Germany and especially its capital city are quickly turning into a development hub for cryptocurrencies and blockchain technology.

Today, Germany is home to some of the world’s most exciting blockchain projects and startups including IOTA, Lisk and Slock.it, which are all harnessing the country’s world-class blockchain coding community and aiming to serve the large pool of German firms looking to get into the blockchain bandwagon.

German firms look to integrate blockchain

Several German firms and banks are looking to integrate blockchain into their operations as the technology promises increased automation, speed and efficiency. Deutsche Bank and Commerzbank for instance have both joined R3, the banking consortium focusing on advancing blockchain and distributed ledger technologies for the banking and finance sector.

Several German firms and banks are looking to integrate blockchain into their operations as the technology promises increased automation, speed and efficiency. Deutsche Bank and Commerzbank for instance have both joined R3, the banking consortium focusing on advancing blockchain and distributed ledger technologies for the banking and finance sector.

Thomas Nielsen, Deutsche Bank’s chief digital officer for transaction banking has qualified blockchain as “a fabulous enabling technology that will help optimize our existing business but more importantly will open up new revenue streams.”

Deutsche Börse Group has gone a step further, announcing in March 2018, that it had teamed up with financial management firm HQLAX, to develop a blockchain-based system for securities lending. The Germany-headquartered securities listing and trading exchange said it sought to use the technology to offer more efficient securities settlement.

Meanwhile, UBS is testing out a blockchain-based trade finance platform Batavia. Earlier this month, the bank said it successfully conducted its first live cross-border transactions involving corporate clients. Batavia was developed by the bank in partnership with IBM

Most recently, the fintech arm of Germany’s second largest stock exchange unveiled plans to launch a cryptocurrency trading app later this year. Sowa Labs, a subsidiary of Börse Stuttgart, said earlier this month that the new app, called Bison, will be available for use in September and will initially offer trading support for bitcoin, ether, XRP and litecoin.

But beyond the German banking and financial services industry, blockchain technology is also being used in areas that include healthcare and energy.

Pharmaceutical giant Merck is reportedly investigating the use of blockchain technology for healthcare, having stated in 2016 that blockchain could be deployed in the industry for myriad uses, including setting up vaccine registries and transactional histories for patients.

The application of blockchain in the area of energy is arguably the most popular advanced in Germany. Innogy, a subsidiary of RWE, one of Germany’s largest energy and gas provider, is involved in Share&Charge and Conjoule. Share&Charge is an open network enabling mobility companies to offer “smart charging” experience, and Conjoule focuses on peer-to-peer energy trading solutions using blockchain.

In October 2017, energy companies E.ON and Enel successfully traded electricity for the first time via a new marketplace based on blockchain technology. The first peer-to-peer contracts over the blockchain were executed via Enerchain, a software developed by Ponton. The German IT company has been working for years to develop the operating system for energy wholesale trade.

Blockchain Startups in Germany

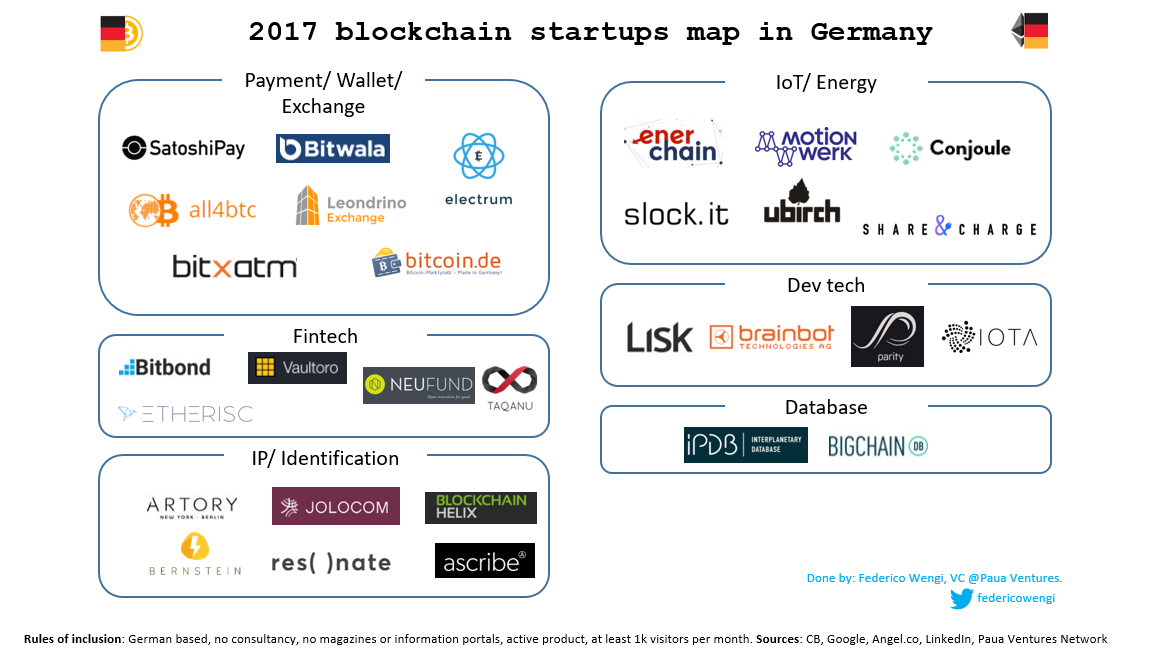

As of 2017, Germany was home to about 30 blockchain startups. While the German blockchain startup ecosystem can seem relatively small when compared with the likes of London, which has some 80 blockchain companies, and New York with about 60 companies, there are nevertheless some recognizable names.

IOTA for instance, is a distributed ledger technology designed specifically for the Internet-of-Things (IoT). Several ventures have partnered with the IOTA Foundation, the German organization overseeing the project, to experiment with the technology including the International Transportation Innovation Center, a non-profit foundation specializing in developing open and close autonomous vehicle testbeds, and InnoEnergy, a European energy company.

IOTA for instance, is a distributed ledger technology designed specifically for the Internet-of-Things (IoT). Several ventures have partnered with the IOTA Foundation, the German organization overseeing the project, to experiment with the technology including the International Transportation Innovation Center, a non-profit foundation specializing in developing open and close autonomous vehicle testbeds, and InnoEnergy, a European energy company.

Slock.it is another German blockchain startup that focuses on the IoT and the sharing economy. Slock.it enables anyone to rent, sell or share their property without middlemen.

Other notable German blockchain and cryptocurrency ventures include Bitwala, a service that lets users make bank transferts for goods and services with Bitcoin, Electrum, a popular Bitcoin wallet, and Ascribe, a startup that is using the Bitcoin blockchain to timestamp intellectual property and create a ownership structure for artwork and other digital media.

If you’re keen to find out more on Blockchain in Germany, why not take part in Blockshow Europe 2018 which will be held in Berlin from the 28th – 29th May. It is set to attract over 3000 guests, 120+ partners, over 70 globally recognized speakers and much more. Our readers get 30% off when you register with code: 30FINTECHNEWS

Learn more and register for BlockShow Europe 2018 here