Demand for virtual land plots and real estate is surging on the back of booming activity on the metaverse. Betting on a virtual reality future, real estate promoters and investment firms are snapping up properties on popular virtual environments such as Decentraland and The Sandbox for millions of dollars.

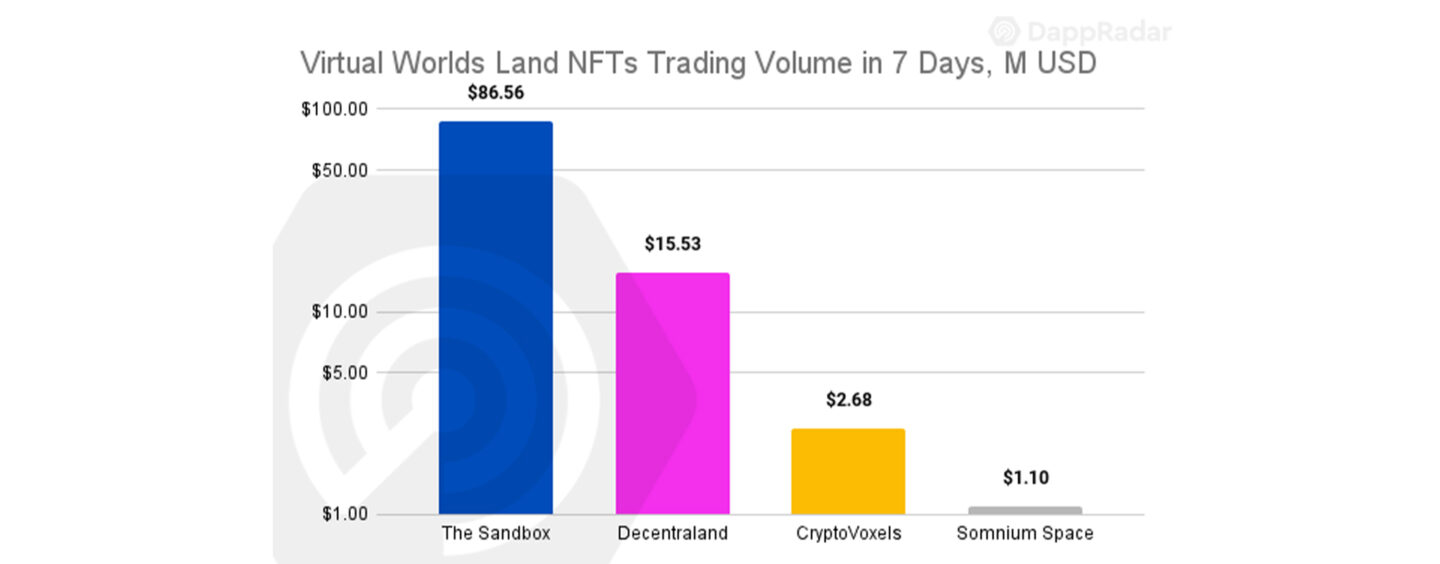

Data from DappRadar, a platform that tracks decentralized applications (Dapps), suggest that in the last week of November, all virtual environments combined recorded upwards of US$100 million in NFT land sales, giving an idea of the magnitude of these types of transactions.

Virtual worlds land NFTs trading volume between November 22 – 28, 2021, million USD, Source: Dappradar.com

Just a few weeks ago, Republic Realm, a firm that develops real estate in the metaverse, bought a land plot in the Sandbox for US$4.3 million in what has been deemed the biggest virtual real estate sale to date.

The Sandbox is a virtual metaverse where users can create their own virtual worlds, interact with others, and create digital assets like non-fungible tokens (NFTs).

Republic Realm, which purchased the digital land from videogame company Atari, said that the two companies plan to partner on the development of some of the properties. Republic Realm runs two real-world investment vehicles focused on virtual real estate and owns about 2,500 plots of digital land across 19 worlds, co-founder Janine Yorio told the Wall Street Journal.

These digital land plots are either left vacant and sold later on when they appreciate in value. Or, Republic Realm develops them into commercial or residential properties with the help of architects and game developers, she said.

Meanwhile, Tokens.com, a Canadian investment firm, purchased in November virtual land for US$2.4 million in Decentraland, the largest transaction recorded on the platform.

Similarly to the Sandbox, Decentraland is a virtual reality platform powered by the Ethereum blockchain that allows users to create, experience, and monetize content and applications.

Tokens.com said it’s looking to develop properties in Decentraland, which it wants to rent out to fashion companies as event and retail space. The company is also developing an 18-story skyscraper that it hopes to lease to lawyers or cryptocurrency exchanges.

According to a new paper by academics from the University of Basel in Switzerland, despite being intangible, virtual worlds are much more than gimmicks and are attracting a large number of users which spend substantial amounts of time and money in the metaverse.

This provides corporates with new opportunities to sell their goods and services, promote their products and organizations, and hold virtual events.

In fact, the researchers, whom analyzed the determinants of virtual land prices in Decentraland, found that these prices are mainly driven by commercial considerations with investors willing to pay substantial premiums for parcels that are more easily detectable or have more easily memorable coordinates.

Booming metaverse environments

These million dollar real estate transactions are coming on the back of surging activity on virtual reality environments.

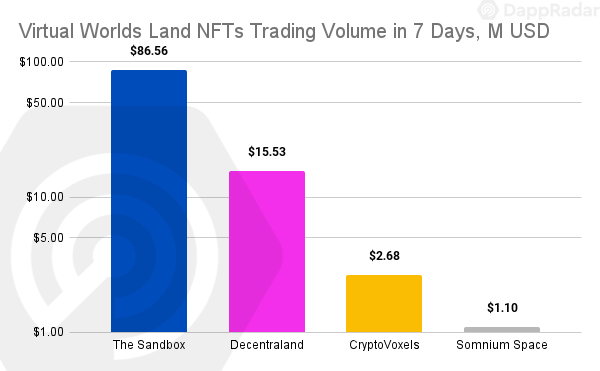

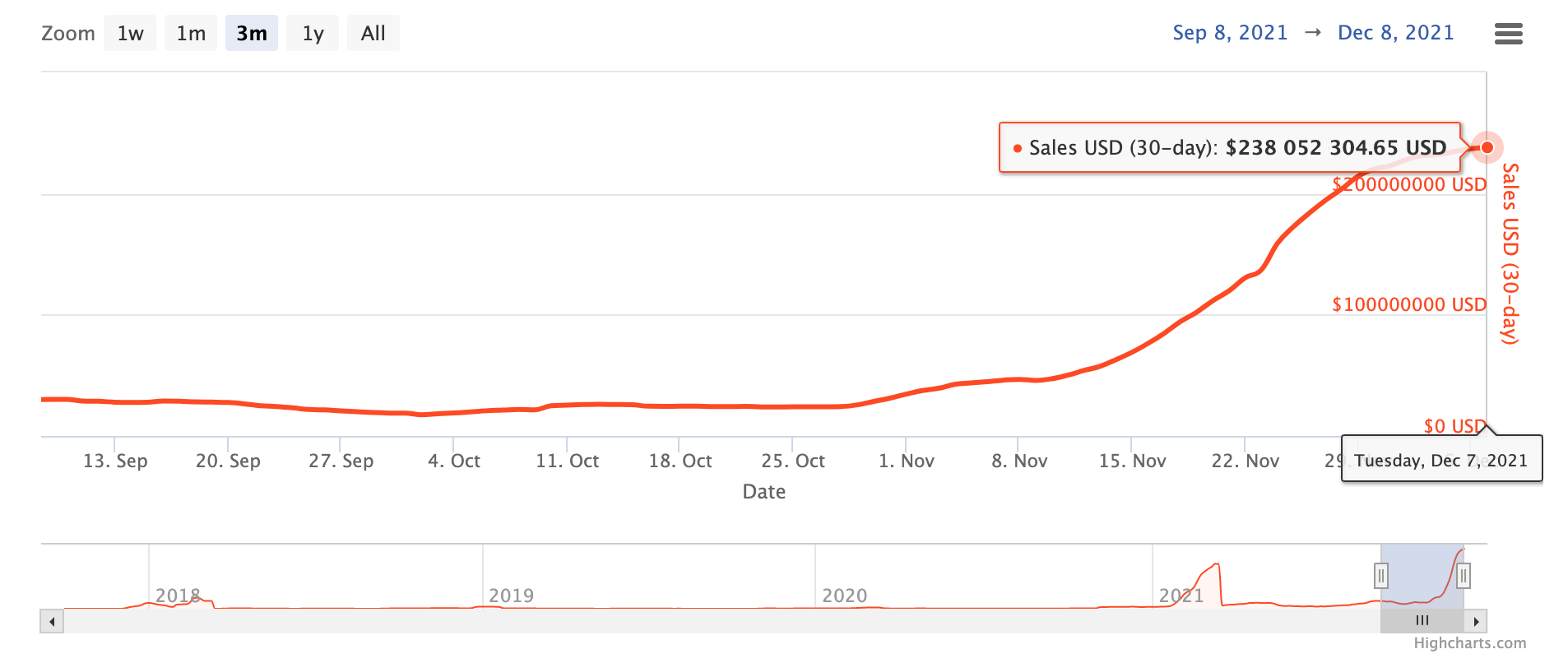

Data from Nonfungible.com, a website that tracks non-fungible tokens (NFTs) on the Ethereum blockchain, show that over the past month, 19,805 transactions on blockchain-based metaverse platforms were witnessed, totaling a record of US$238 million.

Total USD spent on completed sales related to the Metaverse (monthly), Source: Nonfungible.com

The Sandbox and Decentraland led most of the month’s activity, recording US$179 million and US$20.7 million worth of NFT sales over the period, respectively. Combined, these two platforms held a market share of 84% in transaction volume during the period.

The metaverse, a concept referring to an immersive virtual reality environment, has been one of the year’s hottest tech trends, fueled by renewed interest in crypto-assets and the NFT frenzy.

Companies related to the metaverse have raised nearly US$10.4 billion in funding so far this year across 612 deals, Crunchbase data show, nearly doubling the US$5.9 billion raised for the whole year 2020. Epic Games’ US$1 billion funding round in April leads the pack, but other notable transactions were recorded also including the Softbank-led US$100 million funding round for the Sandbox.

Last month, Andrew Steinwold, a crypto podcaster and a managing partner of Sfermion, a Chicago-based investment firm, raised US$100 million for a new NFT fund focused on metaverse-related investments. Backers included the Winklevoss twins and two general partners from Andreessen Horowitz.