Growth of Switzerland’s Fintech Sector Stalls: Fintech Report 2021

by Fintechnews Switzerland March 22, 2021Despite an increase in the number of Swiss fintech companies in 2020, an evaluation of fintech companies’ capitalization and the number of employees working for them signals a slowdown in the growth of the sector, according to the Lucerne University Applied Sciences and Arts’ annual fintech report.

The 2021 IFZ Fintech Study, released earlier this month, looks at the state of the Swiss fintech sector, outlining key developments and future trends to watch for.

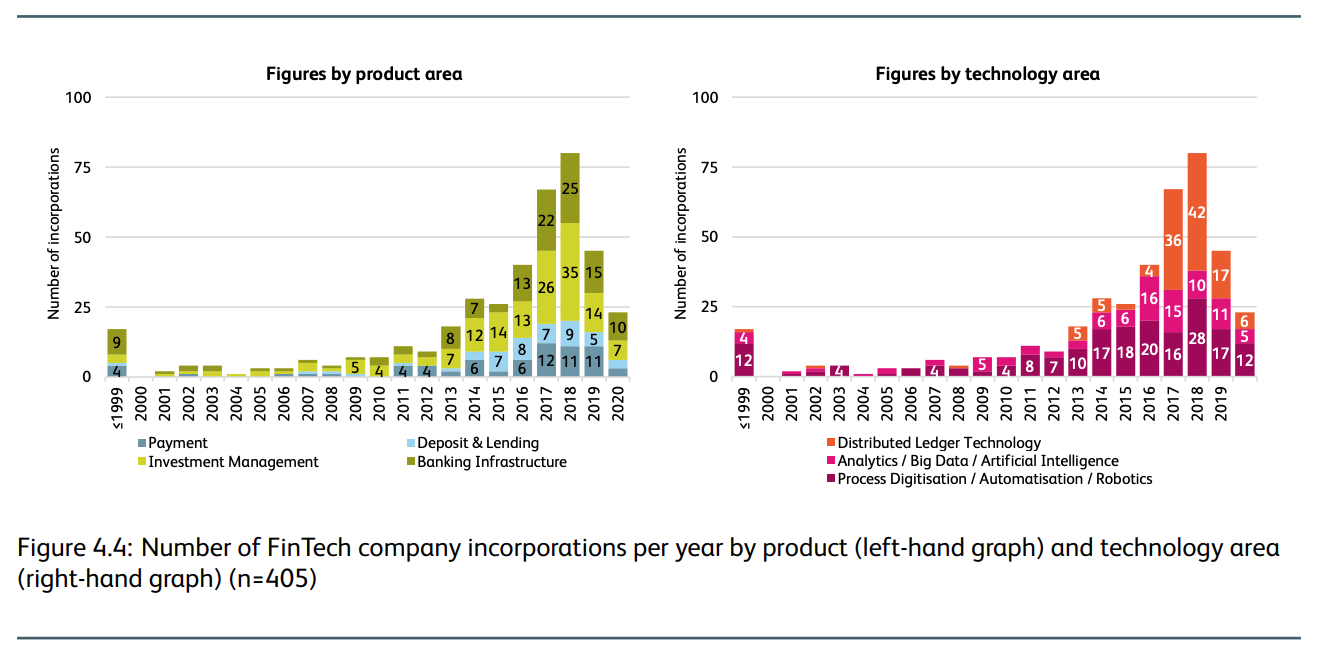

According to the study, the Swiss fintech sector continued to grow in 2020, adding 23 new companies that brought the total number of fintech companies in Switzerland to 405.

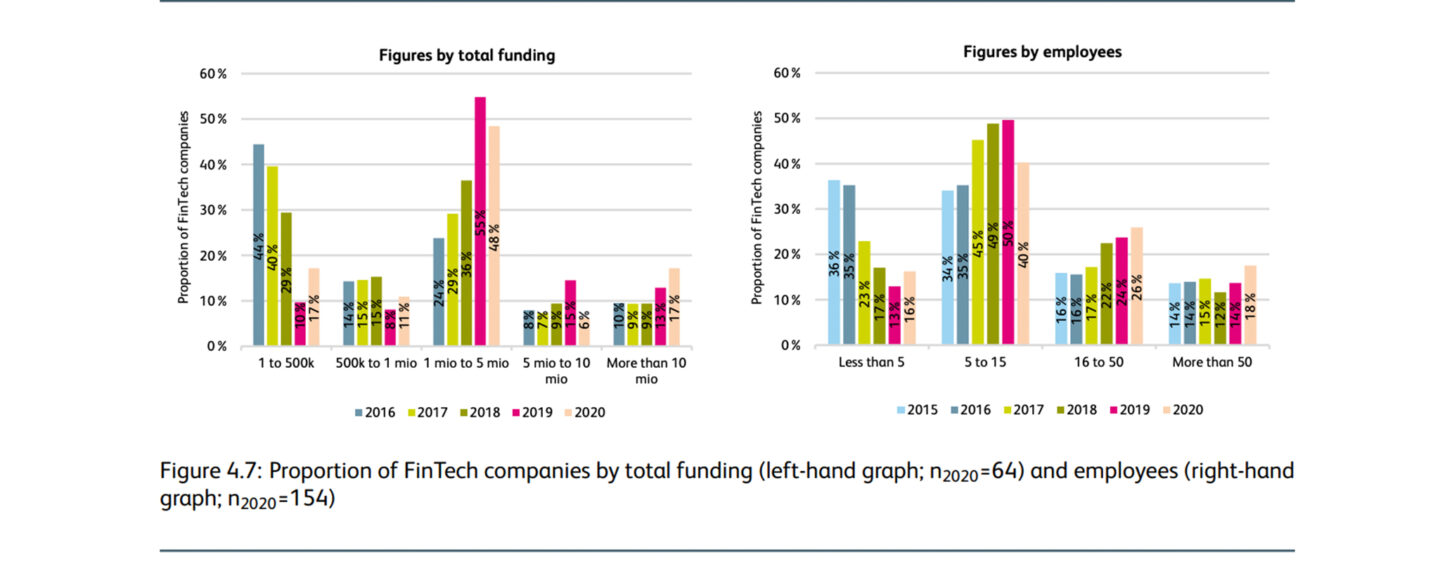

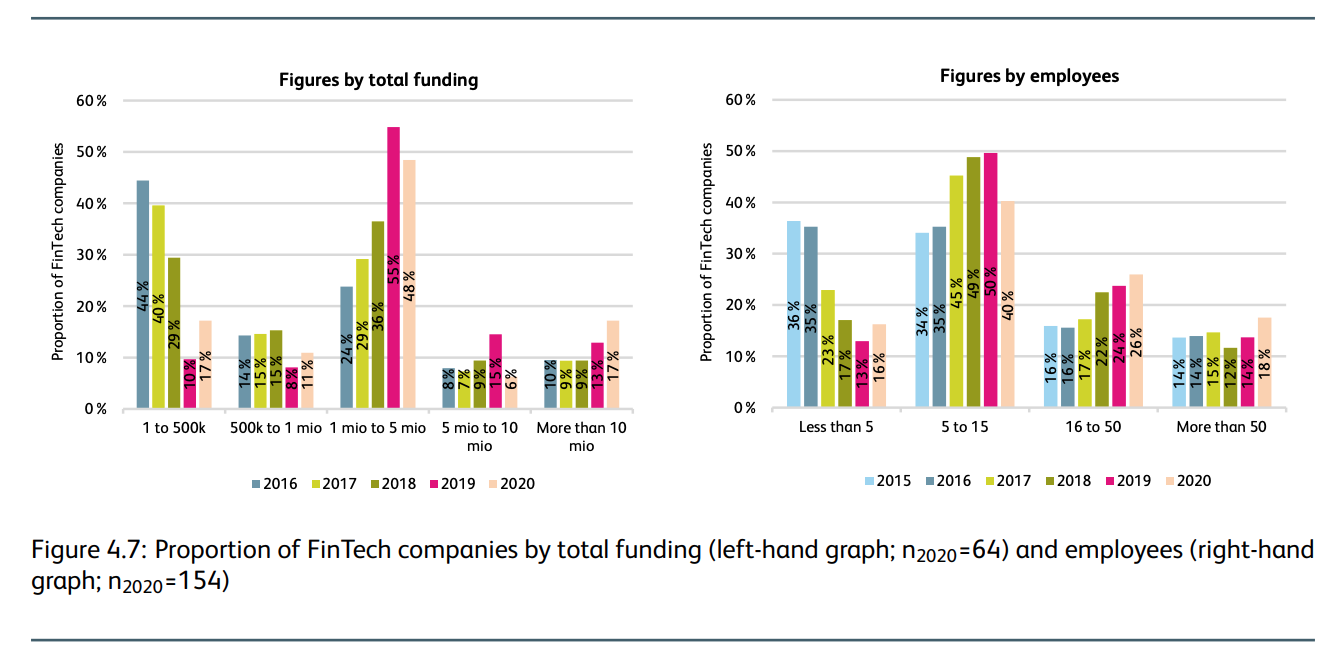

Despite this, 2020 witnessed the first signs of a slowdown in the development of the sector, a trend evidenced by the larger share of companies with low-sized total funding. In 2020, the proportion of fintech companies that raised less than CHF 1 million increased 10% points, while the proportion of companies with capitalization above CHF 5 million reduced by a 5% point.

Another indicator of the downtrend in the Swiss fintech sector is the evolution of the workforce. While most Swiss fintech companies employ between five and 15 full-time equivalents, 2020 saw a year-to-year decline of 10% points in this middle interval.

The decrease was mainly in favor of larger fintech companies with 16 to 50 employees and more than 50 employees, which increased their share by 6% points in total. This implies that Switzerland is home to some fintech companies with sizeable workforces.

Proportion of fintech companies by total funding and employees, IFZ Fintech Study 2021, Lucerne University Applied Sciences and Arts, March 2021

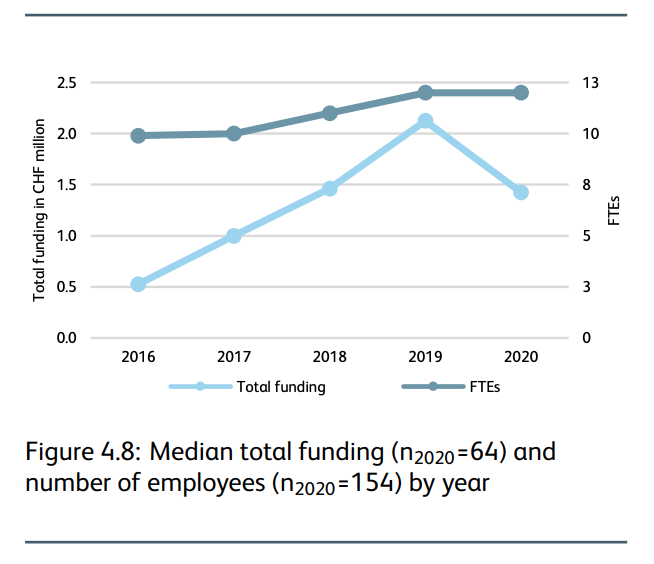

Looking at the median values – the value separating the higher half from the lower half – for both total funding and number of employees by year, there’s a clear shift in 2020.

While the median value for the number of full-time employees employed at Swiss fintech companies stagnated at 12, the total funding median value decreased from CHF 2.1 million to CHF 1.4 million, suggesting that the continued growth of the Swiss fintech sector observed earlier came to a halt in 2020, the report says.

Median total funding and number of employees by year, IFZ Fintech Study 2021, Lucerne University Applied Sciences and Arts, March 2021

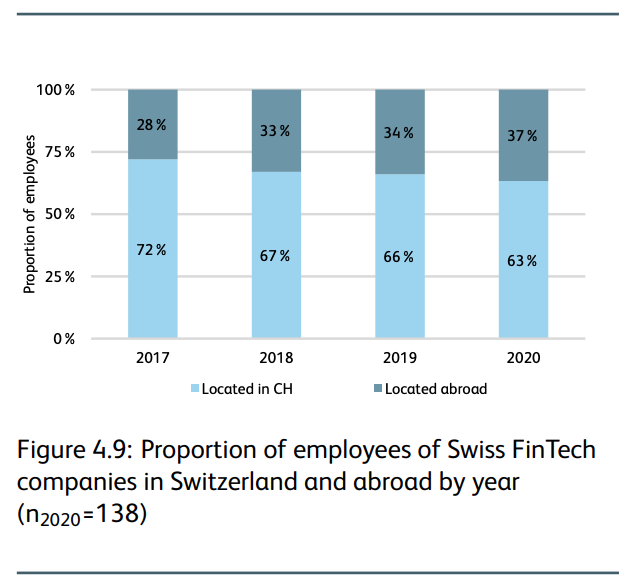

Furthermore, an analysis of human capital at Swiss fintech companies shows that an increased share of their employees is located abroad. Internationalization of the workforce in the sector has been an ongoing trend for years, with the proportion of employees of Swiss fintech companies working from overseas growing from 28% in 2017 to 37% in 2020.

Proportion of employees of Swiss fintech companies in Switzerland and abroad by year, IFZ Fintech Study 2021, Lucerne University Applied Sciences and Arts, March 2021

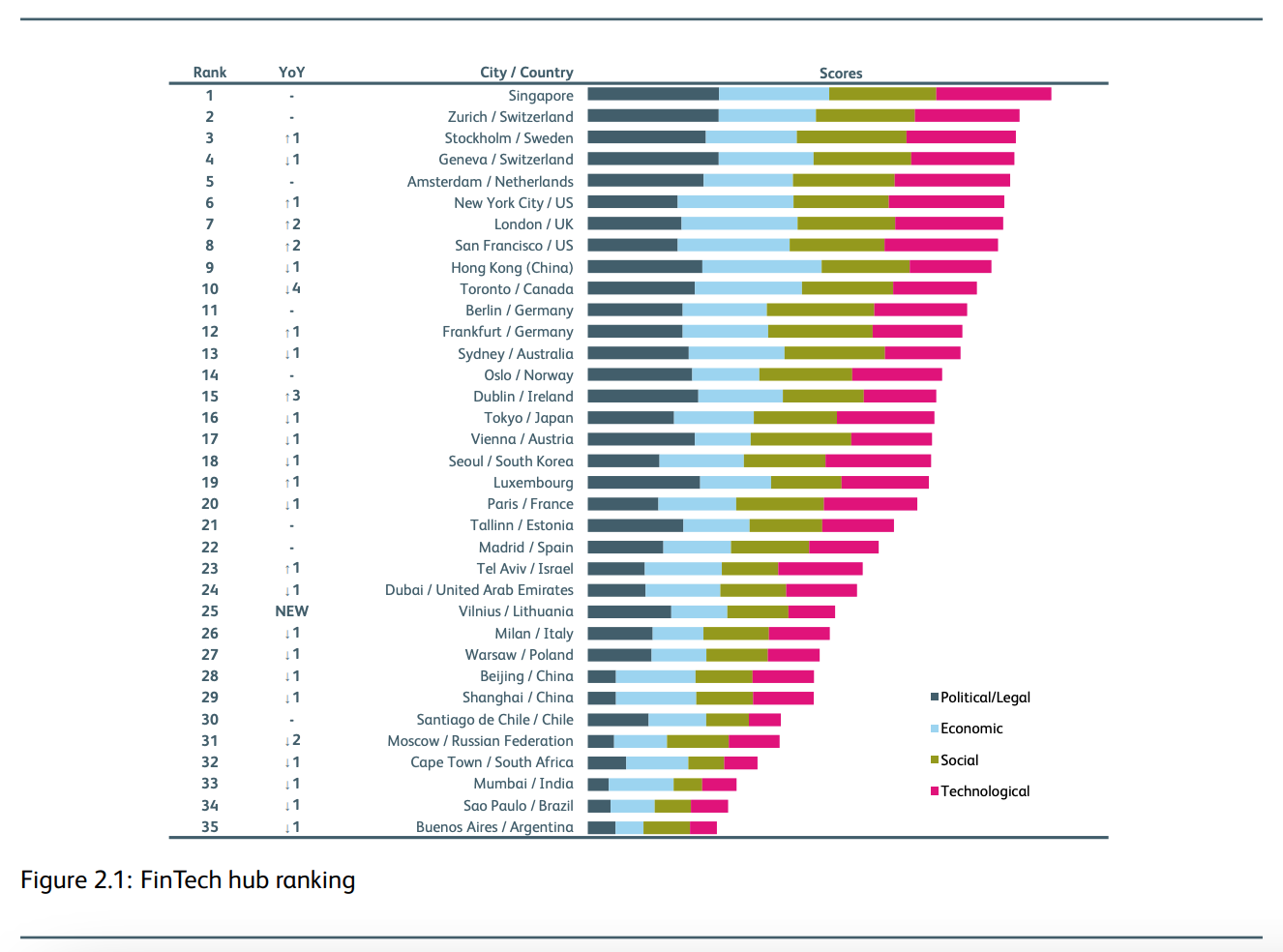

On a global scale, while Switzerland continued to perform well in 2020, conditions have deteriorated in recent years.

For the first time since the first edition of the IFZ Fintech Study was released back in 2017, the composition of the top three fintech hubs in the world changed. While Singapore and Zurich once again claimed the top two ranks, Stockholm took the third place, replacing Geneva.

The relative deterioration of Swiss cities in the top ten fintech hubs this year was due to a performance decline in the political/legal, economic and social dimensions compared to international counterparts, the report says.

Fintech hub ranking, IFZ Fintech Study 2021, Lucerne University Applied Sciences and Arts, March 2021

Since 2015, the total of number of companies in the Swiss fintech sector has increased by more than one and a half times from 161 at the end of 2015 to 405 at the end of 2020.

After a surge in 2017-2018 partly caused by the emergence of the Crypto Valley and the rise in the number of distributed ledger technology (DLT)-based fintech companies, the number of company foundations has decreased consistently.

Number of fintech company incorporations per year by product and technology area, IFZ Fintech Study 2021, Lucerne University Applied Sciences and Arts, March 2021