Revolut thinks that kids and teens need to learn about money. That’s why they introduce “Revolut Junior”, a safe and easy way for parents and guardians to teach kids essential financial skills for life.

What is Revolut Junior?

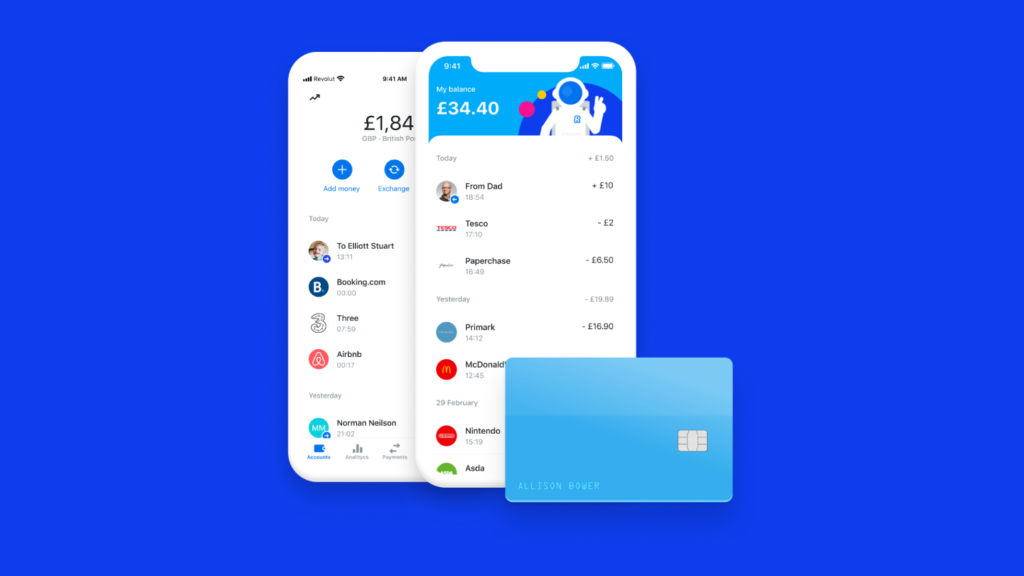

Revolut Junior is a Revolut account for young people aged 7-17. It gives them the freedom to manage their money and build essential financial skills, but for added security and peace of mind, it’s owned and controlled by you. Right now, Revolut Junior is available to Premium and Metal customers in the UK.

Revolut Junior is more than just a pocket money account. It’s a way for kids to learn about saving and budgeting — because let’s be honest, they’re not learning it in school!

Revolut Junior at a glance

- Available for kids aged 7-17

- Can only be set up by a parent or guardian with an existing Revolut account

- Funded by a parent or guardian from their main Revolut account

- Parent or guardian can control Junior account holder’s security features

- Instant notification to parent or guardian’s phone when Junior card is used

- Great way for young people to develop essential money knowledge

- Card details printed on the back of the card, to reduce risk if card is shown on social

- Built with relationships in mind

Money is an important part of any child or teen’s life, whether it’s pocket money or a part-time job. But few young people are taught how to manage their money. Imagine giving them the tools to develop greater financial sense, with resources your younger self probably never even imagined.

With Revolut Junior, young people get the freedom to spend both offline and online (fully customisable by you), and you get the peace of mind of being able to see where their money goes. That, plus those essential saving and budgeting skills.

It’s all about starting conversations around money.

Tracking and transaction alerts

With the freedom of a Revolut Junior account also comes the need for tracking. You’ll be able to see where they spend, directly from your own Revolut account. Transaction alerts are sent whenever they spend, and by default, Junior cards cannot be used at certain age-restricted merchants.

This kind of trust and respect is central to Revolut Junior, and Revolute hopes that by giving the tools to lead the way, parents help the kids to grow up smarter about their money.

Real account, real responsibilities

When it comes to money, no young person wants to be treated like a kid. Revolut Junior gives them the opportunity to handle their money like an adult.

That said, they’re probably still going to show off their new Revolut card on social media, which is why we’ve taken the extra security precaution of putting their card number on the back, out of sight.

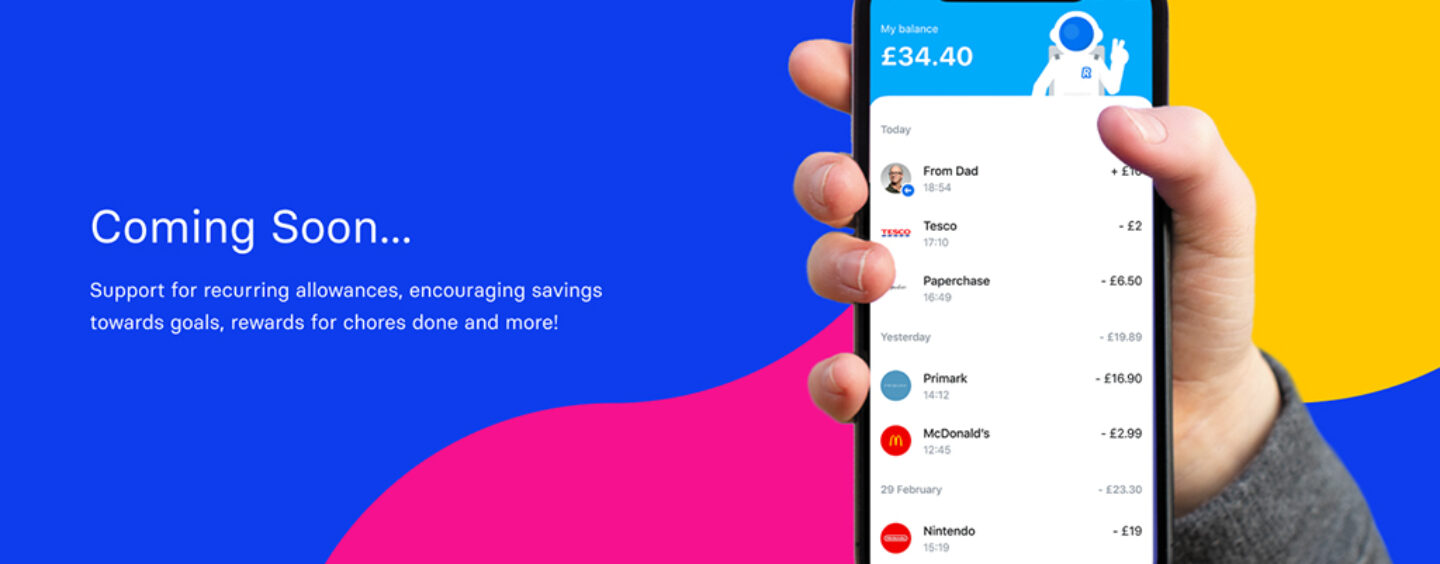

Revolut Junior launches with plenty of great features. In the coming months we’ll introduce additional budgeting features to Junior, setting up a recurring weekly allowance, as well as the opportunity for kids to create vaults, to help them save for their goals and passions. Revolut Junior is also planed to be launched outside of the UK..