EU’s Shareholder Rights Directive II, a Catalyst for Change in the Securities Industry

by Fintechnews Switzerland June 18, 2021September 10, 2020 marked the deadline for member states of the European Economic Area (EEA) to implement new measures required by the Shareholder Rights Directive II (SRD II).

SRD II, which came into force on June 09, 2017, amends the Shareholder Rights Directive to strengthen shareholder engagement, increase transparency, and improve corporate governance in companies whose securities are traded on the European Union’s (EU) regulated markets.

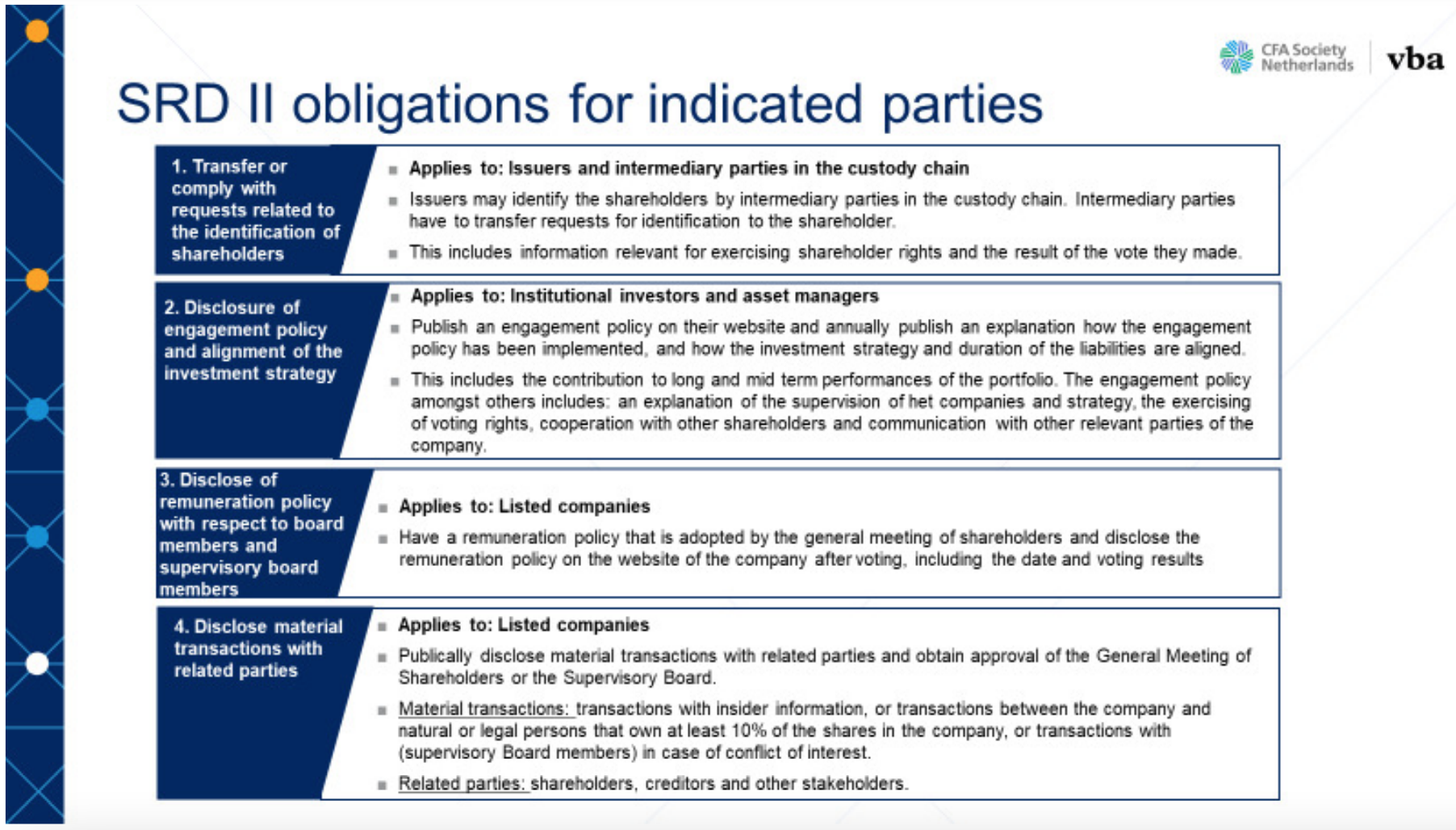

Key changes include the identification of shareholders when they hold more than a threshold share of issue capital, increased rights for investors and shareholders at general meetings, access to investment strategy information, and better insights into proxy advisors’ actions and how they establish voting instructions.

SRD II obligations for indicated parties, Source: CFA Society Netherlands and VBA

Globally, the directive is far-reaching because it impacts all firms that hold or trade shares in EU-based issuers listed on regulated EU markets, regardless of where they are based.

This means that any company that provides services such as safekeeping of EU shares, administration of EU shares or maintenance of securities accounts on behalf of shareholders in the EU, must comply with SRD II. And that goes for Swiss intermediaries and proxy advisors that carry out activities in relation to shares of EU companies.

Rising demand for transparency

As discussed in Bottomline’s whitepaper leveraging their experience of supporting 40+ customers in SRD II compliance; How will SRD II positively impact the securities industry in 2020 and beyond?, despite the issues raised, the cost of implementation and busy regulation roadmaps, SRD II has the potential to revolutionise corporate investment and inspire investor confidence

“Because SRD II requires asset managers to document and publicize their investment strategy, shareholders gain greater visibility and information, and are thus able to make better, more informed decisions,”

said Frédéric Viard, Product Director – Securities at Bottomline.

SRD II is a new type of corporate action designed with new flows and new standards aiming at more automation and speed. The directive also provides issuers with increased options to position and disclose their strategies in order to gain market share”

And because the directive gives shareholders the chance to vote on director’s remuneration, it provides real clarity on the companies they are investing in and represents an essential step in avoiding any future scandals by creating a new platform for investor confidence, the paper said.

Not only that, but since SRD II requires all parties to pass information down the chain of intermediaries in a timely and secure manner, it could also be a catalyst for change, accelerating adoption of technology to improve operational efficiency and increase automation.

Viard, Frédéric

“SRD II is meeting evolving customer expectations. Investors will like it because they need transparency and they are looking at companies with strong rates in governance. SRDII is part of that and empowers investors much more than ever before and this is appreciated by the market,”

Frédéric explained.

Some specialist proxy voting and disclosure-handling companies are already exploring the use of distributed ledger technology (DLT) as a more efficient way of sharing shareholder information.

Delays and tech issues

SRD II might have been in effect since last year, but it’s still very much in the early stages of a full and seamless adoption across EU regulated markets.

As of January 2021, seven countries had not yet fully transposed the requirements into national law, namely Cyprus, Liechtenstein, Poland, Portugal, Slovenia, Spain, and Sweden, and two countries, Norway and Iceland, were still awaiting the EEA agreement to be updated before they transposed the directive.

“SRD II is a new type of corporate action designed with new flows and new standards aiming at more automation and speed. The directive also provides issuers with more options to position and disclose their strategies in order to gain market share,”

Viard explained.

Since the rules are being applied differently across European markets, many market participants have indicated technical issues and delays in requests for information. In addition to that, some intermediaries do not yet have systems in place that allow them to process disclosure requests.

Under SRD II, intermediaries are required to transmit information on the same business day, and to make any disclosures by the end of the following business day.

Penalties for non-compliance with SRD II vary on a member state by member state basis, and a number of jurisdictions have already confirmed they will levy fines for non-compliance with requirements.

Featured image credit: edited from Unsplash