Bernard Arnault, the chairman of luxury goods group LVMH and Europe’s richest man, is the latest billionaire to embrace the SPAC frenzy, joining hands with global alternative asset management group Tikehau Capital through his investment holding company Financière Agache to launch a special purpose acquisition company, or SPAC.

Tikehau Capital said on February 15, 2021 that the SPAC will focus on the financial services sector with potential targets that include fintech companies, asset management platforms, insurance services, and diversified financial services companies.

SPACS are “blank-check” shell corporations set up by investors with the sole purpose of raising through an initial public offering (IPO) without going through the traditional burdensome process.

In an IPO, a company announces its intention to go public, and then has to disclose a lot of details about its business operations. After that, investors put money into the company in exchange for shares.

In the case of a SPAC, investors pool their money together first, while having no idea what company they’re truly investing in. The SPAC then goes public, after which it hunts for a company that wants to go public and merges with it.

Investors who invested in the SPAC then own stock in a real company, not just a shell company, and the sponsors who organized the SPAC get a big chunk of the company as a reward.

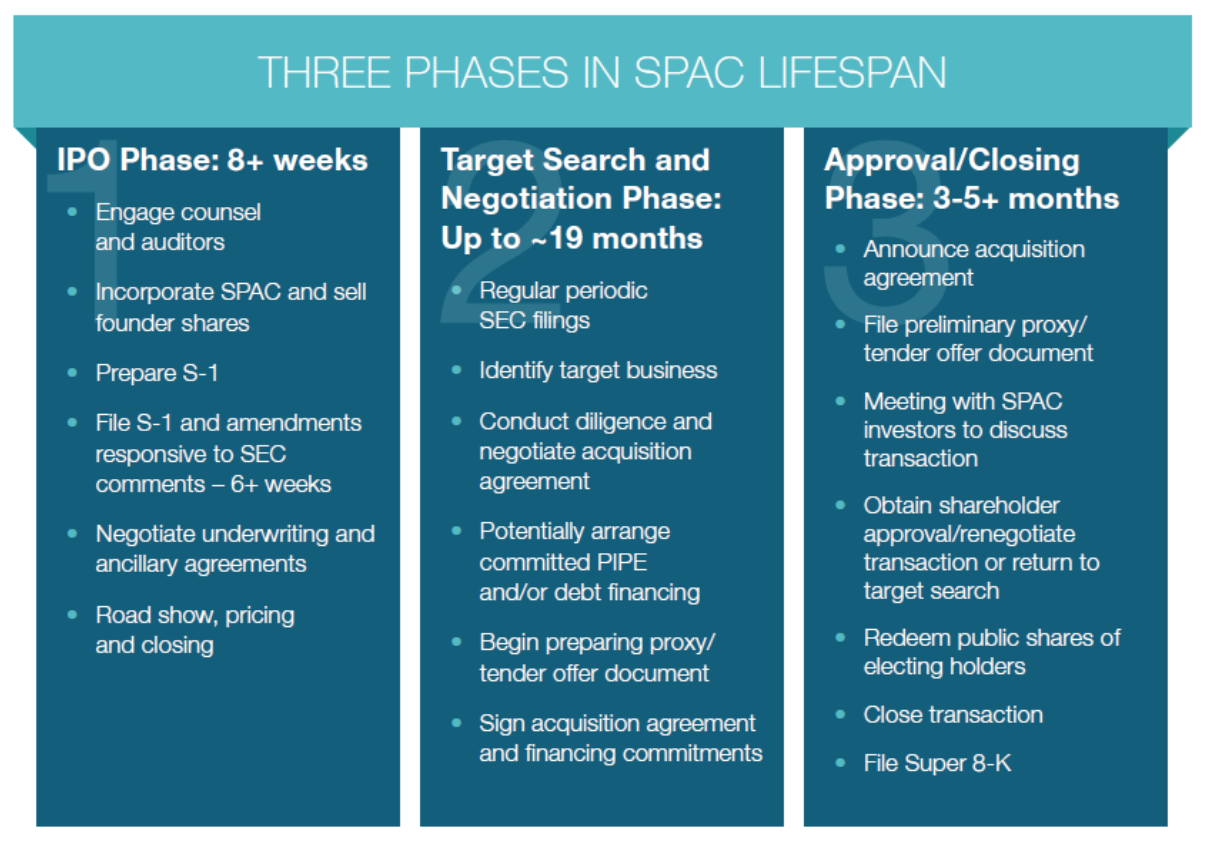

Three phases of SPAC lifespan, Special Purpose Acquisition Companies- An Introduction, by Ramey Layne and Brenda Lenahan, Vinson & Elkins LLP, via Harvard Law School on Corporate Governance

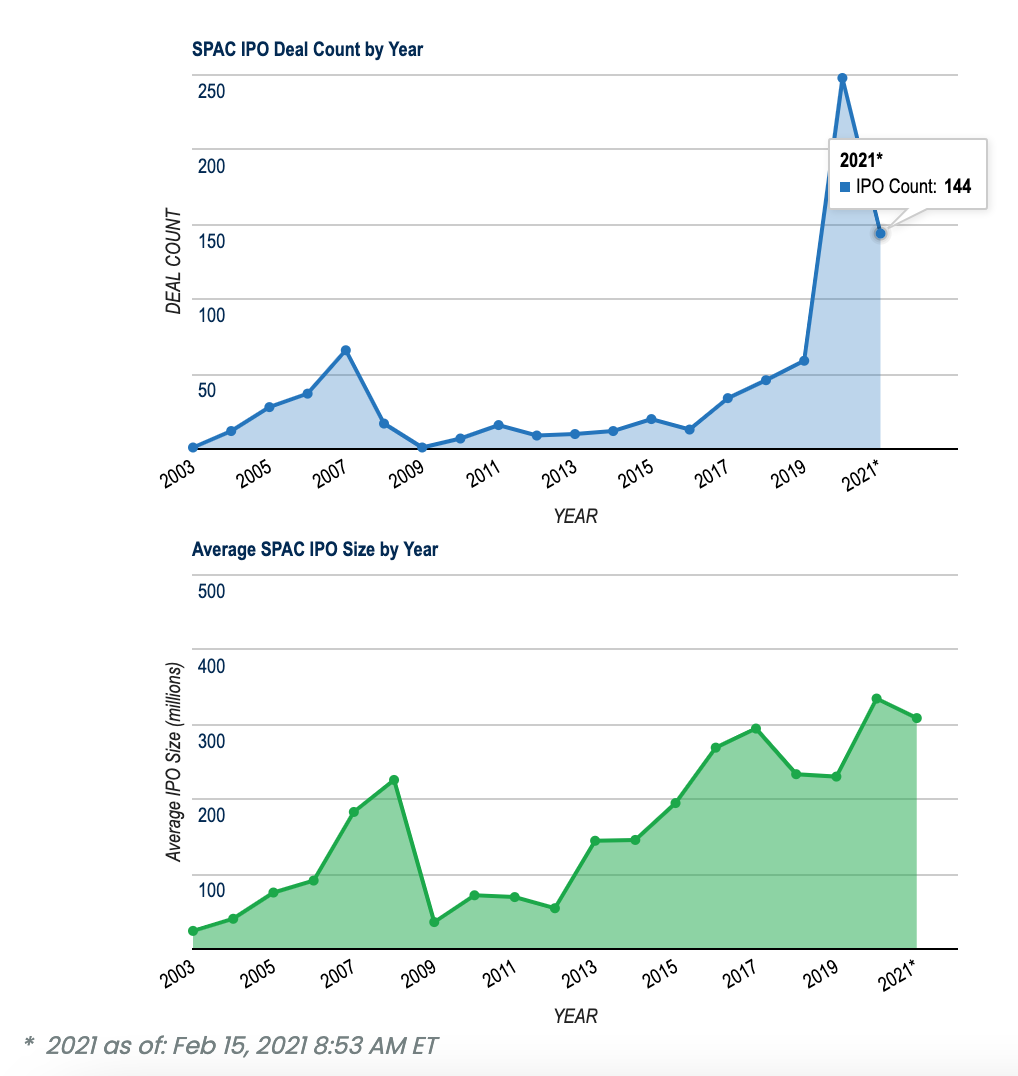

SPACs were once an obscure part of the industry but have since exploded in popularity. More than half of all SPAC IPO transactions that ever took place occurred in 2020 and 2021, data from SPACInsider.com show. These transactions raised a combined US$127 billion in gross proceeds, or 73% of all SPAC IPO proceeds in history.

2020 saw 248 SPAC IPO transactions that raised a total of US$83 billion in gross proceeds, up 320% in deal count and up 510% in amount raised. 144 SPACs went public in 2021 already, demonstrating that the momentum will continue this year.

SPAC IPO by year, SPACinsider.com

Fintech SPACs

Since the end of 2020, the fintech industry has seen a flurry of SPAC deals. Payoneer, a startup that provides cross-border payments for small businesses, online sellers and freelancers in over 190 countries, is one of the latest fintech companies to agree to merge with a SPAC, announcing on February 3, 2021 its planned combination with FTAC Olympus Acquisition Corp in a US$3.3 billion deal.

FTAC Olympus Acquisition Corp is one of the latest blank-check companies backed by Betsy Cohen, a fintech pioneer and the founder of the Bancorp. Cohen has also been the name behind FTAC Athena Acquisition Corp, FTAC Hera Acquisition Corp, and the series of Fintech Acquisition Corp vehicles, which have taken companies including CardConnect, International Money Express (Intermex), Paya and Perella Weinberg Partners public.

FTAC Hera Acquisition Corp and FTAC Athena Acquisition Corp both recently filed for an IPO, the former looking to raise about US$750 million, while the latter, about US$220 million.

Another merger announced just earlier this week is the MoneyLion and Fusion Acquisition Corp deal. MoneyLion, which provides a digital financial platform that helps customers save, borrow money and invest, said on February 12, 2021, that the deal will give it a valuation of US$2.9 billion once it closes some time during the first half of 2021. The company plans to add more features and products including pay over time, a credit card, and a cryptocurrency platform.

Other recently announced or completed fintech SPAC transactions include Social Finance (SoFi) and Social Capital Hedosophia Corp V (US$8.65 billion), United Wholesale Mortgage and Gores Holdings IV, Inv (US$16.1 billion), Paysafe and Foley Trasimene Acquisition Corp II (US$9 billion) and Global Blue and Far Point (US$2.6 billion).

A list compiled by LenditFintech News suggests that at least six SPACs are now actively pursuing fintech acquisitions including JOFF Fintech Acquisition, Quantum Fintech Acquisition, Thunder Bridge Capital Partners III, and Cohen-backed Fintech Acquisition Corp V.

The multitude of fintech SPAC deals that took place just this year showcases that 2021 has so far shown no signs of slowing down last year’s SPAC frenzy. But one trend that experts and industry observers are predicting for 2021 is the spread of the SPAC mania to Europe.

This has already been evidenced by the upcoming Arnault-backed SPAC which will be targeting European financial services companies and fintechs. Now, it appears that VPC Impact Acquisition Holdings II, the latest SPAC of global investment firm Victory Park, is looking to acquire high-growth fintech companies outside of the US, with the most likely candidates being European fintech unicorns like eToro. The SPAC recently filed for a US$225 million IPO.