Asset tokenization, a process that involves converting rights to a real-world asset into a digital token and recording that said asset on a blockchain, is becoming a critical part of the financial market infrastructure, providing substantial benefits including improved speed and efficiency, enabling asset fractionalization, and boosting liquidity.

Prominent financial institutions including US banks JP Morgan and Goldman Sachs, and global investment firm KKR, are implementing tokenization to tap into the opportunity, building infrastructure to cater to the booming trend and creating tokens for everything from real-estate to gold bars.

JP Morgan formed in 2020 Onyx, a business unit which focuses on building and developing digital assets and blockchain-based systems. Key products of Onyx include the JPM Coin, a digital token representing the US dollar that’s used for instantaneous transfer of payments between institutional clients of JP Morgan, and Liink, a peer-to-peer network for cross-border payments.

Onyx also operates a blockchain-based repo network that enables the trading of repos with any third-party entities that join the syndicate.

Tyrone Lobban, the head of the bank’s Onyx digital assets platform, told CoinDesk in April that the platform had processed almost US$700 billion in transactions in short-term loans.

As the platform ramps up, the bank aims for Onyx to focus on tokenizing assets that are traditionally hard to finance, such as money-market funds, and will use them as collateral.

Goldman Sachs, meanwhile, launched its digital asset platform, GS DAP, in 2023, striving to simplify complexities associated with asset lifecycles, improve the speed and efficiency of transactions and support digital processing across various financial instruments.

And KKR, a leading investment firm with more than US$500 billion in assets under management (AUM), tokenized last year a part of one of its private equity funds, allowing for lower investment minimums, improved digital investor onboarding and compliance protocols, and increased potential for liquidity.

Central banks and governmental agencies are also diving in, exploring the concept of tokenization and developing infrastructure to keep up pace with technological advancements.

In Singapore, the central bank is working with financial institutions DBS Bank, JP Morgan and SBI Digital Asset Holdings on tokenizing bonds, while in the Brazil, the central bank’s digital currency project is now in the advanced proof-of-concept stage, seeking to enhance “asset tokenization” by turning assets, such real estate, stocks, and commodities, into digital representations to facilitate their transfer and increase their liquidity.

Most recently, the Bank of Italy’s innovation hub, the Milano Hub, announced that it would support the development of institutional decentralized finance (DeFi).

The project, led by Cetif Advisory, a consultancy spinoff of the Universita Cattolica del Sacro Cuore of Milan’s Cetif Research Centre, aims to develop a platform that would help traditional financial institutions experiment with security tokens and execute transactions using DeFi rails.

The project involves Italian banks, asset managers and financial institutions, according to a CoinDesk report, including the country’s largest banking group Intesa Sanpaolo.

Cost savings, improved efficiency and new business opportunities

Accelerated development of asset tokenization technology comes at the time when traditional financial institutions and banking incumbents are looking to capitalize on the many benefits brought about blockchain, and tap into the new business opportunities digital assets offer.

By allowing ownership rights to be digitally represented, asset tokenization enables fractional ownership and allows for assets such as real estate, a work of art and a vintage car, to be divided into tokens representing smaller ownership stakes. This unlocks access to illiquid assets, allows more people to participate in investments previously limited to those with high net worth and lowers thus the barrier to entry.

Tokenization can also greatly reduce the time and resources required to buy and sell assets. By using blockchain technology and smart contracts, this technology cuts down on paperwork and processing time, eliminates the need for many traditional intermediaries, and decreases operating costs due to disintermediation.

Tokenization can also lead to the development of new business models and investment strategies. For example, a real estate firm could tokenize a property, allowing investors to buy “shares” of it as tokens.

It could also allow for the creation of “asset baskets” or tokenized funds where a variety of assets would be grouped together into a single token, allowing for diversified investment with a single purchase. For example, a token could represent a balanced portfolio of stocks, bonds, and real estate, making diversified investing easier and more accessible.

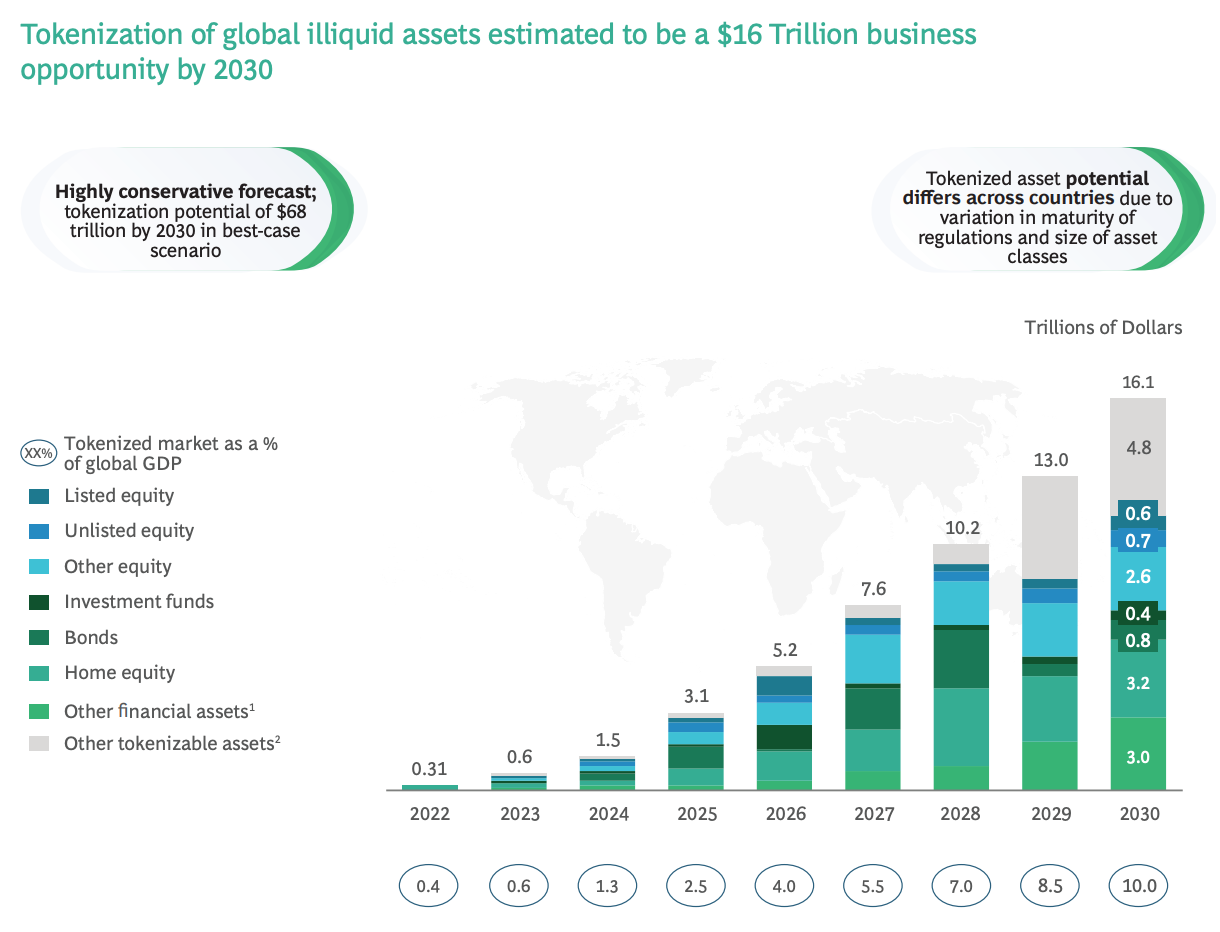

Boston Consulting Group estimates that asset tokenization and blockchain could generate savings of US$20 billion annually in global clearing and settlement alone, and unlock a US$16 trillion market for tokenized illiquid assets by 2030.

Tokenization of global illiquid assets estimated to be a US$16 Trillion business opportunity by 2030, Source: Boston Consulting Group, 2022

This article first appeared on fintechnews.am

Featured image credit: Edited from Freepik