Despite ranking high in digital evolution, Switzerland lags behind some of its European counterparts in digital trust, behavior and demand. These attributes, coupled with consumers’ stronger affinity for cash and their loyalty to the traditional banking sector, have led the country to see slower open banking momentum compared with countries such as the Netherlands, France and Spain, a new report by Mastercard says.

The report, titled “Four European takes on open banking”, shares findings of Mastercard surveys, supplemented with other sources, to shed light on the development of open banking in Switzerland, the Netherlands, France and Spain and compare these countries between one another.

According to the document, Switzerland ranks high in the 2020 Digital Intelligence Index (DII), a rating that orders each country based on their state of digitalization, ranking sixth in the state of digital evolution, second in digital trust environment, eighth in attitudes to digital trust, and fifth in digital trust experiences. These are higher than the Netherlands’, France’s and Spain’s rankings.

Yet, in the user behavior category, Switzerland ranks last out of the 42 nations studied, indicating a relatively low level of trust and online engagement from consumers, a discrepancy which can be partly explain why open banking momentum in Switzerland currently appears slower than France and Spain, the report says.

A cash-reliant economy and a well-entrenched banking sector

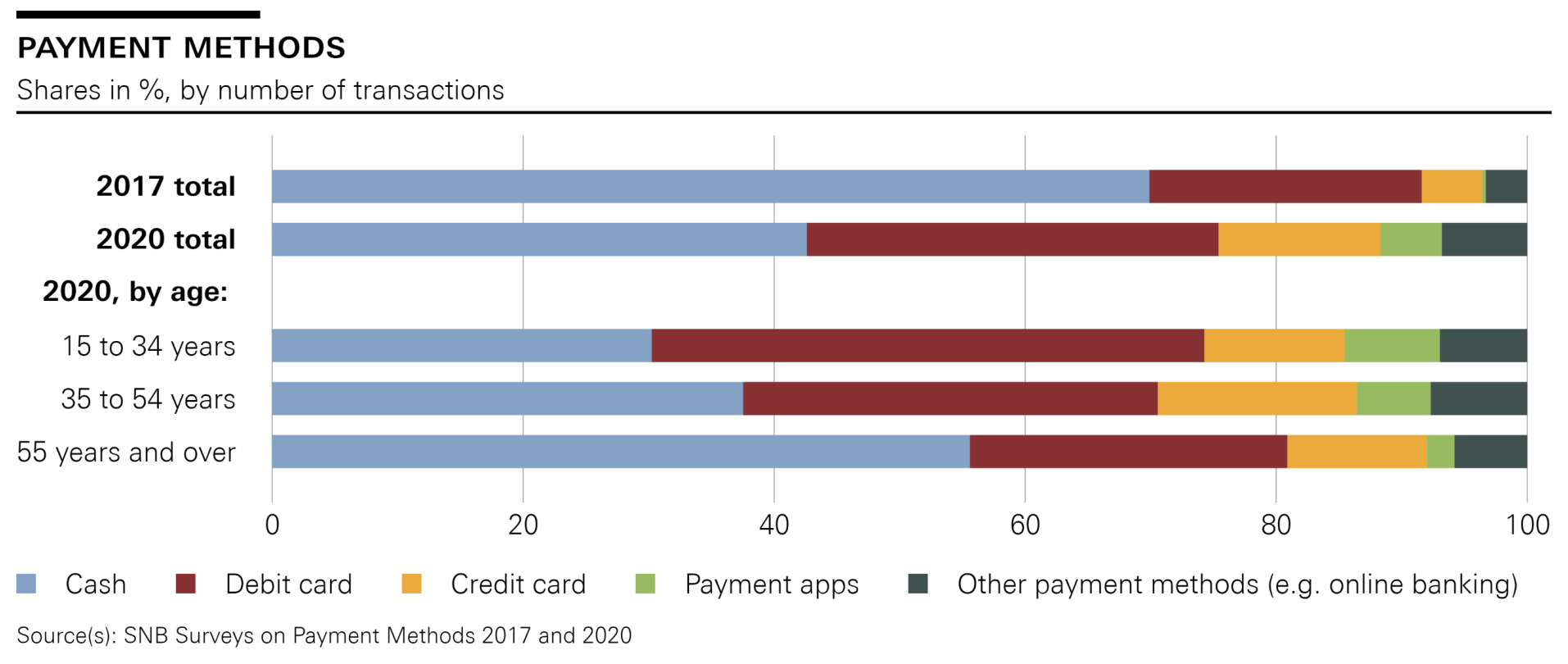

Another key trait of Swiss consumers that may contribute to the slow uptake of open banking is their affinity for cash. Data from the Swiss National Bank (SNB) show that cash accounted for 43% of all transactions in 2020, equivalent roughly to the combined share of credit and debit cards. The figure is in sharp contrast to nations in the Nordic region where almost a third of consumers indicated this year never paying with cash in physical sales locations, findings from a new study conducted by Nets, part of Nexi Group, reveal.

Shares in % by number of transactions, Source: Swiss National Bank, Nov 2022

Giving these circumstances, the Mastercard report notes that it isn’t surprising that only 59% of Swiss consumers said they would like to make a payment directly from their bank account without having to input credentials, a figure that pales in comparison to 61%, 65% and 74% in France, the Netherlands and Spain, respectively, and which reflects Swiss consumers’ relatively low interest in new digital experiences.

In addition to a preference cash, the report notes that payments cards are firmly established in Switzerland, a characteristic that’s exhibited in the fact that Swiss consumers own 3 payment cards on average, higher than the European Union (EU) average of 2.4, Spain’s average of 2.7, the Netherlands’ average of 2.5 and France’s average of 1.8.

Cards are also the preferred payment method for e-commerce transactions, accounting for 42% of the total value of e-commerce transactions in 2022, worth CHF 9 billion, the report says. Credit transfers follow with 16%, which is more than the 11.4% contributed by debit cards, alone. Twint, an account-to-account payments provider owned by a consortium of Swiss banks, takes 7.4%.

The report also notes that close private relationships with banks and the sector’s strong foothold in the country could make Swiss consumers less willing to try new solutions and share their data.

A 2021 research conducted by Mastercard found that three quarters of consumers were satisfied with their primary bank. 48% said they had had a banking relationship since childhood, 56% had never changed their primary bank, and 94% said they did not plan to change banks.

Still, the study found that, despite strong customer loyalty to their primary bank, a significant proportion of respondents (49%) said that they would be willingness to change their primary bank or add a new banking relationship to benefit from at least one open banking-enabled service.

A market-led approach

Unlike in other countries, such as the UK or EU member states, there is currently no legal obligation in Switzerland for financial institutions to make financial data available to third-party providers at their clients’ request. This has prompted industry stakeholders to come together and initiate standardization efforts.

The Mastercard report notes that, today, most demand for open banking in Switzerland currently comes from corporate and wealth clients, a demand which the OpenWealth Association is attempting to address by developing open API standards that cover wealth management-related services.

These standards are meant to complement the Common API Specification for Finance being developed by industry trade group Swiss Fintech Innovations (SFTI). The standards currently cover APIs related to account information, payment initiation, loans and wealth management (the latter one in collaboration with the OpenWealth Association), and aim for international compatibility,

The Common API initiative overlaps with the Swiss NextGen API, an initiative by openbankingproject.ch that seeks to develop APIs based on the PSD2 standards with minimal deviations and which aims to achieve international interoperability for API users.

But despite limited involvement from Swiss regulators, the Federal Council is closely watching developments, instructing in December 2022 the Federal Department of Finance (FDF) to submit measures to them by June 2024 if the financial sector does not sufficiently commit to opening up their interfaces.

Featured image credit: edited from Freepik