Mt Pelerin’s Tokenised Shares Can Now be Converted to Standard Shares

by Fintechnews Switzerland October 13, 2020Mt Pelerin, a Swiss blockchain company specialising in banking and finance, unveiled a new process to make security tokens bankable with financial institutions in a move to accelerate adoption by all types of investors.

Mt Pelerin made its first breakthrough in the world of security tokens in 2018 when it created what they said to be the very first share-token, a company’s registered share incorporated in the form of an ERC-20 token providing direct ownership of the share with full voting and dividend rights.

That innovation is said to have highlighted the multiple benefits of tokenising shares, such as zero cost issuance, instant and 24/7 share transfers, cap table and corporate action automation, and the possibility for any company to open its shareholding to the public easily.

However, the downside of tokenised shares was the quasi impossibility to address traditional investors such as VCs, family offices and other institutions as ERC-20 tokens were not bankable within the existing infrastructure of trading, clearing and settlement systems.

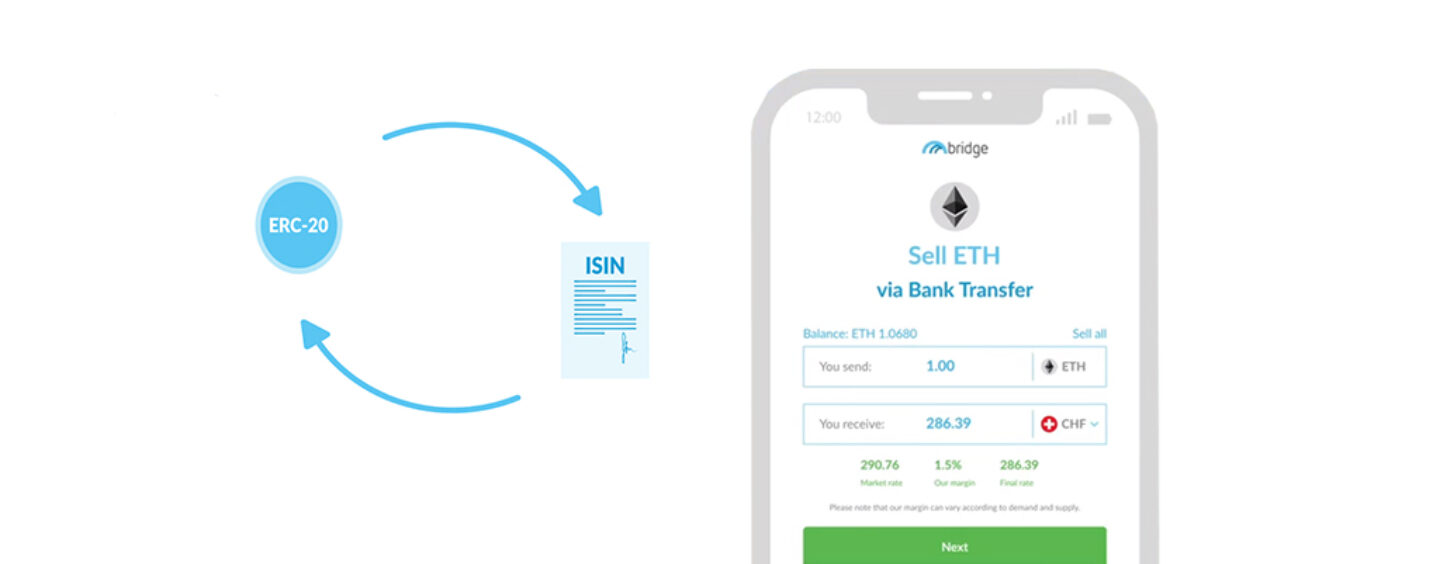

To solve that problem, Mt Pelerin proposed a simple process allowing a share (or any other security) to exist in both forms; a tokenised version and a standard version attributed with an ISIN code (International Securities Identification Number) which is the global standard for tracking securities across markets.

As a result, any company can incorporate its shares in either forms, then switch between tokenised and regular shares when needed.

To demonstrate this process, Mt Pelerin has un-tokenised 10% of its own shares, which now have the Swiss ISIN code CH0539730892. To do so, Mt Pelerin has worked with Swiss bank REYL & Cie as the paying agent, ShareCommService as the registrar, and SIX as the ISIN provider.

To demonstrate this process, Mt Pelerin has un-tokenised 10% of its own shares, which now have the Swiss ISIN code CH0539730892. To do so, Mt Pelerin has worked with Swiss bank REYL & Cie as the paying agent, ShareCommService as the registrar, and SIX as the ISIN provider.

By getting an ISIN code, tokenised shares become compatible with the financial data software used by institutional investors and can therefore be traded and kept in custody according to their usual processes.

This new bridge between traditional finance and tokenised securities is a considerable progress toward their adoption.

With it, institutional investors can now process private equity related tokens as any other security, and small cap issuers can now address crowd and professional investors simultaneously.