Alessandro Hatami’s personal view

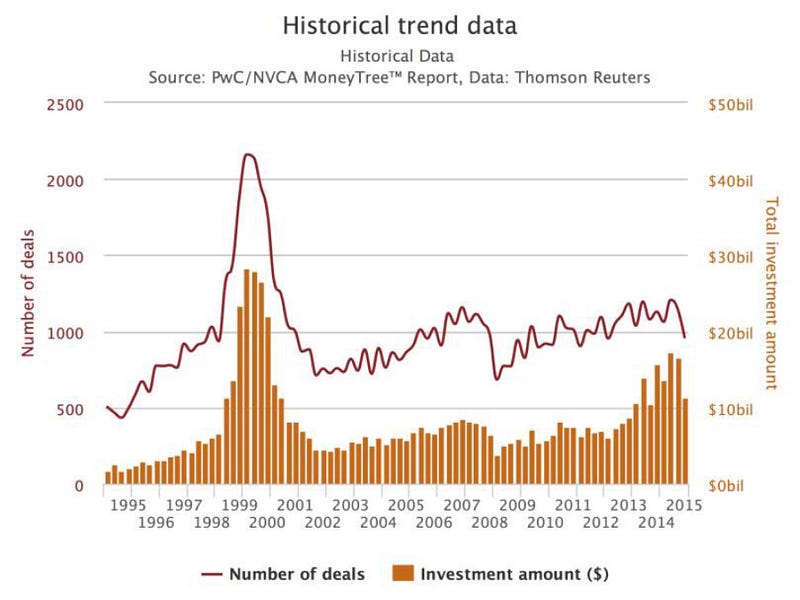

In a lifecycle, a bubble is where something is totally exaggerated and that then leads to a bust. That is to say, the FinTech Bubble will happen when there is a massive explosion in FinTech startups yet a very few have truly worked. Inevitably, the participants of this cycle are facing a battle where there will be winners and there will be losers once the bubble bursts. In 2015, global Fintech investment was predicted to top $20bn, up from $12bn in 2014. There is no official report on how many players in the Fintech industry across the world, but some said the number can be more than 10,000. Recently, an interest in the blockchain has been growing fast among big banks which has been turning to an intense battle.

Below is the post from Alessandro Hatami, a Serial corporate entrepreneur with a passion for digital innovation and FinTech and the founder of The Pacemakers, about who wins and loses after FinTech Bubble:

Lately, it seems that every meeting I go to someone announces that the end of the “FinTech Bubble” is upon us. This declaration often comes from e-commerce, VC or IT veterans that experienced the 2000 Dotcom Bubble in person. I am one of these people but I’m not sure about their predictions. Even though some of the most recent business valuations in the sector may be a bit over optimistic, 2016 is very different from 2000.

An “irrational exuberance” (quoting ex-Fed Chairman Alan Greenspan), partly fuelled by the media at the beginning of the century, led to Internet businesses being seen as unrealistically big growth opportunities by investors. This resulted in an unjustified rise in valuations of digital businesses (called Dotcoms at the time) followed by a huge fall and subsequent collapse in trust in the whole Internet sector.

The consequences of this collapse were quite profound. VC investment almost dried up overnight leaving many start-ups stranded and underfunded. In the next few years many companies including some high profile ones (see Pets.com, Boo.com, Webvan ) went bust because they couldn’t fund their own growth.

Businesses set up to help create and “accelerate” the growth of internet companies were also badly hit and were either wiped out or dramatically downsized – these included Viant, Idealab, and Antfactory to name a few.

The demand for talent became less frenetic with anecdotes of programmers going back to school to study accounting circulating widely.

The press, that had in the previous years had a great time in creating unrealistically high expectations from the sector, started fuelling a continuous flow of negative stories on the risks of the Internet. This spooked some customers but it also led to certain complacency in the businesses target by the Dotcoms, leading them to underestimate the threat they were under – a mistake some paid for dearly.

After the initial turmoil, the effect on customers was less marked. Some initially became suspicious of the Internet, but most just continued using Dotcom businesses – albeit at a slower rate than that forecasted by the start-ups and their investors.

Similarities and Differences Between 2000 And 2016 in the FinTech industry

It is undeniable that there are some similarities between 2000 and 2016, but at a closer look, I would suggest that today’s situation is very different from the Dotcom bubble. Let’s take a look at some of these similarities and differences:

Similarities

- Businesses are getting valuations that some say are not realistic reflections of their long-term value generation potential (I won’t name any one business here).

- Large numbers of young talented professionals are leaving traditional careers to start FinTech start-ups.

- VC money is pouring into the sector at breakneck speed – Accenture says that up from $4b in 2013 to $12b in 2014.

- A number of high-profile businesses incubators are being set up to help accelerate the growth of start-ups. The Moneywiki blog lists over 30 worldwide.

Differences

- The size of the “FinTech Bubble” is still a fraction of the Dot-com bubble – even at $12B

- Today we a much bigger target market Internet Live Stats estimates that today we have 3.3b people with Internet access compared to 500m in 2000.

- Financial Services are an inherently digital product that can be easily sold remotely – differently than the complexities of selling physical goods.

- The quality of the businesses we are seeing today is substantially superior to those in 2000.

- The investors are mainly VCs, Corporates or Angels all of which are more experienced investors that the general public in 2000.

These points would suggests that the growing interest in FinTech is probably not a bubble but just a sector reaching maturity. That said, there is still a strong probability that in the next few months we will see a levelling or even a contraction in the volume of funding targeting the sector. This could be triggered by many factors: a failed IPO, the collapse of one of the FinTech poster children or even another recession to name a few.

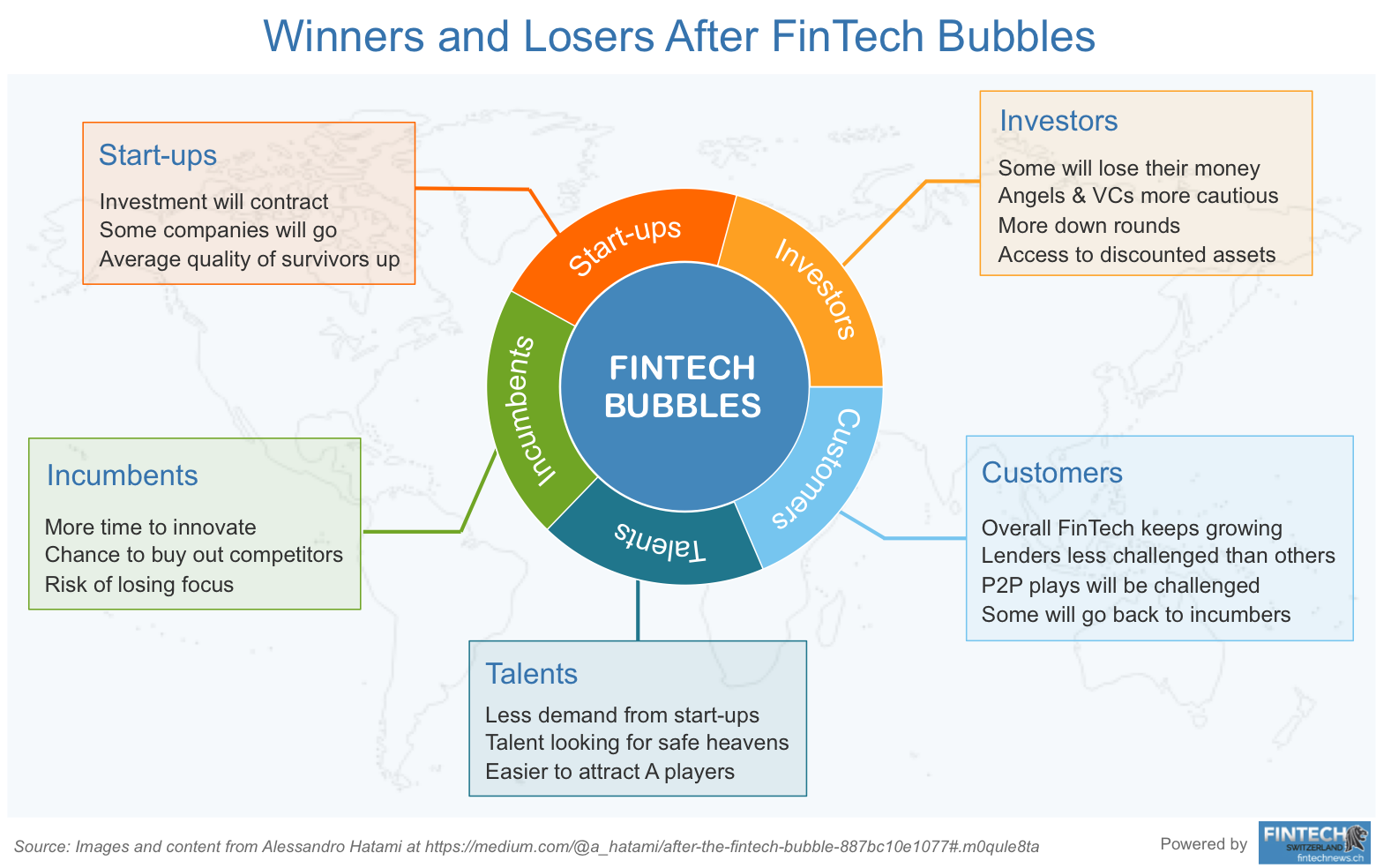

FinTech Winners vs. FinTech Losers

I thought it would be interesting to explore what the impact of this would be for the different stakeholders.

Investors

FinTech is attracting many different types of investors. With few exceptions (luckily) unlike the Dotcom Bubble, the general public is the major one of these. Let’s take a closer look:

Angels:These are a major source investments for FinTech startups. The effect of a contraction in the sector’s valuations could be profound on Angels. A few will see the value of their shares diluted – many will see their investments disappear. This will probably lead many Angels to exit the sector in a big way making it hard for entrepreneurs to get their businesses off the ground.

Venture Capital: VCs will have a similar behavior – only with a few more zeros added to their losses. They will also become more conservative in their investment strategies. Some more courageous firms will wait for the market to settle and will then get back into the sector with the aim of getting a few good assets on the cheap.

Corporate Investors: These will also be affected. A downward push on the value of the sector and possibly in businesses they have invested in already will trigger uncomfortable conversations with the leadership of the organizations they are part of. Some may see this as an opportunity to invest more but most will probably become more cautious.

Incubators & Accelerators: These could be hit hard, with substantially reduced exit options for their start-ups. I think we may see a reassessment of this industry as a whole.

Private Equity: These will be largely unaffected as most have not entered the sector too aggressively, with the exception of two sub-sectors of FinTech: payments and challenger banks. A FinTech valuation realignment will be substantial in both areas.

Start-ups

It will become harder for early stage firms to raise funds. Some businesses, that just a few months earlier had seen many interested suitors, will struggle to fund subsequent rounds. Some will have to accept down rounds and some may even fail.

New businesses will also find it harder to find investors. Only the ones with the most decisive leaders, strongest business models and clear path to profitability will find backers. Valuations will much lower that those of a few months earlier.

The only upside will be that the average quality of the businesses post shakeup will be much better than before.

Incumbents

These will have a mixed response. Some will see the downsizing of the “FinTech Bubble” as a validation that they are safe with their business-as-usual approach and and will probably slow down their investment in digital change. Moneys will flow to maintenance and management of legacy systems and investment in innovation will contract. They will eventually see that this was a mistake.

Other incumbents will see this as an opportunity to accelerate innovation. They will be able to acquire start-ups that are proven and complementary to their business at a fraction of the cost just a few months earlier. A great way to renew the business for less.

Regulators

Most regulators will become more cautious about supporting FinTech. I don’t think we will see any real reversals of past regulatory decisions, but I would expect most regulators will become more skeptical of the potential of new FinTech firm becoming real challengers to the big players.

Customers

The end-user will largely be unaffected provided that the possible collapse of some FinTech firms does not leave them out of pocket. I believe that customers will react differently with different businesses. FinTechs that provide loans, payments, forex or information will be largely unaffected. Those that provide investment or savings propositions will feel the impact as customers may expect more reassurance that FinTech startups are secure places for their money.

A sector that may need to tweak its business model will be P2P lending. They will increasingly explore going from a crowd-sourced model to a “financial marketplace” approach, enabling institutional investors to take positions on their platforms.

Some customers will opt to go back to the incumbents. But these returning customers will be different than before as they will have new expectations of service service, pricing and UX. The incumbents will have to work hard to keep these returning customers happy.

Talent

Some good talent will suddenly be back on the market, because either their business is gone bust or the down rounds made their share of the business so diluted that it’s no longer worth it for them. These people will most likely seek roles with more established player with deeper pockets than their previous employer. It will become a lot easier of the incumbents, well-capitalized start-ups, consultants and agencies to attract talent.

Bursting of the “FinTech Bubble” be Beneficial to the Industry

The excesses seen during Dotcom Bubble in 2000 are not present in the same scale today. But we are certainly seeing very early-stage businesses being valued too richly, so a downturn or at least a cooling of period is probably ahead.

As with any financial downturn, a downward push of the FinTech valuations will benefit some and damage others. I believe that – at least in the long term – the bursting of the “FinTech Bubble” will be a beneficial thing for the industry as a whole.

1 Comment so far

Jump into a conversationHow to escape this cycle?