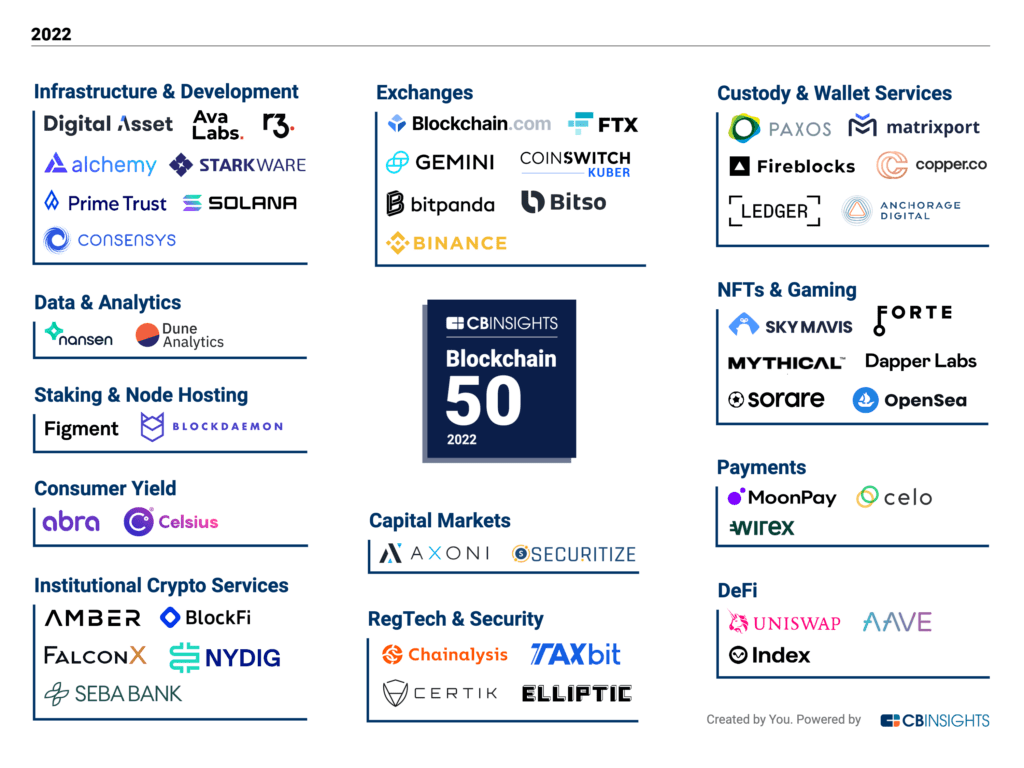

2 Swiss Startups Make 2022 Top 50 Blockchain and Crypto Companies Ranking

by Fintechnews Switzerland March 9, 2022Market intelligence platform CB Insights has released its second edition of The Blockchain 50, an annual ranking of the world’s top 50 most promising blockchain and crypto companies. Two Swiss startups made the 2022 ranking: SEBA Bank and the Solana Foundation.

The 50 private companies were selected from a pool of over 3,000 startups based on factors including data submitted by the companies, company business models and momentum in the market, and Mosaic scores, CB Insights’ proprietary algorithm that measures the overall health and growth potential of private companies.

These companies are being recognized for pushing blockchain and crypto toward greater adoption and product maturity, as well as for their ingenuity in applying the technology to solve business and consumer problems across various industries.

Switzerland’s SEBA Bank, a digital assets banking platform licensed by the Swiss Financial Market Supervisory Authority (FINMA), was among the 50 companies included in this year’s cohort.

Founded in 2018 and headquartered in Zug, SEBA Bank provides a suite of regulated banking services, allowing institutional clients to invest, safekeep and trade in digital and traditional assets as well as borrow against these assets and issue tokens all out of an integrated and end-to-end banking platform.

SEBA Bank recently closed a CHF 110 million Series C funding round to accelerate the growth it had achieved over the prior year, and fuel its expansion plans in Asia-Pacific (APAC) and the Middle East where it opened an office just last month. The company raised a total of US$245 million in disclosed funding, according to CB Insights data.

The Solana Foundation is the second Swiss entity to make the list this year. Headquartered in Zug as well, the Solana Foundation is a non-profit organization that’s responsible for maintaining and growing the open source Solana project.

Released in 2019, Solana is a public blockchain platform with smart contract functionality that seeks to facilitate decentralized app (DApp) creation with a focus on decentralized finance (DeFi). It works to one up Ethereum by providing faster transaction times and cheaper fees, claiming to be able to process up to 710,000 transactions for second, 15 transactions per second for Ethereum.

Solana’s token (SOL) is currently priced at about US$84 for a market capitalization of US$27 billion, making the cryptocurrency the 9th biggest in the world. The project has raised US$23 million in venture capital financing, according to CB Insights data.

The US as the most represented country

Besides Switzerland, 14 other countries are represented in the 2022 Blockchain 50. With 28 startups, the US tops the list with ventures including NYDIG, a subsidiary of US$13 billion+ alternatives asset manager Stone Ridge that specializes in bitcoin products for institutional clients and businesses; Fireblocks, an institutional digital asset custody, transfer and settlement platform; Forte Labs, a blockchain gaming and non-fungible tokens (NFTs) company; and the Celsius Network, an interest-bearing and crypto-lending DeFi platform.

After the US, the UK is the second most represented country with 5 companies: Blockchain.com, a crypto services platform, Copper, a cryptocurrency custody firm serving the institutional digital asset investment community, Elliptic, a leader in cryptoasset risk management for crypto businesses and financial institutions, Aave, an open source DeFi protocol, and Wirex, a digital payment platform.

Canada, France and Singapore each has two: Dapper Labs and Figment for Canada, Ledger and Sorare for France, and Matrixport and Nansen for Singapore, while Austria (BitPanda), the Bahamas (FTX), Hong Kong (Amber Group), India (CoinSwitch Kuber), Israel (StarkWare), Malta (Binance), Mexico (Bitso), Norway (Dune Analytics) and Vietnam (Sky Mavis), each has one.

Funding and valuation

The 2022 Blockchain 50 cohort has raised US$17.1 billion in aggregate funding across 216 deals since 2016. 77% of that sum (US$13.2 billion) was raised in 2021 alone (excluding token sales), highlighting the surge in venture capital funding that startups in the space witnessed last year.

The list comprises companies at various investment stages, including nine early-stage startups (18%), 29 mid-stage companies (58%), and eight late-stage companies (16%).

Out of the 50 blockchain startups, 31 are unicorn startups and are valued at or above US$1 billion as of their latest funding round.

With a valuation of US$32 billion, crypto derivatives exchange FTX is the highest valued blockchain startup of the list. FTX is followed by crypto goods and NFTs peer-to-peer (P2P) marketplace OpenSea, valued at US$13.3 billion, blockchain development platform provider Alchemy, valued at US$10.2 million, Fireblocks, valued at US$8 billion, blockchain gaming startup Dapper Labs, valued at US$7.6 billion, and crypto exchange Gemini, valued at US$7.1 billion.

Coinbase Ventures was found to be the most active investor in this year’s list, having invested in 16 of the 50 companies. Coinbase Ventures is followed by Andreessen Horowitz with 14 companies, and Paradigm with 13 companies.