SWIFT Assesses What Roles It Could Play in Future CBDC Ecosystem

by Fintechnews Switzerland May 20, 2021As central banks around the world accelerate their digital currency efforts, international payment network SWIFT is assessing what roles it could play in this new future.

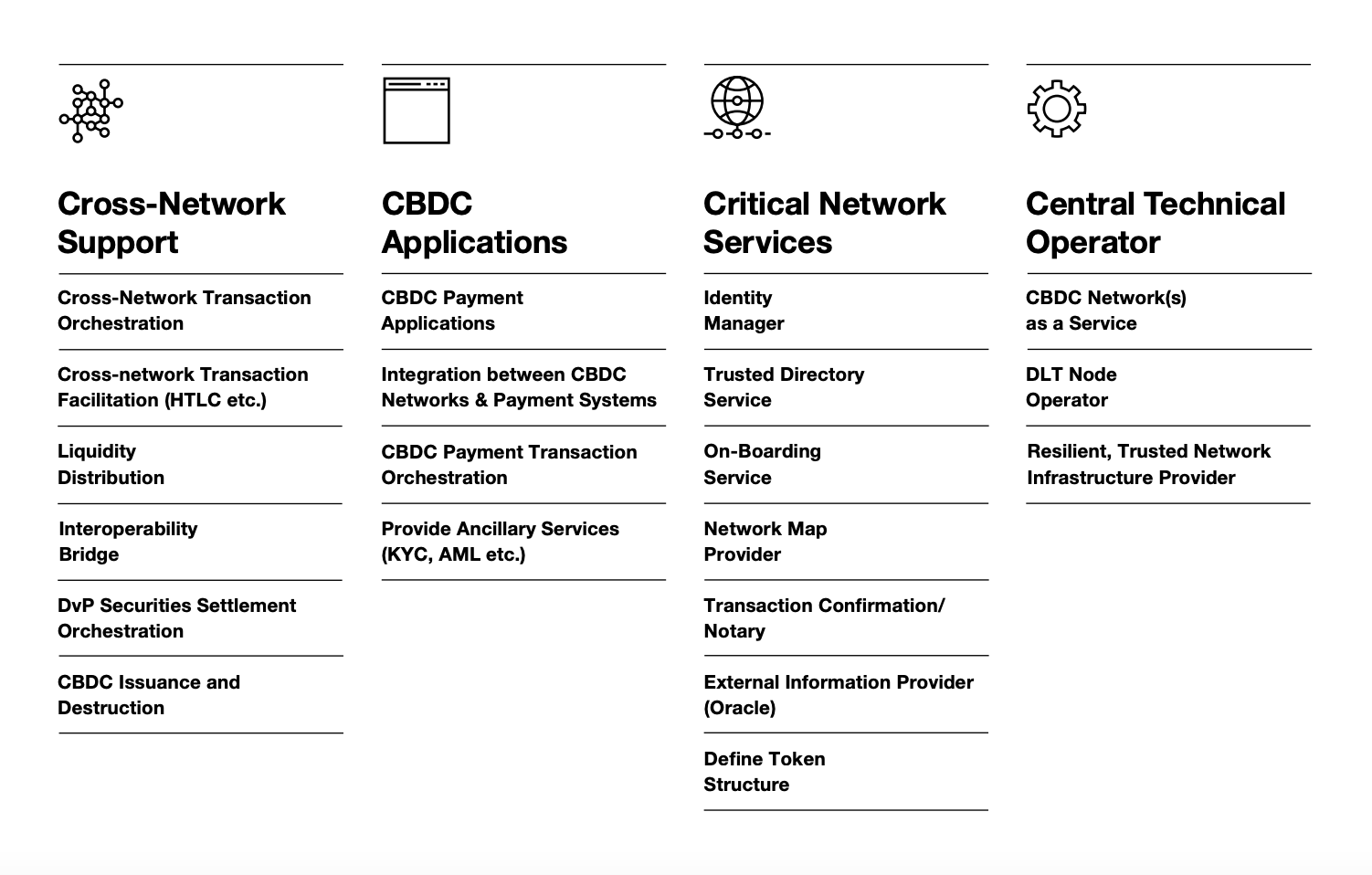

In a new paper released on May 11, 2021 and produced in partnership with Accenture, the cooperative delves into four possible functions it could fulfill in this new paradigm, and provides an overview of the experimentation it will be performed using distributed ledger technology (DLT) and digital currency.

According to the paper, enabling interoperability between central bank digital currencies (CBDCs) could be a role of relevance for SWIFT given that it’s already an orchestrator of the current financial system and has strong relationships with parties within the system.

The coming months will see SWIFT experiment on that idea and conduct trials involving cross-border transactions using digital currencies, the paper says.

The first case will simulate a transaction between two economies in which one country uses a traditional payment system, while the other relies on a DLT-based CBDC system. The second case will focus on cross-border transactions between two parties on different DLT networks.

CBDCs interoperability

In 2021, CBDCs continued to gain traction with development accelerating and institutional involvement continuing to grow. Just last week, the Bank of Israel released a report on the potential issuance of a digital shekel which was accompanied by a public call for responses from the professional community.

“The Bank of Israel has not yet decided whether it intends to issue a digital shekel, but in view of the rapid developments in the digital economy and in payments, and in view of the major central banks’ work on the issue, the Bank of Israel is accelerating its research and preparation for the potential issuance of a digital shekel,” it said in a release.

Research by the Bank for International Settlements (BIS) found that CBDC initiatives are now moving into more advanced stages of development with about 60% of central banks conducting experiments or proofs-of-concepts (PoCs), while 14% are moving forward to development and pilot arrangements.

As works on CBDCs advance, the topic of systems interoperability has been put at the forefront. The BIS is currently experimenting with so-called multi-CBDC (mCBDC) arrangements for cross-border payments and systems interoperability, which it has named one of its top priorities for the years 2021 and 2022.

The project, first initiated bilaterally by the Hong Kong Monetary Authority (HKMA) and the Bank of Thailand under the name Inthanon-LionRock, was renamed mCBDC Bridge when the BIS, the People’s Bank of China and the Central Bank of the United Arab Emirates joined.

Other possible roles SWIFT could play

Cross-network support is the initial role SWIFT will be exploring with its members and the wider banking community, and other functions will be assessed in the future, the organization says.

Another role it has identified would be to act as a central technical operator, or a so-called “CBDC networks-as-a-service” provider. Here, SWIFT would leverage its existing network and infrastructure to provide the DLT network upon which CBDCs are built. Changes will be required to the SWIFT platform and infrastructure but the organization would be open to considering it, it says.

SWIFT could also provide application offerings on top of central banks’ CBDC platforms, providing for example a suite of interfaces and services to interact with CBDC payment applications, or for compliance and know-your-customer/anti-money laundering (KYC/AML) purposes.

Finally, SWIFT could leverage its position as a trusted authority to provide a range of critical services for CBDC networks including transaction confirmation and notary services.

Founded nearly 50 years ago, SWIFT, or the Society for Worldwide Interbank Financial Telecommunication, provides a network that enables financial institutions worldwide to send and receive information about financial transactions. The cooperative, which has based in Belgium, also sells software and services to financial institutions. As of 2021, SWIFT linked more than 11,000 financial institutions in over 200 countries and territories.

Four roles SWIFT could play in a future CBDC ecosystem, Exploring central bank digital currencies: How they could work for international payments, SWIFT and Accenture, May 2021

Featured image credit: SWIFT Operations Forum – Americas (SOFA) 2013 | Taken at SOFA in midtown Manhattan, Tuesday, March 5, 2013