IMF Study: Fintech Poses a Threat to Traditional Financial Institutions

by Fintechnews Switzerland January 5, 2024The rise of fintech is posing a threat to traditional financial institutions, with these emerging companies encroaching on incumbents’ market share. This is evidenced by the adverse impact of fintech on the profitability of established financial institutions, a new research by the International Monetary Fund (IMF) found.

The findings, shared in a paper titled “Is Fintech Eating the Bank’s Lunch?”, were drawn from an analysis of a cross-country database encompassing 10,167 financial institutions and data on digital finance activities across 57 countries. The study sought to gain insights into the relationship between fintech and financial institutions’ profitability and examine the impact of the rise of fintech on banking sector.

Findings of the study reveal that established financial institutions are witnessing a negative impact on their profitability when the presence of fintech companies is high, an impact that’s primarily driven by reduced interest income due to heightened competition in the lending market as well as increased costs.

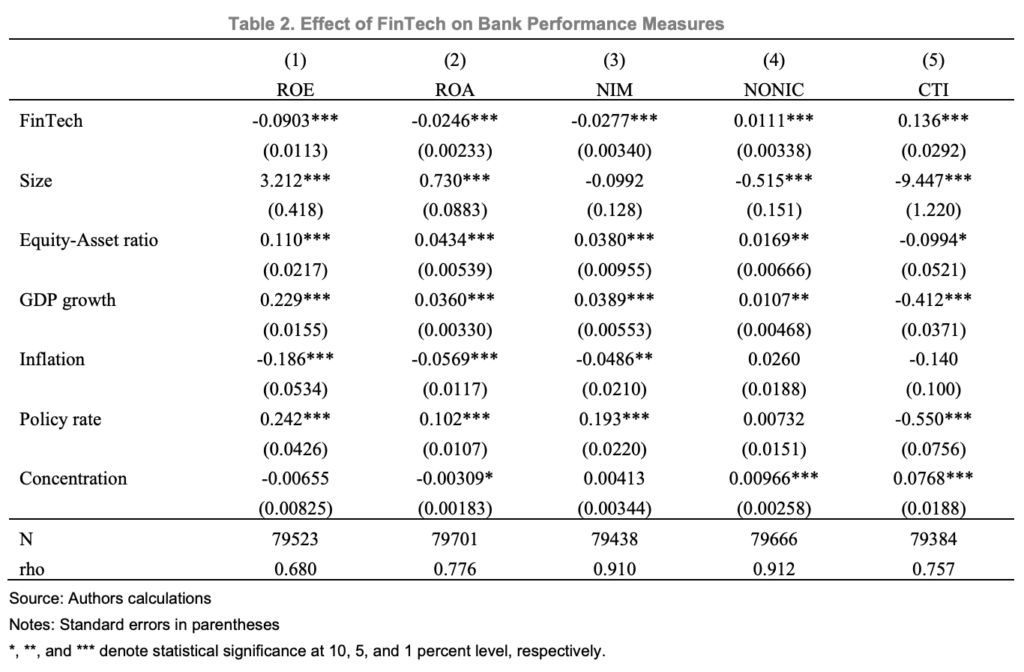

Specially, the study found that a 1% point increase in fintech transaction volumes correlates with a reduction of 0.09% points in return on equity (ROE) and a 0.02% points decline in return on assets (ROA) for incumbent financial institutions. An analysis of the transmission channels also uncovered a negative impact on net interest margin (NIM), with a 1% point increase in fintech transaction volumes prompting a 0.03% point decrease in incumbent’s NIM.

Effect of fintech on bank performance measures, Source: Is Fintech Eating the Bank’s Lunch?, International Monetary Fund, Nov 2023

Furthermore, fintech appears to have an adverse effect on incumbent’s cost to income (CTI), with a 1% point increase in fintech transaction volumes leading to a 0.14% point increase in incumbent CTI. According to the IMF, this could be attributed to the higher level of IT investments required because of fintech pressure. These costs are exacerbated by outdated legacy technology, further impacting profitability.

In parallel, the analysis found that fintech has a positive effect on non-interest income (NONIC), with a 1% point increase in fintech transaction volumes being associated with a 0.01% point increase in incumbent NONIC. This result suggests that, although incumbents are responding to the intense competition by exploring new revenue streams, these efforts to diversify have not fully offset the profitability losses from fintech competition.

Impact of different fintech business models

Delving deeper into the fintech sector, the study found that different fintech models have varying effects on financial institutions with cooperative banks tending to experience greater profit deterioration from P2P lending and balance sheet lending than larger, more complex commercial banks.

Results show that for a 1% point increase in P2P lending transactions, cooperative banks are witnessing a 0.3% point decrease in ROE. Likewise, a similar increase in balance sheet lending results in a 0.2% point ROE decrease. These results are significant given that the median ROE for cooperative banks is 3.8%, the report notes.

Low profit levels for cooperative banks are attributed to reduced NIM and higher CTI. Some of these institutions are facing challenges in affording IT investments and meeting digital banking expectations, potentially limiting lending opportunities, the report notes. Fintech platforms, on the other hand, can achieve economies of scale and broader geographical reach by leveraging technology. Moreover, these platforms may target the same untapped customer segments that cooperative banks aim to serve.

In contrast to cooperative banks, commercial banks seem to be less affected by fintech, potentially due to their larger size and wider geographical reach. In fact, the study found a positive effect of the presence of P2P lending on the NONIC of commercial banks, indicating potential benefits from collaboration with P2P lending platforms to expand revenue streams. However, balance sheet lending was found to be a threat to commercial bank, impacting their NIM negatively.

Effect of fintech models on bank performance measures, Source: Is Fintech Eating the Bank’s Lunch?, International Monetary Fund, Nov 2023

Disparities between markets

Looking at geographical trends and disparities, the study found that incumbents located in markets with lower bank concentration, higher stock market turnover, higher credit depth, and higher commercial bank profitability are more prone to losing ground to fintech companies.

Lower bank concentration suggests fewer entry barriers for new fintech firms, and higher stock market turnover and credit depth imply more competitive and developed financial systems, indicating more sophisticated investors, and access to skilled talent. These conditions are advantageous for fintech success but pose a threat to incumbent profits, the report says.

At the institutional level, incumbents with a lower risk profile, including lower non-performing loans (NPLs), a lower probability of insolvency, and higher capital, are more susceptible to see their profitability decline because of fintech. This is because financial institutions with these characteristics are more risk-averse and less inclined to lend, introducing opportunities for fintech firms to fill the gaps by serving as substitutes for traditional bank lending.

Finally, the study found that in countries with high regulatory quality and government effectiveness, incumbent profitability tends to be positively impacted by fintech competition. This suggests that well-designed regulations can establish a level playing field, enabling new fintech companies to thrive while protecting incumbents from unfair competition practices.

Study Recommendations

The report concludes by emphasizing the importance of ongoing monitoring of fintech development and its impact across the financial system, noting that while fintech platforms are delivering benefits such as enhanced efficiency in financial service delivery, increased competition, and improved access to finance, the sector also presents challenges to incumbent institutions by limiting their profit margins and eroding their market shares.

Consequently, banks may encounter difficulties in building capital buffers necessary for absorbing losses and maintaining solvency. There is also the potential for incumbents to engage in riskier lending and investment activities to preserve market share and boost profits.

These risks and challenges require regulators to establish a proper framework that balances financial innovation and systemic risk mitigation. The report proposes a number of recommendations to broaden the regulatory scope and establish a level playing field, advocating for the review and redesign of licensing regimes to encompass new service providers within the regulatory framework where appropriate, the implementation of more robust capital, liquidity, and operational risk management requirements tailored to the risks posed by different fintech business models, and the enhancement of the regulatory framework for smaller, less technologically advanced incumbents that are more vulnerable to fintech competition.

The IMF also encourages incumbents to respond to the rise of fintech and their growing threat by adjusting their business models, focusing on enhancing cost efficiency, diversifying income sources, consolidating operations, improving internal governance, and addressing problematic loans.

Featured image credit: edited from freepik