referred as ‘mining’ and consists in using computing power in the distributed network to solve mathematical problems.

In this sense, the Bitcoin network is decentralized and completely transparent thanks to the Bitcoin blockchain which stores details of every single transaction that ever happened in the network.

Bitcoin was released in 2009 as open-source software by a mysterious developer called Satoshi Nakamoto. Although many have attempted to find the real identity of the founder of Bitcoin, the mystery still remains unsolved.

Earlier this month, to the surprise of many, finance professor from UCLA and University of Chicago Professor Bhagwan Chowdhry said he had nominated Bitcoin’s reclusive inventor for the Nobel Prize in economics.

Explaining his choice to the Huffington Post, Chowdhry said:

“I can barely think of another innovation in economics and finance in the last several decades whose influence surpasses the welfare increases that will be engendered by Satoshi Nakamoto’s brilliant, path-breaking invention. That is why I am nominating him for the Nobel Prize in Economics.”

Bitcoin in practice

Bitcoin really started gaining international attention as a new global currency in 2012. In 2015, attention switched to the blockchain technology with major banks and institutions openly unveiling their interest in the technology as well as experimenting with it.

However, public knowledge is still low as 64.9% of Americans are still not familiar at all with bitcoins, according to a survey conducted by Coincenter in April 2015. Only 4.5% of the general American population said they have used the digital currency.

As of today, Biggs estimates that around 100,000 merchants around the world are accepting bitcoin as a means of payment. The largest firms that have shown support for the digital currency include Microsoft, Overstock.com, Expedia and Dell.

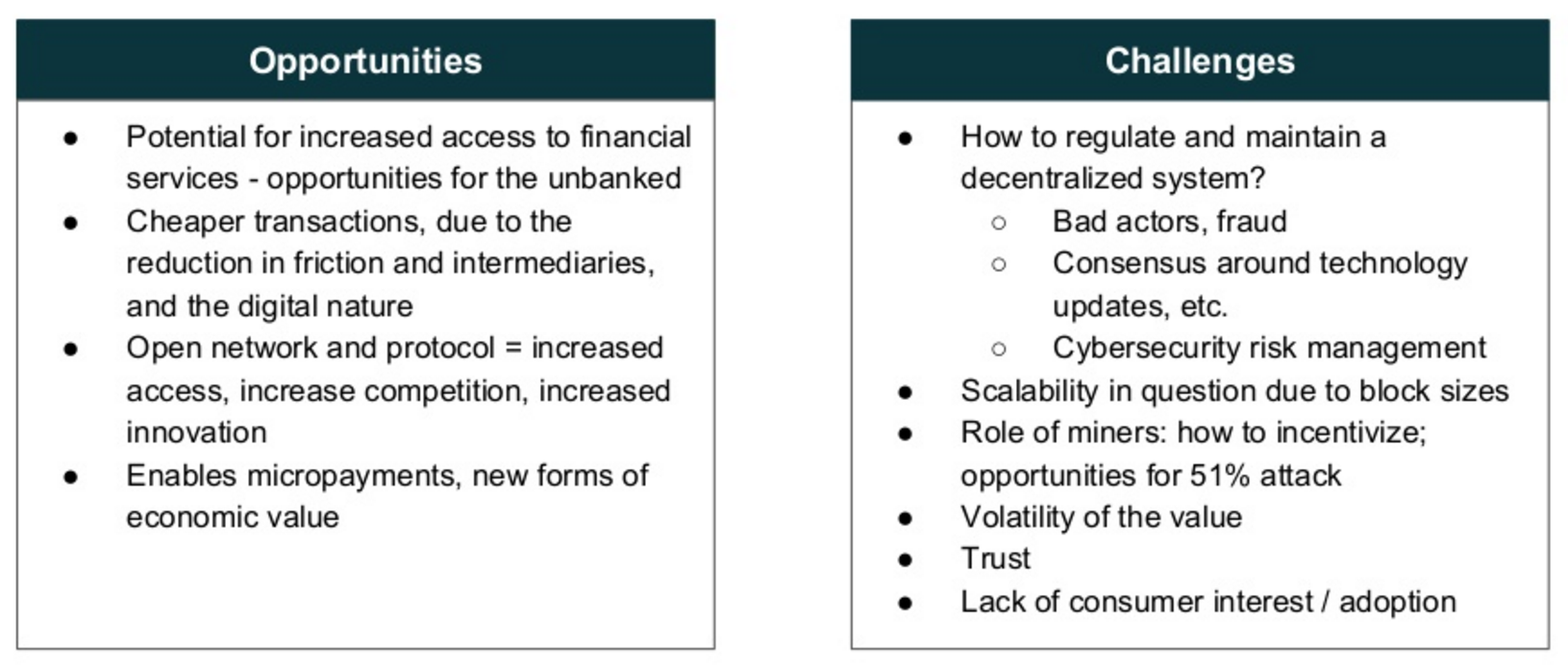

Practically speaking, Biggs highlighted the key advantages and drawbacks of using bitcoins:

Opportunities and Challenges of Bitcoin – Diana Biggs

Blockchain tech for the financial services industry

All major banks and financial institutions have shown interest in blockchain technology, but most particularly in private or semi-private blockchains. Unlike public blockchains such as the Bitcoin blockchain, participants in private blockchains are known and trusted.

Among the benefits for banks and financial services companies of using blockchain technology, many cite the potential improvement in efficiency as well as the lower cost of using distributed ledgers instead of existing infrastructures.

“The potential benefits of blockchain technology to bank-ing institutions are almost innumerable, for example large business-to-business transfers could be completed with significantly lower costs and even with minimal decentralisation, system-based transaction errors are likely to be diminished,” according to Bitcoin information portal WeUseCoins.com.

Banks and financial services players exploring blockchain – Diana Biggs

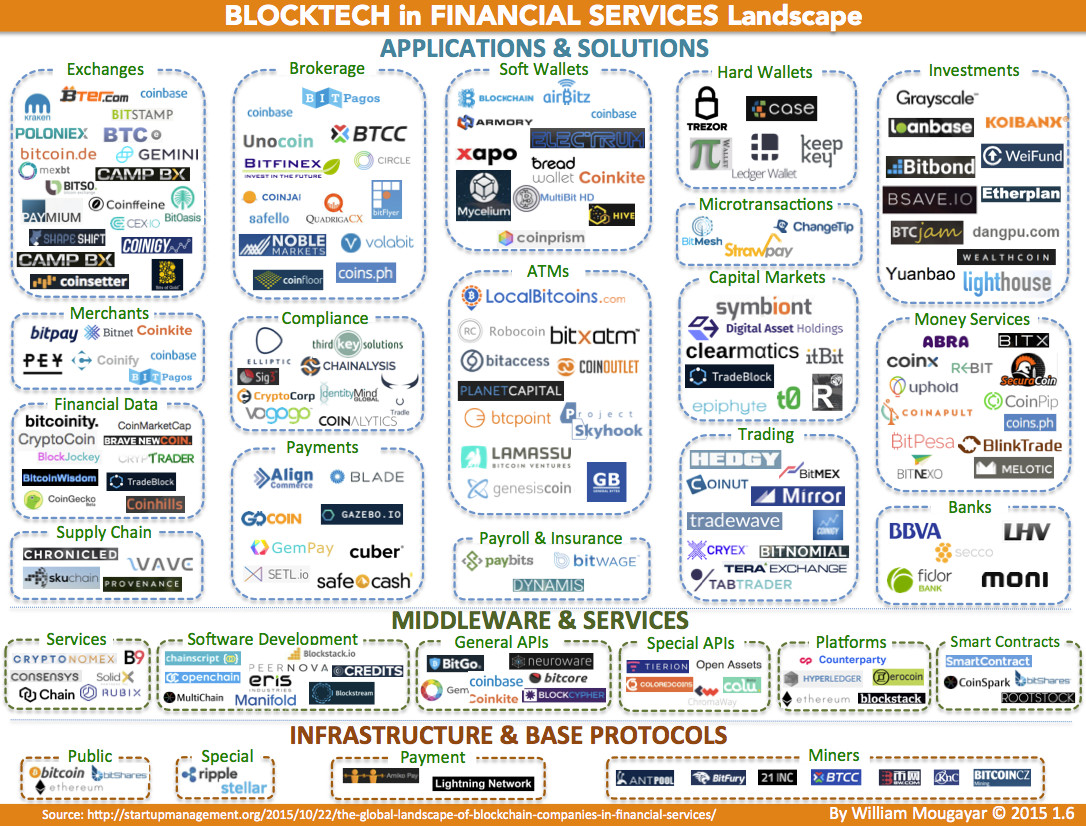

Biggs also linked to a handy infographic from Canadian VC and serial entrepreneur William Mougayar that features 192 blockchain-based companies categorized by three segments: infrastructure, middleware and applications.

Blocktech in Financial Services Landscape by William Mougayar

Check out Diana Biggs’ full presentation:

Featured Image credit: Freepik

13 Comments so far

Jump into a conversationMax greatly appreciate your party products it is of great help to us jav uncensored

Bitcoin is becoming more and more popular. So a lot of people have flocked to it without really understanding it. Your article has made it clear about Bitcoin. Thank you so much for these wonderful comments

Bitcoin is gaining popularity steadily. So, without truly knowing it, a lot of people have rushed to it. The information in your article regarding Bitcoin is straightforward.

More and more people are interested in bitcoin. The result is that many individuals have flocked to it while not truly understanding it. Your essay made Bitcoin very apparent.

What a great idea for me! I appreciate this, but in nytimes crossword it won’t let you down!

I appreciate how this article delves into the topic with depth and clarity. The real-world examples provided enhance understanding and make the content more relatable.

Bitcoin, in particular, has emerged as a hot topic, capturing the imagination of major news organizations, blogs, and firms alike.

I like how clearly and in-depth this article explores the subject. The topic is made more relatable and comprehension is improved by the use of real-world situations.

Of course

Bitcoin is a digital currency that operates on a decentralized network of computers, known as a blockchain.

Incredible post! The examples you provided really helped clarify the concept for me.

games can help players develop critical thinking skills, as they learn to evaluate information and make informed decisions.