UBS Launches Digital Platform for Structured Products in Asia

by Fintechnews Switzerland October 18, 2023UBS Global Wealth Management has gone live with a digital platform for structured products in Singapore and Hong Kong, providing customers in the two locations with access to a wide selection of products, the ability to customize these products, and the ability to trade them on the go through UBS’s online banking platforms.

The product, called UBS Structured Products Digital, allows clients to personalize and transact popular structured products via UBS E-Banking and UBS Mobile Banking. Through the platform, users can access investment products linked to 1,500 underliers across major equity markets, exchanges and sectors, create baskets of equities, customize these products and determine their parameters, set the tenors they deem the most appropriate, and confirm trades within minutes.

UBS Structured Products Digital platform, Source: UBS

Structured products are financial instruments that combine various traditional financial assets like stocks, bonds, options, and derivatives into a single investment product. These products are typically designed to meet specific investment objectives and risk tolerance of investors. They are also highly customizable and can be tailored to provide investors with exposure to a diversified portfolio of assets through just one investment.

Nicola Pantone, UBS’s co-head of unified global markets for Asia-Pacific (APAC) told Citywire Asia that the UBS Structured Products Digital platform aims to address the rise in demand for these investment products. The bank said that at launch, the platform will focus on providing access to equity-linked notes (ELNs) and reverse convertible notes (RCNs), but it will eventually expand its list of structured products available later on.

UBS Structured Products Digital is part of the bank’s digital wealth and trading offering, which already provides clients with UBS My Way, a hybrid digital wealth management platform; We.UBS, a digital-led platform offering wealth management services to affluent clients in China; and UBS Neo, a multi-asset trading platform that’s used by more than 1.8 million UBS customers.

An expanding wealthtech sector

The expansion of UBS’s digital wealth proposition comes at a time when tech startups are developing advanced wealth management platforms and intuitive advisory solutions to tap Asia’s middle-class population. Some of these startups have gained considerable traction and are now expanding beyond their borders.

Endowus, an independent digital wealth startup from Singapore, claims it witnessed a revenue growth of 80% in 2022 and says it now serves over a hundred thousand clients with content, advice and access, managing more than US$5 billion worth of assets.

The startup, which was founded in 2017, operates in Singapore and Hong Kong, providing a wealth platform that spans both private wealth and public pension savings.

Syfe, another Singaporean wealthtech startup, claims more than 100,000 customers in its home country. Launched in 2019, the company offers a holistic range of solutions across both managed portfolios and brokerage services to retail clients, and recently expanded to Hong Kong.

Asia’s wealthtech startups are rising on the back of increased adoption of digital financial solutions. A 2022 study commissioned by insurer Prudential Singapore polled 800 Singapore residents aged 25 to 65 and found that more than four in five (85%) respondents are skilled at using mobile banking apps, while 70% are skilled in financial management apps.

Separately, a 2022 Endowus study, which surveyed 680 Singapore respondents, revealed that digital investment platforms are rising in popularity, with 90% of respondents indicating using digital wealth platforms and robo-advisors.

Asia’s booming asset and wealth management industry

APAC has been witnessing strong economic growth, owing to the region’s regulatory landscape, well-developed infrastructure and open business environment. This has led to a rise in the population of high-net-worth individuals (HNWIs), which now totals about 15 million people, data from KPMG show. The figure makes APAC the home of the second-largest concentration of HNWIs in the world after North America.

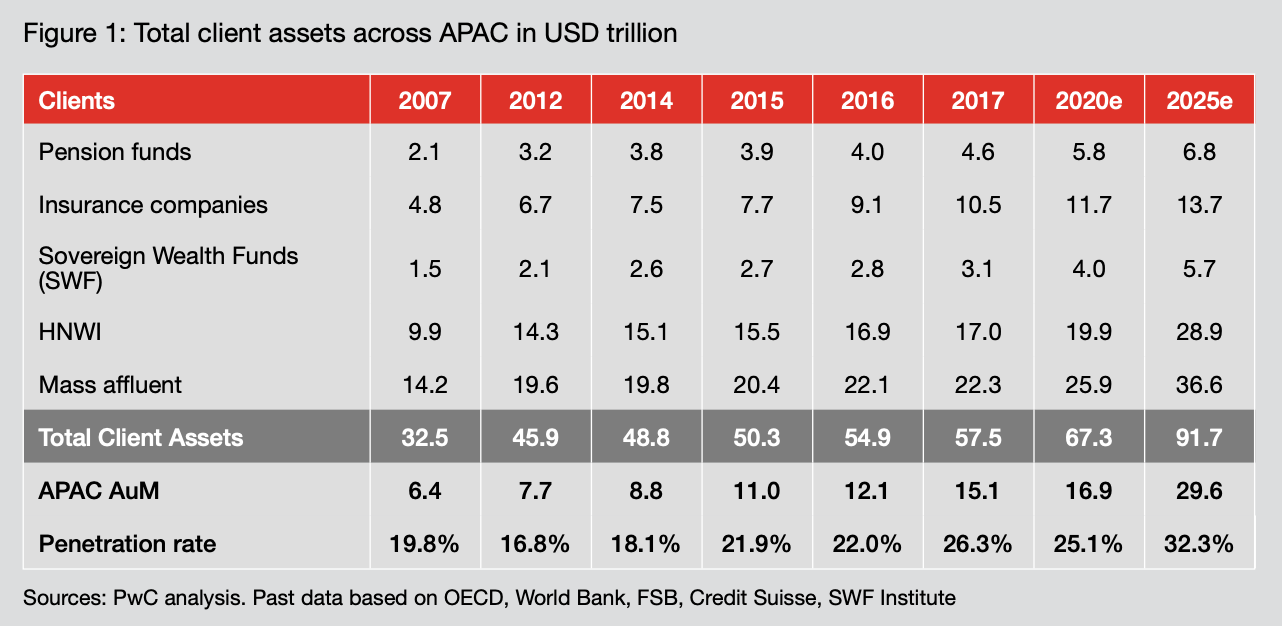

PwC expects APAC’s assets under management (AUM) to grow faster than any other regional globally, rising from US$15.1 trillion in 2017 to US$29.6 trillion in 2025.

Total client assets across APAC in US$ trillion, Source: Asset and Wealth Management 2025: The Asian Awakening, PwC 2019

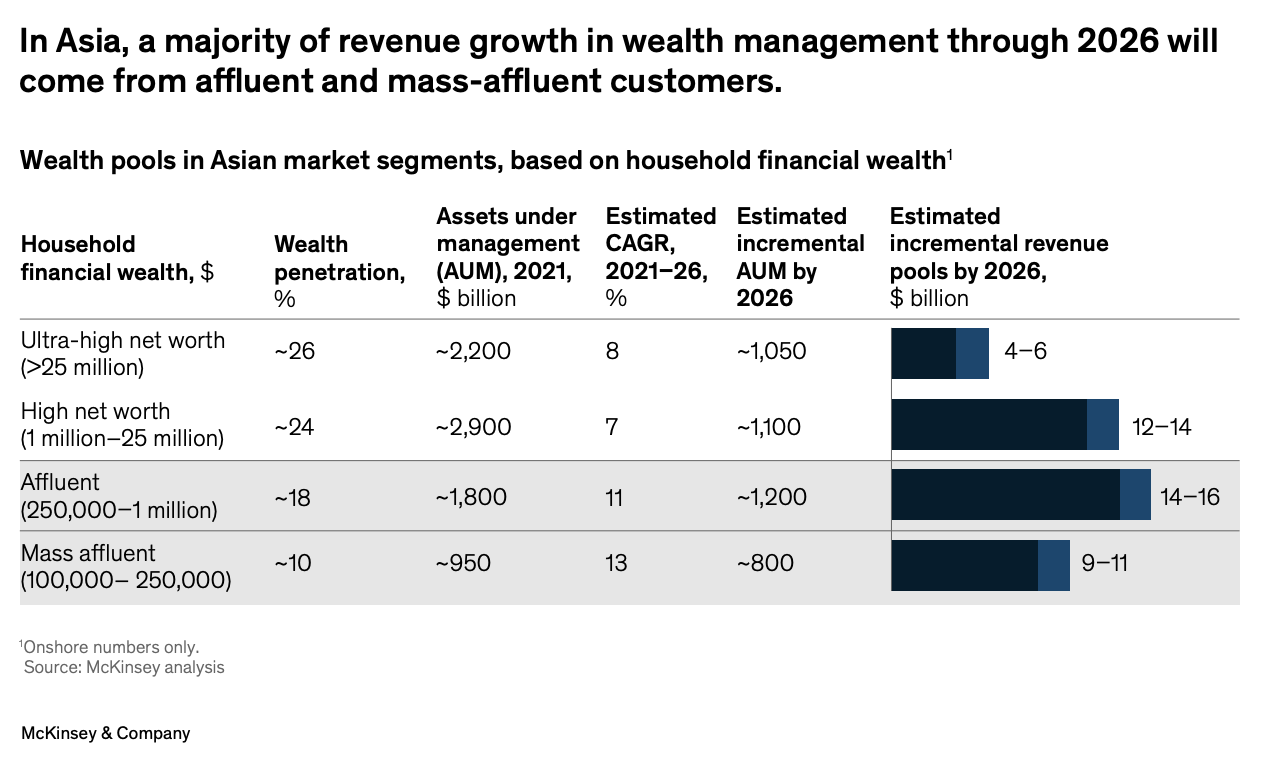

McKinsey projects that the affluent and mass-affluent segments in Asia, particularly those in developing economies, will drive most of this growth. The wealth pool of this group, which comprises households with investable assets of US$100,000 to US$1 million, is projected to hit US$4.7 trillion by 2026, up from US$2.7 trillion in 2021 as Asians’ incomes rise.

For banks and wealth managers, McKinsey estimates the potential incremental revenue from serving these clients to be standing between US$20 billion to US$25 billion, contributing more than half of the industry’s revenue growth in Asia over the next three years.

Wealth pools in Asian market segments, based on household financial wealth, Source: McKinsey and Company, Feb 2023

This article first appeared on fintechnews.sg