Research: Crypto Fundraising and M&A Declined Sharply in 2019

by Fintechnews Switzerland April 14, 20202019 saw a sharp decline in deal volume and value for crypto fundraising and merger and acquisition (M&A) transactions, according to a new report by PwC.

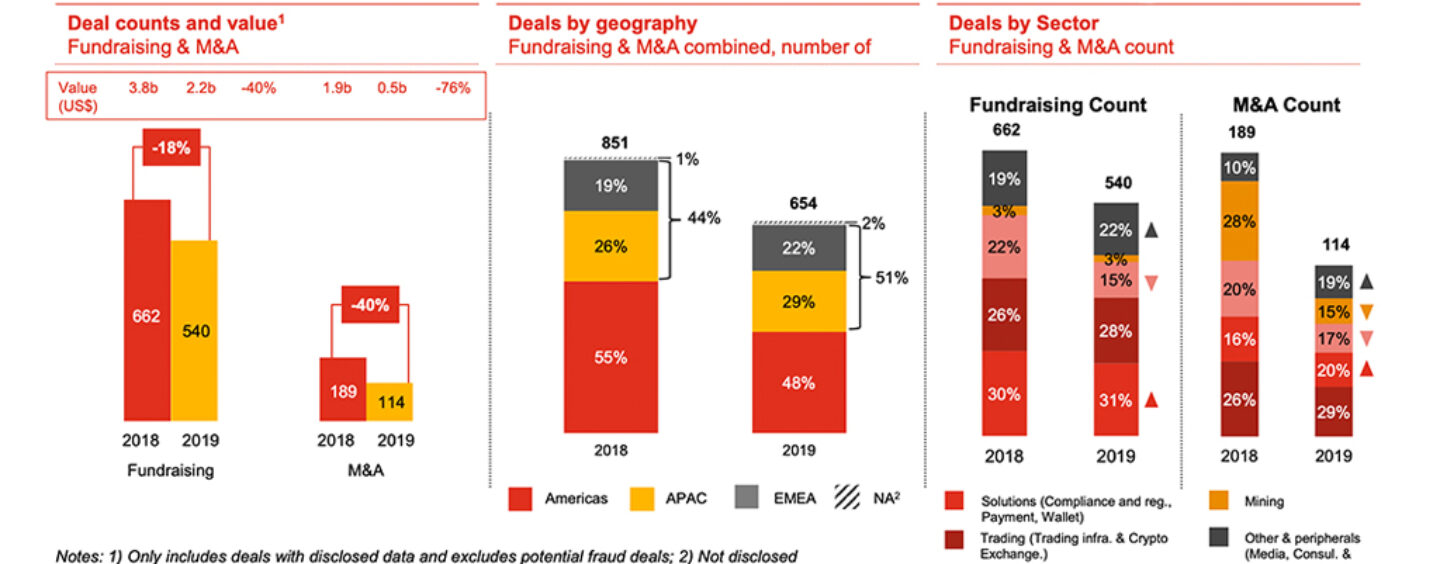

Crypto companies raised US$2.2 billion through 540 deals in 2019, a 40% decline in dollar amount and a 18% decline in deal count compared with 2018. 114 M&A transactions took place, amounting to a total of US$500 million, and representing a 76% drop in value and a 40% drop in deal count, according to the 2nd Global Crypto M&A and Fundraising Report.

Crypto fundraising and M&A, Deal counts and value, 2nd Global Crypto M&A and Fundraising Report, PwC, April 2020

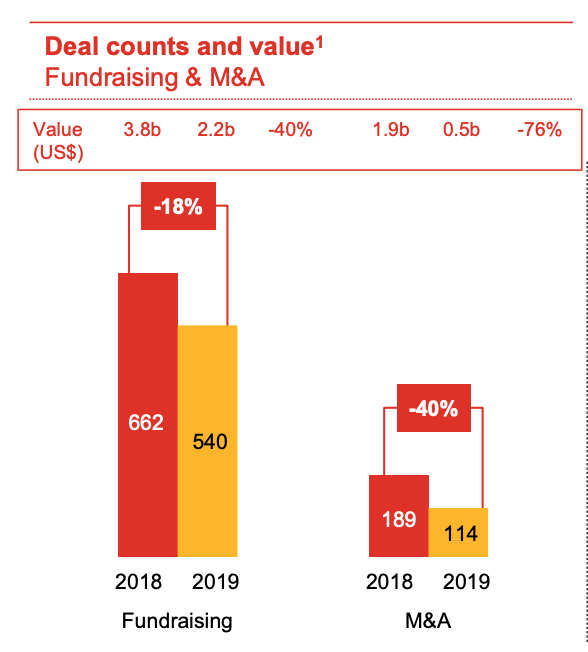

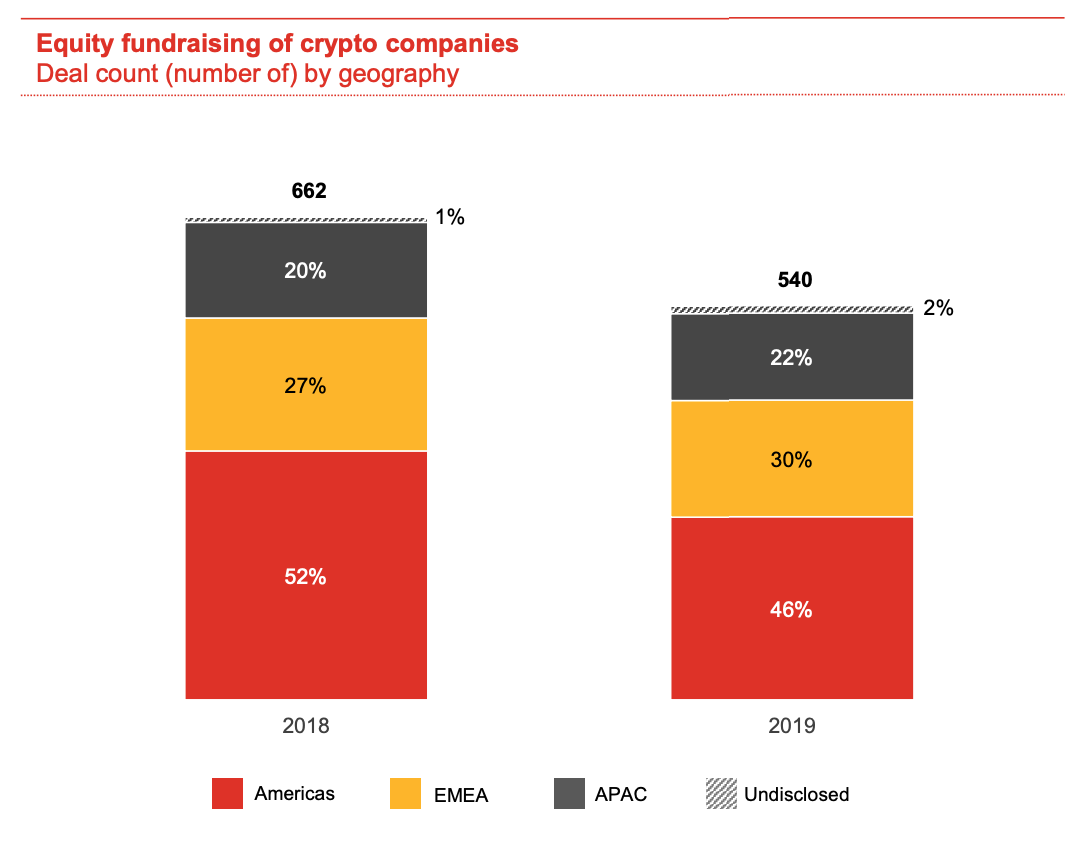

Though the Americas continued to dominate crypto fundraising and M&A activity in 2019, the year also witnessed a shift towards Asia and the Europe, Middle East and Africa (EMEA) region.

Equity fundraising of crypto companies, Deal count (number of) by geography, 2nd Global Crypto M&A and Fundraising Report, PwC, April 2020

M&A of crypto companies, Deal count (number of) by geography, 2nd Global Crypto M&A and Fundraising Report, PwC, April 2020

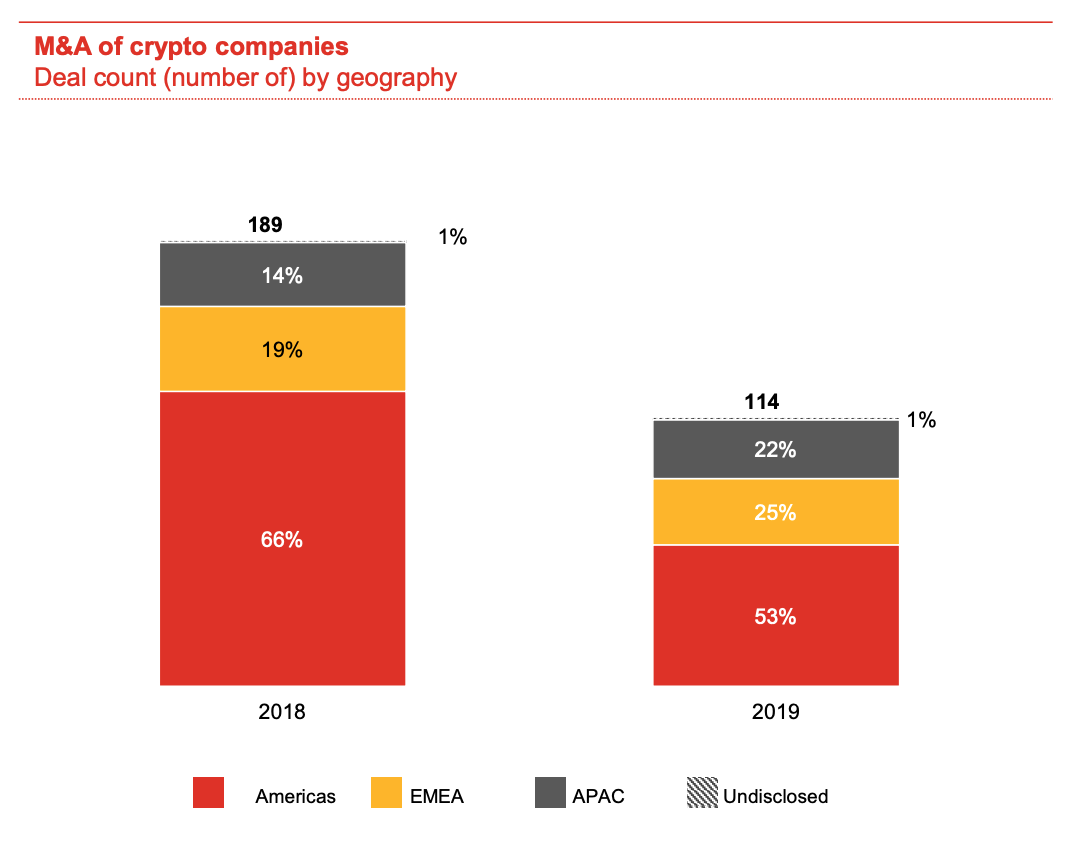

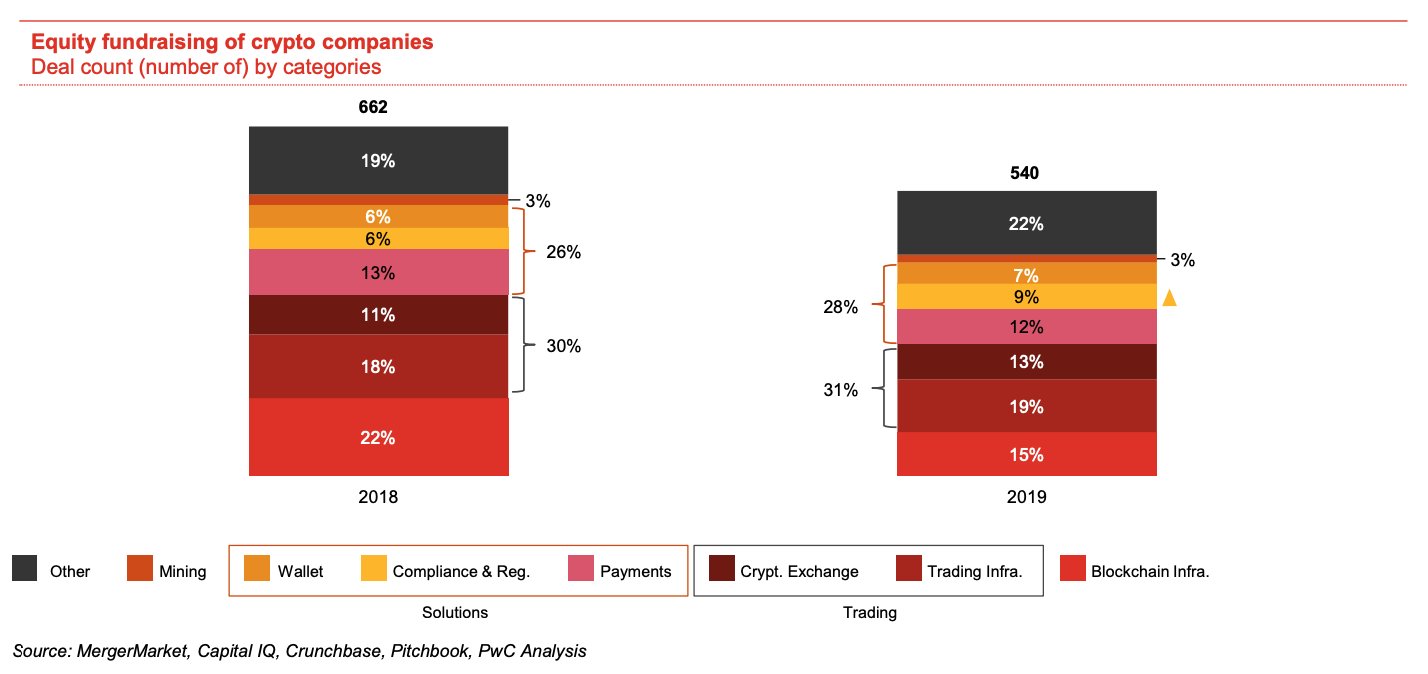

The report also notes a shift in sectors of interest. While in 2018, crypto fundraising went mostly towards blockchain infrastructure projects, 2019 saw a rise of investments in crypto exchanges, as well as in solutions for the crypto ecosystem such as compliance and regulatory solutions. This coincides with the institutionalization of the industry, the report says.

Equity fundraising of crypto companies, Deal count (number of) by categories, 2nd Global Crypto M&A and Fundraising Report, PwC, April 2020

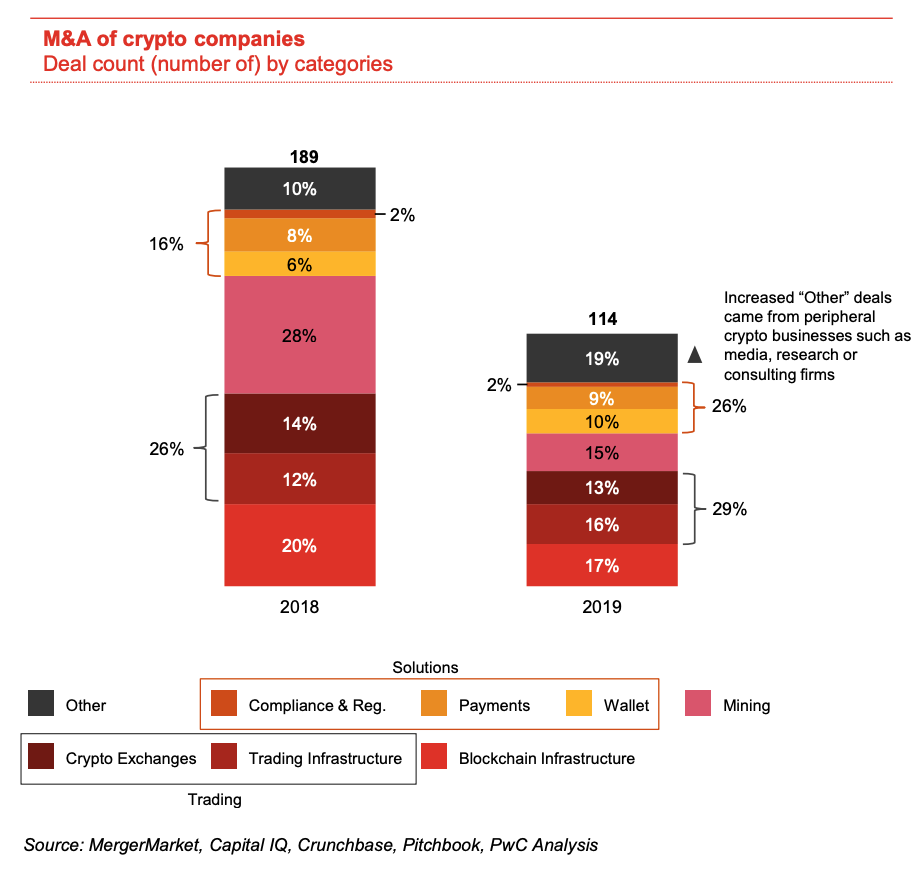

In terms of M&A deals, 2019 saw a decline in the number of transactions towards crypto mining startups, but an increase in activity in trading infrastructure projects and in the crypto solution-related sectors such as media, research and consulting. This is in part due to established companies wanting to expand their range of crypto services, it says.

M&A of crypto companies, Deal count (number of) by categories, 2nd Global Crypto M&A and Fundraising Report, PwC, April 2020

Crypto industry continues to consolidate

The crypto industry continued to consolidate and mature in 2019 with deals being made across the entire value chain and nearly half of the M&A activity being led by existing crypto market participants looking to expand their product portfolio.

Notable M&A transactions that took place last year include the acquisition of Crypto Facilities by trading platform Kraken for US$100 million, and Coinbase’s purchase of bitcoin wallet and storage provider Xapo for US$55 million.

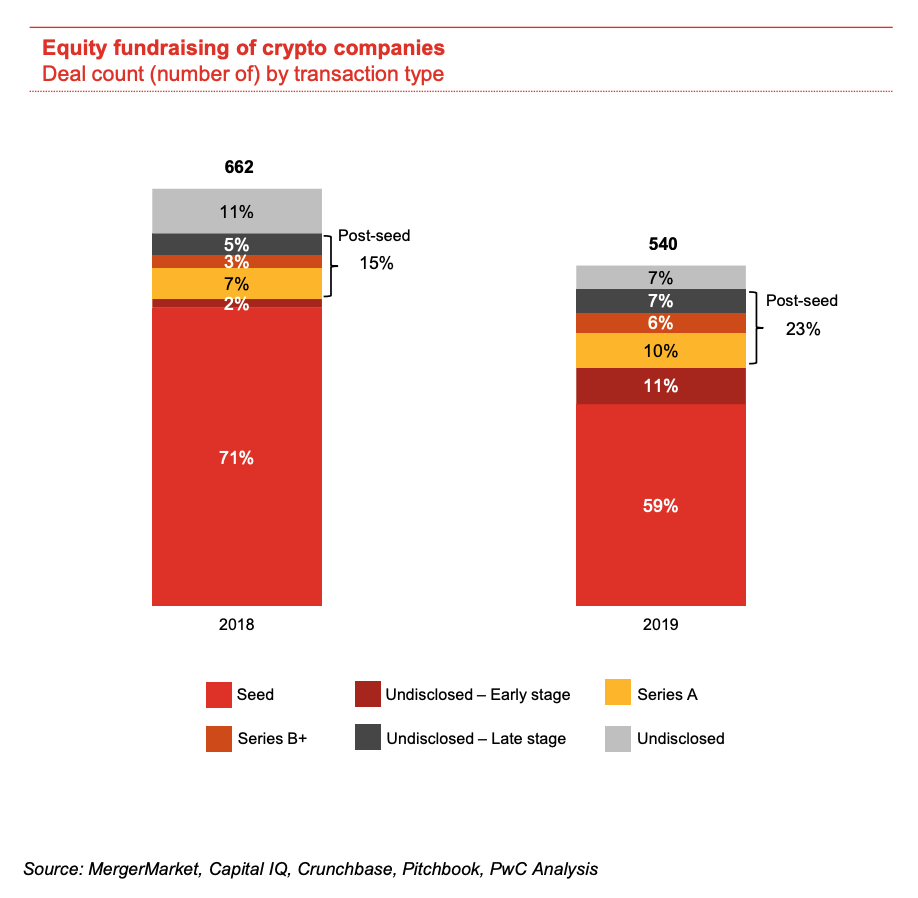

Another sign of the sector maturing is the increasing proportion of fundraising going towards later-stage companies. In 2019, post-seed funding rounds accounted for 23% of all equity funding rounds, against 15% in 2018.

Equity fundraising of crypto companies, Deal count (number of) by transaction type, 2nd Global Crypto M&A and Fundraising Report, PwC, April 2020

Notable funding rounds in 2019 include trading app Robinhood, which raised the largest round at US$373 million. Robinhood is followed by Ripple and Bithumb, both raising US$200 million.

In 2020, PwC expects further consolidation with more M&A deals and larger crypto players expanding their offering. Asia Pacific (APAC) and EMEA are expected to continue playing a bigger role in the global crypto M&A and fundraising space driven in part by family offices. Finally, macro-economic conditions, including the COVID-19 pandemic, are set to impact the number and value of funding and M&A transactions in the crypto industry.

But it’s not just crypto. The health crisis and the ensuing economic crisis are expected to impact startup funding more broadly, with CB Insights projecting a 16% decline in Q1’20 compared to Q4’19, representing the second steepest quarterly drop in the past ten years.

In Switzerland, the COVID-19 is taking a toll on Zug’s Crypto Valley startups. According to a survey by the Swiss Blockchain Federation, about 80% of crypto and blockchain startups based in Zug believe they will likely go bankrupt within the next six months.