Bitpanda, a Vienna-based crypto startup, has launched a new digital asset exchange, called Bitpanda Global Exchange after raising EUR 43.6 million in the largest initial exchange offering (IEO) in Europe.

On August 6, Bitpanda sold out its IEO for the Bitpanda Ecosystem Token (BEST), the token of the Bitpanda ecosystem. The token grants holders a wide range of benefits and rewards, including reduced trading fees and priority access to upcoming products. Bitpanda raised 43.6 milion Euro.

IEOs have been the latest hot fundraising trend in the cryptocurrency industry, raising a whopping US$262 million through 72 campaigns in H1 2019 alone, according to a recent report by cryptocurrency market data aggregator CoinGecko.

What is an IEO?

IEOs are a byproduct of initial coin offerings (ICOs) but unlike the latter, which are undertaken by startups themselves, IEOs take place on cryptocurrency exchanges, which, for a fee, act as middlemen and perform functions such as due diligence on a project, know-your-customer (KYC) screening, marketing and selling tokens to customers.

Since Binance set the trend with the introduction of Binance Launchpad back in November 2017, a horde of companies has followed suit and launched their own IEO platforms including Huobi, Bitfinex, OKEx and Bittrex. Today, more than 25 IEO platforms exist, according to CoinGecko, and Bitpanda will soon join the rank as the company plans to introduce the Bitpanda Launchpad some time in 2020.

Bitpanda said it will use the proceeds of the IEO to expand beyond Europe and further develop the Bitpanda Ecosystem, which currently includes Bitpanda GE as well as a broker platform.

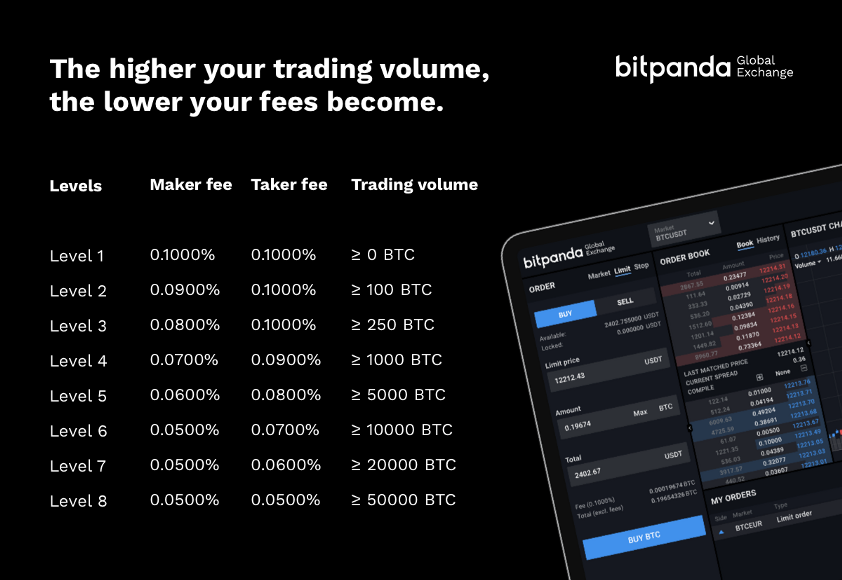

Bitpanda GE, which went live the day after the end of the IEO, is the company’s first worldwide product. The platform is targeted at experienced traders, professionals and institutions, and supports crypto-to-crypto trading and fiat-to-crypto trading in more than 54 countries. It claims to offer some of the lowest maker and taker fees in the industry.

Bitpanda GE has been entirely developed in-house over the past two years and intends to provide traders with “the lowest fees for fiat-to-crypto trading in the industry,” Bitpanda CEO Eric Demuth, said in a release. It promises to be a “reliable, scalable and trusted environment for digital asset trading.”

Trading pairs available at launch include BTC/EUR, BTC/USDT, ETH/EUR, XRP/EUR, MIOTA/EUR, ETH/BTC, XRP/BTC, MIOTA/BTC, PAN/BTC, BEST/BTC, BEST/EUR, and BEST/USDT, with more to come.

In a blog update following the launch on August 9, Bitpanda said that on the first day of trading, the digital asset exchange platform had attracted some 1,000 users, and recorded a total daily volume of €1.722 million. The most active market was BTC/EUR, closely followed by BEST/EUR, the company said.

Bitpanda Global Exchange, via blog.bitpanda.com

Founded in 2014, Bitpanda, formerly Coinimal, is an Austrian startup that started off as a brokerage platform allowing users to buy, sell and store cryptocurrencies and digital assets including bitcoin, ether, as well as digitized gold, in Europe. Today, the company claims more than one million users and an Android app that’s been downloaded over 120,000 times.

In April, the Austrian financial market authority (FMA) granted Bitpanda a Payment Services Directive 2 (PSD2) license. PSD2 regulates payment service providers throughout the European Union (EU) and the whole European Economic Area (EEA).

With the license in hand, the startup said it will launch “exciting features and products in the coming months.”

Interestingly Bitpanda also owns 3.99% of Der Brutkasten, an Austrian multimedia platform for startups, the digital economy and innovation.

Featured image: Bitpanda Global Exchange goes live, by Bitpanda Global Exchange, @BitpandaGE, via Twitter.