Research Reveals Millennial Demographic “Meaningless” for Financial Institutions and FinTechs

by Fintechnews Switzerland November 22, 2016New research has found that the millennials classification is not a meaningful way for financial institutions and FinTechs to understand those aged between 18 and 34.

The findings suggest that younger and older millennials have divergent financial priorities, exhibit disparate financial behaviours, especially around digital finance, and have different tolerance levels for customer experience issues. Financial services providers need to re-evaluate how they market to and serve this demographic.

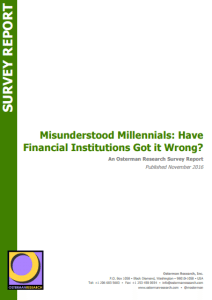

The research ‘Misunderstood Millennials: Have financial institutions got it wrong?’ commissioned by Mitek, surveyed 1001 UK millennials and found that younger millennials – aged 18-22 – are not yet financially independent, with 47.6% most concerned about paying for education. Younger millennials’ financial mindset is also dominated by a reactive, short- term focus demonstrated by their other main concerns, paying rent (43%) and entertainment (33%). Long-term financial planning is not on their agendas, contrary to received wisdom evidenced by the plethora of educational FinTech start-ups.

The research ‘Misunderstood Millennials: Have financial institutions got it wrong?’ commissioned by Mitek, surveyed 1001 UK millennials and found that younger millennials – aged 18-22 – are not yet financially independent, with 47.6% most concerned about paying for education. Younger millennials’ financial mindset is also dominated by a reactive, short- term focus demonstrated by their other main concerns, paying rent (43%) and entertainment (33%). Long-term financial planning is not on their agendas, contrary to received wisdom evidenced by the plethora of educational FinTech start-ups.

It’s only when millennials reach 29-34 that financial services become a necessity. 43.1% of 29-34 year old are most concerned with saving to buy a house but only 30% of young people are. Surprisingly, 40% of 29-34 year-old are also looking to save money for travel and 33% with saving for their retirement, compared to 26% and 17% respectively for those aged 18-22. Between 23 and 28, millennials are not yet financially independent and around a third are still concerned about paying for education. At this age, only 23% are concerned about saving for their retirement.

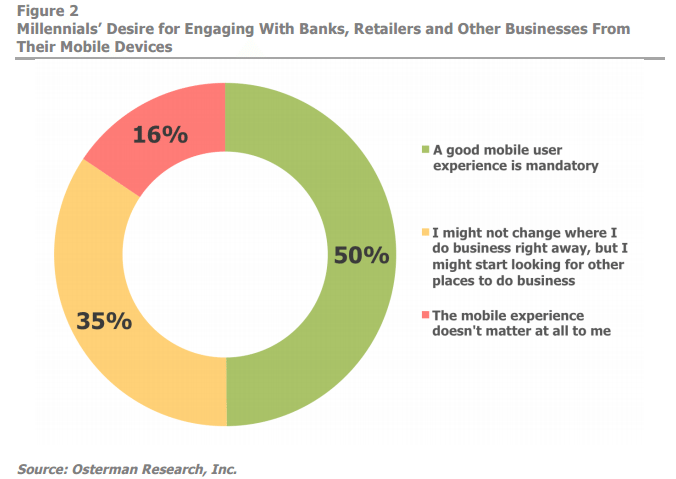

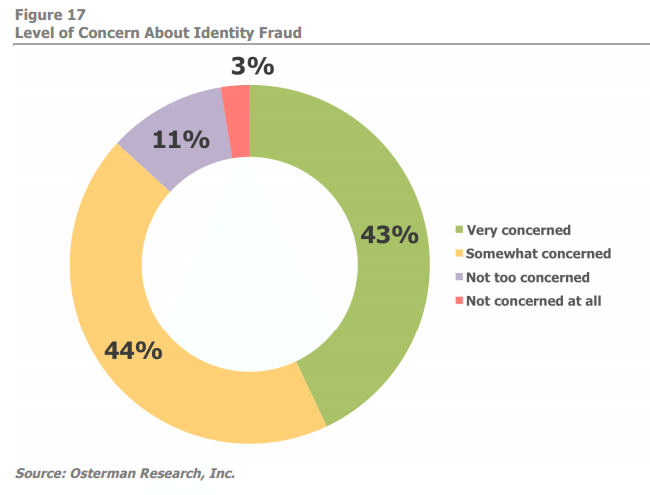

Financial services companies are increasingly serving their customers through mobile channels and 29-34 year-olds are certainly receptive to this. Older millennials are, on average, 5% more likely to use mobile financial services than their younger counterparts with one in five making a mobile purchase at least once a day. However, security concerns are preventing 29-34 year olds from taking full advantage of mobile with 88.5% saying that worries about ID fraud or data security prevent them from making transactions on their mobile, compared to 72.8% of younger millennials.

The research also found that, counterintuitively, those in the older age bracket are much more comfortable using the camera on their mobile, with 72.7% seeing it as one of the most important functions. This is compared to 54% of 18-22 year olds. This is also manifested in the fact that older millennials are 25% more likely to allay their security fears by using their camera to fill in personal information or verify their identity with a selfie or a photo of their ID.

The research also found that, counterintuitively, those in the older age bracket are much more comfortable using the camera on their mobile, with 72.7% seeing it as one of the most important functions. This is compared to 54% of 18-22 year olds. This is also manifested in the fact that older millennials are 25% more likely to allay their security fears by using their camera to fill in personal information or verify their identity with a selfie or a photo of their ID.

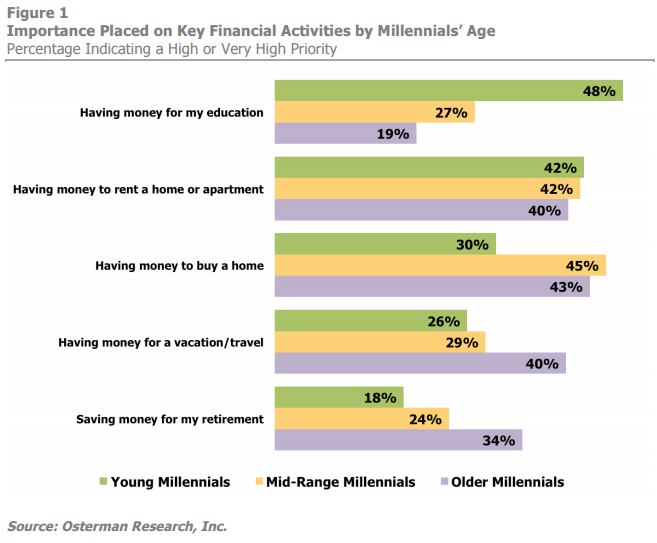

Getting the mobile experience right, however, is key. Millennials are highly intolerant of poor mobile experiences with 56.3% stating that if they were unable to sign up for a financial product on their mobile, they would go to a different, more mobile-friendly competitor. Indeed 42.4% of all millennials have already switched providers because of a poor mobile experience.

Key Findings

Financial Independence

· 47.6% of millennials aged 18-22 are concerned about paying for education, whereas only 19.4% of 29-34 year-olds were.

· 43.1% of older millennials are concerned about saving to buy a house but only 30% of younger people are.

· Around 40% of 29-34 year-olds are also looking to save money for travel and 33% with saving for their retirement, compared to 26% and 17% respectively

Mobile usage

· Older millennials are 5% more likely to use their phones to apply for services or purchase goods than younger millennials

· One in five millennials aged 29-34 make at least one purchase on their mobile per day, compared to 12.4% of millennials aged 18-22

Security and Fraud

Security and Fraud

· 88.5% of older millennials say that worries about ID fraud or data security prevent them from making transactions on their mobile, compared to 72.8% of younger millennials

· 87.4% of younger millennials cite convenience factors as a barrier to usage compared to 79.9% of older millennials

· Older millennials are around 25% more likely to use their camera to fill in personal information or verify their identity using a selfie or a photo of their ID document

Mobile User Experience

· 56.3% of all millennials would abandon an application for a financial services product if they could not complete it on their mobile and would join a more mobile-friendly competitor

· 42.4% of millennials have left a financial services provider due to a poor mobile experience

“Millennials have been the target of financial services providers for as long as they have been recognised as a category. However to date, efforts to attract them have largely been unsuccessful” said Sarah Clark, General Manager, Identity, Mitek. “The reasons for this are now clear. By trying to appeal to this group as one single demographic, financial institutions’ marketing has been misdirected. They now have the opportunity to focus their efforts more sharply and cater for millennials’ diverse needs at different stages in their lives. It can’t be a one-size-fits-all approach anymore. Financial institutions need to tailor their offering to appeal to the lucrative 29-34 year-old market, which is mobile-first, concerned about the security of their identity and willing to disengage due to poor service. ”

With impending regulations such as Anti-Money Laundering Directive 4.1, Payments Service Directive Two and the EU’s Funds Transfer Regulation, there is pressure on financial institutions to improve KYC practices. Electronic identity verification and on-boarding reduces the risk of financial fraud and improves operational efficiencies. Institutions not only need to cater to the demands of this generation and ensure they are best positioned to meet the regulatory requirements of today and tomorrow.

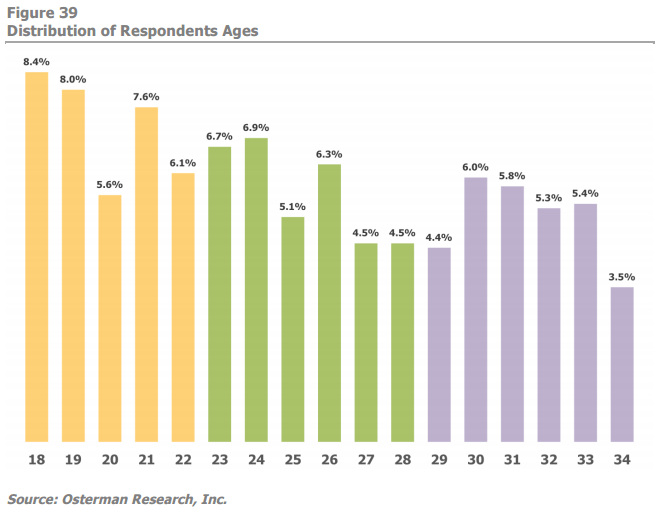

The research was conducted by Osterman Research and covered 1001 UK millennials. Download it here.

Featured Image Credit: Unsplash