Euronext, the leading pan-European exchange in the Eurozone, launches its fourth session of TechShare, the only European programme for non-listed companies dedicated to IPOs. Now also 12 swiss companies are joining the program, at least one of them is a fintech company (see list at the end).

Benefitting from a cohort of fast-growing European tech companies, the programme is an educational network designed to help these high-potential businesses understand the role of capital markets and how they can help them reach the next stage of their growth.

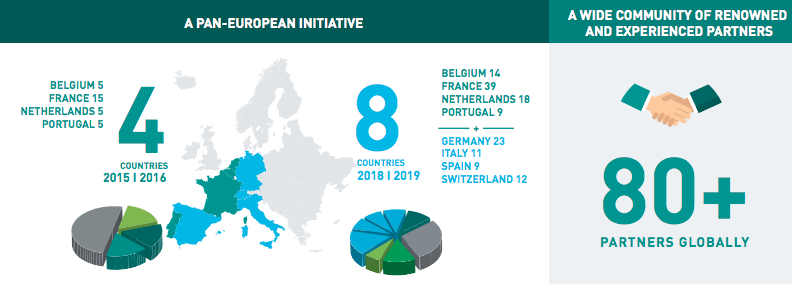

For the first time, Euronext has decided to include companies from outside Euronext’s core markets, with participants from Germany, Italy, Spain, and Switzerland. This decision follows the opening of new representative offices in these countries 12 months ago and demonstrates the potential and dynamism of European companies in the tech sector.

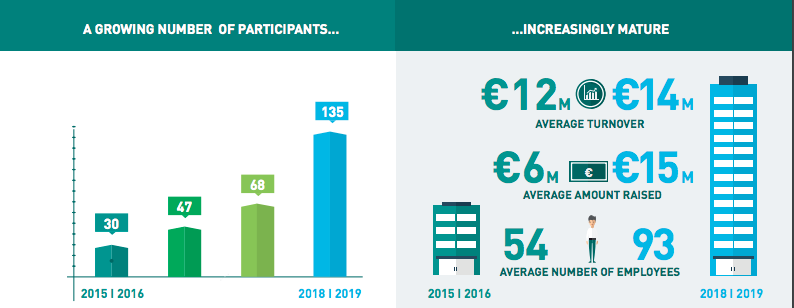

The number of companies participating has also increased significantly with 135 companies in 2018 compared with 30 companies in 2015, representing a four-fold increase in only three years.

The companies taking part in the programme represent the vibrancy and diversity of the technology world, spanning a range of sectors driving the technology revolution, including biotech, software, MedTech, electronics, hardware, cleantech, e-commerce, and fintech.

On average, participants generate annual revenues of over €10 million and employ c.100 staff. They are also at an increasingly mature stage of growth as two-thirds are venture capital-backed and they have each raised around €15 million in capital.

Euronext will support participating companies through academic and practical expertise, including coaching. Two core sessions will be held: one in September in Paris at Europe’s leading business school HEC, and the second one in March 2019 aimed at supporting the long-term vision of the business.

In addition, tailor-made coaching sessions will be held in each country throughout the year. They will be led by around 80 expert partners recruited by Euronext from a wide range of areas to generate unique networking opportunities, including banking, law and audit, financial communications, technology, and research.

Stéphane Boujnah, CEO and Chairman of the Managing Board of Euronext, said:

Stéphane Boujnah

“Europe is brimming with highly innovative tech companies that have reached a critical stage in their growth. After several rounds of financing, they are now looking for better access to capital. To pursue their objectives, they also need focused support and the infrastructure that an efficient pan-European market can provide.

This is precisely what we are offering at Euronext through TechShare and our trading platform. Together with our partners, we are proud to bring together such a diverse and stellar range of participants – companies that I am confident will help power the European economy of tomorrow.”

Since launching in 2015, TechShare has helped four French companies access capital markets: Osmozis, Balyo, Theranexus, and Oxatis.

Switzerland Companies (Total 12)

*Note that only companies that have agreed to communicate their name are included in this list