Fintech on the Rise in Kazakhstan Driven by Digital Payments and Super-Apps Adoption

by Fintechnews Switzerland May 4, 2023In Kazakhstan, the fintech industry is growing at a fast pace, driven by rapid adoption of digital payments, ecosystem services and super-apps, among other digital financial services, a new report by Fintech Consult, MOST Ventures and RISE says. Moving forward, supportive initiatives from the government and infrastructure enhancement efforts are expected to further drive innovation and adoption in the sector.

These are among the key insights drawn from the Fintech in Kazakhstan report, an industry report released on April 14, 2023 that looks at the state of the domestic fintech ecosystem and which points out to booming usage of fintech services and a swift toward digital payments.

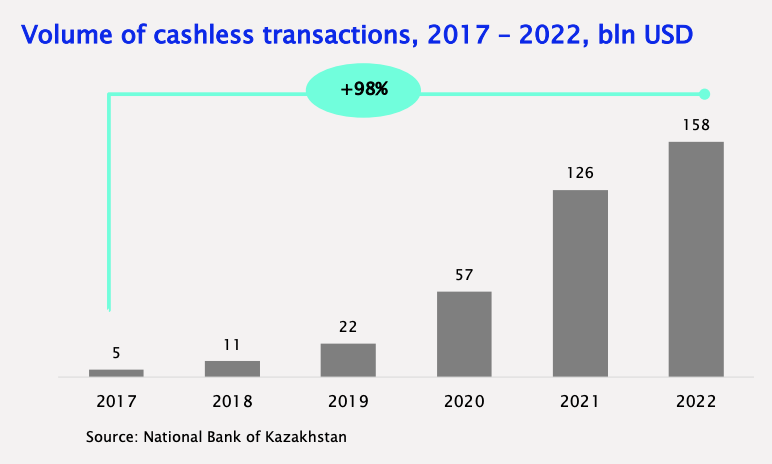

According to the report, digital transactions are growing rapidly. Since 2017, the volume of cashless transactions have doubled each year, soaring from a mere US$5 billion in 2017 to US$158 billion in 2022, data from the National Bank of Kazakhstan (NBK) show.

Volume of cashless transactions, 2017-2022, US$ billions, Source: Fintech in Kazakhstan, Fintech Consult, MOST Ventures and RISE, April 2023

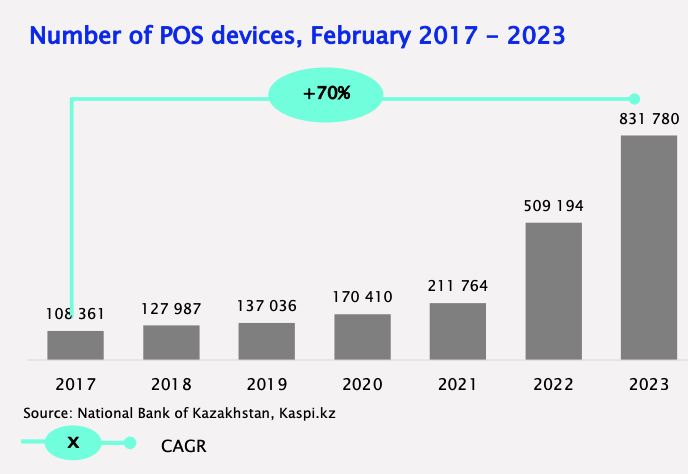

At the same time, merchants are deploying point-of-sale (POS) terminals at a steady pace to adjust to changing consumer behavior. In 2017, only 108k POS devices were in operation in Kazakhstan, a number that rose to 831k in 2023. The figures suggest a 70%+ annual growth rate in the number of POS terminals deployed in the country.

Number of point-of-sale (POS) devices in Kazakhstan, Source: Fintech in Kazakhstan, Fintech Consult, MOST Ventures and RISE, April 2023

Several trends are driving this growth, the report says, including booming e-commerce activity and new infrastructure solutions launched by the central bank.

In June 2022, the NBK launched its Instant Payment System into operation, allowing consumers to make instant interbank transfers 24/7 using only a mobile phone number and a QR code. The effort is part of a broader ambition to revamp the entire payment system and develop a strong technological infrastructure for digital financial services.

The rise of super-apps

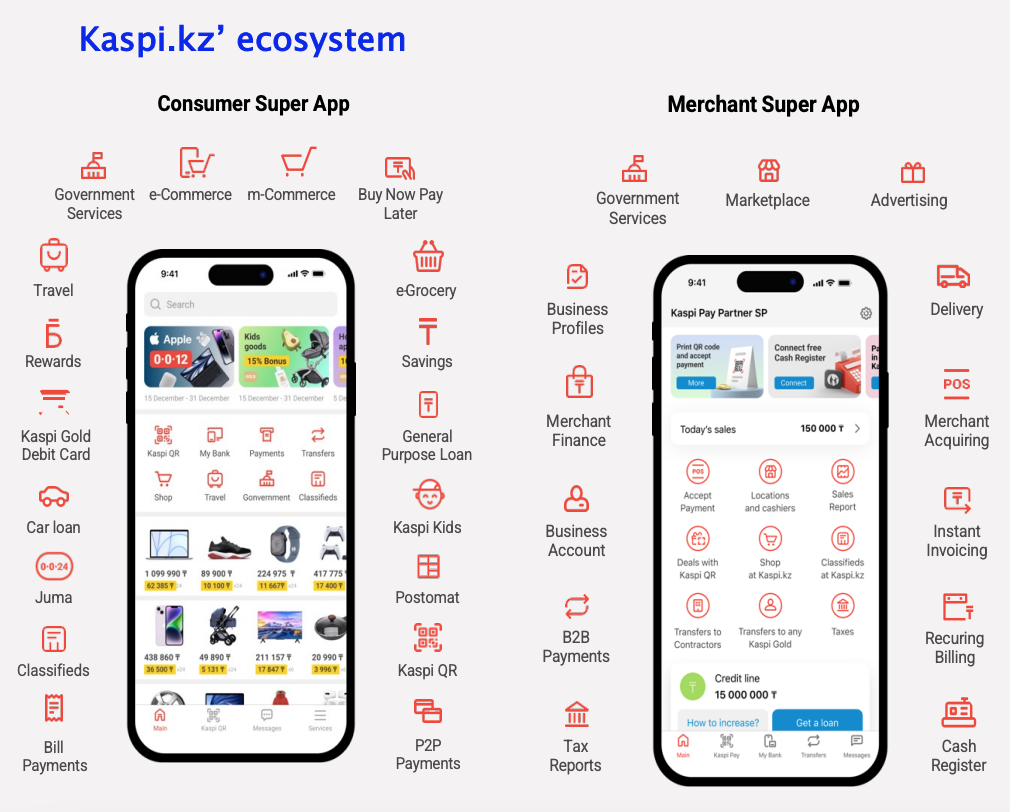

Another trend outlined in the report is the rise of fintech ecosystems and super-apps. These platforms, which combine various financial and non-banking services including online payments, mobile banking, e-commerce and lifestyle, are gaining momentum in Kazakhstan and are witnessing booming adoption from consumers.

Kaspi.kz, a pioneer in the field since 2014, has seen its customer base grow to 12.6 million monthly active users, a number that represents about 65% of Kazakhstan’s total population.

The company provides an integrated consumer-focused ecosystem offering loans, deposits and money transfers services, as well as e-commerce, location services, a reward program and a messaging feature.

Kaspi.kz’s digital ecosystem, Source: Fintech in Kazakhstan, Fintech Consult, MOST Ventures and RISE, April 2023

Founded in 2008 and headquartered in Almaty, Kaspi.kz is reportedly preparing for a US listing that may come this year, the company told Axios earlier this month.

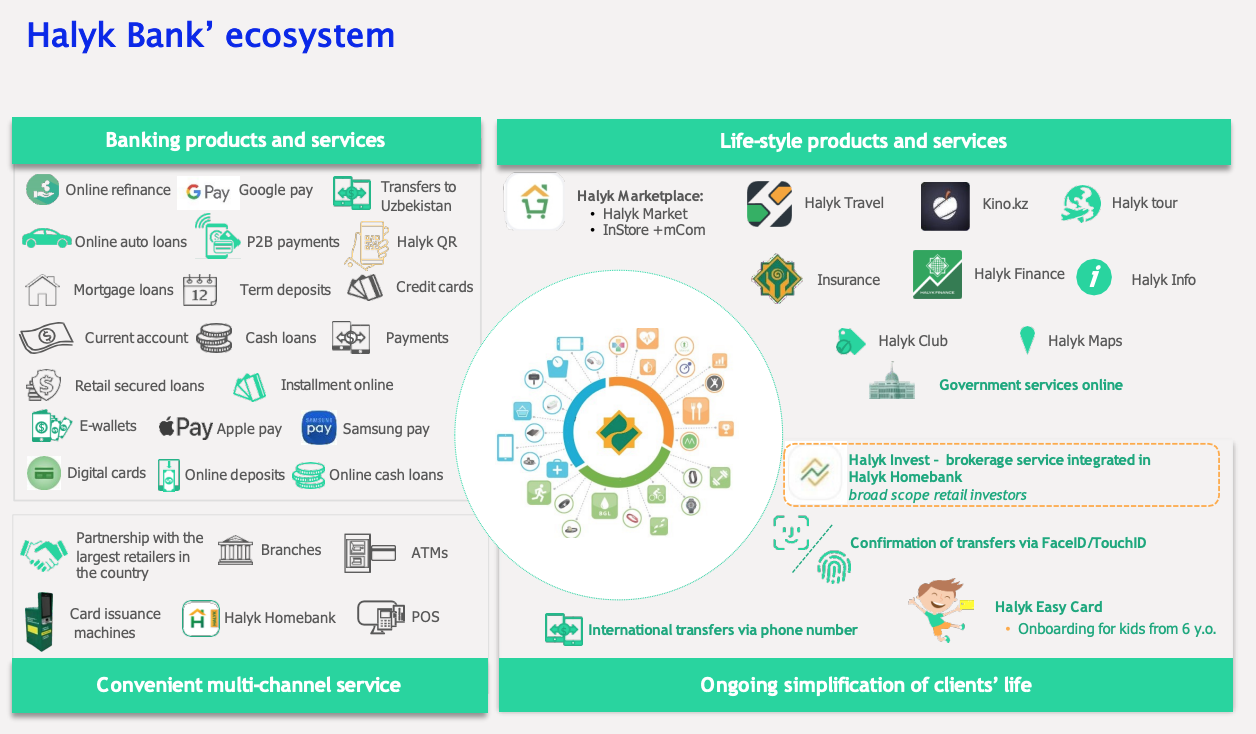

To keep up with the trend, banking incumbents are actively developing and deploying their own fintech ecosystems and super-apps.

For example, Halyk Bank, the largest financial group in Kazakhstan, has built a digital ecosystem accessible through a mobile app that offers standard banking products such as payment services, transfers and cards, as well as lifestyle services including cinema, weather, commerce and travel.

8 million retail customers are reportedly using Halyk Bank’s Homebank online banking system and 273,000 corporate and small and medium-sized enterprise (SME) customers are using its Onlinebank portal, the bank said in its 2021 annual financial report.

Halyk Bank’s digital ecosystem, Source: Fintech in Kazakhstan, Fintech Consult, MOST Ventures and RISE, April 2023

Besides digital payments and super-apps, the report notes that wealthtech and digital trading platforms have recorded sustained growth these past years, on the back of legislative changes and technological advancements.

Mobile investment apps are now playing a critical role in democratizing stock trading by improving accessibility through lower fees, lower capital requirements as well as intuitive and seamless digital user experiences, the report says. This is evidenced by the growth of the number of retail investor accounts in Kazakhstan, which grew nearly fivefold from just 119k in 2019 to 581k in 2022.

Buy now, pay later (BNPL) is another fintech trend that’s been picking up in Kazakhstan, the report says. The trend was spearheaded by Kaspi.kz before other players started entering the market and began offering similar services.

Conducive government initiatives

Governmental efforts to encourage innovation and digital reforms have played a critical role in the growth of fintech in Kazakhstan, the report says. New infrastructural projects are currently in the works and should further propel the domestic fintech sector.

In February, the NBK outlined in a paper its vision for the future of financial services, laying out its ambition to develop “a sustainable digital financial ecosystem.”

To achieve these goals, the central bank said it is implementing a number of infrastructure solutions intended to enhance financial stability, offer a level playing field for all industry participants and develop healthy competition.

These infrastructure solutions include the so-called National Payment System, digital biometric identification, a platform for the secure exchange of data based on open programming interfaces (open APIs) and a solution for know-your-customer (KYC) procedures.

The NBK is also working on a retail central bank digital currency (CBDC), the Digital Tenge, which will be piloted with consumers and merchants this year, the report says.

The CBDC will use an open source distributed ledger and will be issued in token form. The system will support payment options including NFC, QR code payments, biometrics, and offline payments, it says.

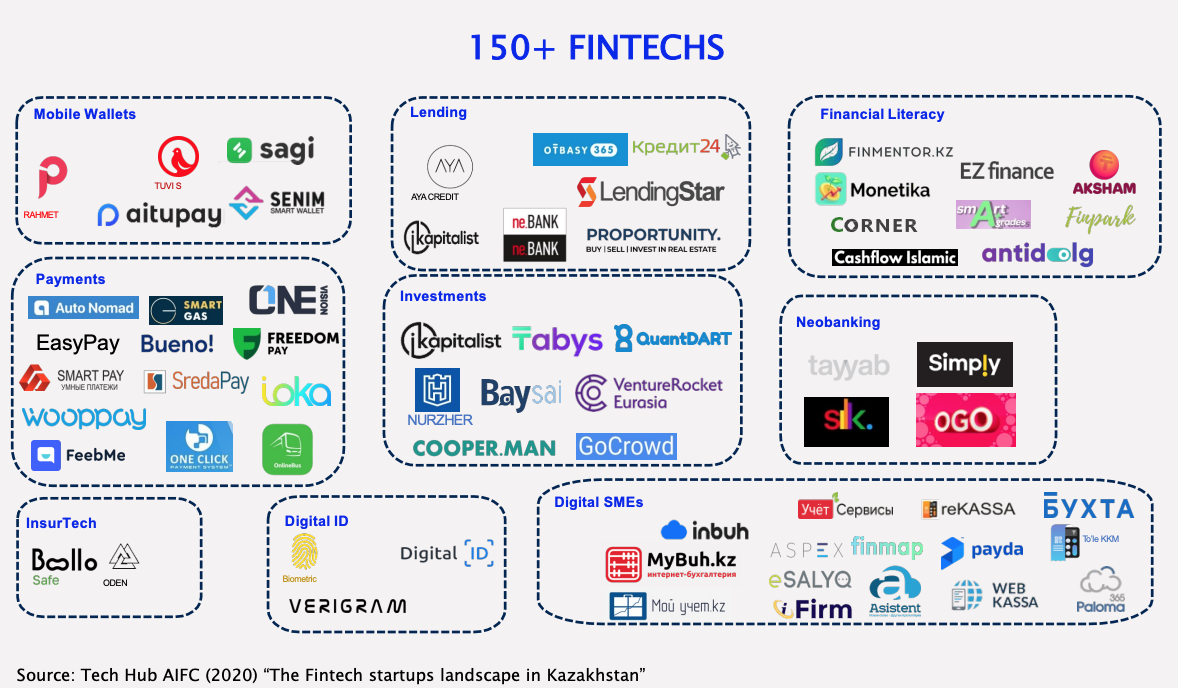

According to the report, Kazakhstan is currently home to more than 150 fintech companies, with payments, transfers and mobile wallets being the largest vertical. The segment accounts for 20% of all fintech companies in the country, and is followed by financial software/back- and middle-office solutions, with a 18% market share, e-commerce and e-marketplace, at 15%, and savings and investments, at 11%.

Between 2018-2022, fintech accounted for 12% of all venture capital deals in Kazakhstan, making it the second largest sector in the country by deal account after the marketplace and e-commerce sector.

Fintech companies in Kazakhstan (none exhaustive list), Source: Fintech in Kazakhstan, Fintech Consult, MOST Ventures and RISE, April 2023

Featured image credit: Edited from Freepik