COVID-19 Brings Fintech into the Mainstream: McKinsey Research

by Fintechnews Switzerland January 19, 2021The COVID-19 pandemic has shifted US consumers’ attitudes towards banking and financial services, accelerating the adoption of digital financial services and bringing fintech into the mainstream, surveys McKinsey conducted found.

In an article titled How US customers’ attitudes to fintech are shifting during the pandemic, the consulting firm shares findings from research conducted monthly between March and November 2020, that measure financial sentiment, behaviors, needs and expectations among household financial decision makers.

Among all financial decision makers polled in the US, 42% said they used at least one fintech solution. More than 6% of them became fintech users during the pandemic.

Respondents using financial technology during COVID-19, %, Source: McKinsey Financial Insights Pulse Survey

The research found that while the younger generations, and most particularly the Gen Z and Millennials, used fintech solutions the most, older generations are joining them in larger numbers.

66% of Gen Z and 56% of Millennials said they were fintech users, making these generations the biggest adopters of fintech products. Meanwhile, adoption is lower among Gen X and Baby Boomers at 44% and 26%, respectively, being fintech users, COVID-19 has

Financial technology usage during COVID-19 by generation, Source: McKinsey Financial Insights Pulse Survey

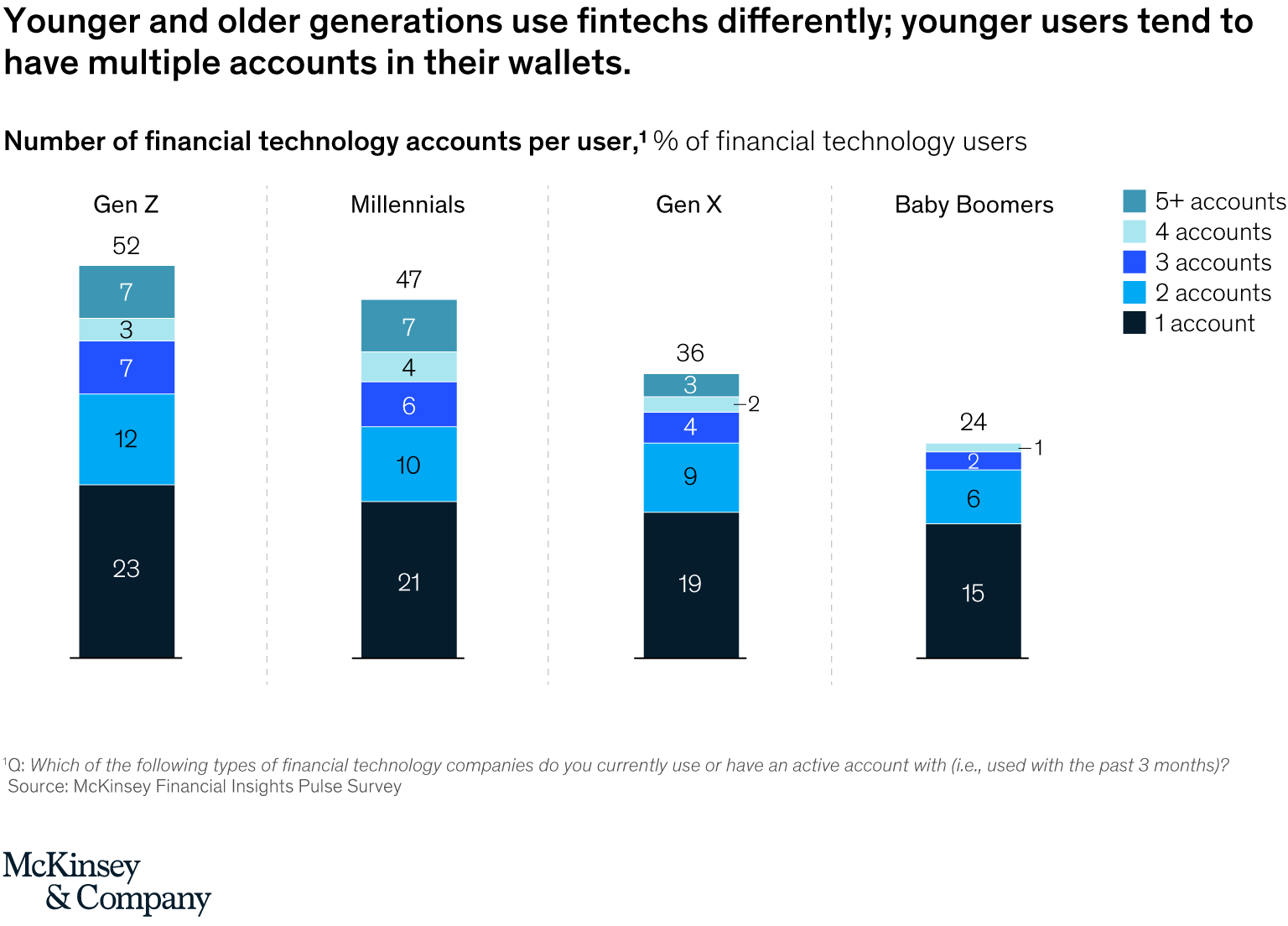

Fintech products are used differently across generations, the research found, with younger people tending to be multi-account users. Over half of Gen Z fintech users said they had two or more fintech accounts. Meanwhile, older generations appear to turn to fintechs as point solutions, with nearly two thirds of Baby Boomer fintech users having just one fintech account.

Number of financial technology accounts per user, Source: McKinsey Financial Insights Pulse Survey

Banking platforms were found to be the most used fintech solutions at 23%. Banking platforms also saw the greatest total absolute increase in users, with 6% of total US consumers opening a banking fintech account during the pandemic.

Payments was the second most used fintech solution with about 16% of consumers using at least one account. 4% opened an account during the pandemic.

Investment and lending recorded lower usage rates at 10% and 5% respectively but saw the biggest jumps in adoption since the start of the pandemic with increases of 23% and 25% respectively in users.

Fintech technology usage increase by platform type, Source: McKinsey Financial Insights Pulse Survey

Recent industry research also corroborate McKinsey’s findings. Early-stage venture capital firm Blumberg Capital conducted a survey last year which found that for a majority of adults in the US, COVID-19 lockdowns accelerated their adoption of fintech solutions.

The study, which polled 1,000+ US consumers since the onset of the pandemic, found that 78% of consumers believe that the days of going into a physical financial institution are coming to an end, and 88% of the respondents agree that the latest fintech will help Americans be better off financially by making transactions easier and/or more affordable.

39% believe that traditional financial institutions aren’t evolving fast enough to keep up with consumers’ new needs and expectations.

Fintech’s acceleration amid the COVID-19 pandemic infographic, Blumberg Capital, Nov 2020