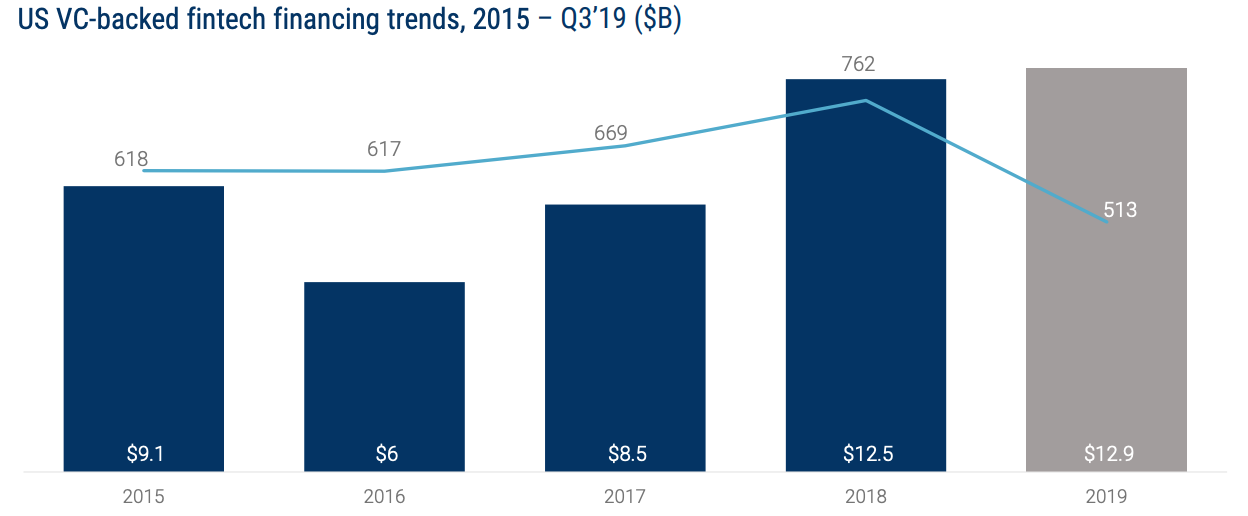

Fintech is gaining momentum in the US with US$12.9 billion raised so far this year, as of Q3’19, already surpassing 2018’s annual record of US$12.5 billion, according to CB Insights’ Global Fintech Report Q3’19.

In Q3’19, the US saw ten so-called mega-round (US$100 million+) investments worth a combined US$1.9 billion. Three of the ten US mega-rounds went to startups outside New York and California, two locations that were drivers for fintech funding in previous quarters. These deals include Root Insurance, an insurtech company from Ohio; C2FO, a working capital lender from Kansas; and Remitly, an online and mobile payment services company from Washington.

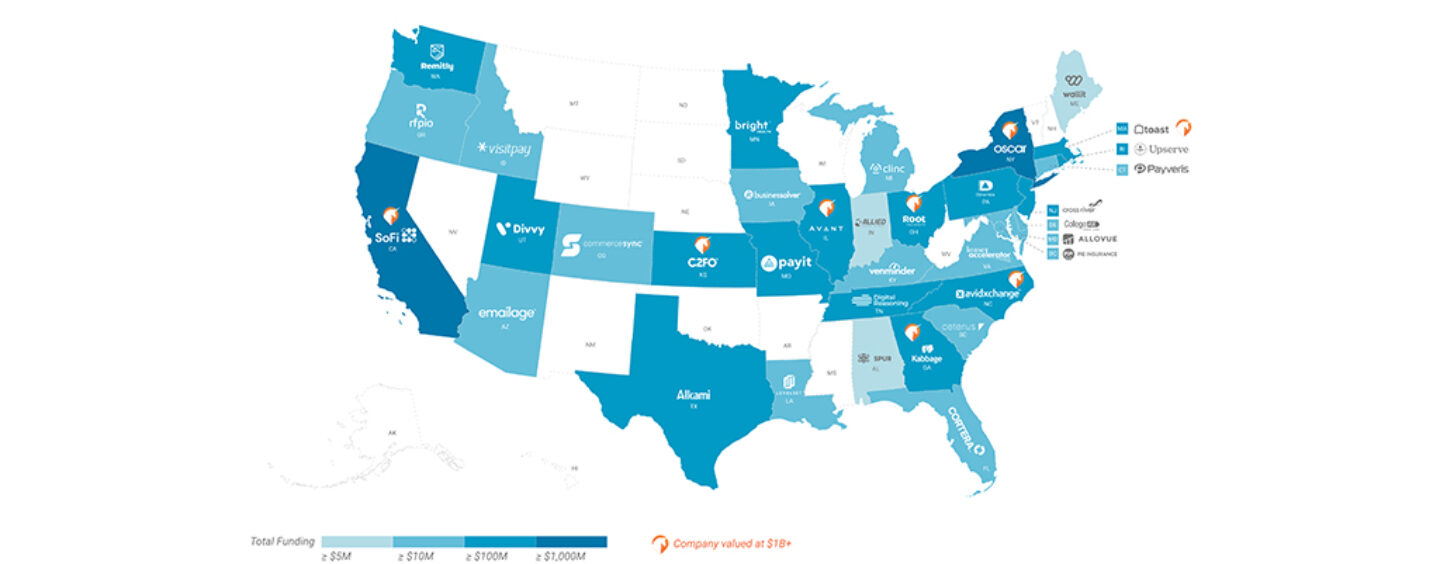

Leading fintech startups in the US

According to CB Insights, the most well-funded US fintech startup is SoFi (Social Finance), which has raised US$2.5 billion in disclosed equity funding so far. SoFi is an online personal finance company from California that provides student loan refinancing, mortgages, personal loans, and more.

SoFi is followed by Oscar Health, a health insurance company from New York that has raised US$1.268 billion in equity funding, and AvidXchange, a bill payment platform from North Carolina that has raised US$724 million.

The US is currently home to eight fintech unicorns: SoFi, valued US$4.8 billion; Root Insurance, valued at US$3.6 billion; Oscar Health, valued at US$$3.2 billion; Toast, valued at US$2.7 billion; Avant, valued at US$1.9 billion; AvidXchange, valued at US$1.2 billion; Kabbage from Georgia, valued at US$$1 billion; and C2FO, valued at US$1 billion.

Top-funded US fintech startups by state

CB Insights mapped out the top-funded fintech startups in the US by state. According to the research firm, these companies have raised over US$9.5 billion collectively, and include leading startups including SoFi, Oscar Health, AvidXchange, Root Insurance (US$509 million), C2FO (US$400 million), Remitly (US$312 million), Kabbage (US$490 million), as well as Avant (US$655 million), a lending startup from Illinois, Bright Health (US$440 million), a health insurance company from Minnesota, and Alkami Technology (US$174 million), a digital banking solutions provider from Texas.

2019 was a big year for fintech in the US. Neobank Chime started the year off with a US$200 million Series funding round, making it the country’s first neobank unicorn. The deal was followed in December by a US$500 million Series E. In September, it surpassed 5 million accounts, making it the biggest neobank in the US in terms of customer base, according to a Business Insider report