Instant Payments Is Booming: McKinsey Global Payment Report 2023

by Fintechnews Switzerland October 6, 2023Usage of cash globally is decreasing at a consistent pace as electronic transactions, including those involving instant payments and digital wallets, are taking off, a new report by McKinsey shows.

The 2023 Global Payments Report, released on September 18, shares key findings from McKinsey’s proprietary payment market intelligence platform and data, which span more than 25 payments products in 47 countries.

An analysis of the evolution of the global payments sector over the past year shows that cash usage dropped by nearly 4% in 2022, led by cash-reliant economies including India and Brazil where the share of cash transactions fell by 7 to 10 points in favor of instant payments. Digital wallets, which are used to conduct most of instant payments, are seeing similar growth.

Usage of Brazil’s Pix system continues upward trend

In Brazil, the report notes that the decline of cash transactions came in tandem with the rise of the country’s Pix system.

Pix is a mobile-based real-time payments service launched in 2020 with the aim of reducing cash transactions and offering an alternative to existing payment instruments that’s faster and more affordable.

The service allows instant payments between individuals and between individuals, companies, and government, and operates 24 hours a day, seven days a week and 365 days a year. Pix has been used by about 140 million individuals, or 80% of the adult population, and 13 million firms, statistics from Banco Central do Brasil show.

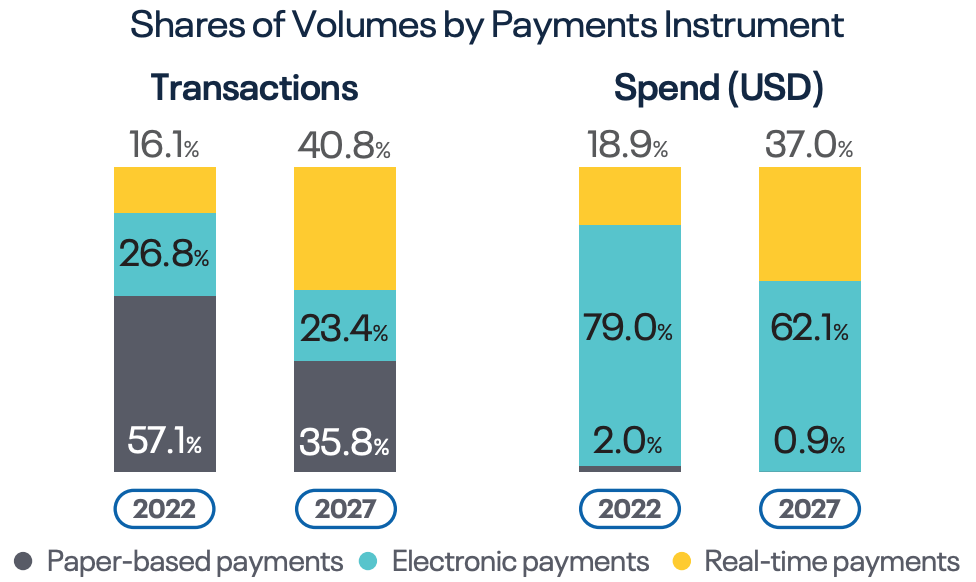

According to a 2023 report by ACI Worldwide and GlobalData, the use of instant payments in Brazil surged by a staggering 228.9% between 2021 and 2022. By 2027, real-time payments are expected to represent a 40.8% share of total payments volume, up by 24.7 points from a 16.1% share in 2022. McKinsey estimates that by then, almost half of the transactional revenue growth through 2027 is expected to come from instant payments.

Shares of volumes by payments instrument in Brazil, Source: Prime Time for Real-Time Global Payments Report, ACI Worldwide, March 2023

UPI transactions dominate Indian payments landscape

Similarly, the volume of India’s digital payments has grown tenfold over the past five years and McKinsey projects it to grow at roughly 35% per year over the next five. New digital transactions in India have so far been the result of cash displacement, a trend which will carry on moving forward.

In H1 2023, 51.91 billion transactions were conducted through the Unified Payments Interface (UPI) network, increasing by 62% year-on-year (YoY), data from the government show.

According to Dilip Asbe, the managing director of the National Payments Corporation of India, which oversees UPI, the platform has grown rapidly and is now used by close to 300 million individuals and 50 million merchants.

UPI is an instant payments system that facilitates inter-bank peer-to-peer and person-to-merchant transactions. The infrastructure was introduced in 2016 and aims to provide a new payment system that’s simple, secure and interoperable. According to a CNBC report, UPI now accounts for over 75% of all retail digital transactions in India, up from just 23% in 2018.

Instant payments pick up in Nigeria

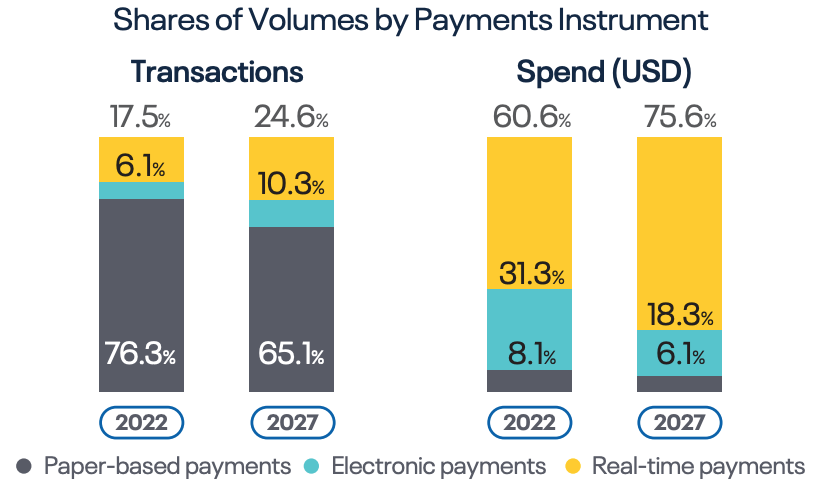

McKinsey notes that a similar trend is being observed in Nigeria where the share of cash transactions fell to 80% in 2022 from 95% in 2019. Over the same period, instant payments’ share quadrupled to 8%.

Nigeria introduced its Nigeria Inter-Bank Settlement System (NIBSS) in July 2011. The system is supported by all commercial banks, micro-finance banks and mobile money operators, and can be used via different modalities including Internet and mobile banking, bank branches, kiosks, mobile USSD, point-of-sale (POS) terminals and ATMs.

NIBSS instant payments rose from 729.2 million transactions in 2018 to 5.2 billion in 2022, data from the government show. The ACI Worldwide and Global Data report projects that the volume of real-time transactions in the country will rise to 8.9 billion by 2027.

Shares of volumes by payments instrument in Nigeria, Source: Prime Time for Real-Time Global Payments Report, ACI Worldwide, March 2023

Rise of instant payments and digital wallets to push payments revenues

Global payments revenues grew by 11% in 2022, reaching an all-time high of over US$2.2 trillion, data from McKinsey show. This growth was largely driven by North America, Latin America, and Europe, the Middle East and Africa which recorded double-digit growth rates.

Global payments revenues, 2017-2027 (US$ trillion), Source: 2023 McKinsey Global Payments Report, Sep 2023

Between 2022 and 2027, global payments revenues are expected to grow by a compound annual growth rate of 7% to reach US$3.2 trillion. According to McKinsey, this future growth will be stimulated by instant payments innovations and the rise in digital wallets.

Cash-heavy developing economies, in particular, are set to drive much of this shift toward real-time payments. By 2027, the consulting firm projects that these countries’ share of instant payments will represent roughly half of their payments transactions – nearly two-and-a-half to three times greater than their share in 2022.

Emerging markets including India and Brazil are already standing as world leaders in instant payments. In 2022, these countries were the two largest real-time payments markets in the world, accounting for 46% and 15% of all real-time transactions globally, respectively, the ACI Worldwide and Global Data report show.

In 2022, global real-time payments transactions reached a volume of 195 billion, representing a YoY growth of 63.2%. By 2027, these transactions are expected to account for 27.8% of all electronic payments globally.

Featured image credit: freepik