Lykke Switches Trading-Place to Centralized Model: Did Blockchain trading fail?

by Fintechnews Switzerland January 9, 2018As cryptocurrencies gain popularity, scalability issues and high transaction fees have forced Swiss startup Lykke to switch from a semi-decentralized to a centralized operational mode.

The transition for Bitcoin trading wallets occurred in late-December 2017, while the transition for Ethereum trading wallets took place on January 03, 2017.

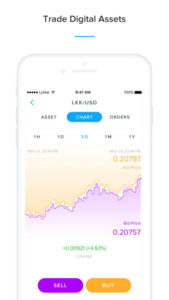

Lykke iOS mobile app

Lykke’s decision to breach its own promise of offering “the world’s first truly decentralized exchange” came following scalability challenges that have risen with the surge in cryptocurrency adoption and trading. This has caused mining fees and transaction times to skyrocket.

“Lykke is currently the only exchange to be semi-decentralized and to offer 0% commission to its users. Both of these are core to our philosophy, but right now our main priority is ensuring that Lykke Exchange is functional and accessible to everyone,” the company said in a blog post. “These considerations led us to decide to switch our exchange to a centralized model.”

Lykke paid 740’000 USD fees in Bitcoin in 1 month!

Since the Lykke Exchange was launched in June 2016, the company claims that Bitcoin transaction fees have increased by more than 24,000%. In the first weeks of December 2017 alone, Lykke had paid more than 45 BTC (around 740,000 USD) in fees for offchain settlement channels.

“This is a difficult choice for us, and we did not make it lightly. But we believe this temporary change will improve users’ trading experience while letting us plan our future,” Lykke said.

Despite the extreme transaction fees, the company said it managed to break even in 2017 – although it would have preferred to use this money to fund new features and products.

The Bitcoin scalability problem exists because of the practical limit on the maximum number of transactions the network can process. Currently, the network can process a maximum of seven transactions per second.

The one-megabyte limit per block has created a bottleneck in Bitcoin, resulting in increasing transaction fees and delayed processing of transactions that cannot be fit into a block. In December 2017, Bitcoin miner fees rose to above US$25 per transaction, making small payments uneconomical.

As for Ethereum, nobody really knows the limits of the platform but because of a hard-coded limit on computation per block the Ethereum blockchain currently supports roughly 15 transactions per second.

In contrast, Visa handles on average 2,000 transactions per second with a daily peak of 4,000 transactions per second. Visa has a peak capacity of 56,000 transactions per second. Paypal handles on average 10 million transactions per day for an average of 115 transactions per second.

Featured image: Bitcoin, Pixabay.