Regtech, a term that refers to the use of technology such as advanced analytics, robotic process automation, cognitive computing and cloud computing, to help financial services firms get better at dealing with regulation, is one of the fastest-growing segments of fintech and financial innovation.

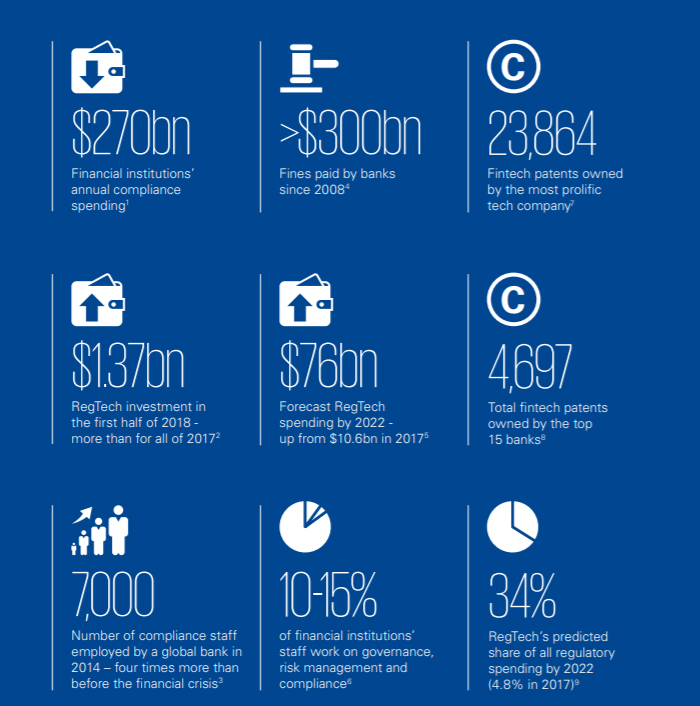

In our recent report, we forecast that regtech spending by 2022 will reach US$76 billion from US$10.6 billion in 2017 and that by 2020 RegTech is expected to make up 34% of all regulatory spendings.

In recent years, regtech has emerged as a key element of financial institutions’ drive towards digital transformation. And there are many reasons why European financial institutions are flocking into regtech.

First, European banks are operating in a very dense, fast-changing and highly complex regulatory environment. With the numerous new and impending regulations in Europe, including the Revised Payments Services Directive (PSD2), the revised Markets in Financial Instruments Directive (MiFID II), and the General Data Protection Regulation (GDPR), among others, it comes with little surprise that the region has been quick to emerge as a hotbed for regtech innovation.

New Regulation needs Regtech 3.0

Second, dealing with regulation and compliance is very expensive. The last ten years have seen a 500% increase in regulatory changes in developed markets. A BBVA research estimates financial institutions now allocate around 10-15% of their total workforce to governance, risk management and compliance, and a research report published in 2017 claimed that regulators in the US and Europe have imposed US$342 billion of fines on banks since 2009 for misconduct. This number is likely to top US$400 billion by 2020.

For financial institutions, regtech promises to strengthen compliance and mitigate risk, reduce the fixed cost of compliance, increase efficiency and improve protection for customers. And through direct improvements and freeing resources, regtech has also the potential to provide valuable business insight, provide customers with better and faster service and drive new products and services.

In Europe today, regtech companies are already using artificial intelligence (AI), machine learning (ML), cloud technologies and blockchain. They operate across various subcategories such as identity management and control, regulatory reporting, risk data management (RDM), compliance management, and automation, just to name a few.

Notable European Regtech players/solutions (Examples)

I was able to select some regtech solution providers with the help of matchmaking experts in KPMG’s Matchi: a global platform that connects financial institutions (and other large companies) with emerging technology solutions and innovators worldwide.

Suade (UK)- Reporting

Launched in 2014 and based in London, Suade provides a “regulation-as-a-service” open platform that automates the process for banks around the world to meet their reporting requirements, making it much more efficient and cost-effective.

The Suade platform helps banks analyze their own practices, then modifies them to comply with complex and changing regulatory requirements.

Privitar (UK)- Privacy protection

Established in 2014, Privitar provides data-privacy software to companies and public sector organizations around the world to protect sensitive data and enable ethical data analysis. Privitar’s software accelerates and automates the provision of privacy-preserving data, helping customers extract more business value from their data, generate data-driven insights, and drive innovation.

Privitar is headquartered in London and offices in New York, Boston, Singapore and Paris. The company is backed by Partech Ventures, Salesforce Ventures, IQ Capital, 24Haymarket, Illuminate Financial, and Citi.

ComplyAdvantage (UK) – AML Compliance

Founded in 2014, ComplyAdvantage provides firms with data intelligence, helping them understand the risk of who they’re doing business with, while automating compliance and risk processes.

ComplyAdvantage take a new approach to building financial crime data by providing real-time insight into the risk of people and companies globally. The company’s technology allows them to spot tens of thousands of risk events from within millions of structured and unstructured data sources, every day.

ComplyAdvantage serves more than 350 clients across 45 countries and with a team of 160 people across regional hubs in London, New York, Singapore and Cluj.

Onfido (UK) – KYC, Document verification

Founded in 2012, Onfido is building the new identity standard for the Internet. The company’s AI-based technology assesses whether a user’s government-issued ID is genuine or fraudulent, and then compares it against their facial biometrics. The solution is used by the likes of Revolut, Zipcar and Bitstamp.

Onfido is backed by Salesforce Ventures, SBI Investment, M12 (formerly Microsoft Ventures), as well as angels including Brent Hoberman, co-founder of lastminute.com, Taavet Hinrikus, co-founder of Transferwise, and Nicolas Brusson, co-founder of BlaBlaCar. The company has offices in London, San Francisco, New York, Lisbon, Paris, New Delhi and Singapore.

AQmetrics (UK)- Risk Management/Reporting

Established in Ireland in 2012, AQMetrics offers a full risk management and regulatory reporting platform. The company leverages the latest cloud computing and big data analytics technology to deliver an ultra-fast, high quality cloud-based platform that saves its clients time and money. AQMetrics serves billion-dollar hedge funds, alternative investment managers, MiFID firms, asset servicing providers, fund administrators, and banks.

Governance.com (Luxembourg)- Data and Process Mgt

Governance.com is a Luxembourg-based regtech created in 2011. The startup provides a platform that helps regulated companies with data, document and process management.

The platform connects data and documents across the organization and presents it in simple report, automated processes and understandable dashboards. The solution gives a transparent view on complex data structures and ensures that controls and decisions are taken appropriately.

NetGuardians (Switzerland)- AI Fraud protection

NetGuardians is an award-winning Swiss regtech established in 2007. NetGuardians has developed an AI solution for banks to proactively prevent fraud. The solution integrates an organization’s existing network security programs and operating systems, and collects its data in real-time, correlates, and filters the data into a central control console to discover attacks, policy violations and strange behaviors on IT infrastructure.

The company serves more than 50 Tier 1 to Tier 3 banks worldwide fight financial crime.

Apiax (Switzerland)- Digital transaction tools

Apiax is a Swiss regtech startup headquartered in Zurich with offices in Lisbon and London. The company builds tools to master complex financial regulations digitally. It focuses on giving financial institutions access to machine-readable rules on the most pressing regulatory topics and allow them to customize, manage and deploy these rules effortlessly.

The company’s technology provides full transparency and control over rules in action and empowers financial institutions to serve their clients more efficiently.

Finform (Switzerland) – Compliance Solution

Swiss regtech company Finform specializes in standardizing, industrializing and digitalizing compliance formalities.

Finform’s solution can be used on all sales channels, whether that’s front end, mobile or online. A standardized and digitalized process across all sales channels allows for an accelerated on-boarding process, opening up new sales opportunities. Technical progress and new regulatory requirements are implemented automatically.

ClauseMatch (UK) – Regulatory Change Mgt

ClauseMatch enables financial institutions to streamline regulatory change management through effective organization of internal policies, standards, procedures, and controls.

The company is actively applying AI and ML capabilities allowing financial institutions to evidence compliance with regulatory obligations and apply them within governance documents with full audit trail and real-time collaboration. ClauseMatch headquarters is located at Canary Wharf, London’s financial district and serves clients such as Barclays or Revolut.

Source: KPMG Study

Featured image credit: Edited from Freepik