Banks Fell Short of Meeting Customers’ Expectations in 2021

by Fintechnews Switzerland April 16, 2021The COVID-19 pandemic has exacerbated banking-sector issues, forcing retail banks to embrace digital transformation and realign their offerings to customer expectations. But while many have been vocal about delivering superior customer experiences, there is still a large disconnect between what customers want and banks’ priorities are, a new study by Capgemini and Efma found.

This year’s World Retail Banking Report, released in March, discusses the disruption caused by the global pandemic, the growth of neo- and challenger banks, and the need for retail banks to embrace cloud-based banking-as-a-service (BaaS) platform models.

Discrepancies and practical challenges

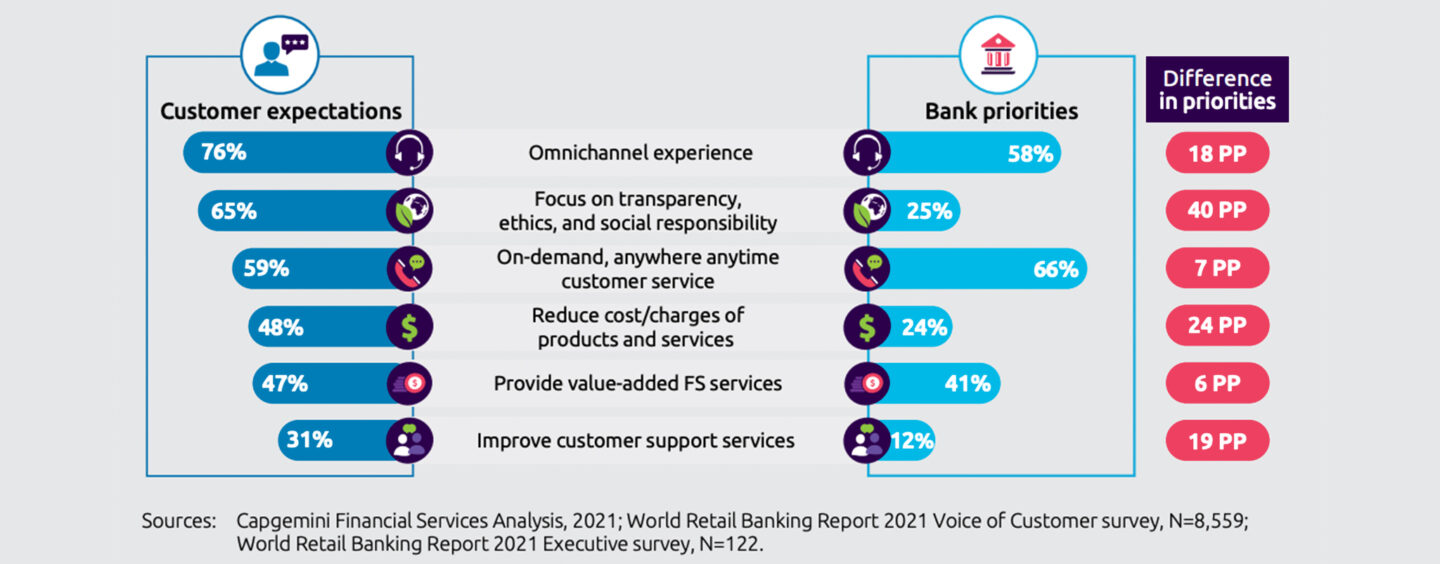

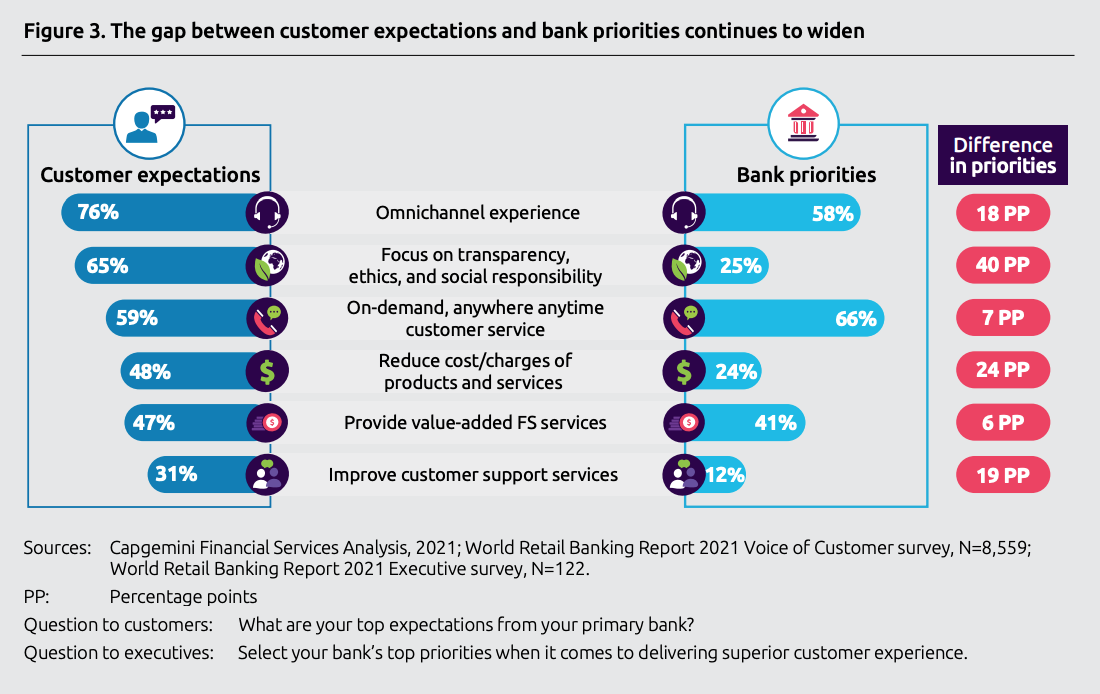

Findings of the 2021 survey indicate a divide between retail banks’ priorities and customers’ expectations. The biggest gap is seen on transparency, ethics and social responsibility, a topic which customers feel strongly about but which banks are putting at the bottom of their priority lists. Reduced cost/charges of products and services, as well as improved customer support services are other top customer expectations overlooked by retail banks.

The gap between customer expectations and bank priorities continues to widen, Sources: Capgemini Financial Services Analysis, 2021; World Retail Banking Report 2021 Executive and Voice of Customer surveys

Forced to accelerate digitalization, banks are now facing practical difficulties, the survey found. 42% of the bank executives polled are not sure how to integrate and streamline mid-, back-, and front-office functions effectively, and 46% are unsure how to embrace open banking, orchestrate the ecosystem and become a truly data-driven organizations.

More than 40% executives said they are not confident about going beyond digital to offer superior customer experience, and are conflicted about the future role of the bank branches.

Neo-, challenger banks as top cause of disruption

These challenges and dilemmas come on the back of fast-growing neo- and challenger banks. These have attracted more than 39 million customers, and their sector is projected to reach a valuation of US$578 billion by 2027, growing at a compound annual growth rate of about 46.5% between 2018 and 2027, according to a report by Facts and Factors Market Research. The 2021 customer survey found that currently, 81% of consumers said easy access and flexible banking could motivate them to switch to a fintech company.

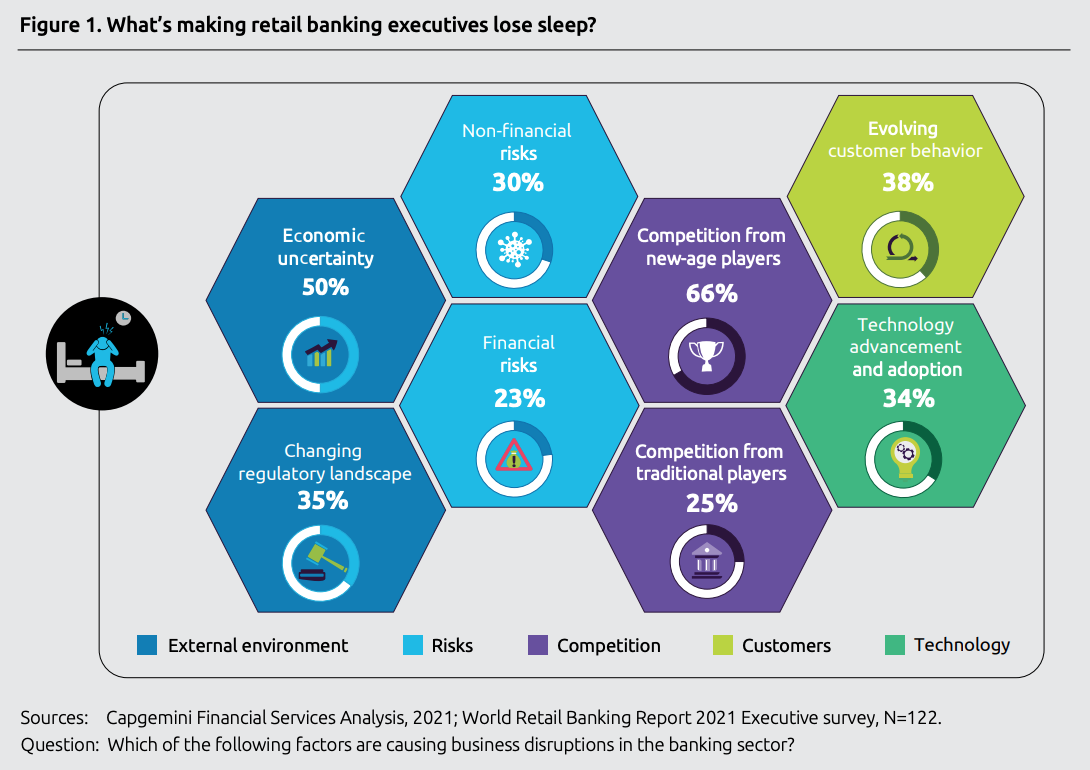

Retail banks are well aware of the threat posed by fintechs and challenger banks. Of the banking executives interviewed, 66% of respondents cited new-age players as a competitive threat and a major cause of business disruption in the banking sector, ahead of economic uncertainty (50%) and evolving customer behavior (38%).

What’s making retail banking executives lose sleep? Sources: Capgemini Financial Services Analysis, 2021; World Retail Banking Report 2021 Executive survey

The Banking 4.X era

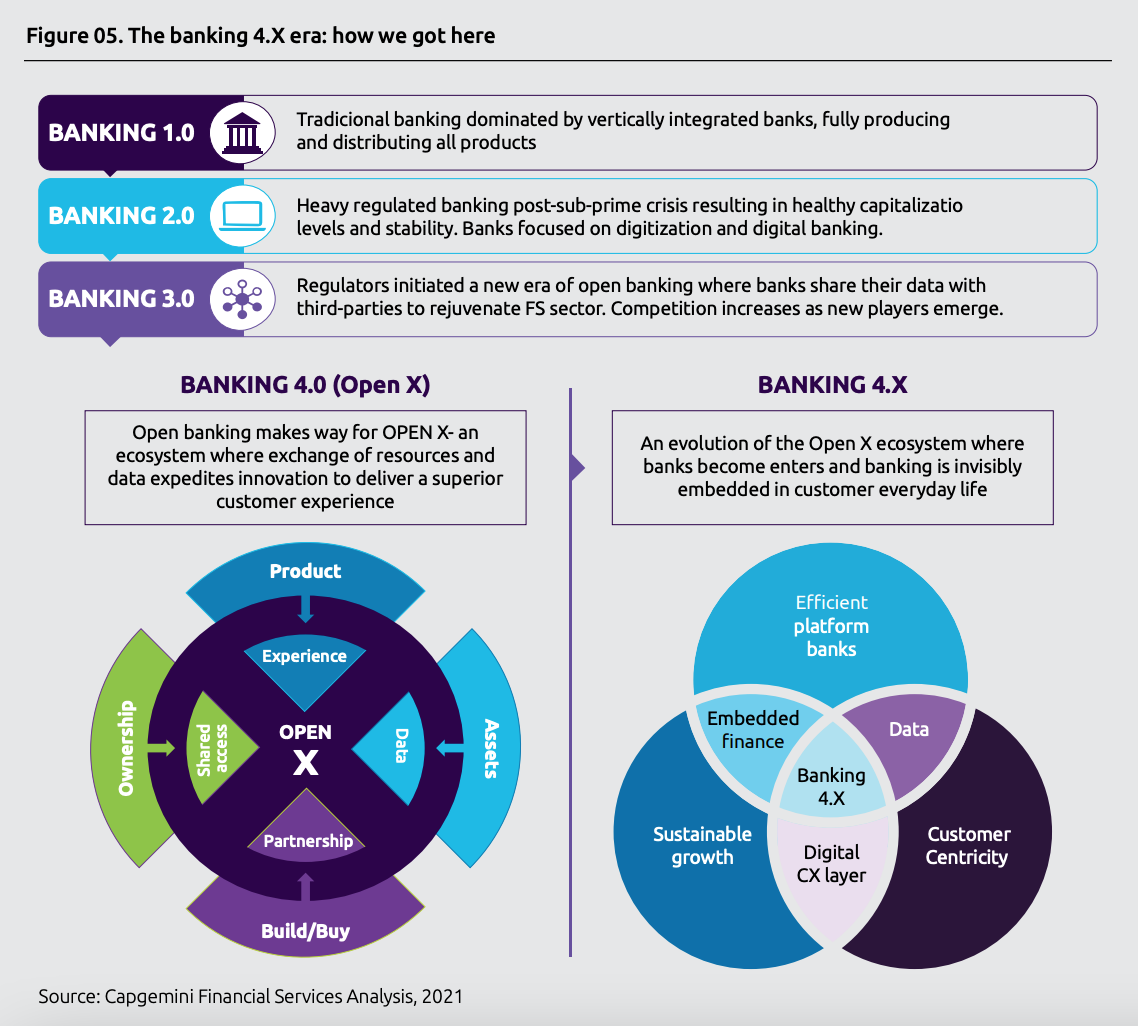

This year, the banking sector is entering a new era which the report calls Banking 4.X. Banking 4.X refers to experience-driven, platform-based banking, where banking is embedded directly into customers’ lifetime experiences and made invisible.

In the Banking 4.X era, core products such as loans, accounts, cards and mortgages, will evolve to become simpler, instant, and on demand, the report says. In tandem, banks will expand the core to include peer-to-peer (P2P) lending, mobile payments and robo-advisory options.

The banking 4.X era- how we got here, Source: Capgemini Financial Services Analysis, 2021

Embedded finance, enabled by banking-as-a-service (BaaS) platforms, is helping banks promote their financial products and services, and reach a broader market. For third-parties, BaaS allows them to embed financial services and services in their customer journeys.

An example of this is Standard Chartered’s BaaS platform Nexus. Launched in 2020, Nexus allows digital platforms and ecosystems like e-commerce, social media and ride-hailing companies to offer their customers loans, credit cards, and savings accounts co-created with Standard Chartered but promoted under their own brand.

Nexus has enabled Standard Chartered to partner with companies such as e-commerce platforms Sociolla and Bukalapak, both from Indonesia, providing the bank with a low-cost opportunity to reach unbanked populations.

In India, ICICI Bank introduced a co-branded credit card with Amazon Pay in 2018, giving the bank low-cost access to Amazon’s vast customer base. 20 months after its launch, the credit card became the fastest in the country to cross the milestone of 1 million.