In Europe, mergers and acquisitions (M&A) activity in the fintech sector remains vigorous as traditional financial institutions and established fintech companies are capitalizing on the venture funding slowdown and the global markets turmoil to snap up young startups to fuel their digital transformation strategies and drive growth, a new report by international law firm White and Case shows.

The report, released on September 18, looks at the fintech M&A landscape in the UK and Europe, exploring the market consolidation wave that’s taken hold of the region’s fintech sector and delving into the key trends observed over the past year or so.

According to the report, more than 55 consolidation deals have been recorded in the previous 15 months, and over 20 significant partnerships have been announced in the past 12 months, revealing continued consolidation in the fintech sector.

Banks’ fintech M&A and funding activity

Many of these acquisition deals involved banks purchasing “plug and play” fintech startups to address a variety of challenges, including cost containment, error reduction, cybersecurity and competition from innovative financial players, the report notes.

These deal included JP Morgan’s acquisition of Renovite, a cloud-native payments technology company from the US, as well as Komercni banka’s acquisition of Upvest, a Czech real-estate investment platform.

JP Morgan announced plans in September 2022 to purchase Renovite to help it build its next-generation merchant acquiring platform, bolster its payments modernization strategy and support its journey to the cloud. Meanwhile, Komercni banka, a member of the Societe Generale international financial group, acquired a majority stake in Upvest in August 2022 in a bid to expand into the crowdfunding space.

Other institutions, meanwhile, adopted a more cautious approach by investing in startups and by partnering with innovative ventures. These tie-ups focused on establishing strategic partnerships to tap new niches and tech capabilities, and included the joint venture between Santander, Allianz Trade and Two, the tie-up between Deutsche Bank and Credi2, as well as JP Morgan Private Bank’s strategic equity investments in both Edge Laboratories and Evooq.

- The partnership between Santander, Allianz Trade and Two, unveiled in January 2023, focuses on developing a business-to-business (B2B) buy now, pay later (BNPL) payment solution for large and multinational corporations;

- The collaboration between Deutsche Bank and Credi2, an embedded finance specialist, was announced in July 2022 and aims to develop a payment solution for invoice and installment purchase; and

- JP Morgan, meanwhile, invested in Swiss wealth management software services companies Edgelab and Evooq in December 2022 in a bid to strengthen its digital investments capabilities for ultra-high-net-worth clients across Europe, the Middle East, Latin America and Asia.

Top fintech verticals for consolidation

Across all major fintech segments, insurtech, consumer finance and open banking were the verticals that witnessed the most consolidation activity in the previous 12 months both in the form of acquisitions of smaller competitors and through strategic tie-ups, the report says.

In the insurtech segment, Total Specific Solutions, Clark Group and +Simple all inked acquisitions during the period, snapping up companies such as Prima Solutions, a French insurtech group; Anorak, an automated life insurance advice platform; and GMBC, a German insurance company that helps companies set up and run managing general agents (MGAs).

In consumer finance, Scalapay and ValU, two BNPL players, and PNL Fintech, a company that provides financial and business management software for entrepreneurs and businesses, made several purchases over the past year, acquiring Cabel IP, Paynas and Finadvant, respectively.

Cabel IP is an Italian payment institution, Paynas is a digital platform tailored for small and medium-sized enterprises (SMEs), and Finadvant is an online business banking software designed to facilitate international trade.

All three acquisitions were meant to strengthen the acquirers’ offerings and access new capabilities.

Finally, in open banking, consolidation deals included Fintech Galaxy’s acquisition of Egyptian rival Underlie, GoCardless’s acquisition of Nordigen and Weavr’s acquisition of Comma Payments.

The Underlie deal allowed Fintech Galaxy to boost its expansion across the Middle East and North Africa (MENA) region; the Nordigen deal allowed GoCardless, a digital bank payment specialist, to incorporate next-generation open banking connectivity into its account-to-account network; and the Comma Payments deal allowed Weavr to become the first embedded finance provider to combine banking-as-a-service (BaaS) and open banking into an embedded payment solution for B2B applications.

M&A activity rebounds in DACH

After a dip in 2022, M&A activity rebounded considerably this year across Europe, especially in Germany, Austria and Switzerland, also referred to as the DACH region, a new report by investment bank Clipperton reveals.

In the first half of 2023, the DACH region witnessed a 54% increase in the number of M&A transactions compared to the same period in 2022, which totaled 235 transactions. Transaction volume surged by 59% during the period, showcasing reviewed interest in strategic acquisitions.

Notable deals in H1 2023 included the sale of Airplus, Lufthansa Group’s payment specialist, to Swedish bank SEB Kort for EUR 450 million, as well as the sale of online pharmacy Zur Rose’s Swiss business unit to rival Medbase for CHF 361 million.

Growth and venture capital (VC) funding volume and number of rounds, Source: Clipperton, Sifted, Oct 2023

The surge in M&A activity in DACH comes at a time when growth funding in the region is declining considerably. In H1 2023, DACH startups secured a mere EUR 2.7 billion in funding, down by a significant 66% year-over-year.

M&A volume and number of deals in DACH, Source: Clipperton, Sifted, Oct 2023

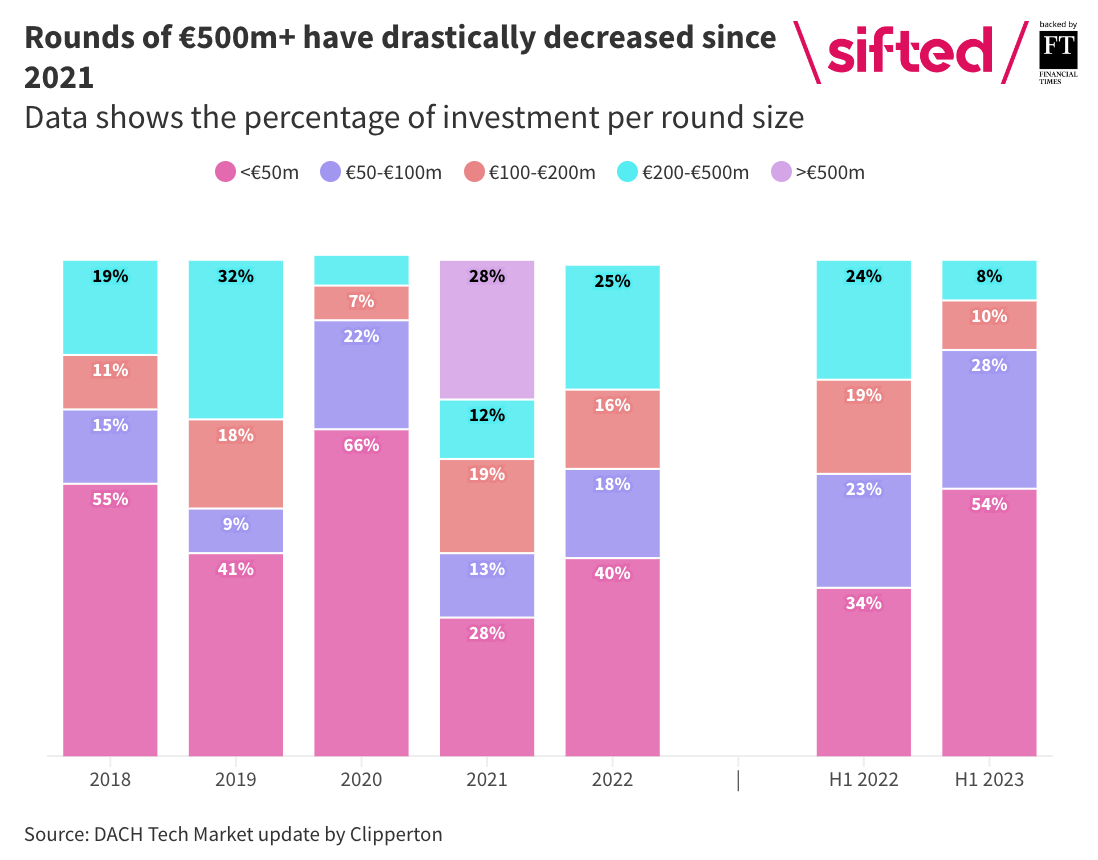

This decline was accompanied by a decrease in megarounds of EUR 100 million and up, which saw their share shrink from making up 59% of all capital raised in 2021 to just 18% in H1 2023.

Percentage of investment per round size in DACH, Source: Clipperton, Sifted, Oct 2023