In spring 2023, the Swiss National Bank conducted its second payment methods survey of companies in Switzerland.

Around 1,750 companies, across all sizes, language regions and industries, participated in this survey on payment method topics. In-depth knowledge of these topics helps the SNB to fulfil its statutory tasks in relation to the supply and distribution of cash and to cashless payments.

The most important findings of the payment methods survey of companies are as follows:

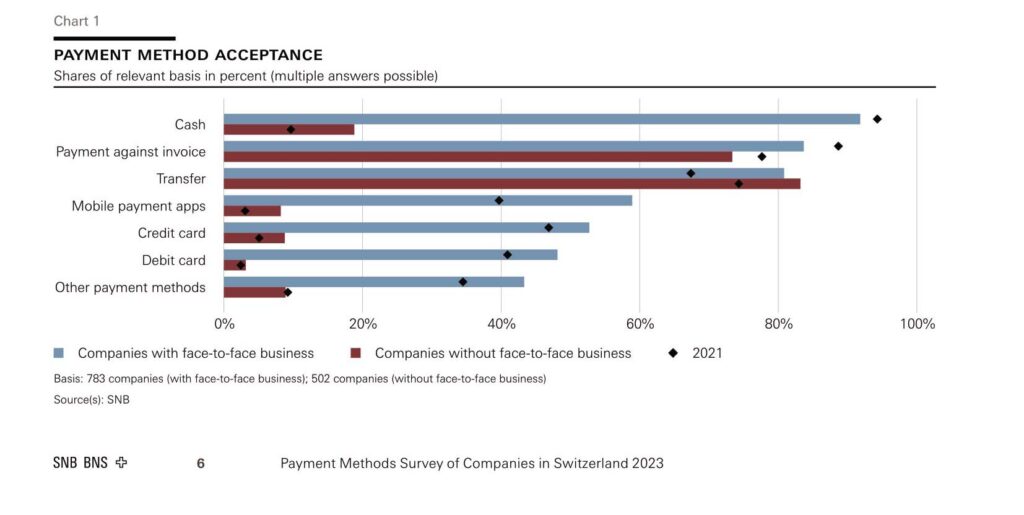

Companies are creating a good basis for freedom of choice between cash and cashless payment methods in everyday transactions by accepting a wide range of payment methods. Since the last survey in 2021, companies have tended to broaden their payment method acceptance. In particular, mobile payment apps and transfers are accepted more often. Cash acceptance continues to be high and has changed little since 2021.

For cash to continue to be accepted by companies, it has to be used by the population. According to the payment methods survey of private individuals from 2022, there is a broad desire among the population for cash to continue to be available as a payment method. The company survey now shows that customer needs play a key role in determining which payment methods are accepted by companies. A decline in cash usage could therefore lead to a decline in cash acceptance.

To be able to accept cash, companies are also reliant on having good access to cash infrastructure. The survey indicates that ATMs and bank counters are key for companies’ cash withdrawals and returns.

The majority of companies state that they are satisfied with their access to cash. There are however some companies which do not have an alternative available (e.g. a bank counter) to their current supply source. In the case of a decrease in the cash infrastructure, one in four companies would use less cash, which would in turn be likely to have a negative effect on cash acceptance.

You can find the full report on the 2023 payment methods survey of companies on the SNB website.

Featured image credit: Edited from freepik