Wealthtech

Austrian Unicorn Bitpanda Bags US$263 Million, Now Valued at US$4.1 Billion

Austrian digital investment platform Bitpanda has raised US$263 million in funding at a US$4.1 billion valuation 4 months after gaining unicorn status. The Series C funding round was led by Valar Ventures, with the participation of Alan Howard and REDO

Read MoreAustrian Unicorn Bitpanda To Invest €10 Million for a Blockchain Hub

Bitpanda, the Austrian digital investment platform which recently achieved unicorn status, announced that it will be investing €10 million over the next two years into the newly launched Blockchain Research & Development Hub. The new Blockchain Research & Development Hub

Read MoreJulius Baer Taps Wecan Comply’s Blockchain-Based Compliance Platform

Swiss wealth management group Julius Baer has formed a partnership with Wecan Comply, a blockchain-based compliance platform for private banks and external asset managers. Wecan Comply’s solution helps prevent compliance and administrative work from overwhelming the day-to-day activities of asset

Read MoreLiechtenstein’s LGT Acquires Stake in German Digital Wealth Manager LIQID

LGT, an international private banking and asset management group owned by the Princely House of Liechtenstein, has agreed to acquire a strategic minority stake in the Germany-based digital wealth manager LIQID. In the future, LGT will contribute to the development

Read MoreWealth and Asset Managers Will Go Head to Head as Their Opportunities Converge

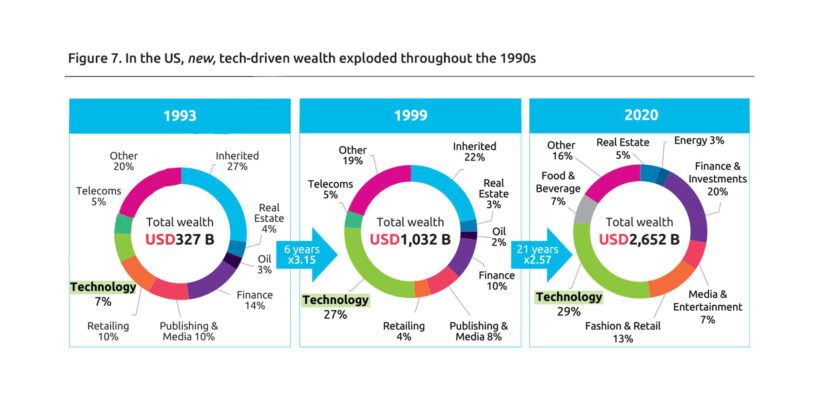

The recent Weath and Asset Management Report 2021 by Oliver Wyman and Morgan Stanley sheds light on emerging industry trends as the global market is poised to grow significantly over the next few years. According to the report, wealth and

Read MoreM1 Finance Clinches Unicorn Status with US$150 Million Fundraise

M1 Finance, an all-in-one money management platform, announced that it has secured US$150 million during a Series E funding round, the firm is now valued at US$1.45 billion. SoftBank’s Vision Fund 2 led the round, with participation from existing investors.

Read MoreBroadridge Acquires ECS From Jordan & Jordan to Enhance Its Regulatory Compliance

Broadridge Financial Solutions, an American-based investment banking company, announced that has acquired cloud-based Execution Compliance and Surveillance Service’s (ECS) assets from Jordan & Jordan. The solution provides a combination of surveillance and regulatory reporting as well as compliance consulting capabilities for

Read MoreWealthtech Kaspar& Advances to Stage Two of Venture Kick’s Accelerator Programme

The St.Gallen based wealthtech startup Kaspar& announced that it has secured a seat in the second stage of Switzerland startup accelerator programme Venture Kick. Launched in 2017, Venture Kick offers a three stage funding model initiated to support Swiss startups

Read MoreWorld Wealth Report 2021 Highlights Booming Wealthtech Sector, Rising Crypto Adoption

The wealth management sector is undergoing a profound transformation on the back of macroeconomic, technological and social shifts. High-net-worth-individuals (HNWIs) are increasingly investing in emerging asset classes, evolving client profiles and behaviors are creating service gaps, and non-traditional players and

Read MoreSwiss Impact Investing Platform Rebrands as Inyova Ahead of Germany Expansion Plans

Inyova, an impact investing platform in Switzerland, announced that it is expanding to Germany. The startup had also rebranded from Yova ahead of the move. At Inyova, investors can invest in sustainable companies from as little as CHF 2,000. No

Read More