McKinsey Report: Metaverse to Generate up to US$5 Trillion in Impact by 2030

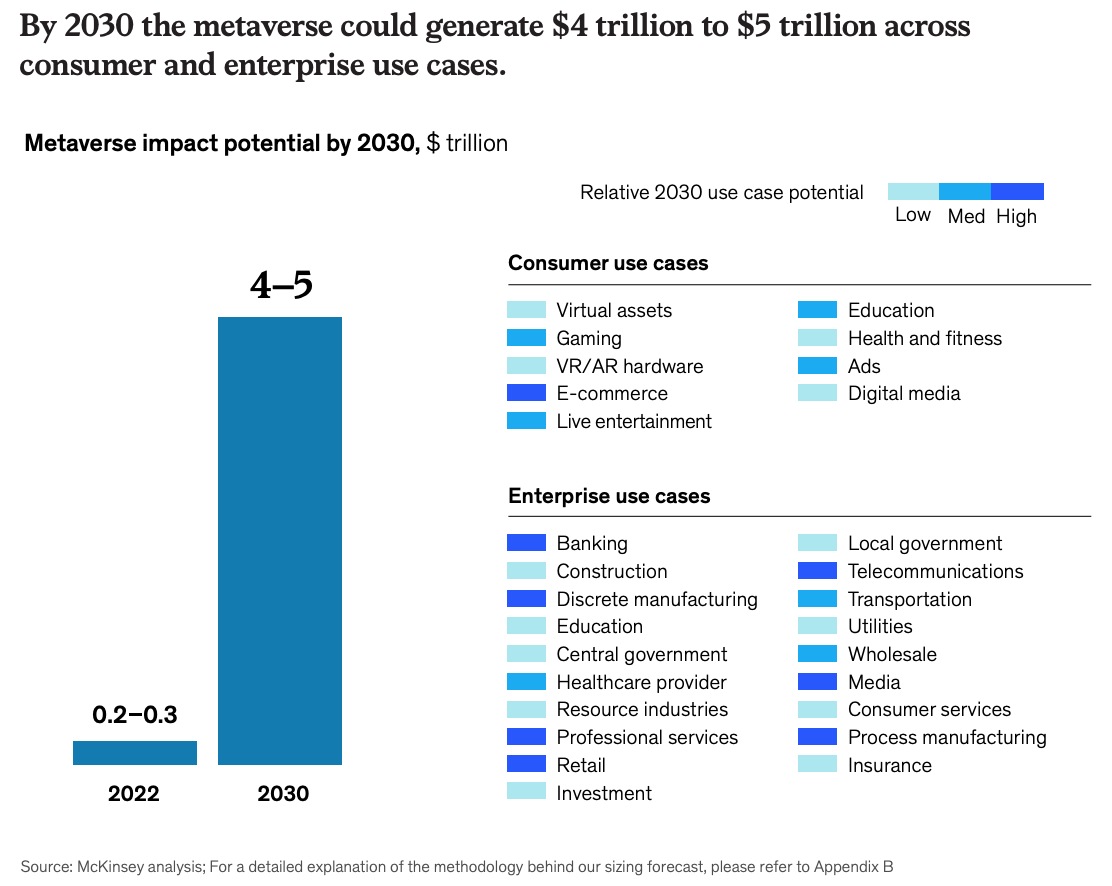

by Fintechnews Switzerland July 7, 2022By 2030, the metaverse could generate up to US$5 trillion in impact, a sizeable opportunity that will be brought about rapid adoption of immersive virtual environments by consumers, rising openness to digital assets and new technologies, and heavy investments from the private sector.

This is according to an extensive report by McKinsey, which looks at the state of the sector, shares predictions for what’s to come, and unveils findings of a survey of 3,000 global consumers and 450 senior executives to understand both end-users and industry participants’ views on the topic.

According to the report, the metaverse holds implications for all sectors, but e-commerce will likely be the most impacted one. By 2030, McKinsey estimates that the metaverse could generate between US$2 trillion and US$2.6 trillion across e-commerce use cases, figures that drastic dwarf sectors such as academic virtual learning (an estimated US$180 billion-US$270 billion impact by 2030), advertising (US$144 billion-US$206 billion impact), and gaming (US$108 billion-US$125 billion impact).

Metaverse impact potential by 2030, $ trillion, Source: McKinsey analysis, 2022

For retailers, one of the biggest opportunities lies in the ability to remove the need to open up stores in every city, relying instead on a single store available in the metaverse for customer globally.

This opportunity is being explored by a number of companies: Samsung opened in January a store in blockchain-powered virtual world Decentraland; Nike introduced its virtual space in online gaming platform Roblox in November 2021, allowing customers to participate in various games and dress up their avatars with Nike products; and retailers including Ralph Lauren, Urban Outfitters, Walmart, Nike, Gap and Abercrombie & Fitch have all filed trademarks related to virtual world stores, virtual goods and non-fungible tokens (NFTs).

Retailers can also use the metaverse for advertising, brand activation, and recruiting purposes, McKinsey says. Mexican food brand Chipotle, for example, ran a Halloween campaign on Roblox last year, offering a voucher for a real-life burrito to any visitor of its virtual restaurant wearing a costume. In France, retail and wholesaling corporation Carrefour launched in May 2022 a metaverse-based recruitment effort to fill data-related job openings.

Finance in the metaverse

Like other industries, companies in the financial sector have too started to explore opportunities in the metaverse. So far, efforts have been focused on Web 2.0 initiatives that make use of centralized platforms built in-house, McKinsey says, but a lot of opportunities remain untapped in the open Web 3.0-enabled metaverse.

Bank of America, for example, introduced in October 2021 a virtual reality (VR) training program for employees; South Korea’s KB Kookmin Bank launched last year a virtual environment called the KB Metaverse VR Branch Testbed which it used to engage with customers and train employees; similarly, Nonghyup Bank and NH Investment & Securities, have too been developing their own metaverse platforms.

Others have gone a step further, establishing a presence on open, decentralized metaverse environments and introducing products destined to be consumed in these virtual spaces. HSBC, Standard Chartered and JP Morgan have all purchased virtual land in Ethereum-based metaverse platform The Sandbox; and Zelf, an American neobanking company, launched last year a new functionality that allows gamers to trade in-game virtual assets on popular gaming messaging platform Discord.

Excitement among consumers and businesses

McKinsey’s bullish predictions and estimates for the metaverse were drawn from a global survey of more than 3,400 consumers and executives which found a high level enthusiasm among both end-users and businesses for the prospects of virtual environments.

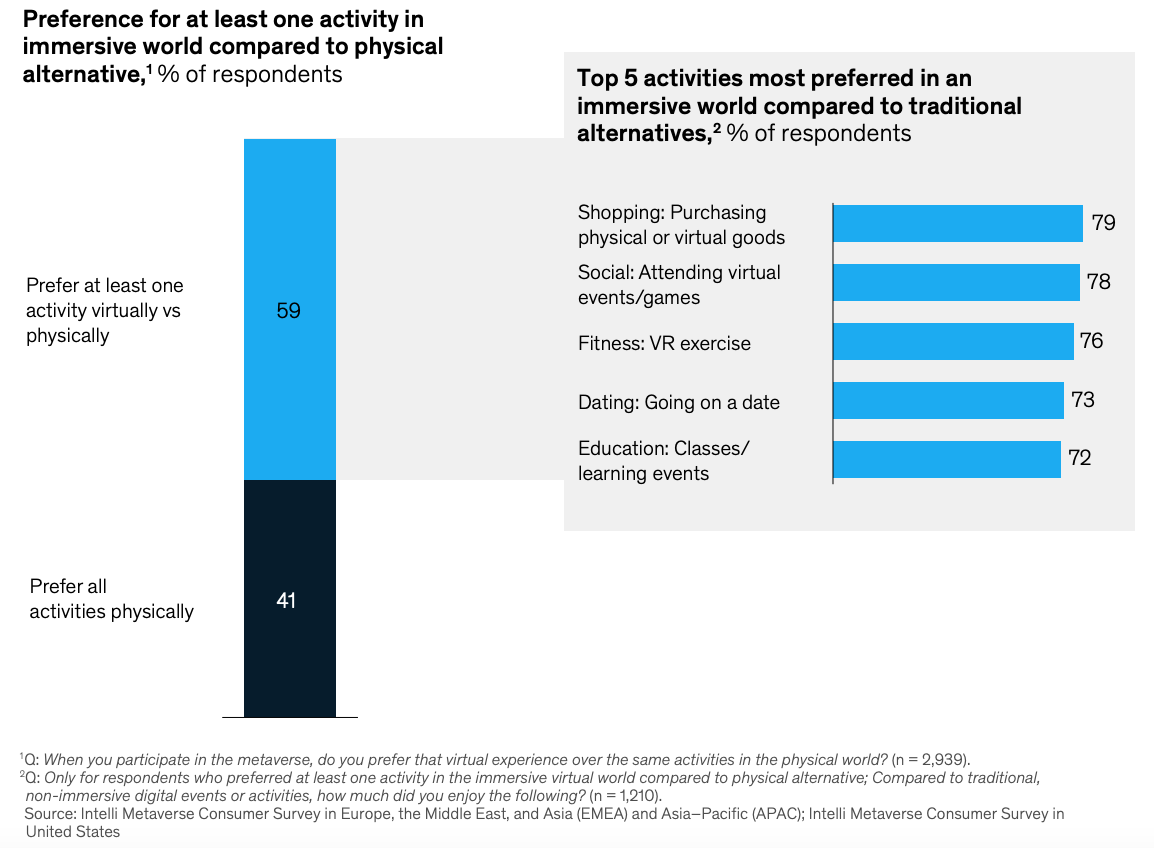

Consumers showed eagerness in spending more time in the metaverse, with almost 60% of respondents indicating a preference for at least one activity in the virtual world compared to the physical alternative.

Shopping (79%), social gatherings and events (78%), fitness (76%), dating (73%) and education (72%) were named as the top five activities most preferred in an immersive virtual environment.

Preference for at least one activity in virtual world compared to physical alternative, % of respondents, Source: Intelli Metaverse Consumer Survey in Europe, the Middle East, and Asia (EMEA) and Asia–Pacific (APAC) (April 2022)

The executives survey also found a high level of excitement among the business community. 95% of business leaders expect the metaverse to have a positive impact on their industry within five to ten years, and 65% believe metaverse technology could drive more than 5% of their organization’s total revenue in five years.

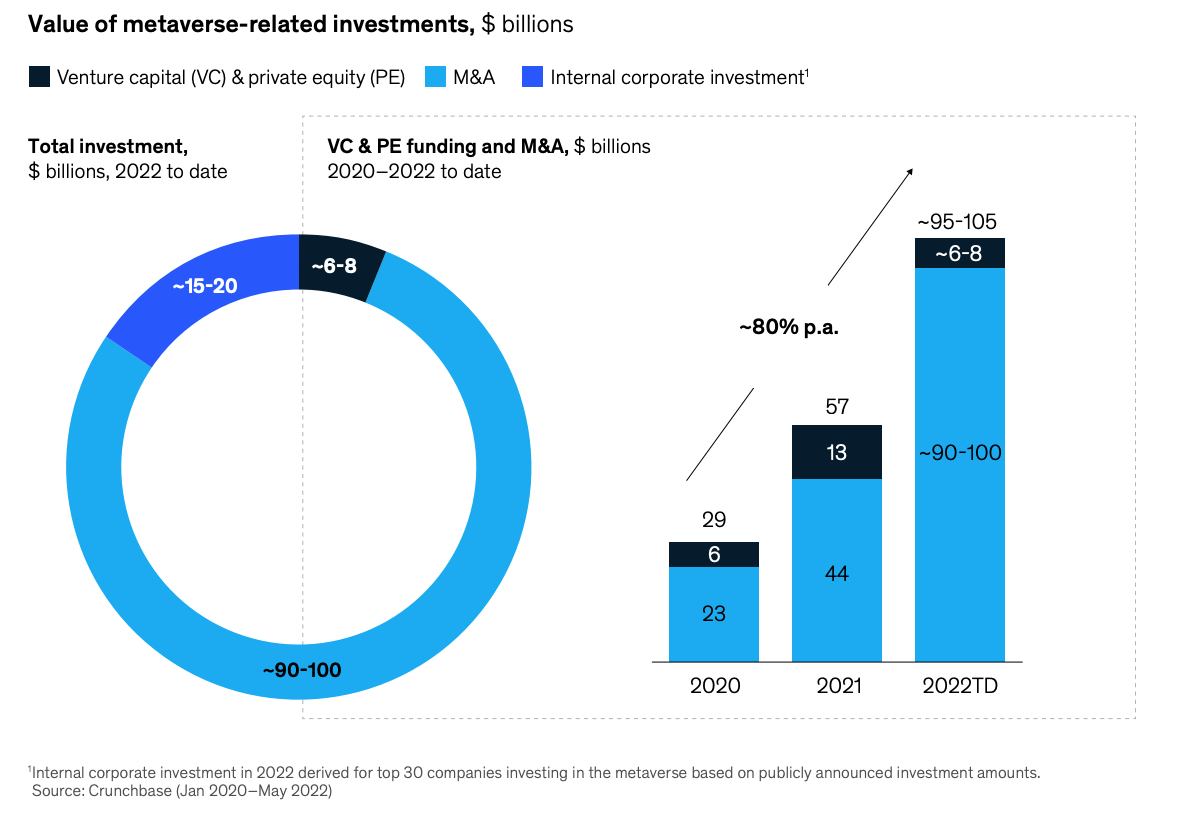

Investment into the metaverse space has soared over the past years. In the first five months of 2022, corporations, venture capitalists, and private equity firms injected more than US$100 billion into the space, more than double the US$57 billion invested in all of 2021.

Value of metaverse-related investments, $ billions, Source: McKinsey analysis of Crunchbase data, 2022

Featured image credit: Pixabay