Monese, a UK-headquartered mobile-only challenger bank, has launched its iOS app alongside a refreshed Android app.

Monese lets you open a UK current account almost instantly even without a UK address or credit history, all through the app.

Opening a Monese bank account is quite simple and only requires a snapshot of your passport and a selfie. Monese is available to customers located in Europe.

The banking account comes with a (free) contactless Visa Debit card, which allows you to purchase goods and services online and in store, withdraw cash from ATMs globally, as well as deposit cash at any shop with a PayPoint.

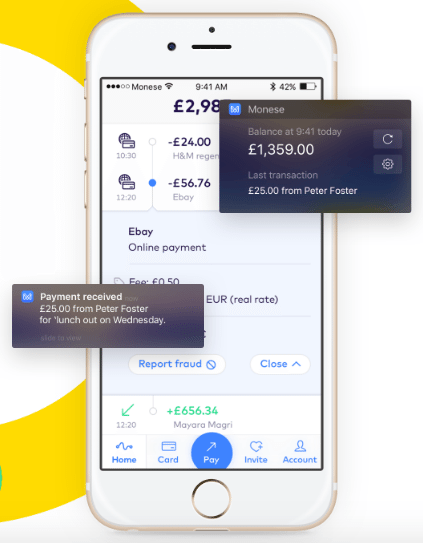

The Monese app works pretty much like any other banking app: you can receive payments, send money at home or abroad (8x cheaper than using a traditional bank), pay your bills and manage your money on the go.

The Monese app works pretty much like any other banking app: you can receive payments, send money at home or abroad (8x cheaper than using a traditional bank), pay your bills and manage your money on the go.

Monese primarily targets immigrants, digital nomads and the expats community who often have to experience challenging tasks when opening a UK bank account as foreigners.

Named ‘Best Challenger-Bank’ in Europe, the startup has been awarded €1.1 million by the European Commission for research and innovation.

Monese, one of the first 100% mobile current account services to launch in the UK back in September 2015, is registered by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money.

Since the UK’s financial regulators loosened rules for new entrants in 2013, a host of startups have applied for banking licenses in order to take on the established lenders. Monese, but also Mondo, Atom Bank and Starling, have that one thing in common: they are all engaging with customers almost entirely through digital channels.

In April, app-only bank Atom Bank launched its iOS app in the UK and is currently looking to replace passwords with biometrics banking. The company is authorized with restrictions by the Prudential Regulation Authority (PRA) and regulated by the FCA.

Atom Bank is backed by BBVA, Anthemis Group, Polar Capital Holdings and Toscafund Asset Management, and has raised over US$170 million in funding so far.

Digital banks and millennials

In May, Viacom Media released results of a survey of over 10,000 millennials on their perception of banking. The survey found that 73% would be more excited about a new offering in financial services from leading technology companies than from their own bank.

Image: Millennial Generation by William Perugini, via Shutterstock.

Engaging with millennials, a growing population of 80 million individuals in the US along with radically different expectations from their predecessors, has become a top priority for banks. Growing up in the age of the Internet boom, millennials have ushered in the rise of mobile apps, crowd-source funding, digital peer-to-peer payments and online banking.

According to the Millennial Disruption Index, 68% believe that in five years, the way we access money will be totally different and 70% say that the way we pay for goods and services will completely change in five years.

Interestingly, 33% believe they won’t need a bank at all in five years, and almost 50% are relying on tech startups to fundamentally change how banks work today.