2021 Was a Record Year for Fintech Funding, Unicorn Minting and M&A Exits

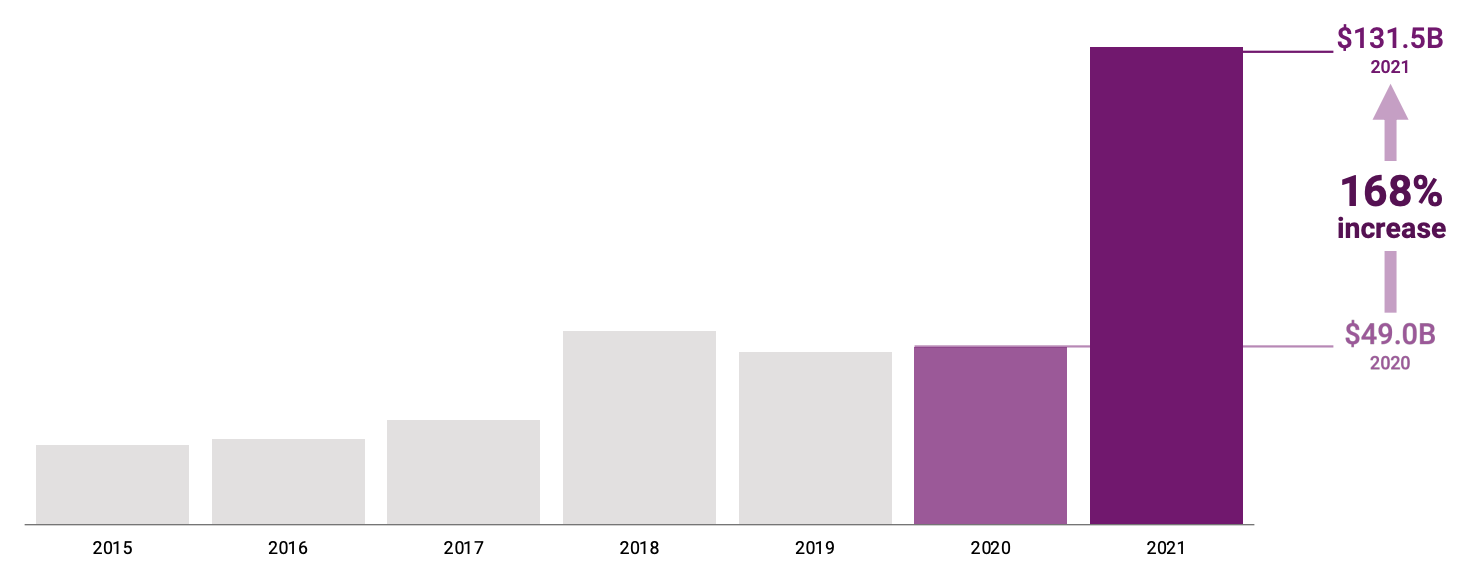

by Fintechnews Switzerland February 11, 2022In 2021, fintech companies attracted a new record of US$132 billion, more than double the 2020 figure. The amount represents 21% of all venture funding for 2021, making the sector the undisputed champion, data from CB Insights’ State of Fintech 2021 report show.

Global funding funding, Source: The State of Fintech 2021, CB Insights

Mega-rounds of US$100 million and up led most of the fintech funding activity in 2021. Though these represented just 7% of global deals, they accounted for 67% of total funding.

In particular, seven of these rounds were US$1 billion+ fundraisings. They included the US$3.4 billion raised by Robinhood in the beginning of the year, GoTo’s US$1.3 billion pre-IPO funding round, Integrity Marketing Group’s US$1.2 billion round, Devoted Health’s US$1.2 billion round, and Klarna’s US$1 billion equity funding round.

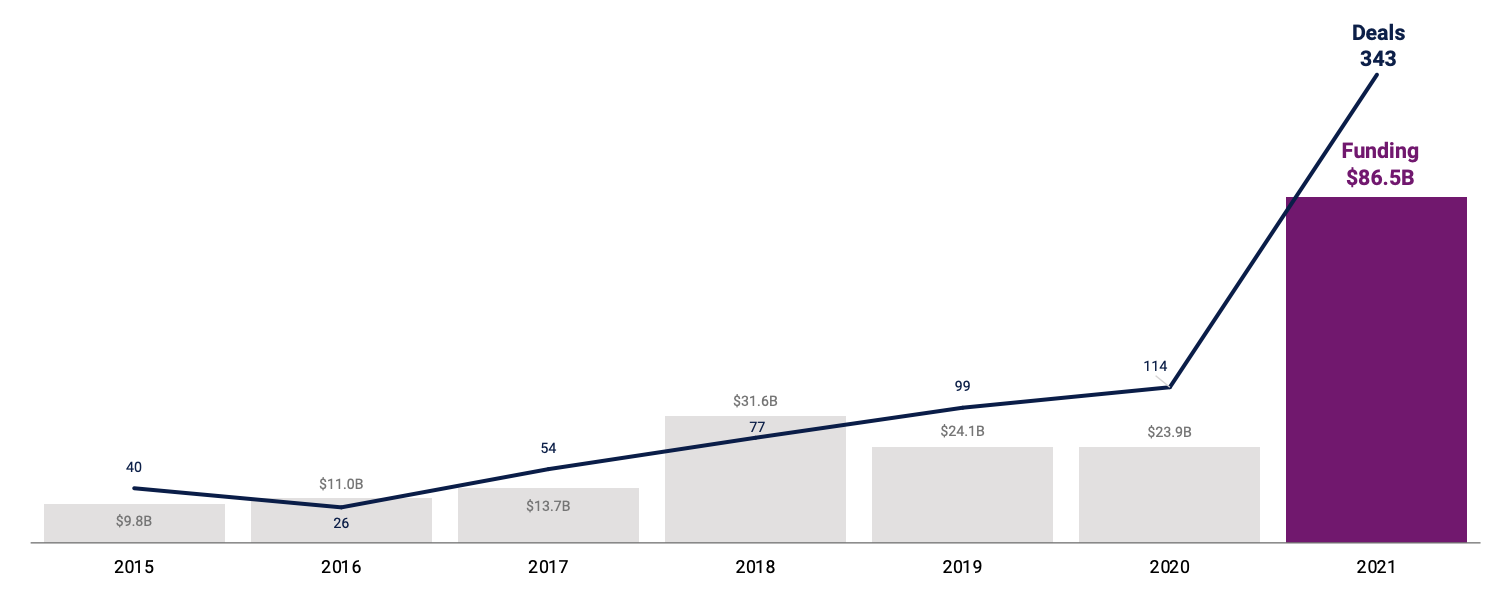

Number of US$100M+ fintech mega-rounds in 2021, Source: The State of Fintech 2021, CB Insights

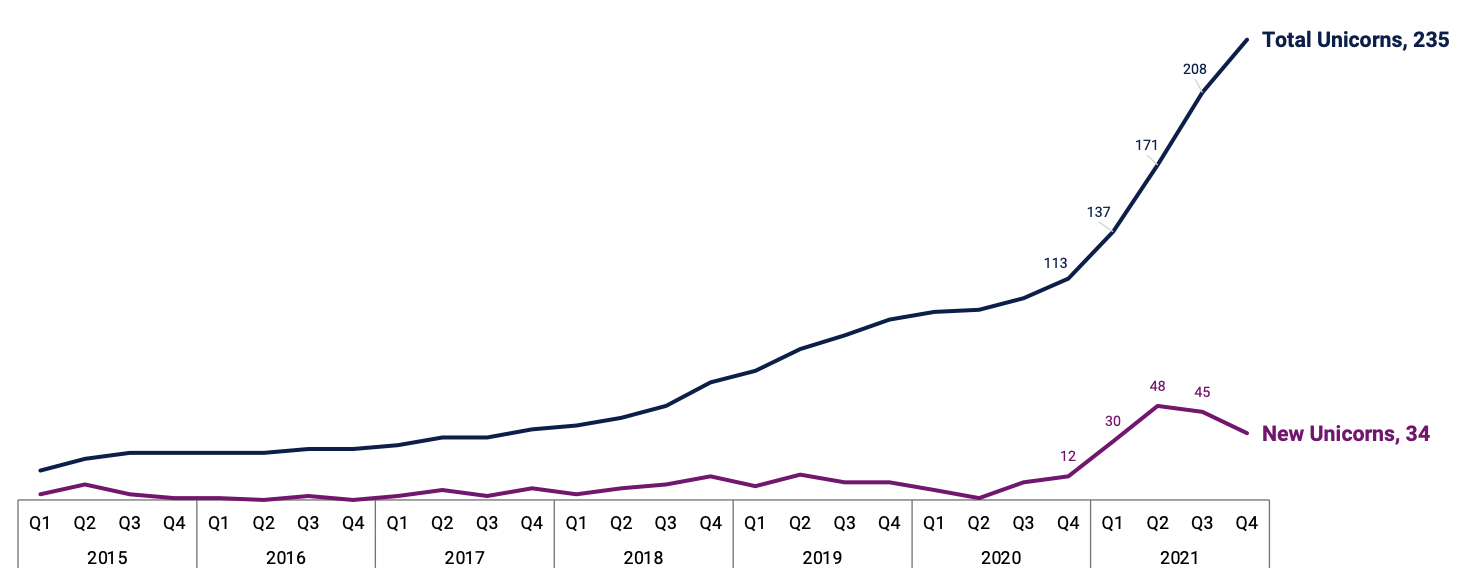

Booming fintech funding activity pushed valuation to new heights, allowing 157 startups, including cryptocurrency exchange FTX, e-commerce checkout fintech Bolt, German neobroker Trade Republic, and Dutch banking software provider Mambu, to reach unicorn status. The figure brought the unicorn herd to 235, up 108% from 2020.

New unicorn births in 2021, Source: The State of Fintech 2021, CB Insights

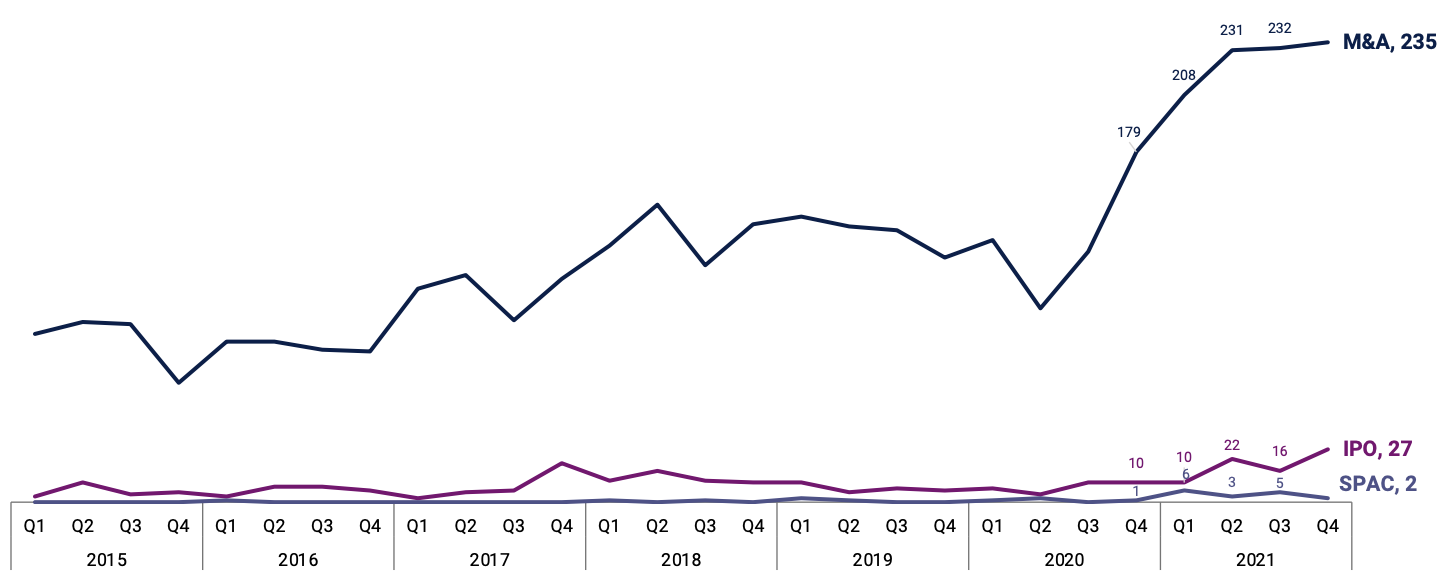

Fintech exits also broke a new record last year. Across all exit types, it is mergers and acquisitions (M&As) that witnessed the strongest rise, up from 540 deals in 2020 to 906 in 2021. The year also saw 75 public listings through initial public offerings (IPOs) and 15 mergers with special purpose acquisition companies (SPACs).

Fintech exits in 2021, Source: The State of Fintech 2021, CB Insights

2021’s largest fintech exits included American crypto exchange Coinbase (US$65.3 billion IPO), Brazilian neobank NuBank (US$41.5 billion IPO), Singaporean super-app Grab (US$39.6 billion SPAC merger), and American restaurant software company Toast (US$17.5 billion IPO).

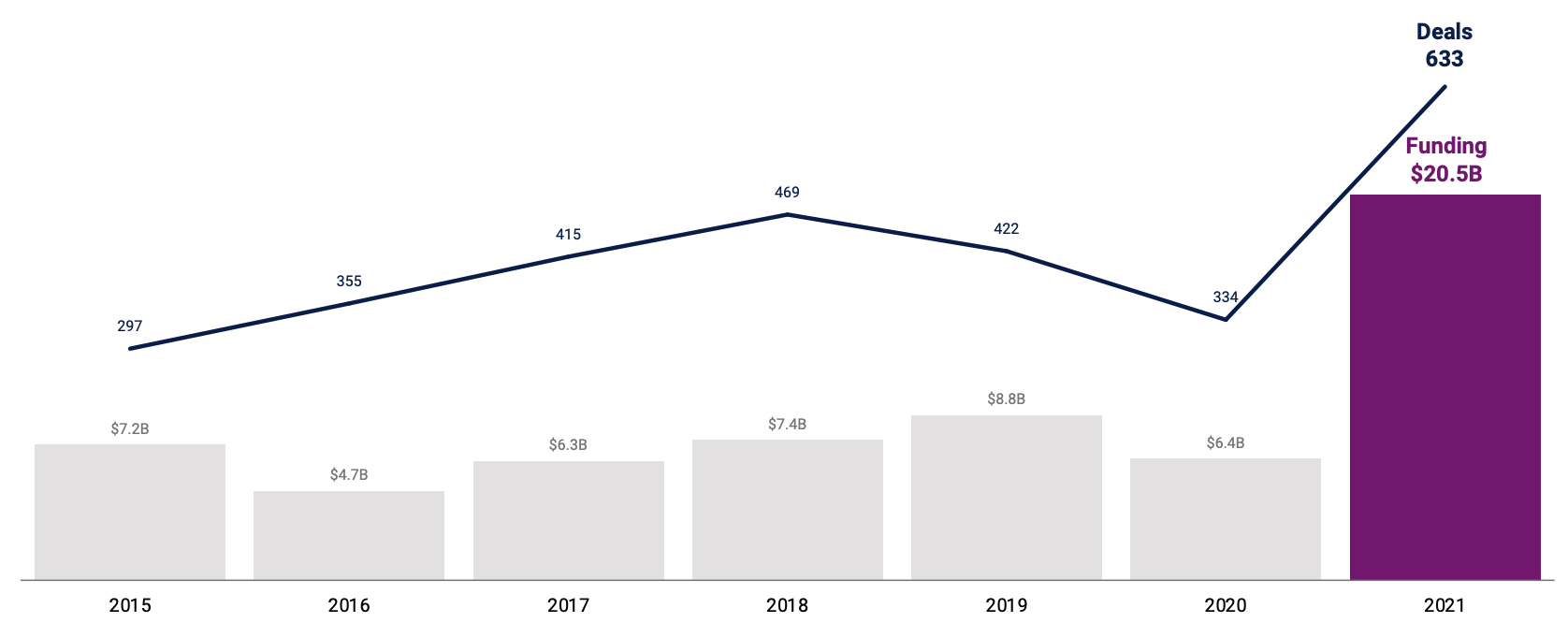

Digital lending saw biggest jump; interest in fintech-focused blockchain picks up steam

Although every major fintech segment broke new records in 2021, digital lending funding and deals exploded, recording the largest annual jump, up 220% to US$20.5 billion and 90% to 633 deals, the report notes.

Top digital lending equity deals in 2021 included Better.com’s US$750 million Series F, Kavak’s US$700 million Series E and Brex’s US$300 million Series E. Better.com is an online mortgage originator company from the US, Kavak is a platform for buying and selling secondhand cars from Mexico, and Brex is an American all-in-one finance platform for businesses.

In 2021, 16 new digital lending unicorns were minted. 75 digital lending companies were acquired, 12 went public through IPOs, and four merged with SPACs.

Digital lending funding and deals in 2021, Source: The State of Fintech 2021, CB Insights

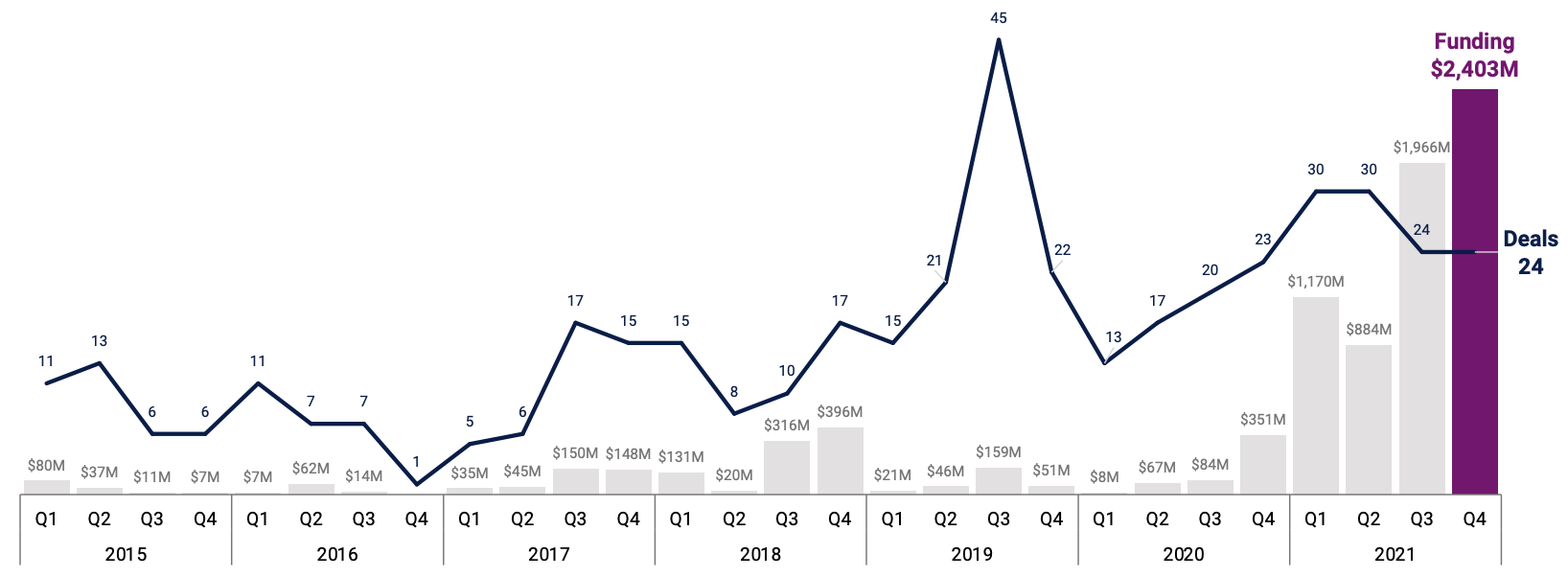

2021 was also a fruitful year for fintech-focused blockchain startups with cryptocurrency exchanges and decentralized finance (DeFi) startups in particular picking up steam, a separate study by CB Insights show.

Out of the US$25.2 billion raised by blockchain companies in 2021, a quarter (US$6.4 billion) went to crypto exchanges and brokerages.

The biggest deals of the year were closed by global players such as FTX and Gemini, but country-specific exchanges also saw traction, with India-based CoinSwitch Kuber, for example, closing a US$240 million round, and Bahrain-headquartered Rain Financial raising US$75 million in a Series B funding round.

Global funding to crypto exchanges and brokerages, Source: The State of Blockchain 2021, CB Insights

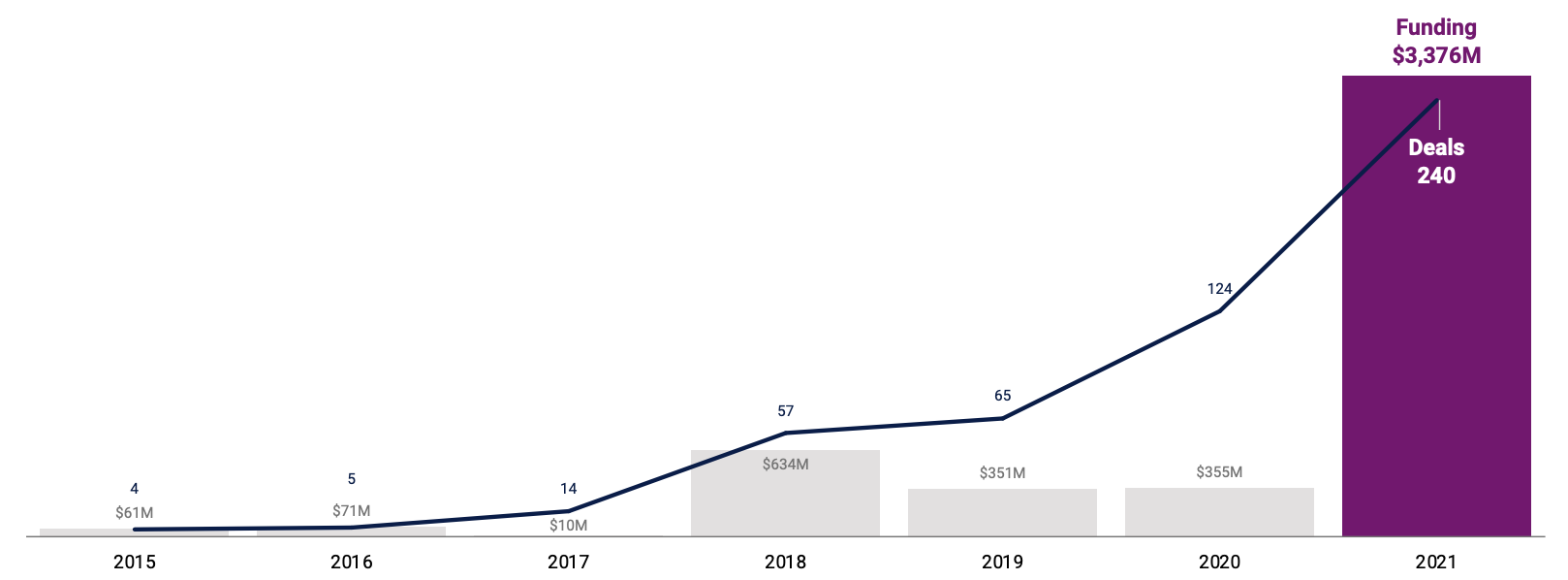

DeFi startups, meanwhile, closed 240 deals, nearly double 2020’s 124. 2021 funding reached US$3.4 billion, up nearly 10x from the US$355 million raised in 2020.

Top DeFi equity deals included Celsius Network’s US$750 million Series B, Alchemy’s US$250 million Series C, and ConsenSys’ US$200 million venture capital round. Celsius Network is a DeFi platform focusing on crypto lending, borrowing and earning; Alchemy is crypto infrastructure company; and ConsenSys is a blockchain venture studio supporting projects within the Ethereum ecosystem.

Global funding to DeFi startups, Source: The State of Blockchain 2021, CB Insights

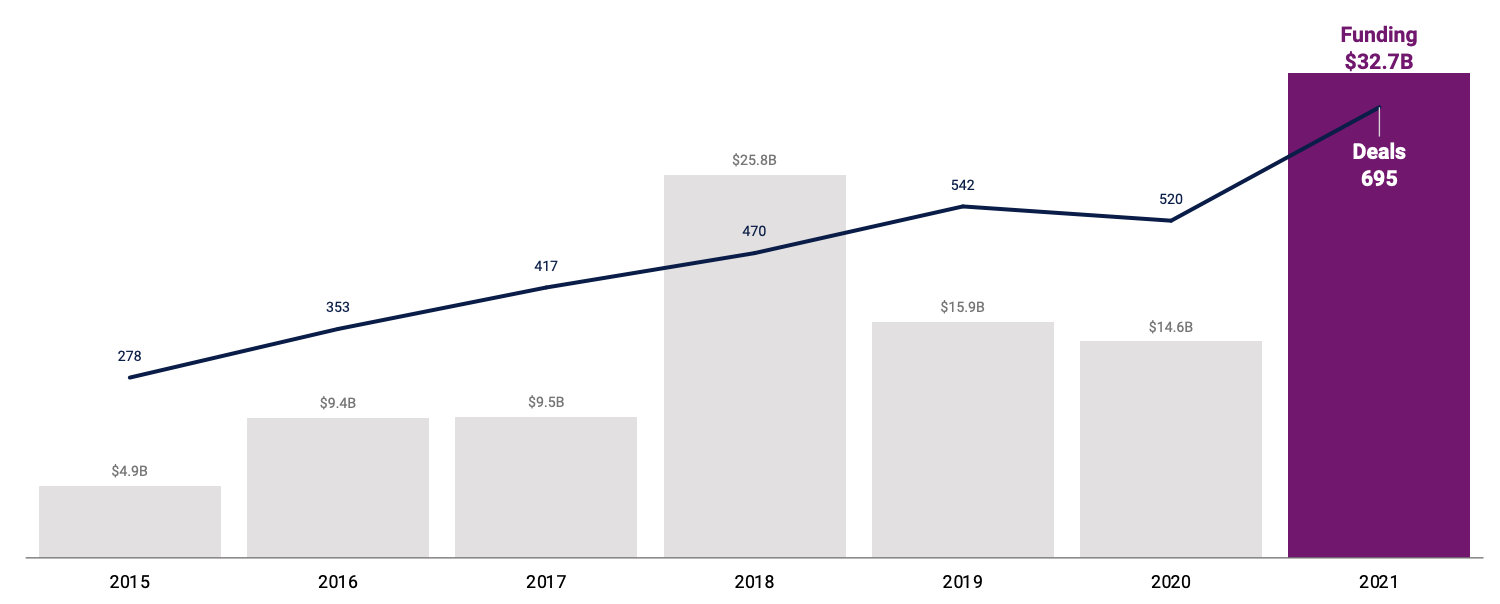

With US$32.7 billion raised through 695 deals, payment was the top fintech category in 2021. The amount represents a 124% increase compared to 2020.

Notable deals included MoonPay’s US$555 million Series A, Atome’s US$500 million round, and Socure’s US$450 million Series E. MoonPay is a startup from the US that’s building a payment infrastructure for cryptocurrencies, Atome is a leading buy now, pay later (BNPL) provider from Singapore, and Socure is a digital identity specialist from the US.

55 new payment unicorns were minted in 2021, 87 payment companies were acquired, 18 went public through IPOs and four merged with SPACs.

Payment funding and deals in 2021, Source: The State of Fintech 2021, CB Insights

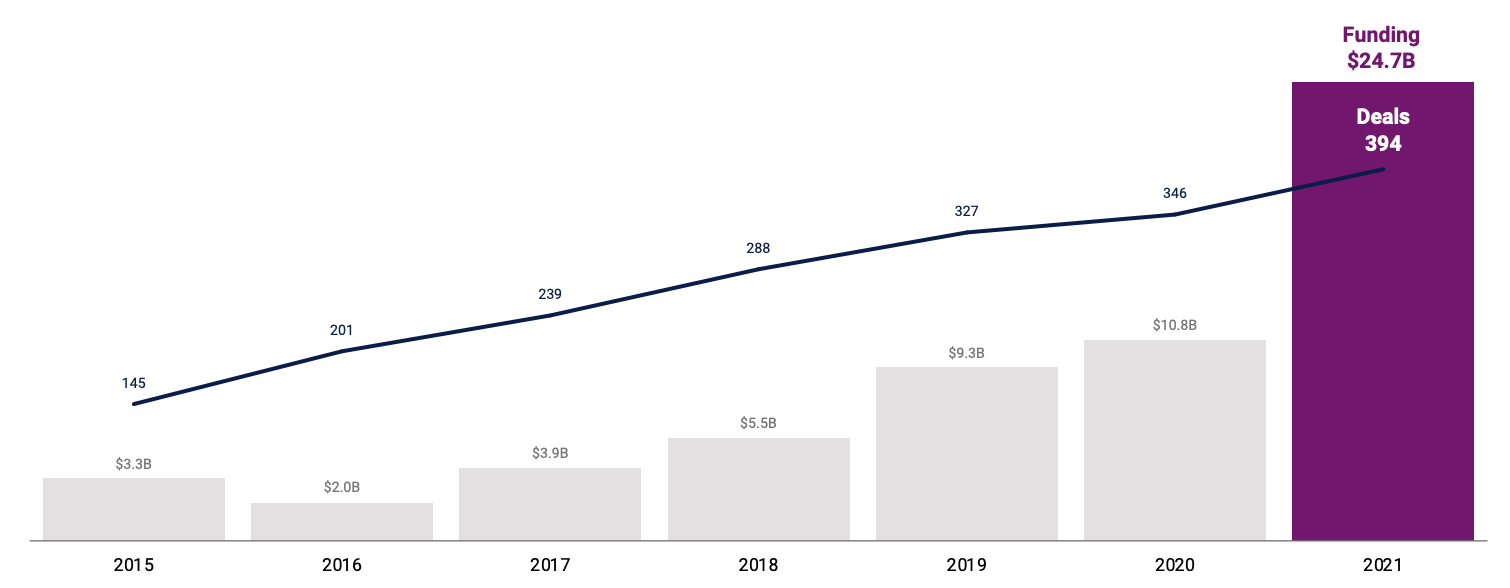

After payments, banking attracted the second largest fintech funding amount in 2021, with US$24.7 billion raised through 394 deals, up 129% and 14% compared to 2020, the report shows.

The largest banking rounds last year included N26’s US$900 million Series E, Monzo’s US$500 million Series H, and NuBank’s US$750 million extension to its Series G.

30 new banking unicorns were minted in 2021, 39 banking companies were acquired, 6 went public through IPOs and four merged with SPACs, the report says.

Banking funding and deals in 2021, Source: The State of Fintech 2021, CB Insights