Global Fintech Funding Continues to Decline; Drops 38% QoQ

by Fintechnews Switzerland November 1, 2022Fintech funding continued to slide in Q3 2022, dropping 38% quarter-over-quarter (QoQ) to US$12.9 billion. The sum makes Q3 2022 the sector’s weakest quarter since Q4 2020 and brings the total raised by fintech companies so far this year to US$63.5 billion, down 64% year-over-year (YoY), data from CB Insights’ latest State of Fintech report show.

The downward trend observed over the past year comes amid global uncertainty and growing inflation concerns which have prompted venture capital (VC) firms to invest more cautiously and favor sustainable businesses.

Global fintech funding by quarter, Source: State of Fintech Q3 2022, CB Insights

According to the report, Q3 2022 was marked by fewer mega-rounds, smaller deal sizes, plummeting new unicorn births and declining mergers and acquisitions (M&A) activity.

Only 19 mega-rounds worth US$100 million and over were recorded in Q3 2022, the fewest since Q2 2018. These rounds accounted for just 34% of total funding (US$4.4 billion), down 32 percentage points from the 2021 average of 66%.

Quarterly fintech mega-round funding and deals, Source: State of Fintech Q3 2022, CB Insights

Average deal size dropped as well, declining 38% from 2021 to US$20 million. And fintech unicorn births fell below double digits for the first time since 2020, with just six new unicorns in Q3 2022: 21.co, a cryptocurrency startup from the US; OneCard, a mobile-first credit card offering in India; Stori, another credit card provider but from Mexico; Dana, an Indonesian digital wallet, Paystand, a business-to-business (B2B) payments platform from the US, and Zebec, a crypto startup from the US.

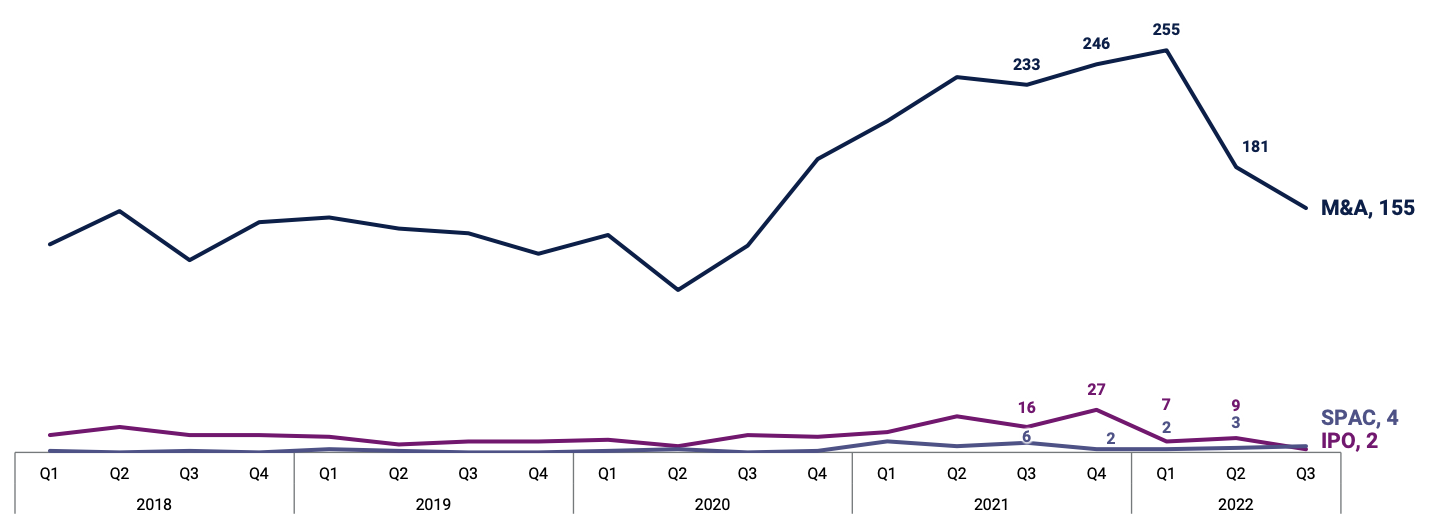

M&A, meanwhile, continued to be the preferred exit type, recording 155 deals in Q3 2022. The number, however, represents a 14% QoQ decline and an eight-quarter low. Only four mergers to special purpose acquisition companies (SPACs) were recorded for the quarter, surpassing the number of initial public offerings (IPOs) of two.

Fintech exit trends, Source: State of Fintech Q3 2022, CB Insights

Regional and sectoral trends

Looking at regional trends, data show that the downturn took a toll on the US market, with fintech funding plunging 43% QoQ to US$5.1 billion, reaching its lowest point since Q1 2020.

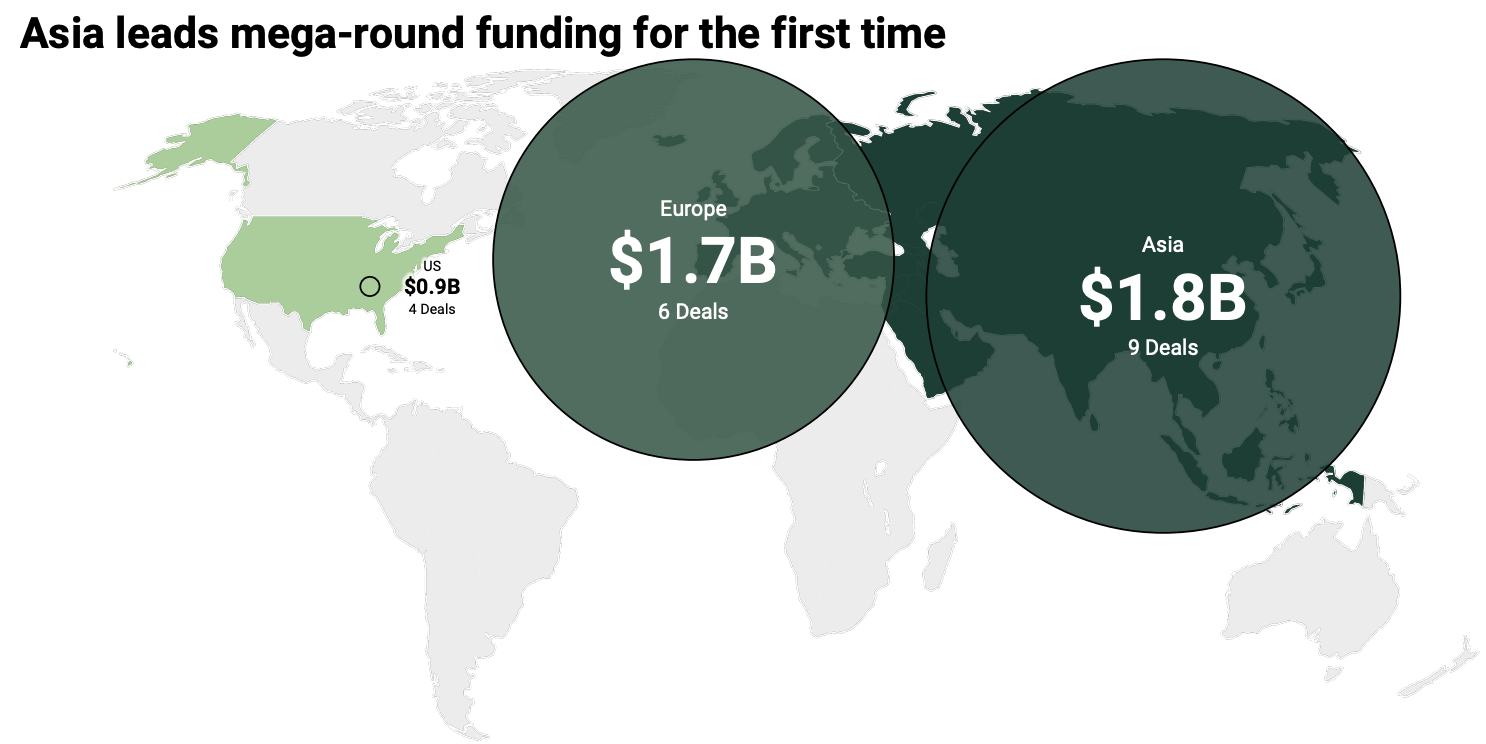

Though the US still led the world in regional deal share (39%) and total funding sum (US$5.1 billion), it fell behind Asia and Europe in mega-round funding, recording only four deals totaling US$900 million, compared to US$1.8 billion and nine deals for Asia and US$1.7 billion and six deals for Europe. This the first time Asia takes the first position in mega-round funding.

Asia and Europe also surpassed the US in late-stage deal share, with Europe drawing 32% of deals in Q3 2022 and Asia 33%, while the US brought in 24%.

Mega-round funding in Q3 2022 by region, Source: State of Fintech Q3 2022, CB Insights

Across geographies, Australia was the only region to see a QoQ increase in fintech funding and deal count, growing at a notable 40% rate in funding total (US$144 million) and at a 42% increase in deal count (17 rounds).

Looking at fintech segments, all categories recorded a drop in funding, with payments sliding 27%, banking, 37%, and lending, 16%. Wealthtech took the biggest hit, with global funding plummeting 69% to US$1.1 billion, followed by capital markets, which saw funding drop 50% to US$400 million.

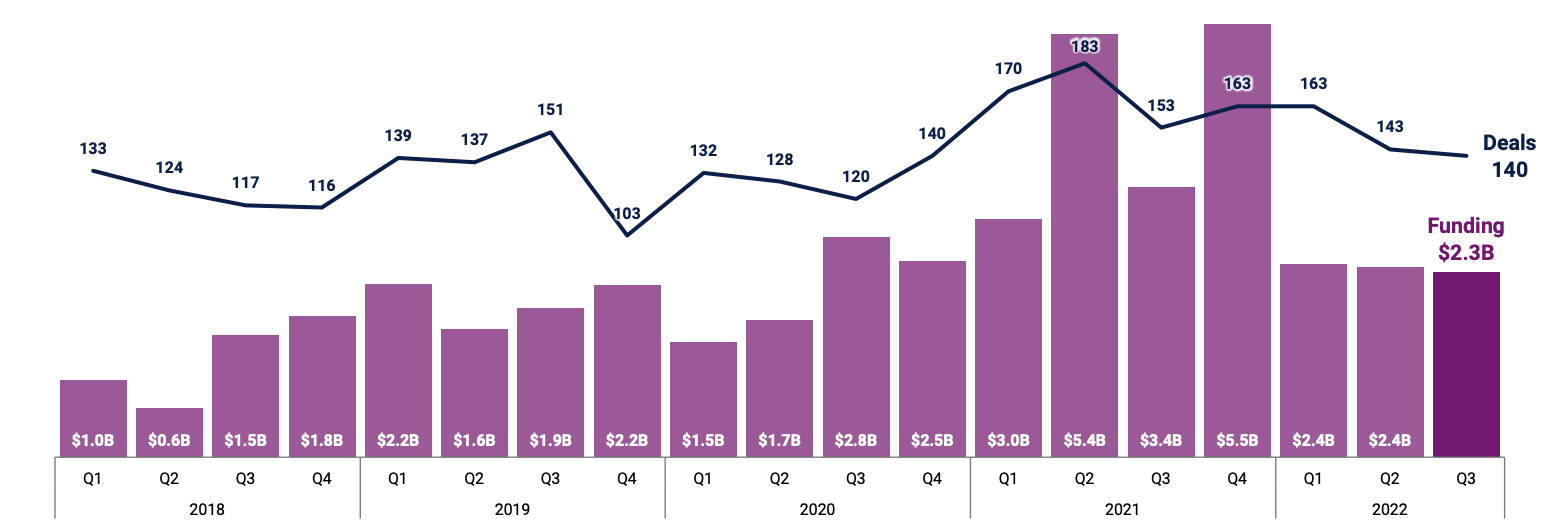

Insurtech recorded the smallest QoQ decline across all fintech segments, ticking down 4% from US$2.4 billion to US$2.3 billion. Though insurtech funding activity this year is significantly down compared to 2021, unlike other sectors, insurtech has remained relatively flat throughout 2022.

Quarterly insurtech funding, Source: State of Fintech Q3 2022, CB Insights

In Q3 2022, payments dominated the global fintech funding landscape, collecting a total of US$3.9 billion through 178 deals. Asia secured nearly half of that sum, raising a total of US$1.6 billion across 49 deals. Notable rounds included Dana’s US$555 million Series A, Toss US$371 million Series G, and OneCard’s US$100 million Series D.

Insurtech was the second largest fintech segment in Q3 2022, with the US leading the world in total funding and deal count. The largest equity deals in Q3 2022 included Wefox’s US$400 million Series D, Pie Insurance’s US$315 million Series D, and Coalition’s US$250 million Series F.

After insurtech, digital lending took the third spot, securing a total of US$2.1 billion through 131 deals. Europe took the lion’s share, collecting a total US$900 million through 23 deals. Klarna’s US$800 million private equity round made up for most of the sum.

Global fintech funding by segment, Source: State of Fintech Q3 2022, CB Insights

Startup funding has pulled back significantly this year amid public markets slump and economic concerns. VC investment for Q3 2022 totaled US$74.5 billion, hitting a nine-quarter low. This represents a 34% QoQ drop and is the largest quarterly decline in the last decade, data from CB Insights show.

Featured image credit: Edited from Freepik