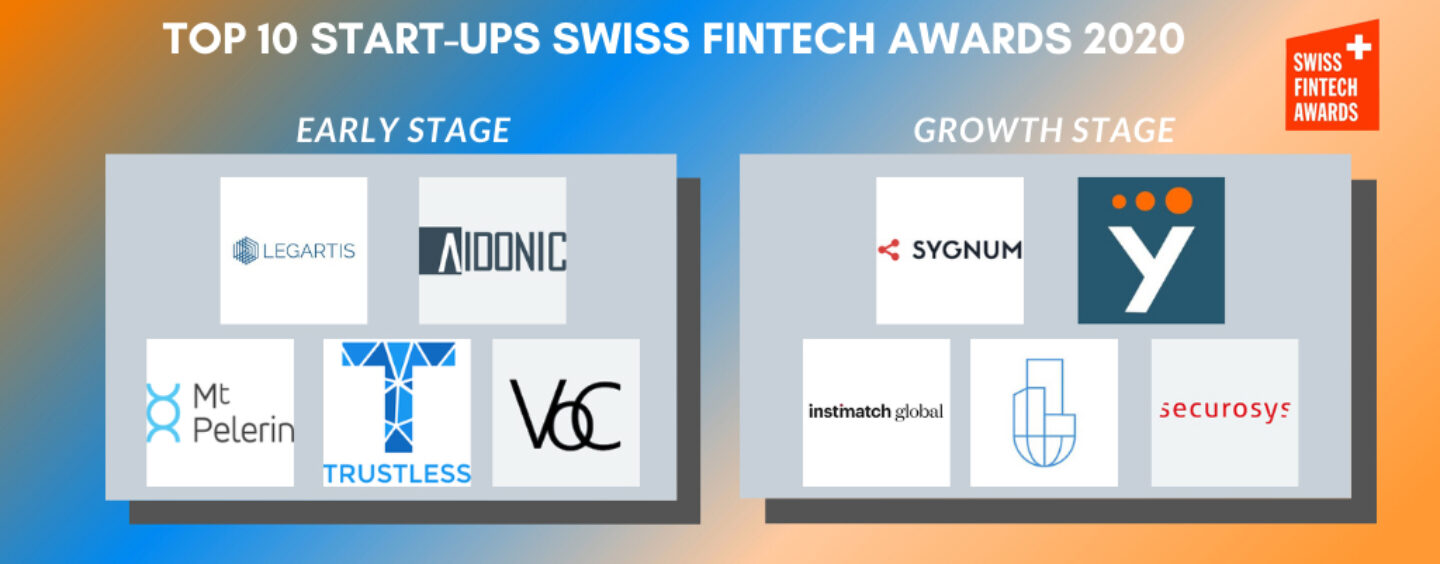

The 10 Nominees for the Swiss Fintech Startup Awards 2020 Revealed

by Fintechnews Switzerland January 11, 2020The Swiss Fintech Awards 2020 have revealed the 10 nominees. 5 Fintech were selected for the early stage category and 5 Startups were slelected for the growth stage category.

The purpose of the Swiss FinTech Awards is to promote Swiss fintech innovators and to contribute to the strong Swiss fintech ecosystem. The awards specifically recognize outstanding fintech startups and fintech influencers. The winners are chosen by a renowned jury consisting of 20+ fintech experts. The grand finale and awards ceremony will take place after the annual fintech conference by Finanz und Wirtschaft Forum «FinTech 2020» on March 12.

The nominees are :

EARLY STAGE

For fintech startups with a Swiss connection which don’t have a product-market-fit yet. We recommend this category for start-ups which are currently working on a first demo, prototype or which are about to go-to-market with the first product or service.

AIDONIC

AIDONIC is a new innovative tool for any NGO, foundation, international organization and institution in the field of charitable giving, social impact and sustainable development. Our technology helps to manage funds and data safely, ensures reliable aid allocation and last mile tracking. The Platform connects donors to end beneficiaries and service providers through our mobile app and last mile mechanism, to ensure that almost 100% of all donations reach the intended people in need. Lack of transparency have become the biggest issue in today’s nonprofit sector. It discourages institutional donors and individuals from committing funds to charitable causes. People want to know where their donations are going to. They want to see the positive impact in people’s life they intend to help. AIDONIC provides 100% transparency and secure funds allocation to those in need, this will regain public trust in NGOs and attract donors to spend more for good causes.

AIDONIC is a new innovative tool for any NGO, foundation, international organization and institution in the field of charitable giving, social impact and sustainable development. Our technology helps to manage funds and data safely, ensures reliable aid allocation and last mile tracking. The Platform connects donors to end beneficiaries and service providers through our mobile app and last mile mechanism, to ensure that almost 100% of all donations reach the intended people in need. Lack of transparency have become the biggest issue in today’s nonprofit sector. It discourages institutional donors and individuals from committing funds to charitable causes. People want to know where their donations are going to. They want to see the positive impact in people’s life they intend to help. AIDONIC provides 100% transparency and secure funds allocation to those in need, this will regain public trust in NGOs and attract donors to spend more for good causes.

Legartis Technology AG

Identify, classify and understand your contracts within seconds.

Identify, classify and understand your contracts within seconds.

Mt Pelerin

Mt Pelerin is a Swiss fintech company expert in applying blockchain to banking and finance. It is creating a full reserve, marketplace-based digital bank using that technology to democratize access to financing and investment. Mt Pelerin will be a full reserve bank, meaning that customer deposits will be kept in reserve as high quality liquid assets (HQLA as defined in Basel III) which can be converted in cash within a day. In this way, Mt Pelerin de facto eliminates market risks on deposits and establishes the safest custodian bank in the world.

Mt Pelerin is a Swiss fintech company expert in applying blockchain to banking and finance. It is creating a full reserve, marketplace-based digital bank using that technology to democratize access to financing and investment. Mt Pelerin will be a full reserve bank, meaning that customer deposits will be kept in reserve as high quality liquid assets (HQLA as defined in Basel III) which can be converted in cash within a day. In this way, Mt Pelerin de facto eliminates market risks on deposits and establishes the safest custodian bank in the world.

Trustless.AI

At TRUSTLESS.AI we are building the Seevik Pod, an ultra-secure 2mm-thin touch-screen human computing device that seamlessly delivers radically-unprecedented privacy and security to your most sensitive social and business computing, by eliminating the assumption of trust in anything or anyone.

At TRUSTLESS.AI we are building the Seevik Pod, an ultra-secure 2mm-thin touch-screen human computing device that seamlessly delivers radically-unprecedented privacy and security to your most sensitive social and business computing, by eliminating the assumption of trust in anything or anyone.

Value on Chain

Value on Chain is the first decentralized marketplace for real assets. Value on Chain’s whitelabeled DLT platform gives asset managers the power to manage their current investors, organise new primary issuances, and enable investors to join a network and exchange value without intermediary.

Value on Chain is the first decentralized marketplace for real assets. Value on Chain’s whitelabeled DLT platform gives asset managers the power to manage their current investors, organise new primary issuances, and enable investors to join a network and exchange value without intermediary.

GROWTH STAGE

For fintech start-ups with a Swiss connection which have a product-market-fit and are on a growth trajectory. We recommend this category for start-ups which have a successful product on the market, a working business model and clear signs of (exponential) growth.

Instimatch Global

Instimatch Global AG (Instimatch) is a two year-old, established, Swiss fintech company with the leading digital marketplace for money market products. Our goal is to allow liquidity to circulate more efficiently in the institutional borrowing and lending space. We will use DLT in the future to ensure a fully transparent, secure and global trading network, even in geographically secluded areas.

Instimatch Global AG (Instimatch) is a two year-old, established, Swiss fintech company with the leading digital marketplace for money market products. Our goal is to allow liquidity to circulate more efficiently in the institutional borrowing and lending space. We will use DLT in the future to ensure a fully transparent, secure and global trading network, even in geographically secluded areas.

PriceHubble AG (Finalist 2018 in Growth Stage)

PriceHubble enables better real estate decisions by using ML and Big Data

PriceHubble enables better real estate decisions by using ML and Big Data

Securosys SA

We are a technology company and dedicated to securing data and communications. We design, produce and distribute hardware, software and services that protect and verify data and their transmission. Our products are built and developed in Switzerland alongside our vetted partners in Europe. We put great importance to our secure supply chain. As such, there are no possibilities for back doors.

We are a technology company and dedicated to securing data and communications. We design, produce and distribute hardware, software and services that protect and verify data and their transmission. Our products are built and developed in Switzerland alongside our vetted partners in Europe. We put great importance to our secure supply chain. As such, there are no possibilities for back doors.

Sygnum

Sygnum offers a portfolio of traditional banking services for digital assets, including custody with a fiat-digital asset gateway, brokerage, lombard loans with digital assets as collateral, asset management and soon tokenization services. B2B banking services are also available to existing financial institutions to enable them to provide regulated digital asset products and services to their own customers.

Sygnum offers a portfolio of traditional banking services for digital assets, including custody with a fiat-digital asset gateway, brokerage, lombard loans with digital assets as collateral, asset management and soon tokenization services. B2B banking services are also available to existing financial institutions to enable them to provide regulated digital asset products and services to their own customers.

Yova (Top 10 2019 in Early Stage)

A digital platform to make impact investing mainstream globally

A digital platform to make impact investing mainstream globally