SwissBanking Outlines Success Factors for the Industry in the Age of Open Banking

by Fintechnews Switzerland August 26, 2020In Switzerland, it is no longer a question of whether or not open banking is to stay, but rather in what form it will establish itself in the country, according to industry trade group the Swiss Bankers Association (SBA).

In a series of documents outlining its position on open banking and the steps forward for the industry, the SBA praises the market-driven approach that Switzerland has taken towards open banking implementation, noting that it was the best strategy to maintain trust in the financial center.

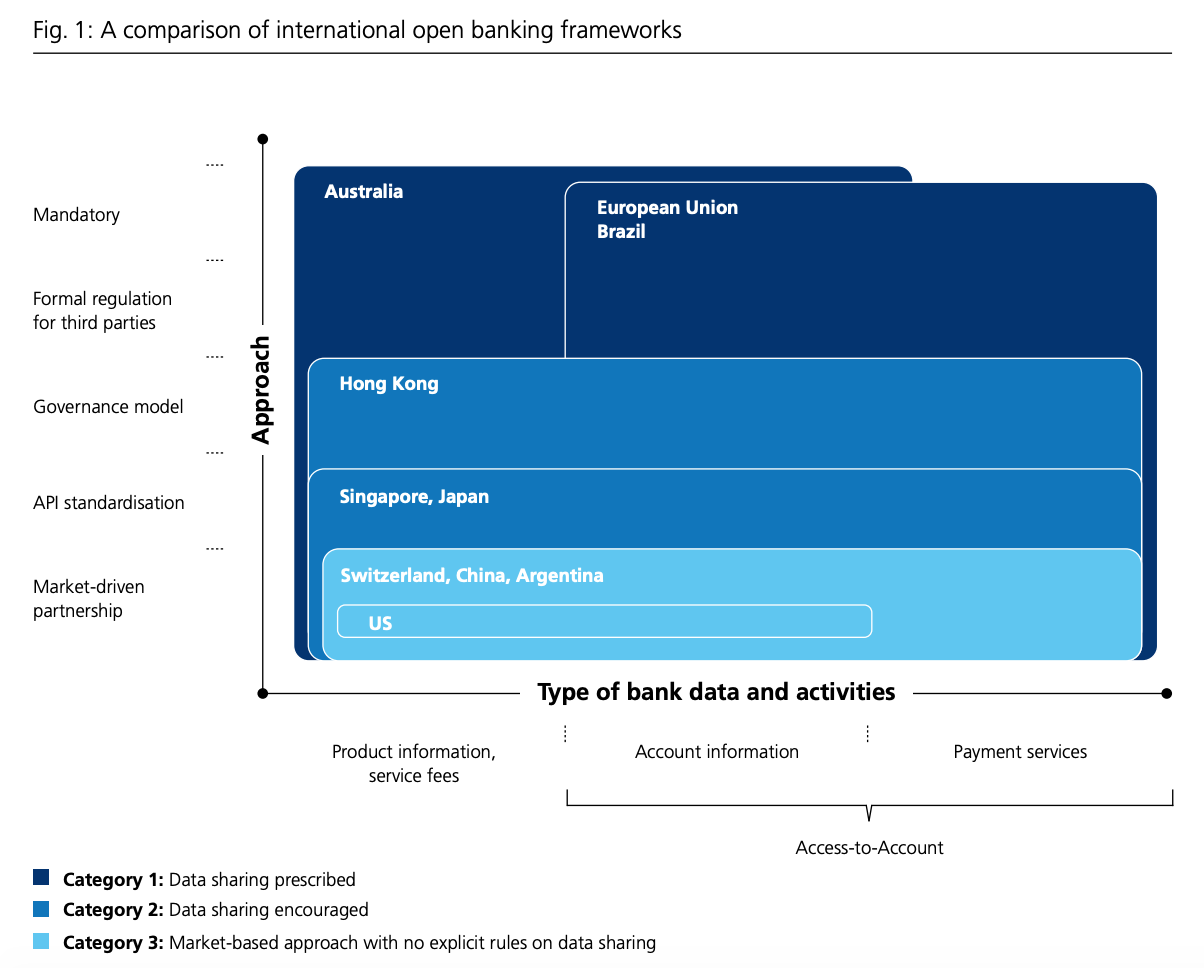

Unlike the European Union (EU) where regulators have introduced regulations like PSD2 (the revised Payment Services Directive), which ensures that banks create mechanisms to enable third party providers to work with their services and data, Switzerland does not currently have formal or compulsory open banking regimes to promote and accelerate the take-up of data sharing frameworks in banking.

Instead, the country has taken a market-driven approach where banks are free to decide for themselves who they work with and who is allowed access to their interfaces.

According to the SBA, this approach “ensures that the collaboration between bank and third party provider is based on market forces and specific use cases that add value for customers.” The organization said it considered “market-based solutions as key to maintaining the trust of customers.”

“Regulatory measures such as the forced opening of interfaces are not expedient,” the organization said.

“Free competition and customer needs in particular must and will decide whether open banking is implemented in Switzerland. It should remain the decision of the banks whether and with which third-party providers they wish to work … This is the only way that the Swiss financial centre will develop customer-orientated and non-government-ordered solutions in the area of open banking. Solutions that can also prevail in international competition.”

A comparison of international open banking frameworks, Open Banking- An overview for the Swiss financial centre, Swiss Bankers Associations, July 2020

The SBA said it was a believer in the many opportunities offered by open banking, noting that the global banking industry was moving towards this trend, including Switzerland.

Recognizing the potential of open banking for all market participants, the SBA said it was “actively contributing to the establishment of framework conditions that facilitate business models based on open banking” and working towards maintaining Switzerland’s competitiveness as a financial hub.

In a paper produced by a working group headed by the SBA and titled Open Banking: An overview for the Swiss financial centre, the organization outlines fundamental guidelines for the industry moving forward.

According to the trade group, banks must ensure that open banking fits in with their overall strategy, brand positioning and offering strategy. They must have a clear positioning and a precise idea of which offerings they want to combine with what specific added value.

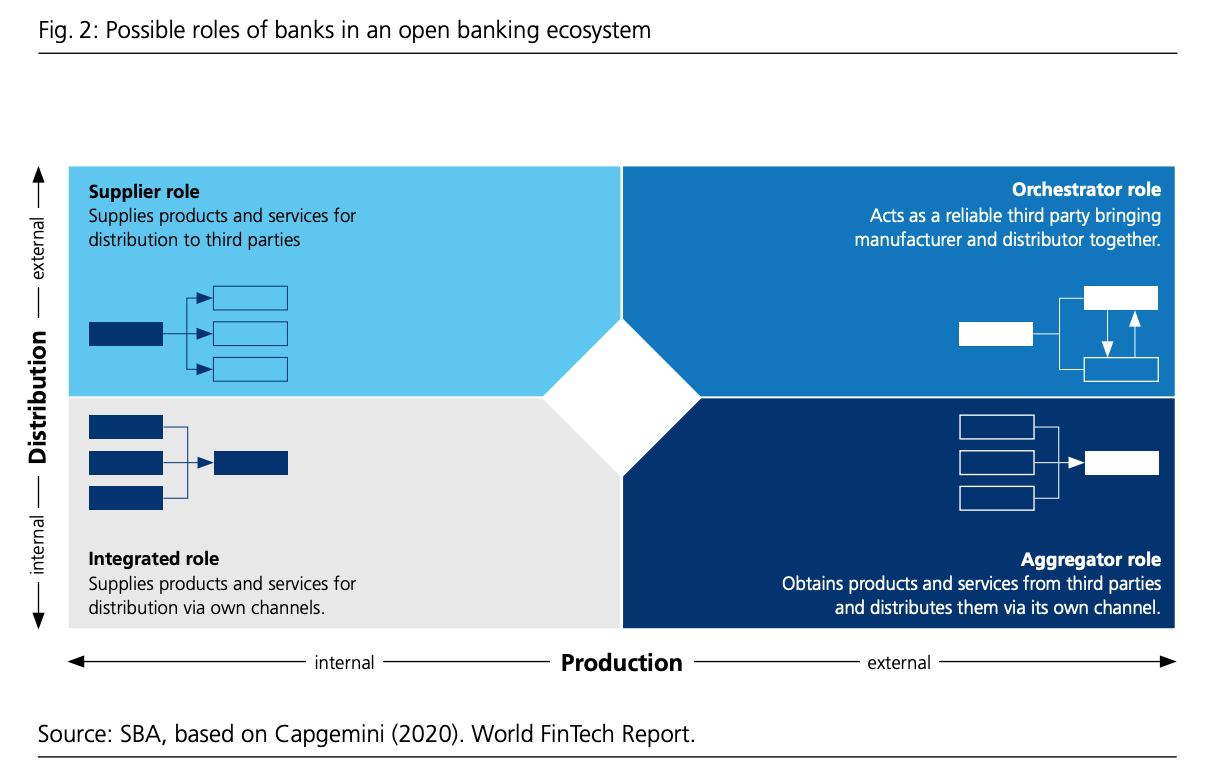

Based on that strategic positioning, banks must then decide what role they will play in implementation. This role can be either as a supplier, where they supply products and services for distribution to third parties; an orchestrator, where they act as a third-party bringing manufacturers and distributors together; an aggregator, where they obtain products and services from third-parties and distributes them via their own channels; or if they want to have an integrated role, where they supply products and services for distribution via their own channels.

Possible roles of banks in an open banking ecosystem, Open Banking- An overview for the Swiss financial centre, Swiss Bankers Associations, July 2020, Source- SBA, based on Capgemini (2020), World Fintech Report

There is also the need for the banking industry to adopt a uniform, open API standard to allow market participants to dock seamlessly, without errors, as well as share and make use of data securely.

On this topic, the SBA argues that rather than adopting an existing standard, or designing a brand new one from scratch, the best strategy for Switzerland would be to develop a national standard based on and drawing from existing standards. This would not only allow for international interoperability but would also allow for these standards to meet the specificities of Switzerland’s payment services.

Several standardization initiatives are currently in the works, the SBA said, including Swiss Fintech Innovations’ (SFTI) Common API working group and the openbankingproject.ch initiative. There are also numerous API marketplaces and platforms available, such as SIX’s b.Link platform, the Swisscom Open Banking Hub and the inventx Open Finance Platform.

In Switzerland, SIX’s b.Link platform is the only initiative at the moment that covers all three key aspects: setting standards, building a platform and supporting third-party providers with the relevant technology, the SBA said.

Onepager Open Banking, Swiss Bankers Association, August 14, 2020: