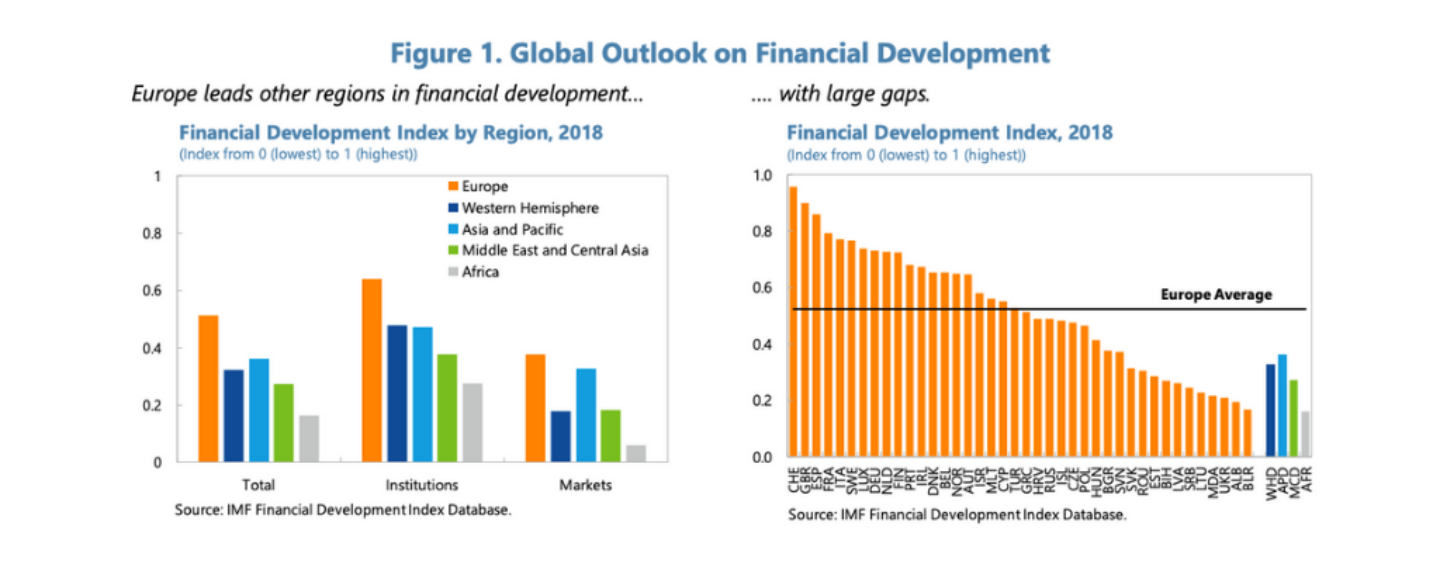

Fintech activities relating to alternative financing and mobile money are less developed in Europe than in the Americas and Asia Pacific (APAC), a trend’s most likely due to the region’s high pre-existing banking presence and financial inclusion, strict regulation, and in some countries, consumers’ strong preference for cash, according to a new working paper by the International Monetary Fund (IMF).

In a paper titled Fintech in Europe: Promises and Threats, the IMF argues that compared to the Western Hemisphere, which comprises the Americas, and APAC, fintech companies’ reach and development in Europe are significantly lower despite the region leading the rest of the world in Internet coverage.

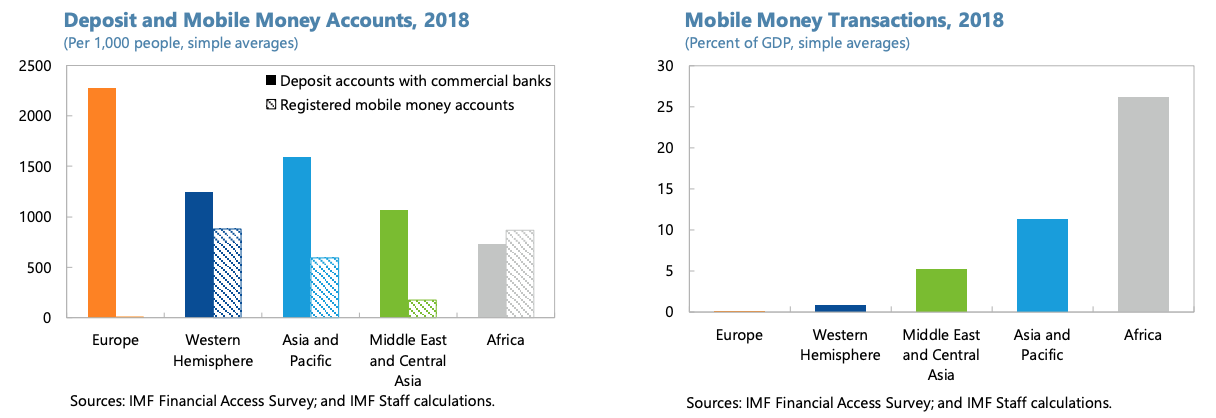

Europe is among the least developed regions in terms of mobile money penetration, the document says, very far behind Africa, the world leader, the Western Hemisphere, APAC and the Middle East and Central Asia.

Mobile money accounts and transactions, 2018, Fintech in Europe: Promises and Threats, IMF Working Paper, Nov 2020

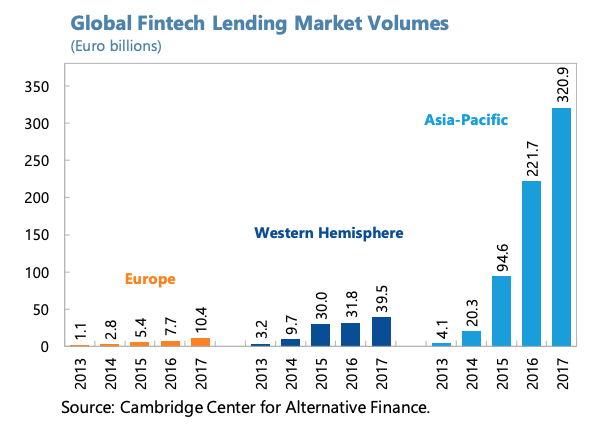

Europe also significantly lags APAC and North America in fintech lending, accounting for just 3% of the world’s total volume in alternative financing in 2017 with 10.4 billion euros. This is far behind APAC at 320.9 million euros, and the Americas at 39.5 million euros.

Global Fintech Lending Market Volumes, Fintech in Europe: Promises and Threats, IMF Working Paper, Nov 2020

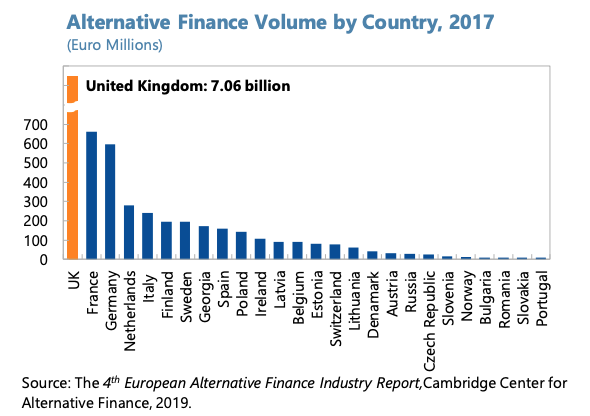

In Europe, the UK dominates the fintech lending space, accounting for about two-thirds of total volume in the region at 7.06 billion euros in 2017. The UK is followed by France at about 650 million euros, and Germany at nearly 600 million euros.

Alternative Finance Volume by Country, 2017, Fintech in Europe: Promises and Threats, IMF Working Paper, Nov 2020

Low penetration of fintech lending and mobile money in Europe can be partially explained by the extensive network of formal financial service providers in the region and high levels of financial inclusion, the paper says.

In addition to that, the bank-dominated financial system in Europe means that the region is not well suited to provide high-risk financing, making it more difficult for fintech companies to raise funding in Europe than they would in capital market-dominated systems such as in the US, the report says. This might explain why none of the bigtech companies, which currently dominate the global fintech landscape, originated in Europe.

Other factors bearing on the lower penetration of fintech in Europe include the heterogeneity of regulation across jurisdictions and, in certain countries, a cultural or institutional preference for cash.

In Germany, for example, cash has long been the motto of consumers and small business owners amid privacy concerns – though the COVID-19 pandemic has changed that and accelerated the adoption of contactless payment methods.

Europe catching up

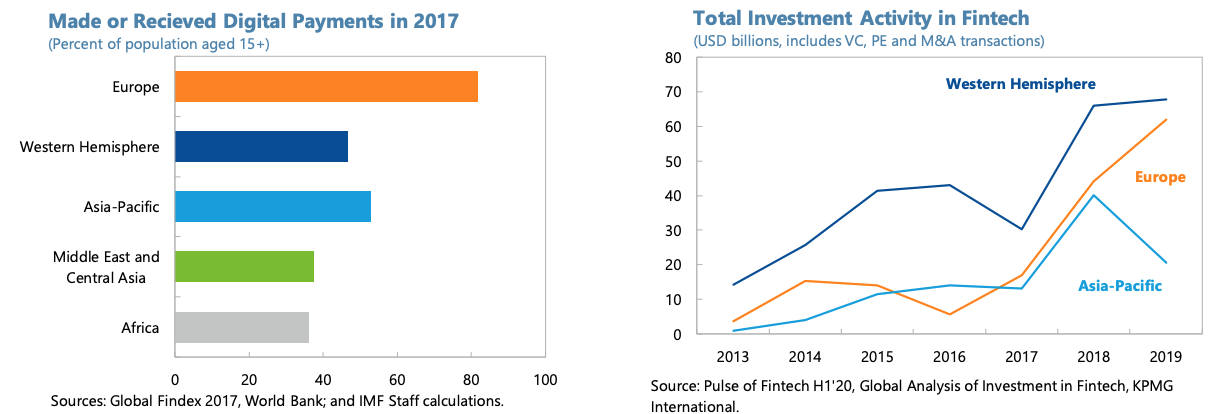

Despite Europe’s apparent lag, the region is rapidly catching up in some fintech segments. For example, while mobile money solutions haven’t quite reached significant traction, digital payments, including both mobile and Internet transfers, have picked up in recent years with more than 80% of the adult population in Europe either making or receiving a digital payment in 2017 – the highest penetration rate for digital payments in the world.

New equity investment in fintech by institutional investors is also growing fast, and the gap with frontier regions, including North America and Asia, is rapidly shrinking.

Digital payment penetration in 2017/Fintech funding, Fintech in Europe: Promises and Threats, IMF Working Paper, Nov 2020

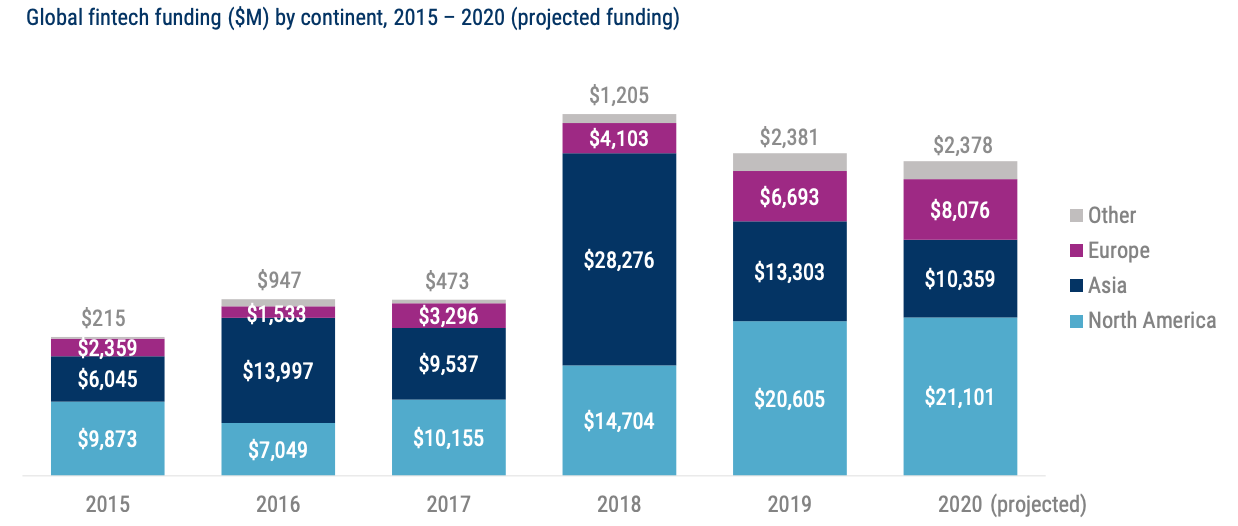

Market intelligence startup CB Insights projects fintech funding in Europe to surge 20.6% to more than US$8 billion in 2020 – the biggest jump across geographies. North America is expected to see a 2.4% increase to US$21 billion, while Asia is on pace for a major decline of 22.1% to US$10 billion.

Global fintech funding ($M) by continent, 2015 – 2020 (projected funding), State of Fintech Preview, CB Insights, December 2020