Fundraising As A Groundwork For Global Mission Projects And A New Conscious Community

by Company Announcement April 13, 2018Kasko2go is an auto insurance application based on cutting-edge technologies which is set to create the community of safe drivers. Token pre-sale is scheduled on April, 19.

Presumably, I will not surprise readers by saying that nowadays everything is about technology. It is woven into basic routine operations as well as in the concept of competitiveness: success in the market is directly proportional to the openness to dialogue with innovations.

The same applies to fundraising. If we take a glance at the startup investment ecosystem — it is a relationship-driven phenomenon rather than a quantitative and true market process.

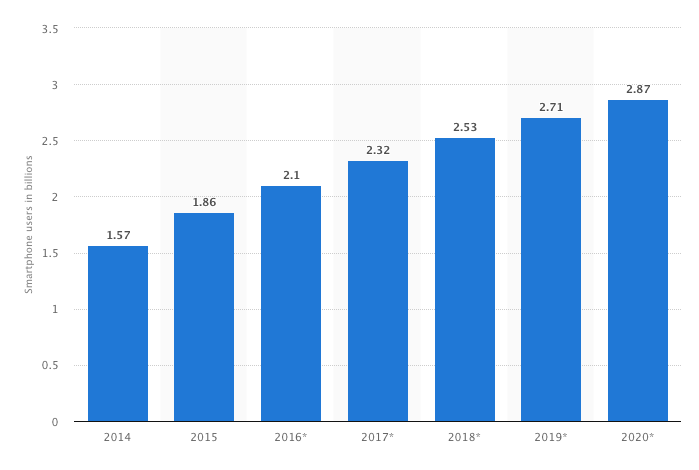

The number of smartphone users is steadily increasing and is predicted to reach the level of 2.87 billion in 2020. Businesses reshape themselves in line with the life ‘on-the go’, and it goes far beyond automation itself: transformations refer to the philosophy standing behind the organization. Traditionally companies have tailored and broadcasted messages to inform and educate people. Now the vertical approach is upended — content is co-created with the public, so business is no longer the gatekeeper.

Number of smartphone users worldwide from 2014 to 2020 (in billions) via statista.com

Changing the mindset leads to constituents departing from the role of foot soldiers or check writers and turning into active partners. The culture of fundraising can help expand giving levels and donor retention, reinforce trust, consolidate collaboration and engagement, and align program goals and mission with revenue production. Projects with a view to improving social good can use fundraising for building the community with shared awareness and responsibility in addressing a specific problem.

Fundraising as a perspective

As the digital landscape is evolving rapidly it is changing the ways we communicate, work, and fundraise. Thus the traditional wisdom of resource development in the context of long-term sustainability is questioned. Transparency and interactivity in co-creation provide people with access to systems, where this control used to be in the hands of the experts and other gatekeepers.

Fundraising cannot be regarded as a standalone function that creates an organization of solicitors. Being both a highly valued and a mission-aligned component, it nurtures a group of people who believe in the organizational mission and embrace their work in it. The company receives a chance to simplify complex structures and firewalls between the departments. The fundraising culture equates fund development with engagement, where every participant — partners, staff, donors — have wide opportunities to approach the mission in meaningful and authentic ways.

The organizations have to be more open to some kind of fusion, otherwise, they can simply become a thing of the past. New generations want to see companies more democratized and relational, moving away from rigid hierarchy. There has to be an understanding that donors do not give to organizations just because of their work; they do it aspiring to the same goals. Donors give their talent, skills, networks, and time — which is much more valuable capital than bringing money to the table.

In the culture of fundraising, relationship building is the core of long-term sustainability. Fund development operates as a means to community change, where interests of the organization, donors, and the larger community are respected. As a result, an organization moves in the direction of stewardship to have an impact on the global problem beyond the institution. An organization is just a vehicle to have an impact.

Current trends

The ownership mindset and channel focus are successfully falling away with the growing demand in what I would call ‘real cooperation’ across silos. The fundraising landscape has changed its face due to the emergence of online channels, growing video content usage, and the application of robust data management. Donors wish to create and adjust their own way of giving. DAFs or Donor Advised Funds, apart from their economic advantage, reflect the transfer to individual ownership in terms of giving decisions.

It is possible to predict fundraising: data analysis can provide one with quantitative information and behavioral science will give one a clear idea of where and why donors give. However, a Fidelity study states that eight out of ten donors are skeptical and have serious concerns about the further destiny of their donations. So being transparent about fundraising will always remain a timeless trend.

Fundraising in insurance

The ideas about connecting technologies and the insurance industry have been floating around quite a while, but little has changed until very recently. The year 2017 was enthusiastically marked by the adoption of the term InsurTech, which led to the emergence of a new source of competitive advantage. The sense of disruptive potential and new revenue streams logically resulted in fundraising growth.

Due to a deficient regulatory atmosphere the insurance industry has been less open to tech innovations than other spheres. While some organizations prefer to stay at the forefront of innovation, the vast majority of companies remain ill-equipped, whether technologically, financially, or in terms of human capital. They are unable to be competitive and they cannot tackle the existing challenges, which is detrimental for the entire industry. Fraud is the most destructive issue. This is why InsurTech startups are of interest, and Kasko2go application can change insurance industry by providing new global standards.

It is past time for insurers to make digital transformation a continuous improvement process, not just a “priority”. The most important hot-button issues for insurance are: capitalizing on connectivity, enhancing customer engagement, accelerating globalization, and re-inventing obsolete business models. The unjustified conservatism of the industry, along with drowning in red-tape, economic unfairness, and being drenched in fraud evoke the necessity for a new insurance community with long-term customer relationships. Here fundraising is the key for building new global standards.

Fundamental steps for fundraising

As currently fundraising is more about the mission than the money, it is essential to raise money to something that really matters. Participation in building the new conscious community means engagement, and if people cannot associate themselves with the organizational goal and feel related — they have no reason or motivation to donate. This means a fundraising letter must be clear, transparent, and specific in explaining the work a company is doing as well as the way donors can make a difference.

Being relationship-centered means that fundraising implies collaboration with certain people, and as a result, with their own package of interests and expectations. Genuine interest in supporters helps with building long-term and meaningful relationships. And it is not just about official reporting (which is crucial) but for future fundraising planning. Speaking about reporting — being ethical and accountable helps donors to see tangible results of their participation.

The fundraising strategy has to be well-managed, as there is a common tendency to drift away from the initial one. Startups are characterized by volatility, and any emergency or change of responsibilities can add variables, distracting from the organizational goals. The fundraising plan must be prioritized above everything else as long as fundraising is the gold mine of opportunities.

Disclaimer: this is an article written by Kasko2go, Fintechnews does not endorse and is not responsible for or liable for any content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any actions related to the company. Fintechnews is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

Please note this is no investment advice.