Switzerland’s Fintech Ecosystem, Startups and Challenges and 11 Fintech Players to Watch

by Fintechnews Switzerland March 17, 2016Switzerland is known for being one of the main global financial centers, with the sector contributing to 10% of the country’s GDP. Given the fast pace of digital disruption in the financial services industry, the country is trying to keep up and nurture its own fintech ecosystem.

But despite the many advantages that Switzerland may have over competing hubs – this includes having excellent education, and deep knowledge in financial and technology know-how -, the country is lagging behind the likes of London, New York, or even Hong Kong and Singapore, that all have taken the lead in the fintech race.

Reports have suggested that Switzerland is falling behind basically because of two things: the lack of governmental support and the challenge of accessing financing.

Johannes Hoehener, head of digital banking initiatives at Swisscom, via Twitter

“What is unique about the Swiss fintech startup ecosystem is that they have easy access to big players and enjoy a great academic background of technical talent, such as ETH and EPFL [Swiss Federal Institute of Technology in Zurich and Lausanne, respectively],” Johannes Hoehener, head of digital banking initiatives at Swisscom, told the Economist’s Intelligence Unit.

While the country “is strong in seed money” with “a lot of wealthy people who are looking to make seed investments … the big problem here is the next stage of funding—series A, series B, and etc,” he said. “We don’t have the venture ecosystem so it’s critical that Swiss startups have a strategy to expand globally.”

Thankfully, some of Switzerland’s banks are “stepping” in, taking on a variety of strategies to support homegrown fintech startups. These include UBS, through coolobaration into digital banks and e-payment solutions such as the cloud-based accounting software bexio, but also Credit Suisse, which has been promoting fintech startups hubs and incubators as well as educating senior leaders.

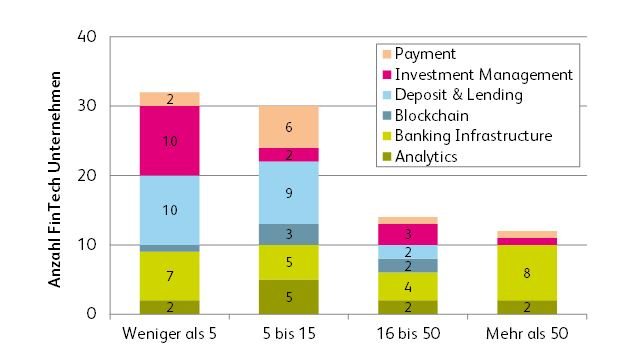

Given the small size of the Swiss market, domestic fintech players need to internationalize out of Switzerland, and yet very few have successfully managed to do so. The startup ecosystem is still mostly made of very small and early stage ventures and not many have over 30 employees.

11 Swiss Fintech Startups to Watch

That being said, the Swiss fintech scene has been growing steadily with some 172 fintech players tackling anything from cryptocurrency, wealth management, to crowdfunding and insurance. Swisscom estimates a 30% increase in the number of players over the past 30 years. (see also various Infographics about Fintech Switzerland)

Here are 11 noteworthy fintech players operating in Switzerland:

Crowdhouse is a real estate crowdfunding platform that allows individuals to acquire shares of rental buildings. The platform, which went live in October last year, aims to gather several small investors and allow them to become co-owners of a property by investing a minimum of CHF 25,000.

Go Beyond is a Zurich-based early-stage investing platform and a community of investors working towards democratizing early-stage investing. It was launched in 2008 by award-winning business angel Brigitte Baumann.

Advanon is an online platform that makes the financing of small and medium businesses easier and more flexible. The platform allows selling invoices in a less frictional manner than what factoring companies offer.

Ethereum is not a company but a platform developed by Switzerland-based non-profit organization the Ethereum Foundation. This ‘crypto 2.0’ project consists in a decentralized platform that runs smart contracts: applications that run exactly as programmed without any risk of downtime, censorship, fraud or third-party interference.

ShapeShift is a platform that enables immediate exchange between digital assets including bitcoin, litecoin, ether, dogecoin, and many more.

Qumram is a Big Data platform that allows companies to record and analyze all of their customers’ online interactions to ensure regulatory compliance, detect online fraud and improve customer experience.

Knip is a curated finance startup that helps users manage their insurances in a single app and provides them with a bi-annual review of their finances. Knip has been experiencing rapid growth and has recently launched services in Germany. Recently Knip was named the 6th best Swiss Startup.

FinanceFox, which has offices in Zurich, Berlin and Barcelona, provides users with a single point of access for all insurance matters, letting them manage all existing insurances and get personal advice.

InvestGlass is an automated intelligent financial information platform (robo advisor) that allows wealth managers and professional investors to navigate through clients’ investments, compliance, and investment convictions.

Sentifi is a crowd-based financial market intelligence platform that allows users to discover which of the hot issues in the market affect their investments. The platform matches thousands of financial relevant events with stocks, currencies and commodities.

Numbrs, a product of CentralWay, is a mobile app that provides worldwide access to users’ bank accounts from any place and in any time. The platform also enables users to manage these finances and conduct transactions.

Featured image: Switzerland flag, via Pixabay.

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.