Blockchain Germany Ecosystem Study: Rapidly Growing Blockchain Startup Scene

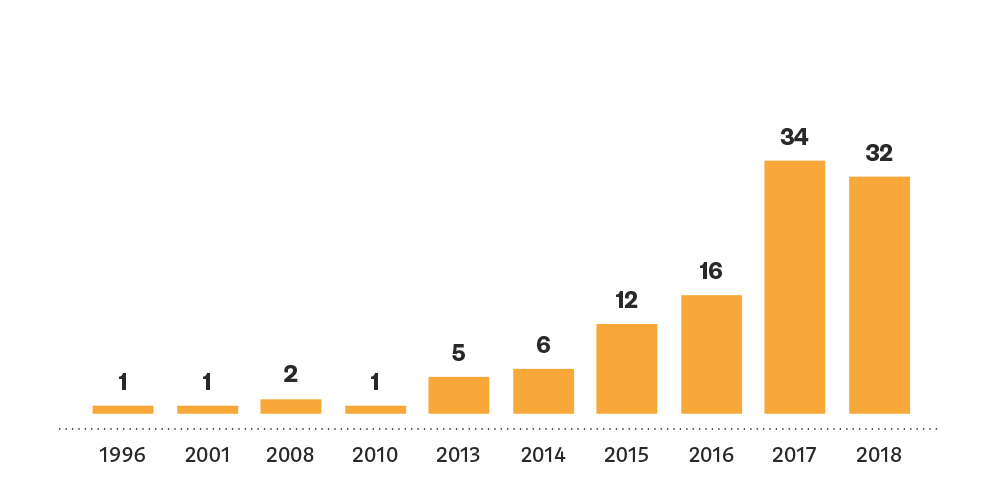

by Fintechnews Switzerland December 12, 2018Germany is witnessing a rapidly growing blockchain startup ecosystem, with 34 new ventures being incorporated in 2017 and already 32 new companies this year, according to a new report by BTC-ECHO and BlockState.

Founding year, The German Blockchain Ecosystem – Study 2018

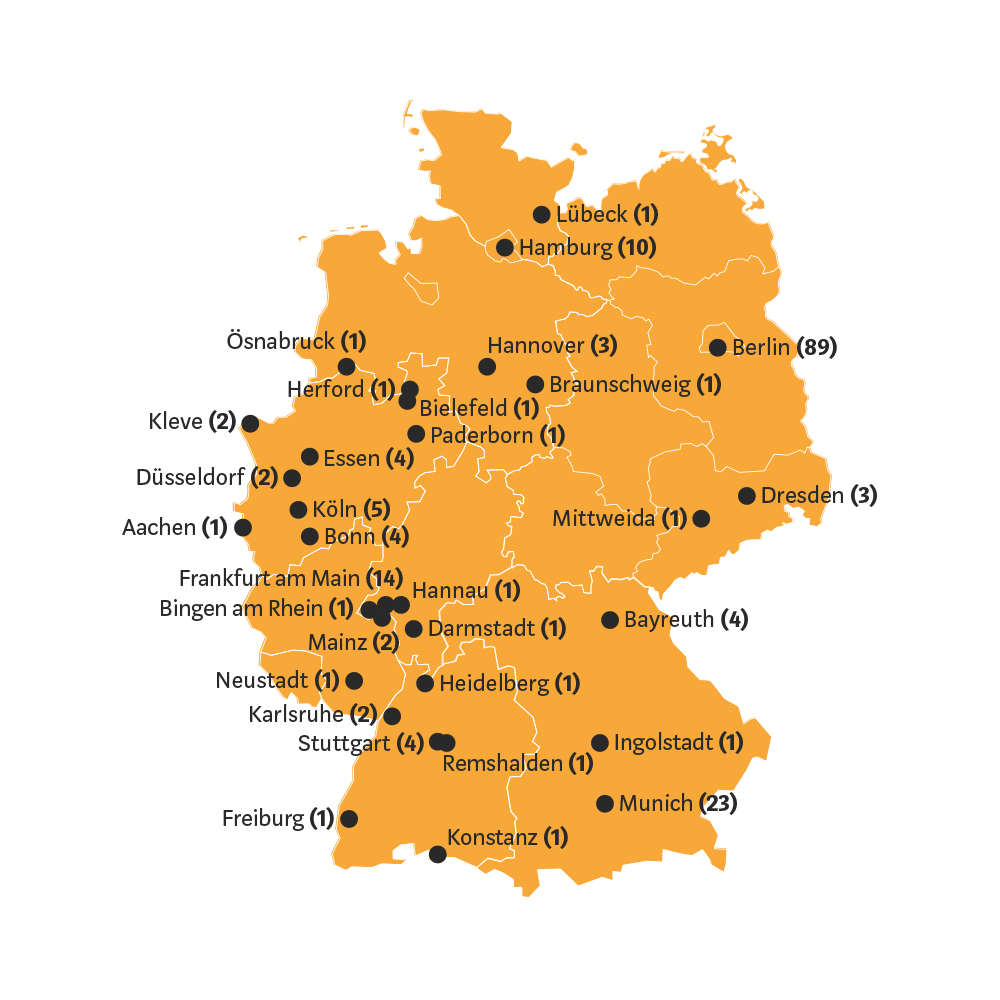

The German Blockchain Ecosystem – Study 2018, which comprises a research of 180 different companies and a survey of representatives of more than 100 German blockchain startups, found that nearly 50% of German blockchain startups are based in Berlin (89), followed by Munich (23), Frankfurt am Main (14) and Hamburg (10).

Cities where the companies are located, The German Blockchain Ecosystem – Study 2018

In Germany, Berlin in particular has emerged as a major center for blockchain development and a serious contender for the crown of Europe’s crypto capital. Jasmine Zhang, Berlin-based CEO of Longhash Germany, a blockchain accelerator, told DW at the Longhash Crypto Festival Berlin last month:

“Berlin is really attractive with a low cost of living and so many co-working spaces and also really good projects that can attract people to come here. Especially with Brexit, Germany is now attracting a lot of talent and funding from everywhere.”

According to Zhang, the diverse range of talent coming into Berlin has allowed for the emergence of a rich blockchain ecosystem and engendered a “very open ecosystem” during crypto and blockchain meetups during which people showcase a desire to “work together and partner with each other.”

She noted the increasing number of German developers and startups working on new applications of blockchain looking to work with big businesses and government agencies. “You actually see more of a willingness to work with government and authorities,” Zhang said.

One such example is IOTA, a distributed ledger for the Internet-of-Things (IoT) overseen by the IOTA Foundation in Berlin. IOTA has signed partnerships with notable players including Bosch, Volkswagen and Fujitsu. In July, it announced that it had been selected by the European Commission under the Smart Cities and Communities call. IOTA’s MIOTA token has a market capitalization of US$687.90 million.

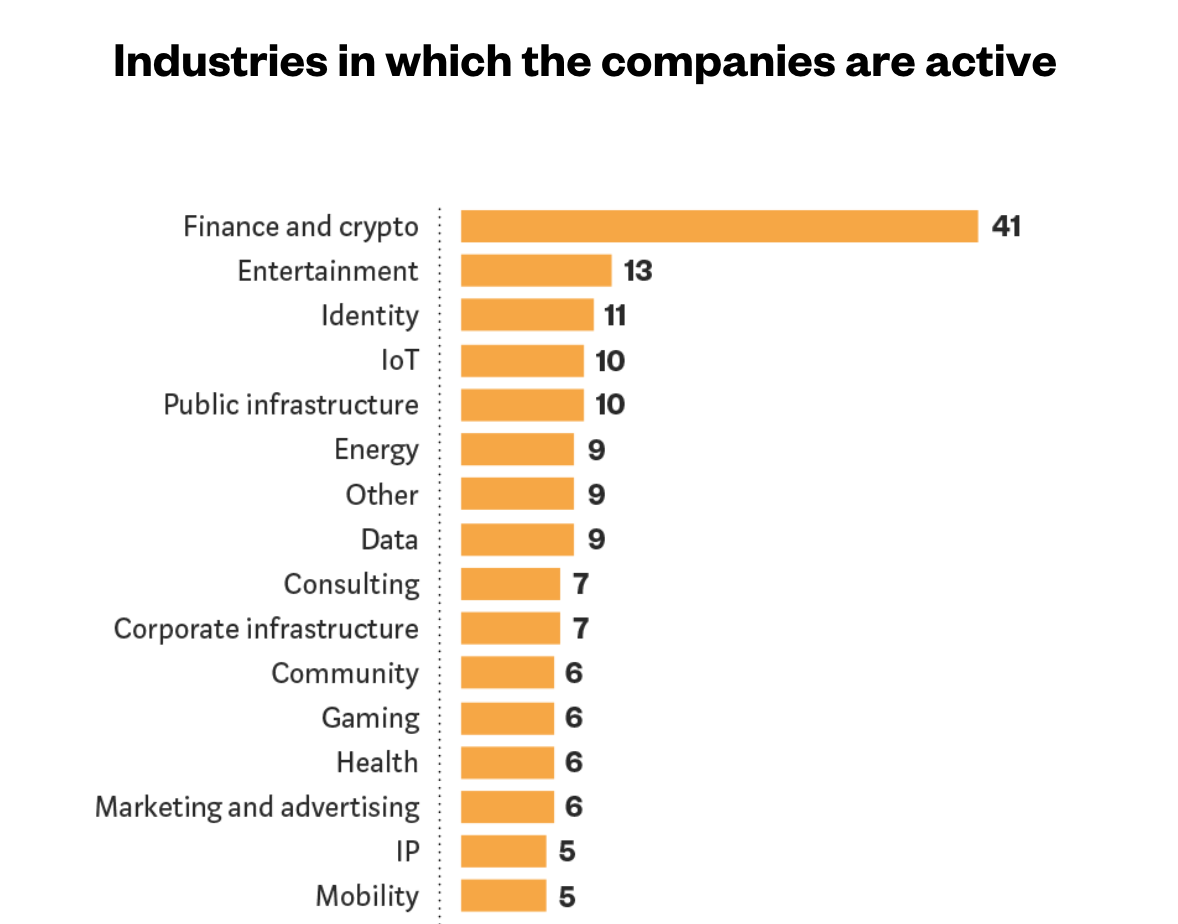

According to the BTC-ECHO and BlockState study, the majority of Germany’s blockchain startups are active in the finance and crypto industry (41), followed by entertainment (13), identity (11), IoT (10), and public infrastructure (10). 67% of these startups claim they are already generating revenue.

Industries in which the companies are active, The German Blockchain Ecosystem – Study 2018

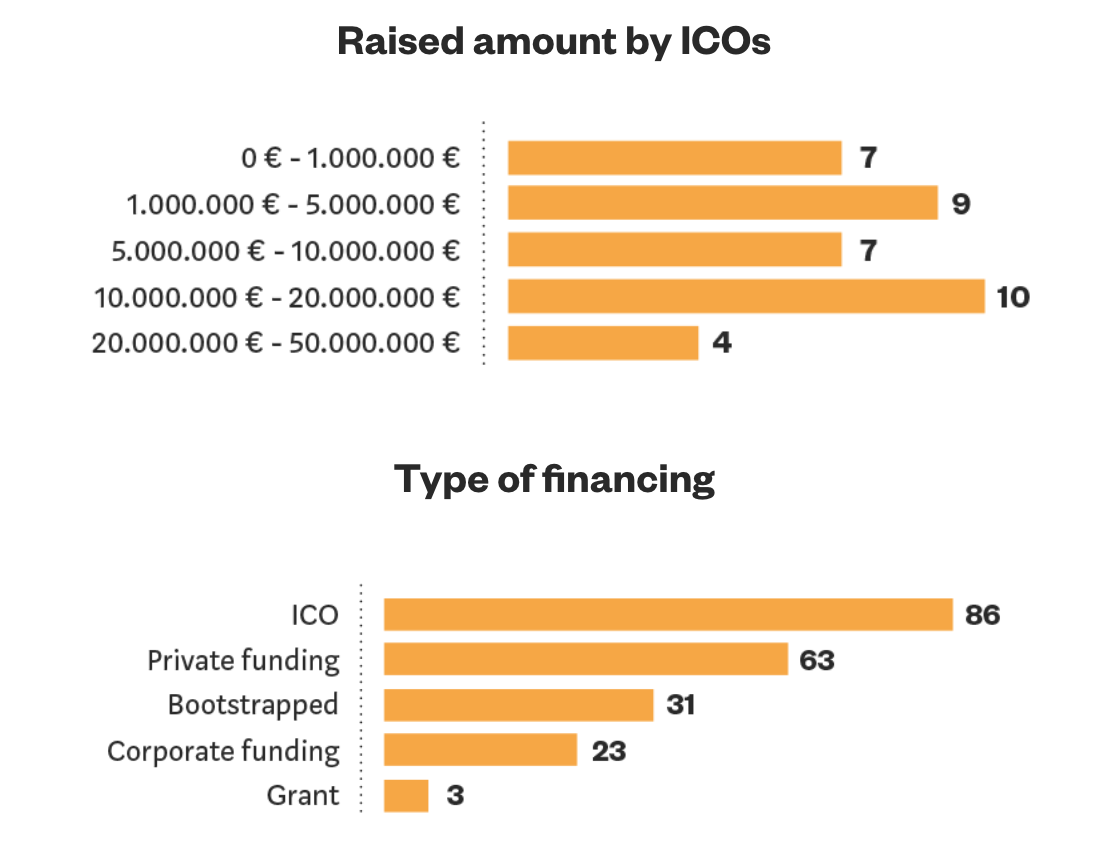

86 are financed through an initial coin offering (ICO) and 63 received private funding. Among those that raised funding through ICOs, most raised between EUR 10 and 20 million (10), followed by EUR 1 to 5 million (9), EUR 5 to 10 million and then less than EUR 1 million (both 7).

Raised amount by ICOs and Type of financing, The German Blockchain Ecosystem – Study 2018

Germany’s burgeoning blockchain sector has seen several notable developments in the past months. In November the German Federal Ministry for Economic Affairs and Energy (BMWi) unveiled plans to fight tax evasion schemes using blockchain technology, reports business news outlet WirtschaftsWoche. That same month, German cryptocurrency exchange Bitcoin Group SE announced that it has successfully acquired investment bank Tremmel Wertpapierhandelsbank GmbH. With the acquisition, Bitcoin Group SE has absorbed Tremmel’s Federal Financial Supervisory Authority (BaFin) license, allowing the company to develop and sell cryptocurrency-based investment contracts.

A recent survey by the German Federal Association for Information Technology, Telecommunications and New Media (Bitkom) has found that over one third of big businesses consider blockchain as revolutionary as the Internet.

Featured image: Bundestag, Germany, Pixabay.