Embedded Finance to Account for More than 10% of All US Transactions by 2026

by Fintechnews Switzerland October 31, 2022In 2021, US consumers and businesses poured US$2.6 trillion in transactions through embedded financial services, a sum that represents nearly 5% of all US financial transactions, according to a new report by Bain Capital and Bain & Company.

By 2026, that amount is projected to exceed US$7 trillion, or over 10% of total US transaction value, reflecting the appeal of integrated financial services among customers.

Embedded finance, a concept that refers to the integration of financial services into non-financial services, is a booming sector that’s been fueled by changing consumer behaviors, advances in technology, and an evolving regulatory landscape.

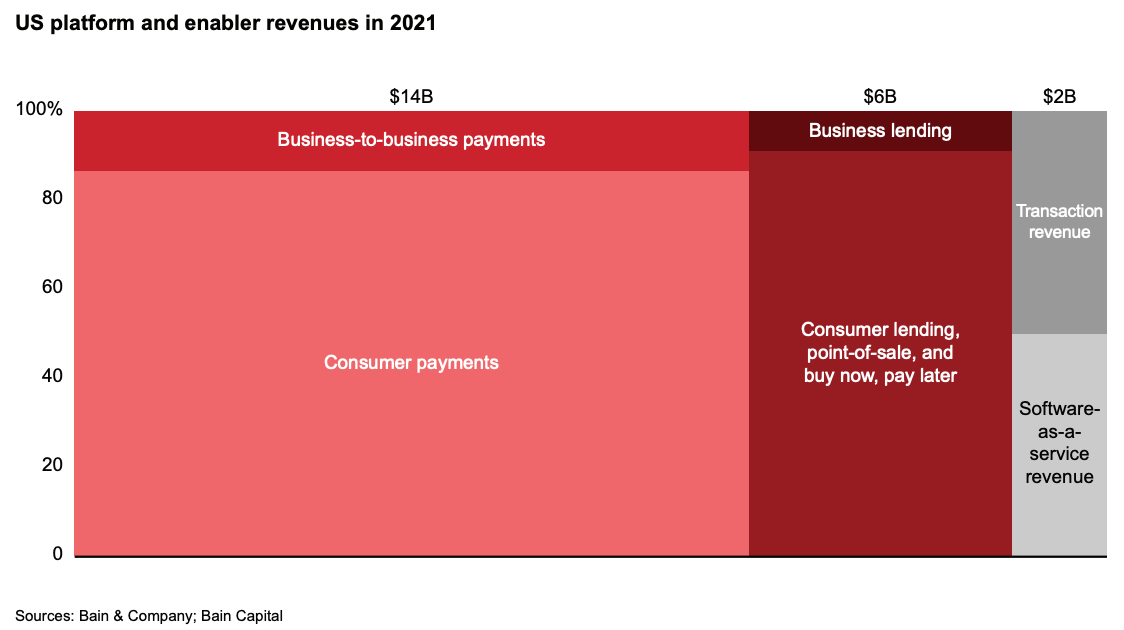

In 2021, Bain Capital and Bain & Company estimate that the US market for embedded finance platforms and enablers reached US$22 billion in total revenue across payments, lending, banking, and cards.

US platform and enabler revenues in 2021, Source: Embedded Finance: What It Takes to Prosper in the New Value Chain, Bain Capital/Bain and Company, 2022

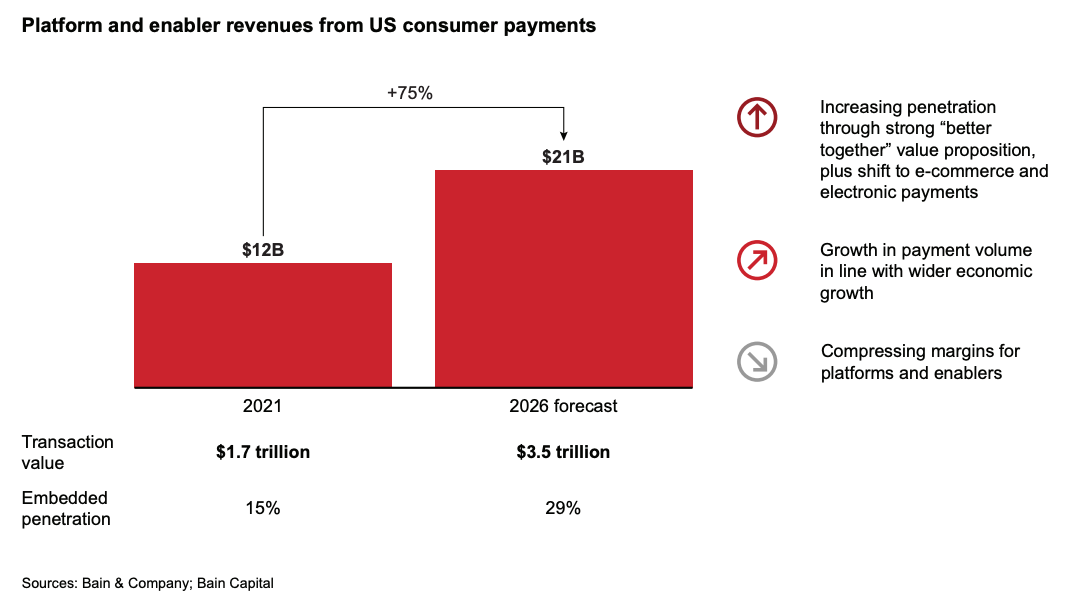

Embedded consumer payments, or solutions that able merchants to accept payments from their customers, accounted for more than 60% (US$12 billion) of all revenues from embedded finance transactions and totaled US$1.7 trillion worth of transactions.

By 2026, revenues from embedded consumer payments are projected to rise by 75% to US$21 billion. Transaction value, meanwhile, is forecasted to more than double and reach US$3.5 trillion.

This surge will be driven by adoption of embedded consumer payments by new verticals, the report says, given that, currently, these solutions are still mainly used by businesses in the e-commerce and retail sectors.

Platform and enabler revenues from US consumer payments, Source: Embedded Finance: What It Takes to Prosper in the New Value Chain, Bain Capital/Bain and Company, 2022

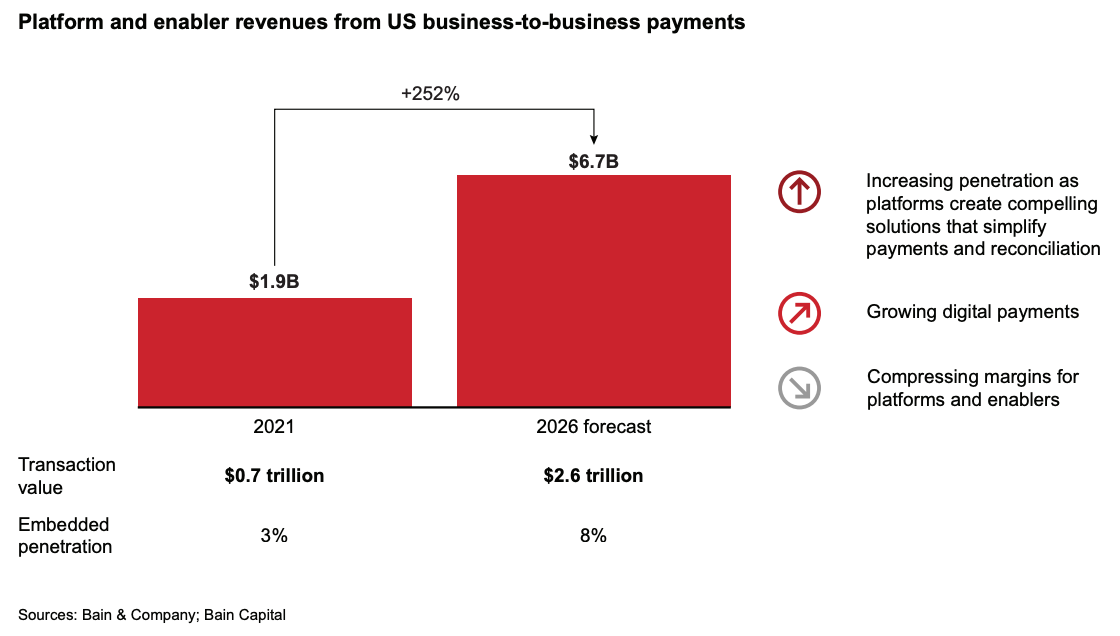

After embedded consumer payments, embedded business-to-business (B2B) payments was the second largest segment by transaction value and revenues, totaling US$700 billion in value and generating US$1.9 billion in revenues.

Transaction value and revenues are projected to grow more than threefold by 2026 with total value expected to reach US$2.6 trillion and revenues, US$6.7 billion.

Platform and enabler revenues from US business-to-business payments, Source: Embedded Finance: What It Takes to Prosper in the New Value Chain, Bain Capital/Bain and Company, 2022

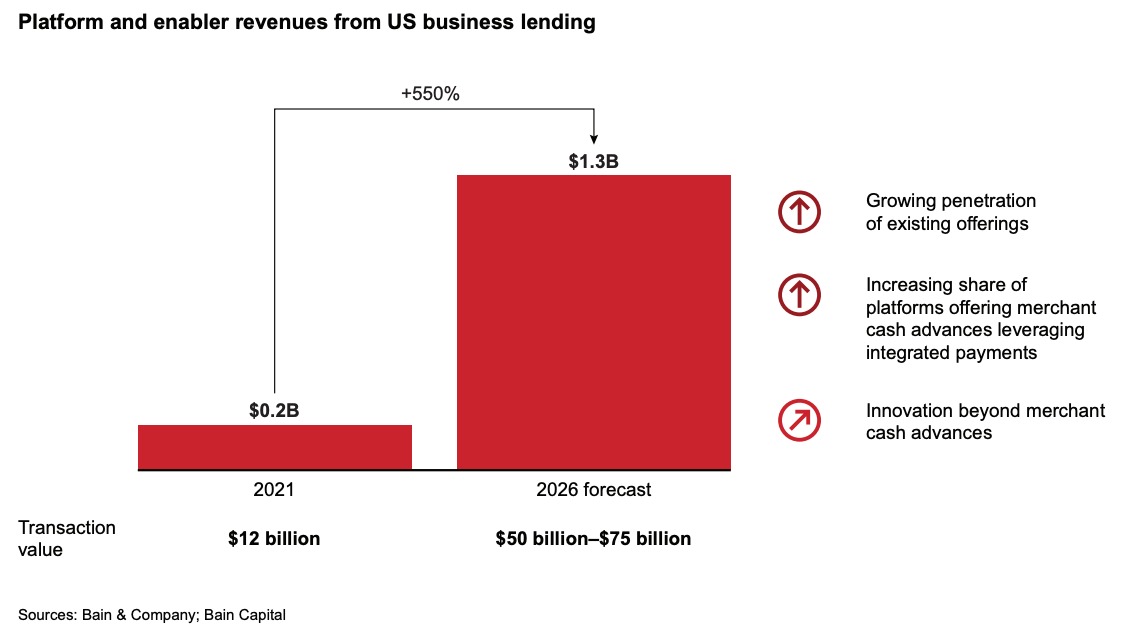

Though embedded payments are set to maintain the lion’s share of the embedded finance market, lending is one segment that’s projected to witness rapid growth, fueled by rising adoption of embedded business lending, buy now, pay later (BNPL), and point-of-sale (PoS) lending.

In particular, embedded business-to-business (B2B) lending will see the fastest growth within the next four years owing to the sector’s current low penetration.

In 2021, around US$12 billion in B2B loans transacted via embedded finance, generating US$200 million in revenues for platforms and enablers, according to the report. By 2026, embedded B2B lending should increase fivefold, totaling between US$50 billion and US$75 billion in loan volume and generating a whooping US$1.3 billion in revenues for platforms and enablers.

Embedded lending comprises solutions that allow buyers to access payment facilities or short term financing at the point of purchase without the need to visit a bank or engage with a traditional lender. Examples include Mindbody Capital, which offers cash advances to its business customers through the core solution powered by Parafin, and Toast, a restaurant management and PoS solution which offers loans from US$5,000 to US$300,000 to restaurants part of its network.

Platform and enabler revenues from US business lending, Source: Embedded Finance: What It Takes to Prosper in the New Value Chain, Bain Capital/Bain and Company, 2022

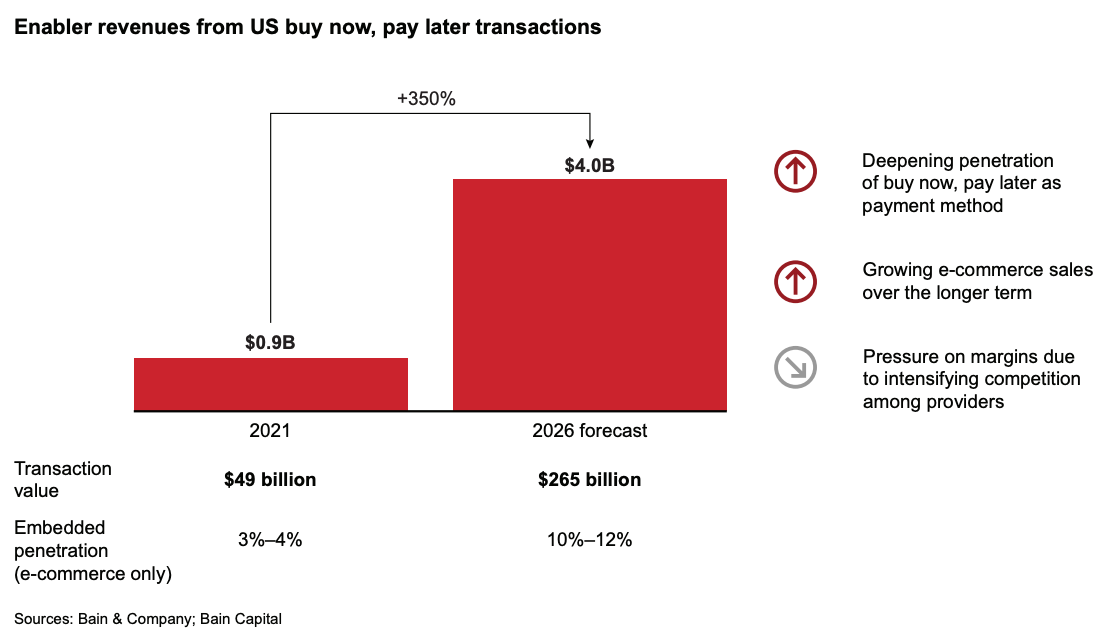

BNPL arrangements, which allow customers to pay for goods and services in instalments at the point of purchase, have proliferated across e-commerce platforms over the past few years and will continue to see increased adoption among customers.

In 2021, it’s estimated that some US$1.4 trillion poured through online retailers and marketplaces in the US. Of that sum, around US$50 billion went through BNPL platforms, giving BNPL a penetration of 3% to 4%. These transactions resulted in an estimated US$900 million in revenues for embedded finance enablers.

By 2026, these totals will grow substantially to reach US$2.4 trillion in transaction value and US$4 billion in revenues. With a forecasted 10%-12% penetration, the report estimates that the BNPL market size could soar to US$265 billion.

Enabler revenues from US buy now, pay later transactions, Source: Embedded Finance: What It Takes to Prosper in the New Value Chain, Bain Capital/Bain and Company, 2022

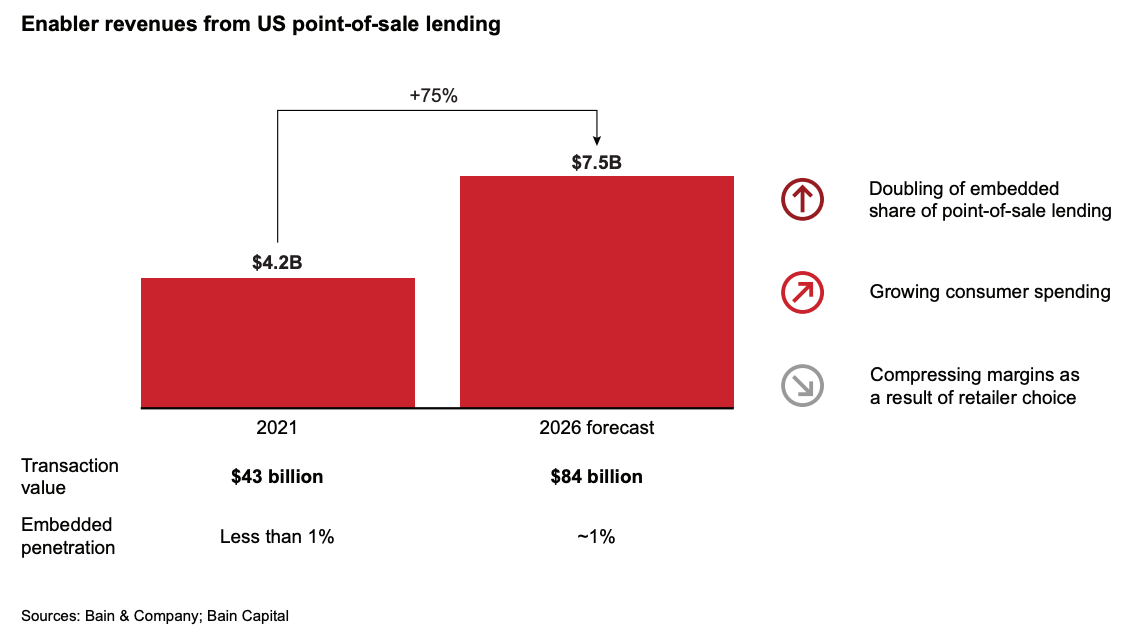

Finally, PoS lending, a credit option for consumers often used for more expensive goods such as furniture and large appliances, collected a total of US$43 billion in transaction value and generated US$4.2 billion in revenues last year. By 2026, transaction value is expected to grow to between US$80 billion and US$90 billion. Revenues are projected to jump to US$7.5 billion.

Enabler revenues from US point-of-sale lending, Source: Embedded Finance: What It Takes to Prosper in the New Value Chain, Bain Capital/Bain and Company, 2022

This article first appeared on fintechnews.am

Featured image credit: Freepik